American Airlines Shutdown My Account – Some New Data Points

AA shutdown my American Airlines AAdvantage account this week (and my wife’s 1 minute prior to mine). Despite all of what you’ve heard or think you know, I believe there’s something new happening here. I think American Airlines has upped its game and changed tactics. I also want to talk about how it happened and what’s happening now, so anyone in a similar situation can start thinking about Plan B. While there has been no shortage of posts about American Airlines shutdowns on numerous sites, I think there’s something novel here that might give pause to some people in 2-player mode.

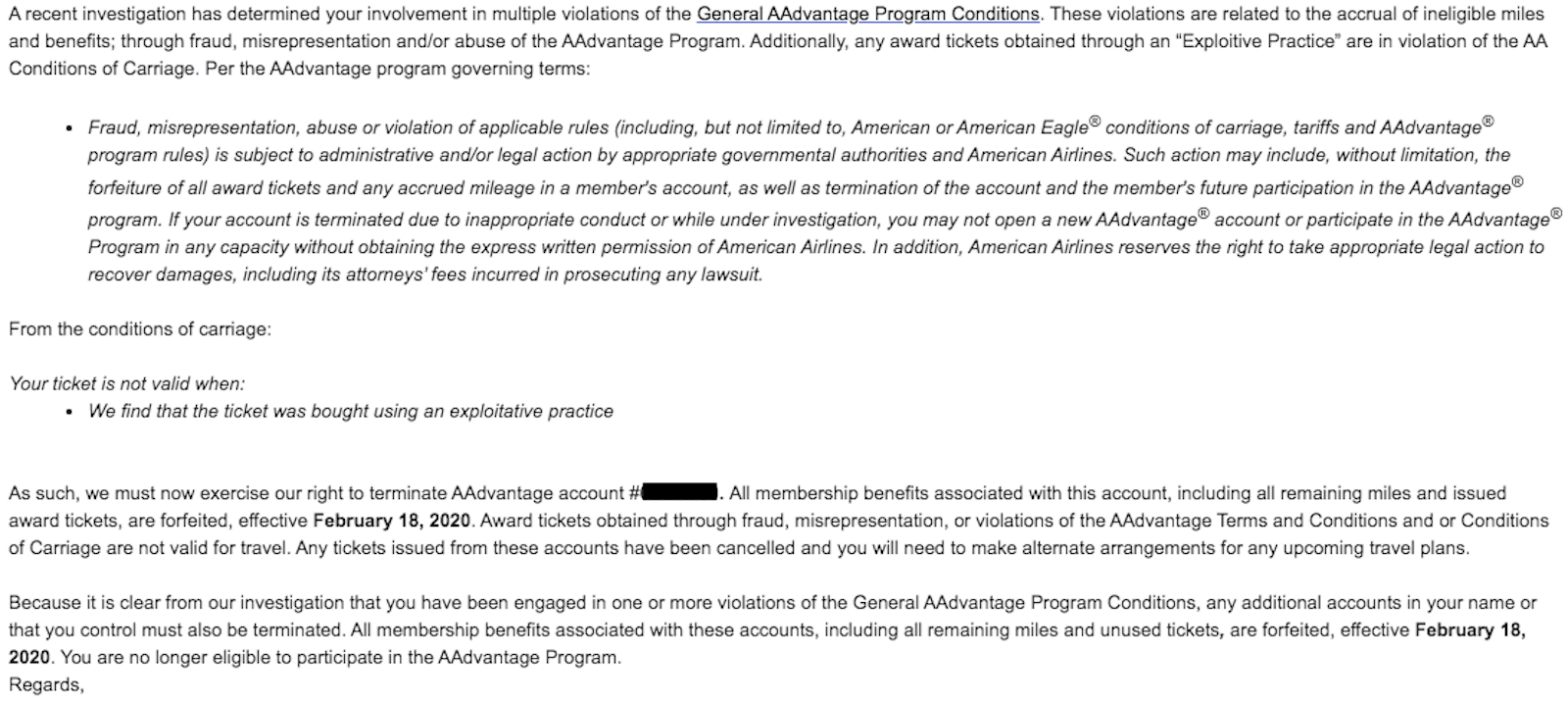

Quick Recap On AA Shutdown

We mentioned American Airlines AAdvantage shutdowns a few times previously. The events: Around mid-December 2019, American Airlines started locking people’s frequent flyer accounts. There were suspicions and rumors. The data led to people being locked who’d had numerous welcome offer bonuses in their AAdvantage accounts during 2018-2019. We’re pretty sure all the data was related to Citi bonuses.

