Crazy! Air France Refuses Refund and Amex Won’t Issue Chargeback

Many airlines are canceling flights and getting refunds it not always very easy. Airlines are hurting so they are trying to push people to take vouchers instead of cash refunds. That is fine when they offer an incentive to do so, like Frontier for example or some other airlines, and you accept. But what about when they just flat out deny you a refund altogether for a flight that the airline cancelled?

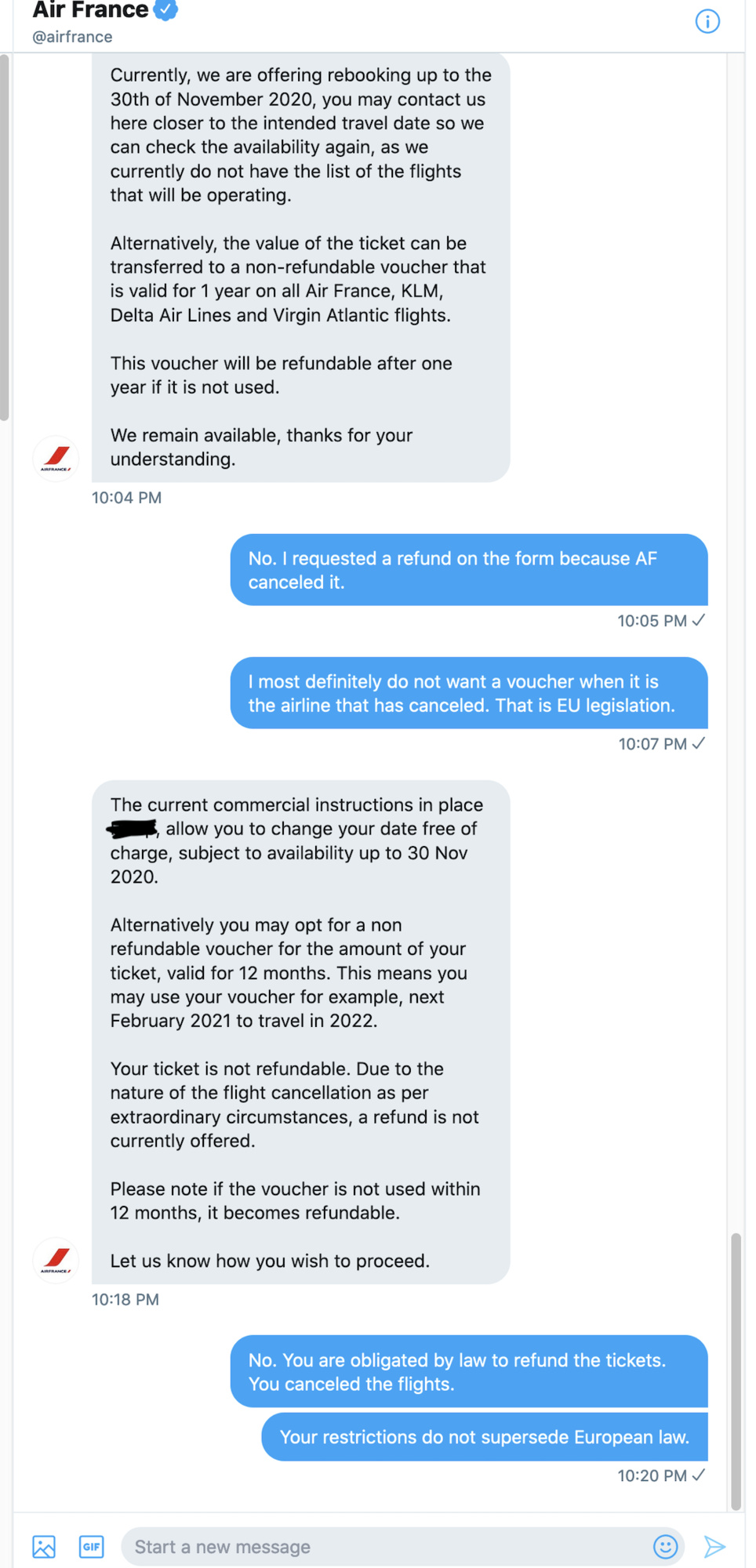

Here is a story about Air France that was posted on FlyerTalk. The flight was cancelled on Saturday and the customer requested a refund (via online form). But he received an email asking to claim a voucher instead of being issued a refund. This is for a ticket worth €3,500. This is the Twitter exchange with Air France customer service regarding the issue.

