Worrisome Western Union Memo At Walmart & Meijer

There is a worrisome Western Union memo being sent out to Walmart and Meijer locations for sure, and maybe elsewhere. Reader Bob was able to get a hold of it and send me a picture of the bulletin. He also shared his experience at several stores after it was sent out. It doesn’t look good, at least for the time being.

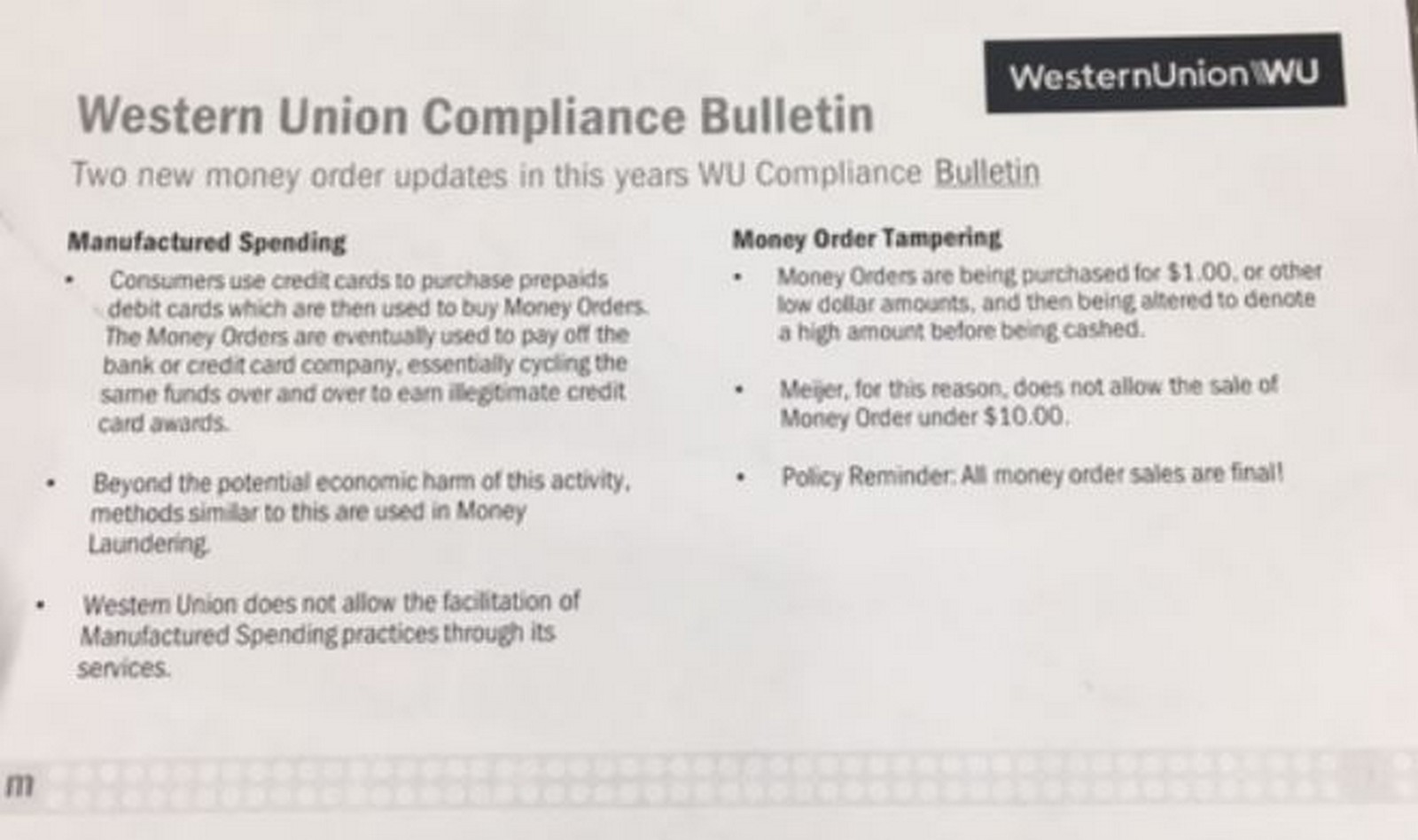

Western Union Memo

A bulletin was sent out to store locations to warn about using prepaid gift cards for money orders. They even explicitly spell out what MS is in the bulletin and what representatives should look out for and do.