American Airlines really strung this out for a while, and Shawn mentioned that leaving people on the hook for weeks/months was not cool. Numerous people showed up to the airport clueless as to whether they’d actually get to board their flights while locked. Some could and some couldn’t. That’s not a good way to treat people, regardless of how you feel about these shutdowns.

AA Changes Tactics

Let’s call it very likely at this point that American Airlines employees created accounts and started reading Reddit. As people posted data points about how to find out if your account was locked, everything changed. I’ve got to hand it to American Airlines that they were doing this. The only real way to know became either receiving an AA shutdown email or attempting to book an award ticket that just never confirmed.

My Wife Got Frozen

Now that we are up to speed, let’s talk about what happened to my wife and I. My wife’s AAdvantage account was frozen…best guess…first week of January. I say “best guess” because we’ll never know. She booked an award ticket in late December, and the ticket was issued/confirmed. Around January 10-ish, we tried to book another award ticket for her. It never confirmed. After 5 days, we called. The phone rep said it wasn’t confirming because the account was “being audited”. The phone rep said she’d spoken to the relevant department asking if they’ll contact us to clear this up so the ticket can be booked. The rep seemed unaware that this was happening to more accounts than just my wife’s. I say that because it sounded like the rep thought this would be solved in a few hours.

With my wife’s account frozen, I assumed mine would be soon. Why? We have the same address, and I was listed as the co-passenger (including my AAdvantage account #) on some of her upcoming award tickets. Also, our account activity was pretty similar. Let’s just assume any company doing audits and shutdowns will at least take a glance at the account of the 2nd passenger during this process.

Why My AA Shutdown Highlights a New Trend

Knowing that the clock was probably ticking on my account, my wife and I had a talk. With our work commitments, her school, our dog needing walked during the middle of the day…when was the earliest I could take a trip and try to use up my miles? The time we chose on the calendar was this weekend.

I spent several hours looking for routing, flights I wanted to take with AAdvantage miles while I had the chance, etc. I went for several things on my previous post about AA sweet spots. Flights were booked and confirmed my flights for this weekend. In fact, the final flight in my planned trip was booked and confirmed just 4 days prior to the shutdown. Yes, 4 days before shutdown I confirmed and ticketed an award flight on my account.

Why am I harping on 4 days? Everything we thought we knew about these shutdowns was like this: lock/freeze for over a month, then get AA shutdown email. Most people waited weeks and months as “frozen” and wondering if they could board upcoming flights. In 4 days, my account went from working normally to shut down. That’s a new twist.

And they didn’t just seize bonuses, which I could understand in this situation. However, they’re seizing points people earned from flying on cash fares, daily credit card spend, retention offers from Barclays, etc. (Joe even talked about some of the crazier data points in the latest podcast) that aren’t related to these bonuses they’re upset about. I think this hobby is one giant “use the loophole”, and my wife and I were shutdown for using a loophole. In the process, we lost what anyone would consider valid American Airlines miles. There’s a legitimate axe to grind on those things, but that’s a different post.

Is American Airlines Changing Tactics Again?

I believe American Airlines is changing tactics again. Since my shutdown this week, I’ve seen new data points on others who were never frozen being shutdown immediately without the freeze period we thought was standard. This is still the less common path to shutdown, but it’s an emerging trend. I’m not trying to scare you, but I think it’s important to note that what we thought we knew might no longer be true. There are a few possibilities at play here to flesh out. The reason why I’m talking about this (even knowing the barrage of hateful comments coming) is because of how many people in this hobby have a “player 2”. Here are some things to think about:

Theory 1: Questionable associated accounts are shut down at the same time, “guilty by association”.

