The Earning, Burning & Comfort Trifecta

My main goal in life is to travel far and long for cheap and in comfort. That is obviously easier said than done. Either it is cheap but not comfortable or comfortable but it costs a lot of money and/or points. While there is no real cure for that other than the occasional mindblowing deal I have found something that is working quite well lately.

Last year I covered my AA elite fast track experience. For a brief moment American Airlines opened up a fast track opportunity where you could earn Executive Platinum status by earning 30,000 elite qualifying miles. I did that by flying to Panama on a couple of cheap business class fares and it also gave me the opportunity to tack on a trip to Cuba as well.

Exploring the Trifecta

So fast forward to this year where I have been enjoying my Executive Platinum status. Not only does it give me unlimited domestic upgrades (I have been lucky to clear on every flight), but it gives me a huge benefit. I earn double redeemable miles on all flights. (Platinum earns this as well.) This means I earn a lot when I fly and comfort wise I have a good shot at first class and worst case I get extra legroom seating.

So the status in and of itself isn’t huge news, but for me it is only one piece of a three pronged puzzle. To satisfy my travel trifecta (good earning, cheap burning and comfort) I have another trifecta if you will.

Here are the three parts:

- AAdvantage Executive Platinum Status

- Citi Prestige

- Citi AT&T Access More

So why these three things? Well the elite status gives me a 100% bonus on redeemable miles, the AT&T Access More card earn 3X ThankYou points for online shopping and the Citi Prestige allows me to book American Airlines flights at a value of 1.6 cents per point. It is a beautiful thing.

An Example These Things at Work

To show you how powerful this trifecta is, let’s look at a recent example. A few weeks ago I traveled to/from the Family Travel for Real Life Conference on three separate one-way tickets due to their stupid new pricing structure. The tickets were LAS-MIA, MCO-MIA, MIA-LAS.

- LAS-MIA: $69 or 4,313 ThankYou points.

- MCO-MIA: $49 or 3,063 ThankYou points.

- MIA-LAS: $104.72 or 5,818 ThankYou points.

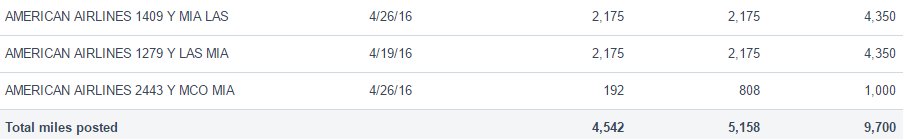

If we add that up, I spent 13,194 ThankYou points, but I earned the following:

- LAS-MIA: 2,175 miles X 2 = 4,350

- MCO-MIA: 500 mile minimum X 2 = 1,000

- MIA-LAS: 2,175 miles X 2 = 4,350

- Total earned: 9,700 AAdvantage miles.

In other words, I spent 13,194 ThankYou points in exchange for 9,700 AAdvantage miles, took a trip to Florida and oh by the way, all of my upgrades cleared so I flew up front.

Another Great Example

There have actually been flights where I earned more AAdvantage miles back than I spent in ThankYou points. Actually, if you look just at the LAS-MIA flight from the last example, I spent 4,313 ThankYou Points to earn 4,350 miles. Here is another example of a flight I am looking to book right now that is a great deal.

Currently there are some cheap fares to Brazil on American. I am thinking about going down for a working trip/mileage run since the Visa fee is currently being waived and I have never been. For some dates I am seeing $590 roundtrip from Los Angeles to Sao Paulo via New York. That is 14,439 flown miles which would earn 28,878 redeemable miles. The cost to me in ThankYou points would only be 36,875. To address the comfort issue, I can use two systemwide upgrades to fly in lie flat business class there and back.

AT&T Access More

So how does the AT&T card fit into all of this? Since I do a lot of online shopping as part of my reselling and also for personal needs, I earn a lot of ThankYou points. I can then churn those ThankYou points into AAdvantage miles by flying. As part of that process I earn more elite credit and re-qualify so I can do it all again next year. (Well, sort of. See below.)

Related: Which Merchants Earn 3X ThankYou Points with the AT&T Access More Card?

Think about this? If I spent just $10,000 per month on my AT&T card for online shopping, I would earn 30,000 ThankYou points. That is 360K in a year. Those 360K points are worth $5,760 in American Airlines flights. Lately I have been earning back about 70% of the ThankYou points I spend as AAdvantage miles. That means if I spent those 360K points, not only would I get a ton of great and often comfortable travel, but I could earn back about 250,000 AAdvantage miles. Of course that number would vary based on the price of airfare. This deal is sooooo good and you know what happens to good deals?

Sad Conclusion

The main point of writing this was to show how powerful each of these three things are on their own and how they can be combined to make something special. Unfortunately, this trifecta will be weakened incredibly when American goes revenue based on the earning side sometime this year. As an Executive Platinum I’ll earn 11 miles per dollar spent, but that is significantly less than now. Look at that combined $222 trip to/from Miami. It will only earn about 2,400 miles instead of the 9,700 I earned. Ouch!

For now I am enjoying the earning, travel and relative comfort knowing that the clock is ticking. Still, even as earning rates go revenue based on American, the combo of an AT&T card for earning and a Prestige for burning at 1.6 cents each on American is powerful by itself and is reason enough for me to keep both of these cards around for the long term.

