AA Shutdown: Citi Account Closure Letters Mailed Out This Week

When we thought the AA shutdown news was over, it seems like Citi decided we’re in for 1 final chapter in this twilight zone saga. Citi is mailing account closure letters to affected account holders. Lots of people had these letters show up in the mail, so let’s look at what they are and your options going forward.

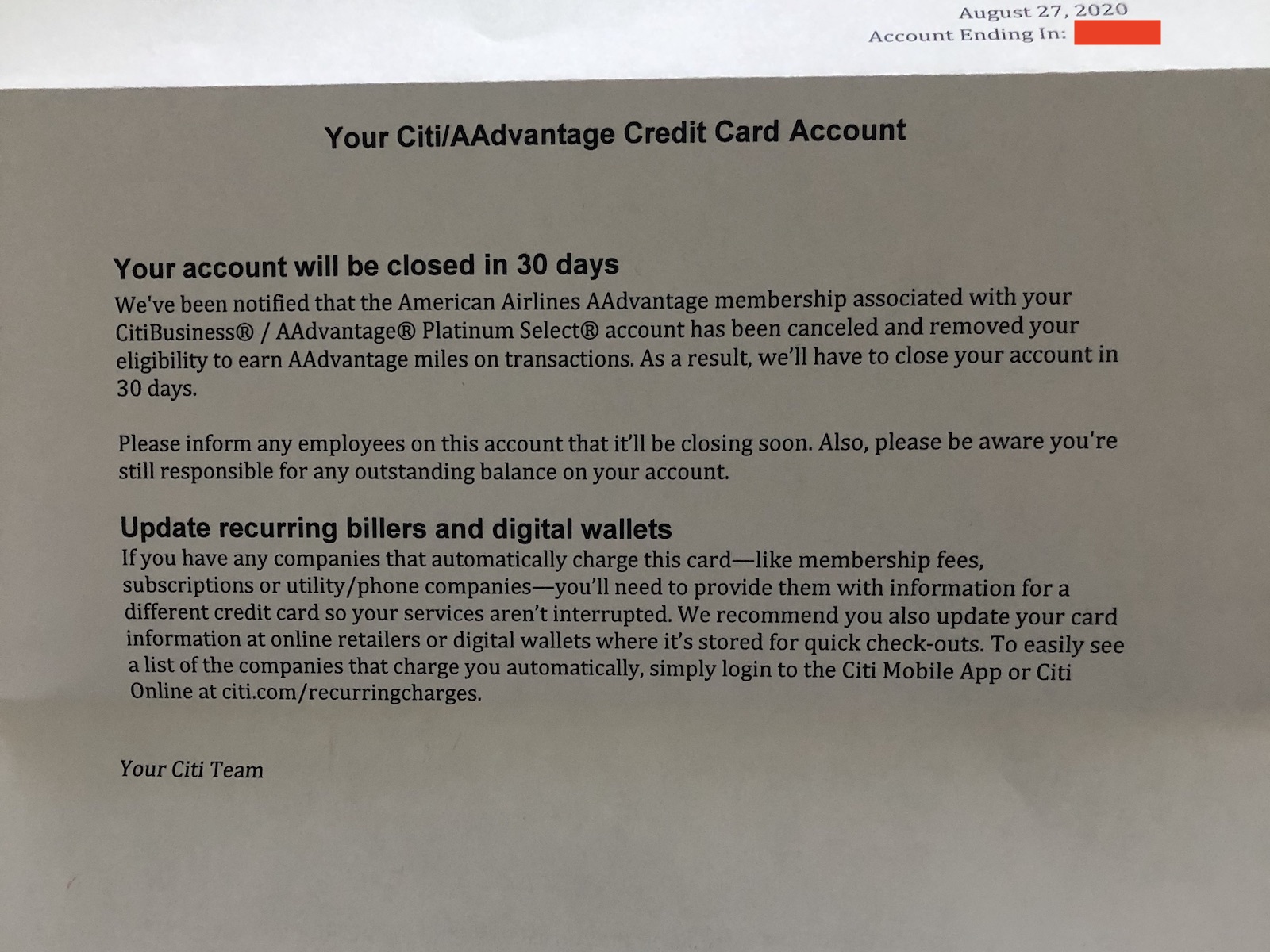

Citi Account Closure Warning Letter

These letters showed up for personal and business card holders with Citi AAdvantage cards. The letters are directed at those who went through an AA shutdown, and it looks like American Airlines notified Citi that these people no longer have AAdvantage accounts. My wife received the exact same letter today for both her Citi AAdvantage Platinum and CitiBusiness AAdvantage Platinum cards.

Because the AAdvantage account is closed, you can’t earn any awards. Thus, Citi plans to close the accounts. This comes as banks are trying to minimize exposure during the economic downturn, so I’m not very surprised.

What Are Your Options With Citi After An AA Shutdown?

If you still have Citi AAdvantage cards open, whether or not you received this letter, it’s time to take action. You have 3 options, so let’s look at what they are.

Option 1 – Do Nothing

Your first option is to do nothing. Citi will close your account(s) in 30 days, as stated in the letter. You’re already not using the cards, most likely, so there’s no love lost. The question becomes how this might affect your credit, if it gets reported as “closed by credit issuer” on your credit report.

Option 2 – Close The Account Now

The second option is to call and close the account immediately. The account will be closed soon, so you’re not losing any benefits. You’re not losing rewards or anything valuable on our AAdvantage account, so close the card on your terms. It should hopefully be reported as “closed by consumer” on your credit report. My wife immediately called and closed her CitiBusiness AAdvantage card yesterday after receiving this letter.

Option 3 – Product Change

The third option is to change your personal Citi cards to another type of card. We recently covered how this works in another article. See if you can change the card to something else that you’ll actually use. The big question marks here are 1) whether you can do this on an account slated for closure and 2) whether the change will be finished before the account gets closed. Maybe changing out of an American Airlines-branded card will get you off this “shut you down because you have no AA account” conveyor belt. Maybe it will turn off the 30-day timer, but maybe it won’t.