They were also informed they should be asking to see the cards and ID before processing the money order.

Bob’s Experience

Here is what Bob told me in his email:

Today, two Walmart stores asked to see my card, one Meijer asked to see my card, another Meijer asked me for my name and address, and a third Meijer told me they had received a memo last night saying they would not be able to take prepaid. These all were locations where I previously had absolutely no issues.

Western Union Money Order Memo – Final Thoughts

Something like this has happened a few times in the past. It has usually caused increased caution for a few weeks, months, and then gone back to somewhat normal. Time will only tell if this is a similar instance or not. This could be area specific as well. If you run into something similar please let me know down in the comments.

I figured it was worth sharing so people don’t load up on cards and get stuck with stuff they can’t get rid of. It is best to be cautious for a bit and see how things play out in your area. Please share your data points below of recent attempts and any successes or failures.

Big thanks again to Bob for sharing this.

Red alert

Today 2/10/23. Walmart could not ring up the old school gray Walmart VGC. They are all void at the register. I hope it is just temporary, I have been reading about a bar code scam going around.

Wow, a useful post breaks into some not so useful arguing in the comments. Sad rewards for being a blogger. Mark, please know that normal folks read and appreciate posts like this. +1 to the “awareness is beneficial” group.

Thanks Lela – glad it was helpful

In case anyone is interested in “data points” – 2 weeks ago I tried to buy a MO @ Meijer, but unfortunately the clerk saw my Visa GC, and told me they were not accepted, per the orders of her boss. It worked fine just a few days earlier, and for the last year.

Of course I’ll try again and let you know what happens. As commentor Mike wrote earlier today, “Awareness is beneficial.”

Thanks, Mark!

Thanks for the DP!

Thanks for the post Mark. Awareness is beneficial.

My pleasure Mike.

And again if IRS taxed points as earned income this would all stop

It is a rebate on spending – they’ll never tax them.

Ignorant people don’t understand how rebates work. They just love to dump negativity in everything.

It wouldn’t stop me. Very easy money. Would just be a little less if it were taxed.

“Potential” economic harm. Clearly, they don’t know what the f*$% they are talking about. Do you not get paid for your services? Does the store not get paid? Are we not paying for the money orders? Oh, we must stealing these money orders. Oh the humanity. What should be more suspicious is if one brought 10k in cash to buy money orders. At least we can trace where we got our gebits. I’m not saying all cash customers are criminals but why don’t they focus on the real criminals. Illegitimate? That’s rich!

And for those who criticize who can take advantage of the system to get points/miles/cb, just because you can’t do it, don’t criticize those who can. It’s a really poor look. Jealous much?

wow, jason. losing doesn’t bring out the best i in you.

I stopped using Walmart a few years ago when I believed they had coded the computers not to accept pre paid gift cards. I was getting them in $200 amounts and they were Blackhawk serviced cards. They were simply not going through their machines anymore. I would get an error message that that typeof payment was not good. So, there is a type that is still able to get through their system? Same thing happened recently at Publix. Machines were hard coded not to accept. Manufactured spending is getting very tough. Wish I could find new methods. Just got a new United card and am doing organic spending to meet the minimum spend. Hopefully, something new will pop up.

BAU at my local Walmart. However, I was doing card loads.

Believe it or not I think this is a good sign for Walmart. Does that mean that doing MOs over $50 is now possible at Walmart? If they had technology that limited us from buying MOs over that amount you would think they wouldn’t need to put a sign up right.

I thought their explanation of Mfg. spending was pretty funny. “Illegitimate credit card rewards” LOL.

+1 The “illegitimate” comment stands out and “economic harm.” Airlines and hotels love to print and sell their points. No harm.

Thanks for the heads up. Hopefully it will blow as in the past.

“Economic harm” my ass. If anything we’re helping them out. Our hobby allows these broke ass hotels airlines to keep selling points to the banks and the banks keep making money off the swipe fees and the annual fees we pay.

WU collects their fee in the process as well as the store selling the money orders and prepaid gift cards. No one is being harmed in anyway by those of us in this hobby.

And if memory serves me right, it was the selling of points to Amex by Hilton and Marriott that kept them jokers afloat during the pandemic…and the reason Amex was comfortable with pre-purchasing such a large amount is in part because of what we do.