Since that went nowhere, the customer then proceeded to file a chargeback claim with American Express. This should be your next step if an airline refuses to issue a refund when you are legally owed one. Mark filed one last night about a similar issue with Frontier and it was accepted by American Express.

But the issue with Air France that we’re talking about here takes a strange twist. The customer called Aemx France to request a chargeback. “They refused to open the case stating that they have been instructed, as Air France is a partner, to not open any cases. All reimbursement cases have to be processed by AXA as an insurance claim.” AXA is a French insurance company and the lead insurer for Air France.

Conclusion

So to sum this up, the customer now really has no other options, besides taking legal action I guess. The airline refuses to give back the money for a flight that they cancelled and the credit card company refuses to do anything about it. It is crazy that Air France and Amex can just team up together and refuse chargebacks. I haven’t heard of this happening is the states, but I guess anything is possible.

Just got a refund from British Airways for a flight cancelled last week…. Leave it to the French to break EU laws.

I have a canceled flight with TAP and haven’t been able to obtain a refund – wondering if the airlines are going to rely on claiming force majeure as their grounds for this tact?

That is why we must get creative in how we dispute these matters. It would have been easier to lie and dispute the original charge as being fraudulent than what the poster went thru. I just got off the phone with AS CSR and then Supervisor getting $375 in change fees refunded. I was successful but it took a fight threats and other negative dialogue. The airlines are desperate for cash and will do whatever it takes to keep monies regardless of the law policies or procedures previously in place

They are using a hidden clause to conserve cash (of which they have little). Not sure of the legality of that.

I thought one of the purposes of the EU was to institute universal (to the EU) policies and regulations. From what is written above, that does not appear to be the case.

Reminds me of the pirate movie with Johnny Depp (“Pirates of the Caribbean”), when they’re discussing “Pirate Rules”. “Actually, they’re more like guidelines!”

I am going through the same thing with Air France! They cancelled my flight and refuse to issue a refund. They even had the nerve to say they are only granting me a travel voucher because of COVID-19 – implying otherwise they could just cancel my flight and not offer me anything.

Wow. Sounds like shit is about to hit the fan!

Not a surprise. People seem to think they can get reimbursed just by disputing a charged w their credit card company. No people – card issuers aren’t insurance and don’t have a pool of money to pay card holders. If it is a legitimate dispute they will act as the card holders agent but only reimburse in the event of fraud or if they can reasonably get the funds back from the vendor.

Sorry people but these are unique times and you really need to understand that the rights to reimbursement you thought you had don’t actually apply.

@AC What are you talking about? It is codified into EU law that refunds must be given, in the US it is a law that they must be given within 7 days. At this point, it is theft or fraud, depending on the interpretation of the law and CoC.

I disagree. I’d say it’s definitely a case of fraud between the airline and the credit card company. Hoping the guy can afford a lawyer. Honestly he could probably get one who would work for free until the case is settled. It’s pretty clear the airline is breaking the law. Hopefully he doesn’t settle out of court, unless they offer a ridiculous amount of money. Not sure how the courts work in other countries. Here they could file for punitive damages.

companies are #1 with the cc companies, customers are somewhat further down the list.

@Ashley

The attorney that would take this on a contingency is one that’s either desperate and/or terrible at their job with no demand for their services.

The Airline Deregulation Act preempts any claim you’d seek in State courts, which doesn’t leave you with a any “easy” options, especially because the dollar amount would almost guarantee a small claims court venue were it not for the ADA.

However this ends up, I feel pretty strongly that courts don’t make a habit of awarding punitive damages for amounts this small or in cases even remotely force majeure related

It doesn’t really have anything to do with the amount or how small it is. They are breaking the law is the point. Punitive damages are awarded in cases that technically don’t even involve money, small or large amounts. A KFC employee sued because they weren’t following the laws in regards to nursing mothers and a place and times to pump. The jury awarded her a million dollars in punitive damages. The point of punitive damages is to punish the company for breaking the law. By awarding large amounts it’s less likely the company will continue breaking the laws. Again, I’m sure it varies depending on what country the court is where it’s happening.