My first theory is that while auditing my wife’s account during the frozen period, they considered any associated accounts. Things like joint passengers or same address. When my wife’s AA shutdown clock struck midnight, they axed anything they felt should be taken out together. Thus, our emails came 1 minute apart. I was axed jointly with my wife without the typical freeze/review period because her time had come and we were associated + I checked some of the boxes they were looking for.

Theory 2: Avoid letting people use their miles if they’re on the “accounts to be reviewed” list.

My 2nd theory is that American Airlines is looking at accounts where anyone fits a certain description. We know “multiple bonuses” is one of those, but I won’t do their homework for them here by suggesting other ideas. Among other factors they add in, let’s assume my account was on the list “to be audited”. They noticed it was close to the departure date on my flights and they axed my account. They were planning on locking me and doing the normal review, but time was short. Straight to AA shutdown. Don’t pass go, don’t collect $200. This avoids letting anyone on the “to be reviewed soon” list from taking more trips. I’ve been getting “flight cancelled” and “taxes refunded” emails exactly 4 days prior to take-off time on upcoming flights. To the minute. They intervened to avoid more award trips on accounts they planned to close anyway.

Or Something Else Entirely

There could be something else. Maybe it’s just a coincidence. However, my data point of not being frozen and getting the AA shutdown email 1 minute after my wife got hers gives me pause. I can’t help but feel they’re connected if signed by the same employ and coming at the same time. If you have a spouse, sibling, or other “player 2” in this hobby, I hope you will think about this. If you’re currently locked and the P2 isn’t (or vice versa), it might be time to consider the “guilty by association” theory. Maybe 1 of the 2 of you isn’t frozen now, but my experience says that might not matter. There’s no knowing for sure, but think about it.

The Data Points For 2 AA Shutdowns

For those who are going to ask for the data, I have no problem sharing. Here’s a recap.

Me

- 2018 – 2 Citi AAdvantage bonuses, both business cards for separate businesses

- 2019 – 3 Citi AAdvantage bonuses (all personal cards) and a Barclays business bonus, plus retention offers on some cards

- Points lost – 280k between points in the account and canceled bookings

- Upcoming bookings canceled – 5

- Mailer codes used – 2

- Age of AAdvantage account – 25+ years

- Elite status – none

My Wife

- 2018 – 2 Citi AAdvantage bonuses, both business cards for separate businesses

- 2019 – 3 Citi AAdvantage bonuses (all personal cards) and a Barclays personal bonus, plus retention offers on some cards

- Points lost – 330k between points in the account and canceled bookings

- Upcoming bookings canceled – 3

- Mailer codes used – 2

- Age of AAdvantage account – 6 years

- Elite status – none

We had no American Airlines welcome offers from credit cards prior to 2018.

Final Thoughts On AA Shutdowns

I’m well aware of the animosity this topic has generated. Despite that, I’m sharing my experience to help others who should consider “what if?” at this point. If you’re in 2 player mode and 1 person is affected, it’s probably time for a talk. Maybe the other person has never had a Citi bonus from a referral code, and you think that account is squeaky clean. That’s awesome. If either of my theories applies to you, I hope some thinking and planning are on your “to do” list. I hope a solid Plan B is in the works for your upcoming trips.

I don’t think anyone in the AA shutdown group is looking for sympathy. The purpose of this post is to point out that what we thought we knew (4-6 weeks of freeze, then get American Airlines shutdown email and flights canceled/refund of taxes) seems to not be true. Prior to this week, there weren’t data points of people being closed down without being frozen first. Something is different now, and since my AAdvantage shutdown email arrived this week, other “I wasn’t frozen” data points are starting to emerge. I hope knowing this might help someone.