And this is exactly WHY we still have some of these cards. The question “why did you keep these cards open?” enters the discussion here. You can only product change cards with Citi after they’ve been open for a year. My wife still had 1 personal card, and I still have 2 Citi AAdvantage cards. We’ve waited for the account anniversary to hit, so we can product change. We’re now product changing and hoping the 30-day hammer doesn’t fall during that process. (Citi will not allow you to change cards that are less than 1 year old, and the first annual fee must post before you can change. If the card is more than 1 year old, you can change any time.)

Final Thoughts

It looks like American Airlines is circling around on this. It’s been quite the year for AA shutdowns and Citi accounts. The question in the air is what will happen with Barclays cards from American Airlines, since Barclays was clueless throughout this ordeal. Are those letters coming next? Whether they are or aren’t, it’s time to figure out what you want to do if you’re interested in preserving your credit history on these cards.

[…] And now the final saga of this…AA Shutdown: Citi Account Closure Letters Mailed Out This Week. […]

What does this mean “public offer with clear terms”? What does AA consider excessive?

The issue is that AA is not overly clear about it. You could read through the other articles linked in this one to get a concept of what happened with AA shutdowns this year, but AA refuses to answer the questions that would make things clear going forward.

So what are you product changing to?

I changed my personal card to the Costco card and my wife’s to Rewards+

Why would people shut down their AA account. Not talking about the credit card. Is this what you are saying?

No one chose to shut down their AA accounts, AA closed the accounts and confiscated the miles for a ton of people this year. They claimed that people got too many credit cards even though Citi approved them and verified all of the people’s identities during the applications.

Hmm.. So applying for citi or barclays aadvantage cards is a bad idea now? Was about to jump on them 🙁

No, applying for them is probably fine if you use public offers with clear terms.