Alaska Airlines Virgin America Merger

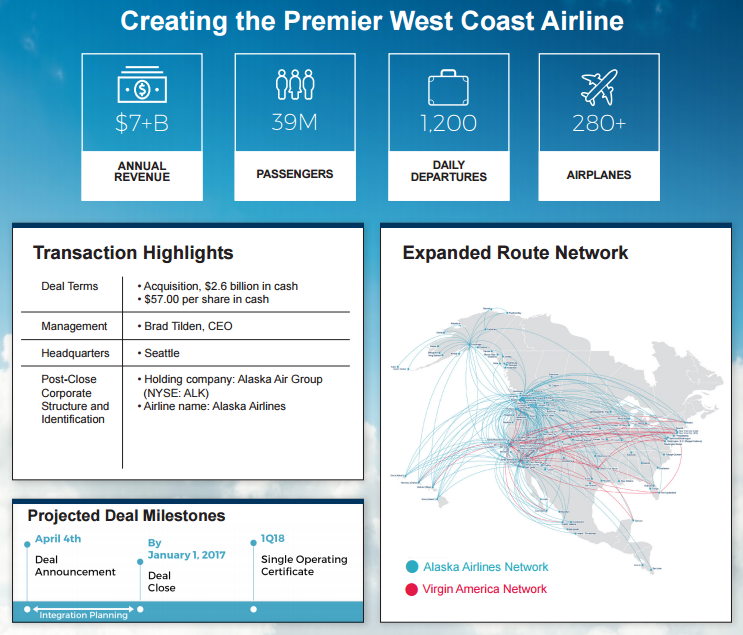

I reported last night that Alaska was rumored to close the deal with Virgin America for roughly $2.5 billion. Now, the purchase has been made official and the actual cost is $57 per share or about $2.6 billion. Once you account for debt and other factors, that price actually jumps up to about $4 billion.

In their press release, Alaska mentions some of the highlights of this deal:

- Deal combines two leading airlines known for outstanding customer service and low fares.

- Alaska Airlines expands its California presence, while creating new opportunities for growth and competition.

- Expanded route network benefits customers, with 1,200 daily departures.

- Transaction is expected to be accretive to adjusted earnings per share in first full year, increases annual revenues 27 percent to more than $7 billion and offers $225 million total net synergies annually at full integration.

- Alaska Airlines Mileage Plan™ to welcome Virgin America Elevate® members.

- Company headquarters to remain in Seattle.

Goodbye Virgin Elevate

One thing that is always speculated about is what happens to a loyalty program when airlines merge. Well, Alaska didn’t waste any time.

Following closing, Alaska Airlines will welcome Virgin America Elevate loyalty program members into its Mileage Plan, ranked #1 by U.S. News and World Report. With Alaska Airlines Mileage Plan, members are able to redeem award miles for travel to more than 900 destinations worldwide, rivaling global alliances. Until the transaction closes, both loyalty programs will remain distinct – with no short-term impact on members. Upon closing, the programs will be merged. Alaska Airlines is committed to ensuring that loyalty members of both airlines maintain the same high-value rewards they’ve come to enjoy in both programs – with access to an even larger network.

Since we know that the programs will merge, it becomes time to speculate how miles/points will be calculated from the old program to the new one. Greg the Frequent Miler calculates Elevate points as roughly worth 2X MilagePlan miles so the conversion will be interested. He even talks about a plan where you could do an indirect transfer from Membership Rewards or Citi ThankYou to Alaska via Elevate. An interesting idea.

Timeline

Before you go transferring points, it is important to know the timeline with which this deal is to close. Tentatively the companies have announced a January 1, 2017 date for closing the deal with a goal of operating under one certificate by 2018. This deal does still need to be approved by regulators as well.

The merger, which has been approved unanimously by the boards of directors of both companies, is conditioned on receipt of regulatory clearance, approval by Virgin America shareholders and satisfaction of other customary closing conditions. The companies expect to complete the transaction with regulators’ approval no later than Jan. 1, 2017.

Conclusion

This is a big deal for Alaska and it is costing them dearly. They paid about double of what Virgin America was worth about a month ago and over $1 billion more than the company’s value on Friday. While they will have to figure out how to merge products and fleets, it seems like both companies are committed to doing it and to maintaining their reputations as being among the best and highest quality airlines.

What do you think? Did Alaska overpay? Are you excited about this new combined airline? Let us know in the comments!

[…] has been a lot of speculation about the fate of the new combined Alaska Airlines after their purchase of Virgin America. Today, the company put a lot of that speculation to rest with a series of announcements. Some of […]

[…] Airlines recently completed their merger with Virgin America. Apparently as part of the merger (or possibly as a mistake), they have deposited 10,000 miles into […]

[…] Elevate is a dying program as it is set to be shuddered sometime after Alaska Airlines complete their purchase of Virgin America. Since Virgin Elevate points are worth much more than Alaska miles, some have speculated that they […]

Quite a premium AS agreed to pay. Only time will tell whether combining workforces, managing polar opposite fleets and merging FF programs yields a sum greater than its parts. IMHO, $2.6B is a head scratcher on the surface.

I agree, and from a competition standpoint it probably would have been better for consumers if B6 had won the bidding. With their really strong East Coast and Caribbean presence combined with VXs strong West Coast operations they would have really brought some competition to the big 4 in the domestic and short haul international market. What you have with VX and AS combining is basically going to be increased dominance of the West Coast market. In fact, consumers on the West Coast will probably be worse off.

Not to mention the B6 fleet is already pretty much the same as VX. I really wonder what AS plans to do with the VX fleet? End the Boeing exclusivity or try to sell/trade the VX Airbus fleet for Boeing products?

This is actually pretty good news for me all things considered. I used to fly VX any chance I could so I racked up a ton of Elevate miles from paid flights and speculative points transfers from Amex MR when they ran some good bonuses, thinking I’d use them for some first class tickets in the future. Then they pulled out of my home market (PHL) and I was stuck. I’d have to drive to DC or NYC if I wanted to use them. I left them there thinking I’d end up doing just that at some point and transferring 100 points from MR every 6 months or so to keep the miles alive. If they transfer to AS at a 2 for 1 ratio I’ll end up with almost 250k AS miles. I say bring this merger on! Too bad about the Emirates devaluation though..

I think AS overpaid for VX. I also won’t speculate further until the feds approve the merger. As for the timeline, I hope they meet it but my gut always tells me these timelines get delayed most of the time.

What will happen to status match for virgin?

What will happen to Hawaii inter island transfers for 3K points?

What do you think will happen with ThankYou and Membership Rewards since Elevate is one of the transfer partners? Will Alaska become one of them, or will those programs lose a partner

I hope they both lose AS as a transfer partner. One of the reasons AS miles are so valuable is none of the big points currencies transfer to AS except SPG and SPG points are a lot harder to come buy. If either MR or TYP becomes a transfer partner I suspect we’ll see more big devaluations like the recent one we had with Emirates.

I’d be happy with some sort of transfer to Alaska. Doesnt have to be 1:1. Options are great, which is why I got a transferable points card. Amex has been hit pretty hard with the loss of Frontier, Best Western, and now potentially Starwood and Virgin America.