[…] the best deal we’ve ever seen for this card, and it’s been years since we’ve heard from Toby. Note that there’s also a $100 targeted referral bonus from Citi. (Thanks to […]

[…] AA Shutdown My Account – Forget What We Thought We Knew:他老婆的账户第一波没被锁,到了 1 月才被锁。他自己的账户一直没事,被锁之后四天就关了。每个人 18-19 年加起来 churn 了各五张,剩余里程 280k/330k。 […]

I had my account closed and I only used ones that were addressed to me. I don’t see how it’s my fault. They sent me at least a dozen applications over a period of years. I opened the card, got the bonus, and closed the card. They kept sending me more applications. Now I’m the one who violated their terms? This sucks. I wish there was a way to remedy this situation.

Robert – I recommend consulting an attorney if you only used approved offers specifically sent to you. That’s messed up. Don’t just roll over on AA doing this.

Ryan,

Do you know if there is any reports of shutdowns for canceling a american executive card after getting a sign up bonus and after the annual fee posts (getting fee refunded)? I’m about to do this and was looking around but no info on this. I honestly was not going to cancel it and was looking forward to using the lounge, but I found out Charlotte got an amex lounge right after I got it, and then well the pandemic, so not gonna be flying much, lol.

You’ve had the card for a year right? I haven’t heard any data on this one way or another, to be honest. I’d think you’re OK if everything else on your account seems clean.

Hi Ryan,

many thanks for post this issue, I have same issue as you. I have citi card and cancelled my card on March 2020, just find out my AAdvantage account (have over 300K mileage balance) locked out and my husband AAdvantage account was shout down by aa. I was trying to call them several times but its never resolved. it said they were send me a email that i need follow because for both of my and husband account for the security reason but i never received the email. did you get you account and your wife account back to open and mileage back ?

No, unfortunately AA sent us ridiculous emails with no details at all. We didn’t have anything to “follow” like you, so I don’t have any advice on that. Sorry :/

Ryan, ValueAct Capital Partners is an activist investor with a large stake in Citigroup. Make them investigate why Citi isn’t recouping millions of dollars from AA (value of forfeited miles which were paid for by Citi). This ought to make AA Corp Sec rethink about defrauding Citi. If they’d have to refund Citi, they can’t simply write off the amount from their balance-sheet.

I finally got around to emailing them. Thanks.

Thank you! They’ve an information-sharing agreement with Citi, which enables them to question its dealings. I hope they’ll act on our inputs. They had ousted Steve Ballmer from Microsoft. I hope to see some action from them, although it might ultimately result in Citi formally shutting down the mailer loophole.

I’m sure the mailers are 100% done at this point.

Not formally. Citi would still pay AA & AA will make money out of thin air by forfeiting miles

I was shutdown a week or two ago mid-trip. My whole family was in Central America and our return flight was with AA miles from a shutdown account.

AA had the decency not to cancel that return trip but did cancel an asia trip that was scheduled for two weeks later.

They also shutdown P2. I didn’t check the times on the emails but they were received the same morning

Wow, surprised to hear they sent a shutdown email but left flights home intact. that’s the first I’ve heard of that. Was it a round-trip and so they knew you’d already flown out? Or were they separate 1-way bookings?

I think the biggest bonuses will go to the RAT people (and those won’t be clawed back). You have to admit they have been very productive, and AA is getting a lot of bang for their buck. It must be interesting coming up with new ways to seek out undesired activities. Look for the RATs to multiply, and other program must be watching.

It is in AA’s interest NOT to explain ANYTHING. Then people will be concerned about EVERYTHING, which is good for AA.

AA sells the miles to the card companies. People apply for the cards, do the spend requirement and get the offered bonus miles. That’s the deal. The fact that people were able to sign up for multiple cards & get multiple bonuses should not be blamed on the card user. NJ Lottery from time to time will have a free scratch off ticket offer in various Sunday papers. In the past I have purchased an extra paper (given to someone else to read), taken out the free lottery ticket coupon and used it. Am I “exploiting” the coupon offer? Airline programs & card companies should make it very clear that card applicants can only get one card sign-up bonus per account or year. Make it large boldface type. That said, I did think that one of these days the FF programs would start cracking down on those that play the game of getting new card bonus miles. Game over !