[…] few weeks ago I wrote about how the AT&T card combined with the Citi Prestige is a powerful combination of 3X earning and 1.6 cents per point redemptions on American Airlines. That alone is a reason to […]

[…] of like my trifecta post last week, this looks at what products work together to create downstream benefits like better […]

[…] to Memories recently wrote about the powerful combination of AA elite status, plus the Citi Prestige card, plus the Citi AT&T car…. To me, the AT&T card benefits (3X points for online shopping), are a side note to the real […]

[…] I Found the Perfect Travel Trifecta (Earning, Burning & Comfort): But This Deal Is Ending Soon […]

Though it might not affect others, I’d like to mention the Citi AT&T card does have foreign transaction fees =[

Lost me at reselling. I try following the bouncing ball to learn that game but it’s over my head. Or my gut check doesn’t like the risk. It seems to be the best MS opp these days however.

AS MVPG status works pretty well with AA (as an MVPG I earn 100% EQM and 200% RDM on virtually all AA paid fares) – will be a compelling alternative once AA goes revenue based.

I really like this idea. And since AS is adding JAL as a partner, I think this will be my plan from now on =]

Also ending soon: Citi Forward which gave 5x TYP on food drinks and Amazon 🙁

[…] I Found the Perfect Travel Trifecta (Earning, Burning & Comfort): But This Deal Is Ending Soon – Finding the perfect mix of elite status and credit cards to earn and burn while being comfortable while traveling. […]

Hey Shawn,

I’ve been using a similar technique, minus the Platinum status. And even if I wasn’t making back as many miles as you were when flying AA, it still made TY point redemptions a lot easier to handle when I knew I was getting something back in return.

But like you said, once AA goes revenue, it won’t be as amazing. But I still love TY points for its partners so I’m still not straying quite yet. I still need to grab the AT&T card as well, so that’s my next plan.

Even if you did the ATT card, see the math – 10k spend x 12 months = $120k – a Cash back card will give you 2400$ at least, with no fuss. 250k AA miles are worth 4800$ at most – you can buy them for 1.8c each now on sale. So it is a temporary savings on miles cost. Long term, you are better off with cash back

@ffi,

You missed some important points. $120k spent on the ATT card at online merchants earns 360,000 in points. That’s $3,600 cash even if you waste the points that way, or $5,760 in AA flights if you use them wisely. It’s not really even close.

And don’t forget the extra 10k points for spending $10k in a cardmembership year =]

Shawn, any idea what might be the next tri-fecta to work on this year?

My AA Platinum Select card AF came due this month, I called and did not get a retention bonus. I thought about converting to a Double Cash card but haven’t yet. My understanding is that if I PC now, the clock restarts on getting another AA Platinum Select card, which is now 24 instead of 18 months. If that’s the case and I PC then I am 2 years out. I also am considering PC to the AT&T card for the 3X bonus. I don’t want the 2 HP so that’s why the PC. Verizon reception is far superior where I live so I’m not switching. So my question, do you think a PC to the AT&T card is worth putting out the AA card for an additional year?

Careful. If you bump up against some unpublished Citi limit, certain merchants will stop earning 3x. From what I understand via Exec team, you hit one merchant too hard and they will cap it.

I think you’re glossing over the external costs – initial investment to earn Exec Platinum, plus the MS from reselling.

I don’t think so. First off, I linked within the post to a post that covers all of my Exec Platinum costs. This post also isn’t about saying that you need to do what I do, but showing how these three things are working well together. Your job as a reader is to see if somehow that makes sense to you.

Yes, the reselling stuff is something that won’t apply to everyone, but some people are having success with gift cards and other purchases online for MS that are coding as 3X. Again, this post isn’t trying to sell you anything, but rather is showing you how well it is working for me and perhaps you can find some value in that.

Sub

the annual fees add up. Any success having those waived?

The AT&T card gives 10,000 points annually if you have spent $10K so I consider that an offset of the annual fee. The Prestige is pricey, but you get a $250 annual airfare credit which can be used for tickets. That brings the price down to $200 and there are a ton of other benefits too to help offset that even more. Additionally Citi is pretty good with retention offers. I even got a 10K bonus offer after only having the card a few months. https://milestomemories.boardingarea.com/citi-prestige-retention-aadvantage/

350 a year in branch with bank rep using Citigold app and blank account number. Crazy to do the 450 version

Re: “Since the Visa fee is currently being waived and I have never been. For some dates I am seeing $590 roundtrip from Los Angeles to Sao Paulo via New York. ”

Questions for you:

– Visa fee waived. Does it apply to US Citizens only?

– Would you share the dates and time?

Thanks in advance

Here is info on the Visa waiver. http://www.reuters.com/article/us-brazil-olympics-visas-idUSKBN0UD1C720151230

As for the dates, you can find them on Google Flights by looking at the calendar. The cheap dates are pretty much in June right now.

Why the AA card is the part of Trifecta? did not get it 🙁

“Here are the three parts:

AAdvantage Executive Platinum Status

Citi Prestige

Citi AT&T Access More”

It is the status which allows me to earn double miles and not the card.

I see it now. any other airline’s elite can get 2x miles on AA flight?

just a thought….

JX- Shawn is referring to the Executive Platinum status member card not specifically any AA Credit card. He mentions his EP status

Tempting to offer for the AT&T Access card. Do they check to see if you’re a current AT&T customer? If so, any way around that requirement so we can get the free phone and resell it for profit?

You can sign-up for an account for a minimum amount of time which doesn’t cost all that much, but the big deal is that you will be hit with a hard inquiry from AT&T which does sting.

Does anyone have any idea whether or not the Citi AT&T Access card will be offered again with the free phone bonus? Thanks.

It still is. Here is the landing page with the offer and you can click the application from there.

https://creditcards.citicards.com/usc/ATT/rewards/2015/Mar/access/dual/digital/default.htm?BTData=PIx.B.gAB4f.J.Bl9.RO3T.b8P.iTK.rJ1.Bj.Mx.g7.E&m=43Y5111111W&ProspectID=B3F6467CD0044E5A8FF2A7C9A85E5CF4#/menu

Thank you so very much!! My sister will be very happy!