What Happens To My Credit Card Travel Insurance If I Close The Card?

Credit Card travel insurance is a key benefit many of us enjoy. What happens if you book a trip with the card offering good protections but then cancel that card? Essentially, if you close the card AFTER paying for the trip (benefits become active) but BEFORE the trip starts? Let’s take a look.

An Example of Credit Card Travel Insurance

One of the most popular cards in this hobby is the Chase Sapphire Reserve. That’s because of the many perks it offers, including the travel insurance this credit card provides. That’s why it’s included in our review of 5 great cards with travel insurance perks.

As a representative of what your credit card might provide, here’s a quick look at what the Sapphire Reserve offers:

- Trip interruption

- Trip cancellation

- Trip delay

- Baggage loss / delay

- Rental car insurance

- Accidental death / injury benefits

There are other benefits, as well. You can read them in detail and compare them to other cards in this analysis.

When Do The Benefits Start And End?

The description of benefits for the Chase Sapphire Reserve are available here.

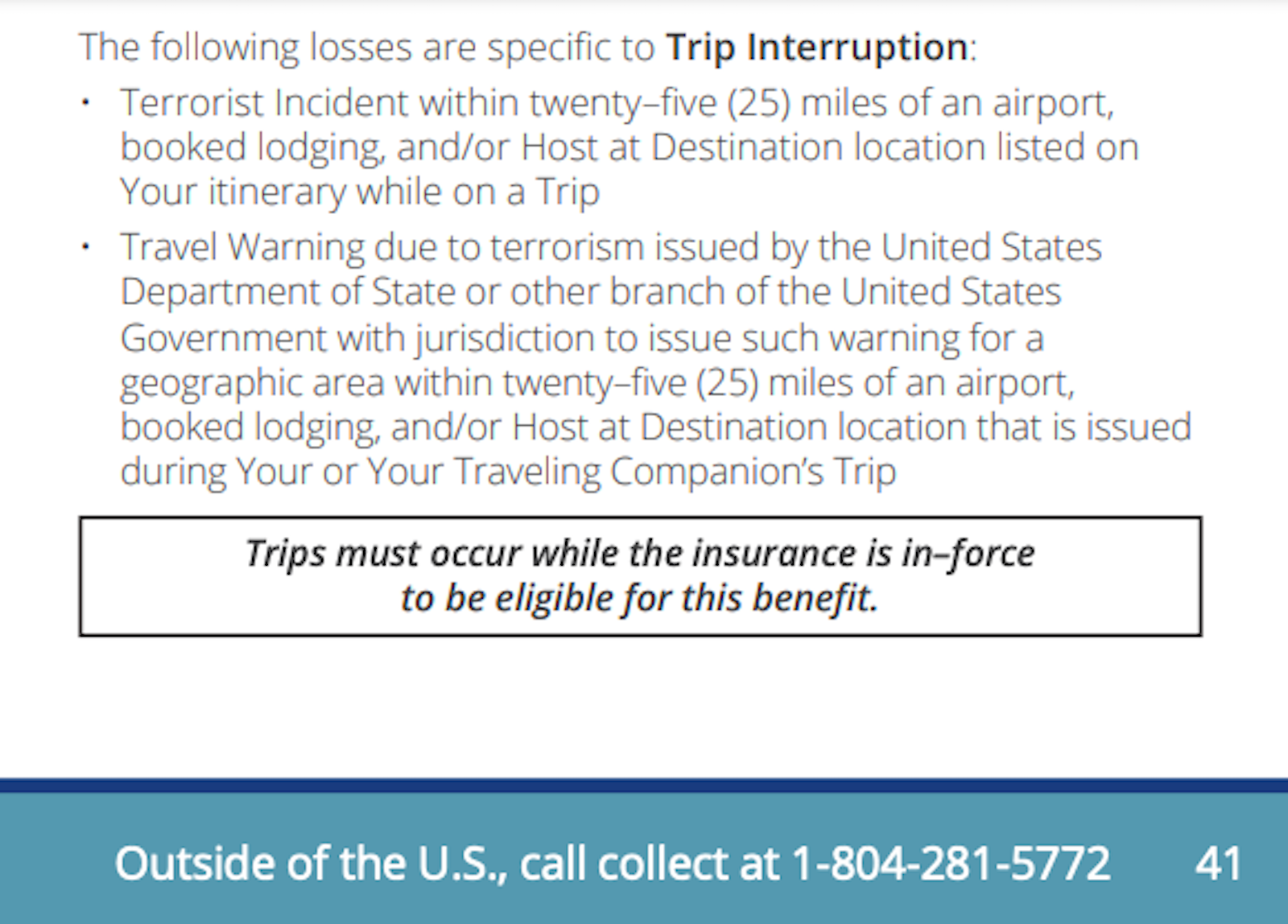

Multiple times throughout the description of benefits, the terms state that “Trips must occur while the insurance is in-force to be eligible for this benefit.” What does that mean? It means the card must still be open. Closing the card or changing to a card that doesn’t include this benefit essentially cancels your insurance policy.

If you close or downgrade your credit card, the travel insurance it offers is no longer applicable. That can be difficult to navigate in this hobby, since many of us are in the habit of closing/changing cards regularly. If you book a trip far in advance, make sure to know which card you used and to keep it open if you need the coverage to continue.

Final Thoughts

While we exalt the benefits of cards in this hobby quite often, it’s important to note their limitations. Trip insurance benefits are a great perk. However, it can’t help you if the policy is closed before your trip. Remember to keep the card open until your trip ends, if you need the benefit. Otherwise, you could do like I do and buy travel insurance, if it’s important to you to have these protections.

Thanks for writing this – I’ve always wondered about this, especially in the case of a card downgrade. Related – do the extended warranty coverages apply the same? I’ve been using my Citi Prestige for some recent bigger ticket purchases for the 2nd year of extended warranty (and in some cases, these tack onto purchased service contracts), so if this is the case, they may have me locked in for several years, vs. say, downgrading to a different Citi product.

I wonder what would happen in the case where 1) the BANK closes your account, or 2) the card goes away entirely (as some have speculated the Prestige card could be on the chopping block since they’re not taking applications right now). This could also happen when a co-brand switches bank (IE; Costco from Amex to Citi, JetBlue from Amex to Barclays).

Grant – great comment. With the change of issuer, they always send you an updated ‘benefits guide’. If the bank simply axes that card product and changes you to something else, you would fall under whatever new benefits they assign you. For example, some people got grandfathered into benefits on the old United Explorer Card from Chase that don’t exist on the new version. It really depends on the bank, but as far as downgrading Aspire to something else, they will tell you during the phone call “some benefits may change” and advise you to read the guide or give you some brief outlines (ex:”instead of earning 2x at restaurants, now you will___” and “your benefit of ____ will no longer apply”). At least Citi has done that every time I’ve changed.

I’m definitely not a lawyer and not an insurance expert, but there would have to be something that would prevent banks from closing products and using it as a get out of jail free card on providing extended warranty coverage that was in place when customers made the transaction. I could see if I proactively closed the card, but I’d wonder if there’s something to protect consumers, because I’m assuming I have some level of extended warranty, and it would be the wild west if the banks could just cancel these as they want or change/close products.

Agreed, which is why I think your choice/bank choice will be a determining factor. It’s likely why banks grandfather people into certain policies even when cards get refreshed/change of benefits.