I keep reading bits and pieces from people who got shut down by AA. It all seems tied to the mailers (using someone else’s mailer specifically) even if just one or two times. I’m sure other activities like churning don’t help the case when they start looking into an account but I’m starting to wonder if the mailers got sent out as a way to test people cheating the system. Imagine this a RAT like team intentionally tracks a typical marketing mailer program to see if the codes are used by people not targeted. This gives them a target list of accounts to check or audit. This takes time so the accounts are frozen while they look through them and either delete them or allow them to continue, likely flagged if so. There may be other factors like elite status, etc. Then a person like you “calls the airline” (you know the cardinal sin of the miles game) and that threw an extra red flag at the account so it went to the top of the stack and got shut down in 4 days along with any accounts tied to that address or passenger that also did mailers. Just theory or course but I could imagine it that way. Gosh I miss the old US Air Grand Slam game instead.

A few problems with this theory:

1-these mailers existed for YEARS before the shutdowns started

2-I didn’t call the airline about this

3-the mailers were for cards from Citi, but the shutdowns were initiated by AA

Ryan, had more than 50% of your cumulatively earned AAdvantage miles been generated from Sign up bonuses? Also, had you ever sock-drawered any of your AAdvantage cards?

Yes and no to sock drawer. They still saw spend, but reduced.

I still don’t understand why AA is the one taking miles away since these miles people earned through Citi and Barclay bonus. I can understand they can close your account but not taking away your miles unless as the request of Citi or Barclay.

It’s a mystery.

[…] Regardless of all of what you’ve heard or suppose you recognize, there is likely to be one thing new taking place right here. American Airways has upped its recreation and adjusted ways. Learn extra right here. […]

Ryan,

I just wonder about people who got to the airport and their flight was cancelled, did they already have the boarding pass or check in? Does AA still do this practice?

I never thought you can apply Citi credit card for more than one in a year.

Haven’t heard of anyone getting a boarding pass/checking in then not being able to board the flight, so I’m not sure.

You can get more than one Citi credit card in a year, I’m not sure what you’re referencing on that.

One time I applied for the second Citi card (not AAdvantage) and was told I already has one with them. Recently, I thought you only can have one kind of Citi AAdvantage and you only can apply for another after 18 months (now 48 months) since the date you closed account.

What I don’t get, they’ve issued those bonuses. Are there any rules in the T&C that say you can only get one bonus? Isn’t it up to AA to make sure that nobody receives bonuses they’re not entitled to at the moment they issue them? If they made an error handing out to many points there customers shouldn’t be the victims of this.

That’s why a note from AA explaining what’s going on here would be helpful. What’s the logic? Why shutdown instead of just revoking points? Why are they now claiming that something they did previously was wrong? Why is it our fault they did this? Etc. Explaining the logic would really help restore confidence in their company from people on the periphery of this.

I am so confused. All of these websites, this one included tells its readers how to get more miles/bonus for “free” travel… and now your saying that AA doesn’t like this behavior and is just takes the mikes back and then kills your account too boot.

Sean – this situation is a little more complex than your comment describes. What’s the confusion you mentioned?

How about a very simple to follow: do not do this. here is what is going to get you in trouble.

Everyone reads, get this card… then this card and so on and goes and does it. Then there is a chance the airlines do not like it and can you? That is mighty crazy.

You’re implying that we had posts detailing what I was doing to earn AA miles and telling people to do the same and then now I need to tell people not to do that? All of your assumptions in your comments are wrong. I think you’ve fundamentally misunderstood this post and assumed a bunch of posts prior to it exist that don’t exist.

I am sorry for anyone/ everyone that lost their miles. I do not understand some of the hateful remarks & gleeful attitudes. Why are you on this website? Who is above reproach?

I just wonder people got turn away from airport already had boarding pass? Does it still happen?

I haven’t heard of anyone yet who had a boarding pass but then couldn’t get on.

Anyone know when the current deals between AA and Cit and Barclaycard US expire? Original press releases and SEC filings do not appear to specify. Would this problem annoy AA enough to move more business to Barclays the next time these contracts are up?