So, WU can take their “economic harm” crap elsewhere and Retired Gambler aka AC, you kick rocks with your lame ass argument as well.

Spot on

I don’t have any problems with pursuing MS, but if you are pushing money around in a circle and taking away points each time around then somebody else in the circle is paying for it and they probably aren’t happy about that. Let’s be realistic and admit that those of us in this hobby in any serious way are taking away a lot more in value than we are adding to the system. I sure hope I am. It seems like the whole point of the hobby is to get as much out of it as possible without stepping over the line too far and getting accounts shut down, approvals denied, the Amex popup, etc. But it doesn’t surprise me that banks and retailers might want to discourage the exact behavior that is the most profitable to me. Fair enough, and that’s what keeps it interesting.

JS,

Please explain to me, truly, who is losing in this? It ain’t Amex, they’re offering these crazy high subs but they’re collecting $400-700 EVERY.SINGLE.TIME via annual fees.

Is the airlines and hotels losing? It’s been established some times ago that the airlines and hotels are in business to sell points and miles to banks…without us, who are they going to sell those points and miles to? I can’t think of one person outside of those I’ve met in this hobby who would even remotely think of carrying around more than one $400+ annual fee card.

AMEX ISN’T STUPID. They continue to solicit us with snail mail, in our Amex offer section, with authorized user bonuses (even encouraging 99+), via email, etc. So they know what they’re doing and they’re smart enough to know what the heck we’re doing. If you believe Amex thinks that normal people spend $25k in grocery on an Amex Gold in 3 months and repeat said behavior across the same account that happens to have 2 more Amex Gold cards, you’re off your rocker.

Not to mention, I can’t make a call to Amex without them ending the call by asking me to ADD AUTHORIZED USERS! So please, stop with the “someone is paying for this”….because you’re right…WE ARE PAYING FOR IT…and WE are also scooping up the points and miles in return.

Airlines and hotels need to sell points and miles to banks…and banks in turn need us to sign up for their expensive credit cards to keep their shareholders happy…and one way to convince us to do it (and pay the high annual fee) is to GIVE US MORE POINTS. Ever heard the phrase “fair exchange is no robbery”? Well it applies here!

So guess what, the hotel and airlines win, the banks win, the place selling the money orders make some cash, the place selling gift cards make some cash, everyone who has their hands in swipe fees make some cash, and we in turn pay the annual fee, collect our points, and read sites like this hoping that folks like you “holier than thou” people would never show up in the comment section to try and rain on our parade.

But atlas, you all one stop…and neither will we…so I’ll see you in the comment section of the next article that you want to defend and you shake your fist to the heavens while telling us we’re all bad and terrible people.

Folks like you and AC/Retired Gambler should really start your own club and sit around and hold and comfort each other while you talk crap about us…at least you’d be in miserable company.

Wow, sorry I hit a nerve! Not sure where all the anger comes from around here but I think I’ll hang out in happier places.

If you’re really curious, the people selling the money orders lose. They have to cough up the transaction fee (usually very low on debit cards, but the same limits don’t apply to prepaid debit cards.)

Good – anything to crack down on the max spend crowd that try to game the system is fine IMHO. Use the cards for regular spending like they were intended. I put $150,000 a year on my cards with regular spend (pay it all off monthly of course) and have zero patience or respect for those that try to game the system. You usually ruin the benefits for the rest of us so hopefully you greed ends up with accounts shut down and point forfeited

Least shocking AC comment ever… 😉

AC? Same person?

Yeah – he uses both names

$150k a year spend.. Big D Energy.

Ah, the siren call of the angry conservative white man. “I got mine, eff you.”

I always love folks who think the way they doing things is moral superior to others. My spend is organic so my spend is more legitimate than yours is dumb I am sorry to say. Then there are the folks who earn points the truly hard way by butt in seats or body in bed earning points and they look down on the Retired Gamblers of the world for earning points via CC and ruing the benefits for them. The rules are set by the banks and loyalty programs if you want to be mad at someone go after them and not the folks who find a way to optimize that works for them.

You forgot those who choose to pay in cash and offset some of the swipe fees that are passed on through higher prices.

As you said, there’s always going to be someone feeling cheated so complaining about what others do is a waste of time.