| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

|---|

Upromise Mastercard Increased Bonus & Analysis

Last month when Doctor of Credit asked me what I thought was an underrated credit card, the first thing that came to mind was the Upromise Mastercard. The card doesn’t get a lot of attention, but it has some pretty generous earning potential.

Today one of my readers emailed me to share that the normally low $25 sign-up bonus has been increased to $100 after spending $1,000 on the card during the first three months. Lets take a look to see if its worth it.

Key Card Features

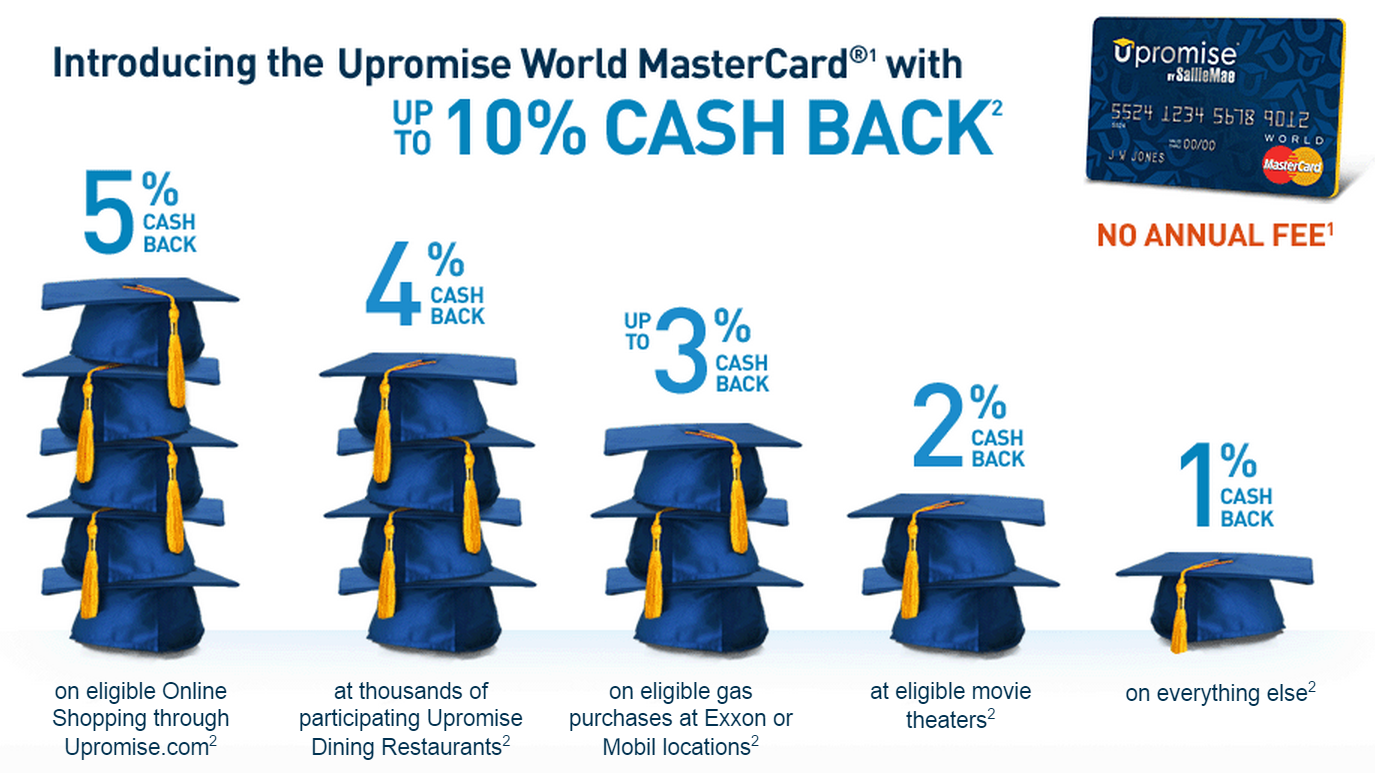

- No annual fee

- Earn a $100 cash back bonus after $1,000 in purchases in the first 90 days of account opening