[…] is a must read on the AA mailers situation imho: American Airlines Shutdown My Account – Forget What We Thought We Knew. Very interesting. Isn’t there some lawyer out there with some time in his/her hands to take […]

Cheaters never prosper

Are you aware that the banks issuing these credit cards think we are all cheaters/gaming the system? Seems like an odd position to take, but thanks for reading.

This is not the first case of a P2 who’s been shut down without being locked. There have been several noted on Reddit. They’re always connected to a P1 who was locked, then they both get shut down. Often the P2 doesn’t even meet the threshold of bonuses that AA has decided they don’t like.

Not the first, correct (I’ve found 3 total prior to last week, which is a fraction of a %). The number of them sharply increased as of last week.

any further data points on time period affected, I had 4 SUB, but all were in 2016-2017.

The data so far seems to revolve around years 2018-2019, but I’m curious about how far back this will go as they continue to work through the data. Honestly, anything could happen at this point and none of it would surprise me.

Ryan, this whole article seems kinda lazy. I am making an assumption here that I am willing to bet is correct – that you and/or Shawn promoted in some manner the same activities that just got you shut down. Maybe not on a blog, but in-person, smaller group-chats, at conferences, etc. in order to grow your credibility and blogging business.

You are part of the cause, but what is worse is the assumption you made that people aren’t expecting sympathy and should roll over, die, and take it. In the comments, you mentioned you couldn’t even be bothered to file a DOT complaint and you clearly tried to make a case that this is merely loophole maneuvering rather than abuse – so don’t take the abuse from them!

Spending hours combing through data to understand what’s happening doesn’t seem lazy, so I disagree. Also, I don’t understand what point you’re trying to make in your comment at all. Also, I didn’t say I wasn’t filing a DOT comment. I specifically said doing so is on my “to do” list.

OK, I am going to take back most of what I said. I respect the fight you are putting into this as referenced by your Mar 5, 2020 post, and the lack of gratitude you are receiving in some of the comments there.

I don’t like when bloggers encourage ideas like the grAAvy train, then hide when things go wrong. You are not hiding.

I also never publicly mentioned it anywhere 🙂 Thanks for the follow-up.

I keep on hearing that AA doesn’t make money flying people and that their revenues comes from selling miles.

If this holds water, then they are going after those with mailers? It’s all about money and their tanking stock. They don’t want to be giving away free miles, especially when this is their money maker?

Funny part is Citi has to buy those miles to give to us, then AA confiscates them. At some point, Citi will care about this loss of $ on their end.

Citi is managed very poorly. Besides, if a Citi executive’s AA golf-buddy can get his kids into Stanford, he’d probably turn a blind eye towards the issue until he’d be forced to investigate

RE: Fraud

I’m no lawyer (thank you Jesus), but I think a logjam to charging criminal fraud in connection with airline mileage programs means assigning a dollar value to the value of miles

Airlines want to claim the miles have value when they send us 1099s but don’t have value when we complain they took something from us. Funny how that works. Good point 🙂

You were not really egregious. Even though you used someone else’s mailer which is downright fraud i think you may have still skirted by.

I think there were some people that did 10s of mailers that brought attention to this. Loopholes are fine if you do one or two. But some greedy assholes ruin it for everyone. They have to go get everything for themselves. Can’t take a little leave some for others. Hope the judge nails their hide to the jail cell. Someone needs to get a massive kick in this hobby. I am talking serious jail time for fraud and people might come to their senses.

Using a mailer that has no terms that say it is non transferable is fraud? Sounds like it was following the rules to me. Fraud would be applying in someone else’s name not your own name which didn’t happen. People really don’t seem to understand what fraud is.

An invitation from a company addressed specifically to a person does not have to state that it is non-transferable. The invitation is for that person unless it specifically states that is is transferable (current resident, or give it to a friend, etc) which is why mailers state that.

So if you used a mailer addressed to another person, you have committed theft by deception since you didn’t get the consent of the person and the company.

I disagree, and I’d wager that many courts would say that not saying “non-transferable” implies legal permission, and that the onus is on the company to state “non-transferable”.

Citi, AA’s partner in this, approved all of the credit card applications. That sounds like consent.

Which makes me wonder why Citi is claiming to be entirely uninvolved in the process…

Amber, in most cases the recipient of the mailer knowingly gave the mailer to another person to use. So it is not theft. The reason some mail pieces say “current resident” is so other people can OPEN it, not to enable others to USE it.

To be clear, MrDioji – are you claiming that mail that comes to me “current resident” and includes a $10 off coupon for Wal-Mart can’t be given to a friend who doesn’t live with me? I was confused by your comment.

Amber they also had mailers that DID say not transferable so why carry both if they didn’t intend them to be shared? And everyone received permission from the person on the mailer since it wasn’t like people were going around town stealing people’s mail.

Deception or theft would have been using a mailer and applying under their name and then adding your AA frequent flyer number. When you apply using your own social security number, credit profile etc. I just don’t see where the deception is. Especially when the terms allowed it.

if one’s account is locked, should she change her AA account’s address (maybe to her investment property address?) to avoid her househould’s other accounts get affected too?

On the other hand, when she files on small claim court, her AA account’s new address would be inconsistent with her home address.. would that be a problem?

Ryan, I am not sure calling this “guilty by association” is accurate.

Your account was shut down (without being locked first) right after your wife’s was shut down – This only means that “both of your accounts were review at the same time” likely by the same person, and the reviewer (probably by Riley, Toby, Blake or whoever) decided that both of your accounts should be suspended. I think you are “charged” by association, not “convicted” by association. You are guilty because you met whatever criteria they set (for example, more than N credit card bonuses in 2018 2019, if our hypothesis is correct), not because you’re associated with your wife.

In other words, I don’t think you will be shut down if you only have, say, one bonus from Citi in 2018-2019, even if you’re associated with your wife.

Therefore I honestly don’t think anything is changing. It sounds exactly like what’s been happening, and “charged by association” (or “reviewed”, “audited” whatever you want to call it) isn’t really a new thing either, it’s just common sense like you said.

Your account probably just slipped through the cracks that it wasn’t locked before shut down.

FWIW, I’m in 3 players mode. We all received the shutdown e-mail from Blake within 10 minutes (6:11am, 6:13am and 6:17am). All three of us had more than 10 SUB in 2018-2019.

It’s really not surprising that cancellation for abuse has only recently appeared on the scene. I think exploiting the so-called “loopholes” is a result of the greed factor. It taxes credulity to rationalize the use of a mailer addressed to another person as a “loophole”. Conscience enters the scene and must be heeded, when doing something very tempting that just doesn’t feel right. Flagrant abuse will eventually harm those, too, who play by the rules. Too, the proliferation of websites that hype the cards for $$ commissions have to share some of the blame.

Ryan – for those that did not use mailers and who just started to collect AA miles, is the current assumption that if you get four Citi AA sign up bonuses, that you will be shut down? Currently people can sign up for four cards and get four bonuses (Platinum, Executive, Mileup, Business). These are all attainable from public links and can all be had within a year.

That is what the thinking, data is currently

There are 4 Citi AAdvantage cards (Personal & Business variants of Platinum Select & Executive) that can get you 4 SUBs, each worth 60k miles or more. Then there’s Barclays.

I have been getting and closing both Citi and Barclays personal and business credit cards for years for the bonuses. IT IS A VERY GOOD THING I WAS NEVER AWARE OF THE MAILERS OR I WOULD HAVE CERTAINLY DONE THAT AS WELL. My wife and I have made good use of our AA miles over the years with many business class trips. In fact, we have one scheduled for Japan in April. I feel sorry for everyone caught up in this. We do try to space our cards out though. My wife has 60,000 AA miles left in her account and I have 235,000. I was thinking of adding to these totals with Citi cards, but I believe I might lay off just a bit. I just got the 100,000 Chase United business offer and completed the $10,000 so maybe I will get my wife one of these cards as well, then go back to AA. Good luck guys…..lifetime lockouts would kill me!