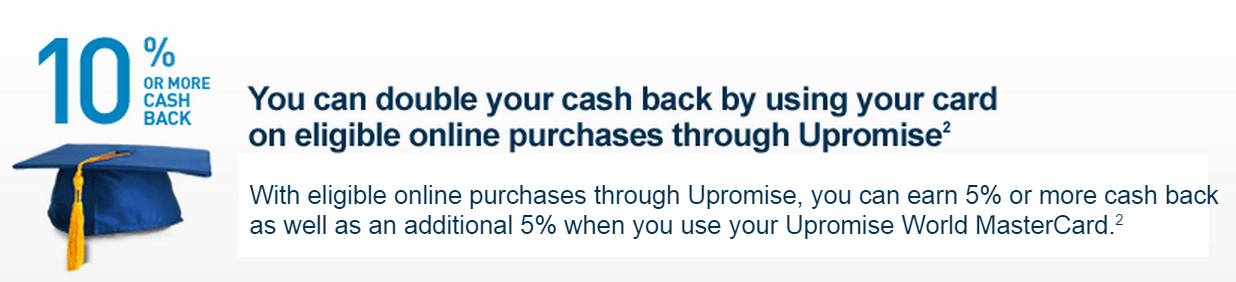

- Earn up to 10% cash back on eligible purchases through Upromise.com

- Earn 4% cash back on thousands of participating Upromise dining restaurants (More info on Dining here.)

- Earn 3% cash back on eligible gas purchases at Exxon or Mobil locations

- Earn 2% cash back on eligible movie theater locations

- Earn 1% cash back on all other purchases

Earning Potential

If you use the Upromise portal (See: Shopping Portal Strategy) then this card should be on your list. Quite often they have the highest cash back percentage and this card doubles the normal 5% cashback rate at a number of stores.

It can also be a nice card for gas purchases if you normally shop at Exxon or Mobil. (Or have one that sells gift cards.)

Drawbacks

The biggest drawback of the Upromise Mastercard is that it is issued by Barclay’s. Since they also issue the Arrival Plus (my review) and the US Airways Mastercard, it falls firmly in third place among their cards in my opinion. (In other words I would get those cards first, especially since the US Airways card 50k offer will go away once the programs merge in the 2nd quarter.)

Barclay’s has tightened significantly over the past few years in allowing multiple cards. If you already have the Arrival Plus and US Airways and have a good use for this card, then it might be worth the application, but there is no guarantee of an approval.

Where to Apply

When my reader sent over the information about an increased bonus, I searched both the Barclay’s and Upromise sites and only found the typical $25 offer.

Fortunately Google came to the rescue and I found that the $100 offer is available via creditcards.com. (I have not found it elsewhere. If you do, feel free to post in the comments.)

You can support Miles to Memories by clicking through from our credit cards page and applying for the card. It is found in the “No Annual Fee” section on page 3. You can also visit creditcards.com directly and find the card and offer there.

Conclusion

I have both the Arrival Plus and the US Airways Mastercard and am seriously considering applying for this. Since my last Barclay’s application was less than two months ago, I will have to wait a bit, so hopefully the increased offer sticks around.

Do you have the Upromise Masstercard? Share your experiences in the comments!

HT: Anthony H.

[…] Increased Offer On An “Underrated Credit Card!” […]

Is this straight up cash back or does it go to a savings plan? I always associate Upromise with college savings.

No you can get a check mailed to you. You don’t have to use their savings plan.

[…] special thank you goes out to Miles To Memories for posting about this deal and to Doctor Of Credit for alerting me of its […]

[…] tip to Miles to Memories for letting me know about this deal. Please consider using his link if you do sign up for this […]

It’s a 10% bonus*

Thanks for sharing that Anthony!

Appreciate you mentioning me in the post!

The way I found out was by email, which contained a direct link. If I sign up, I’ll be sure to use your link.

The only reason I wrote ‘if’ is because you brought up a valid point. I’m wanting to apply for the arrival+ within the next few months and I already have a Sallie Mae cc, also a Barclay product. Not sure what I should do here. Thoughts? The SM card was from last year. I have a FICO hovering in the 790-798 range over the last few months. It’s at 793 after one hard pull about a month ago.

This upromise offer I know is time limited and I feel like I need to pull the trigger soon (was already considering it at $25 bonus). My main use will be for the extra 5% cb using the online portal, which can be utilized more frequently than you think if you’re an avid online shopper.

I’m sure some are aware, but anything that filters into your upromise account will earn a 10 bonus ever year if you have a qualifying account that the upromise funds are deposited into. I have a high yield savings to get the bonus. I haven’t checked the t&c, but if this is directly deposited into your upromise account, it’s worth $110.

It seems the bast Barclay’s strategy based on people’s recent experiences is no more than 1 app per 6 months. That has worked for me and others. People with multiple Barclay’s applications in a short time tend to get denied.