Yeah, even those who use public offers aren’t safe

So Mark you are saying that people who just got bonuses on the schedule that Citi was willing to give them are a small percentage of the shut downs? My husband and I have some Citi AA cards I was planning on closing soon to avoid the annual fee. Am I better off paying the fee, hoping to avoid losing several hundred thousand miles? Also was thinking of downgrading to no annual fee card, but does that just put eyes on the account? Should we be putting spending on these cards? I’ve basically only spent to get the bonus. What is the safe strategy? What are you doing?

Retention offers or buying miles or closing cards etc. seem to have no bearing on the situation. The common thread is 3+ Citi bonuses over 2018-2019. The rest is conjecture and best guesses.

Is this 3+ Citi bonuses for each year, 2018, and 2019, or 3+ Citi bonuses over the entire space of two years, 2018-2019?

Also what if you got one Citi bonus in 2018, one in 2019, and Barclays in 2019? That’s my situation.

3 total, not 3 per year. Your 2 + Barclays situation is where many people are on the “am I next on the chopping block?” fear, and so far you should be OK if not connected to a frozen account. “For now” since we don’t know where this all ends.

Yikes, ok. I was about to complete another Barclays MSR but I will wait for now. Too bad it would have been another 65k miles, for a “legally” acquired card.

If I still can book a flight that mean my account is OK

Hopefully, but remember that I booked a ticket and then was shut down 4 days later, so that doesn’t guarantee anything. However, if you didn’t get multiple bonuses from Citi in the past 2 years, you’re probably OK.

I don’t think closing or product changing cards really matter since this is coming from AA and not from Citi. So I would do whatever you were planning on doing anyway. Shouldn’t change things one way or another honestly.

So you got a couple sign up bonuses, big deal and they gave you a lifetime ban. My neighbor killed his wife and only got ten years.

This is starting to look like Citi and AA did this deal together. Remember this is a airline that hates there customers.Parker is ruthless.

Citi is claiming ignorance and telling people to contact AA about it, refusing to refund fees, etc.

Did your neighbor really kill their wife? That’s awful. Even as an indirect participant, I would find it hard to care about things like frequent flyer programs. I hope you and your entire community have found ways to come to terms with this indescribable tragedy. Be on the lookout for unexpected manifestations of the latent impact of trauma like this. Best of luck and be well.

I hope you weren’t kidding.

Has anyone been locked who didn’t use mailers and who didn’t create extra accounts and who didn’t sell awards? So far all reports I’ve seen are in one of those categories. Thank you.

Yes – there have been some that simply signed up for multiple standard offers.

Same year and same card?

No, but you could get different cards like the CitiBusiness AA, then Citi AA personal, then Citi AA Executive card, Barclays AA business, Barclays AA personal, etc. You could get all of these cards while following all of the application rules and yet be shut down by this current situation. That has happened to a fair number of people here.

You admitted to using mailer codes that were not for you or your wife. It doesn’t matter if you paid for them or not. Play with fire get burned. Isn’t anyway you are getting a dime going to court, long list of cases that let the airlines do whatever they want with their programs.

Yes it does harm everyone else because you use miles yo book seats that I and others can’t book and or have to pay a higher mileage price for.

I couldn’t disagree more about your view that you were negatively affected. I’d say more people getting into this hobby has an impact on your ability to find award bookings. People who got an extra bonus are a very small percentage of this hobby. Until you can show me any data that I booked a flight you therefore couldn’t get, I think it’s ungrounded. Supporting the airlines in their limitless power against us in this hobby harms your future, so it should worry you that they claim infinite power here. Even for selfish reasons, even if you don’t care about others in this hobby, you should care for your own self that airlines are claiming unlimited power over us. That affects you.

In fairness, Daddy is right. It’s not the sort of thing that needs data to prove. It is an undeniably true statement that an award ticket purchased with ill gotten points is an award ticket taken away from someone else because award tickets are limited.

That’s a claim to a certain reality existing, so it needs backed up. This is like saying that a pink unicorn exists. You’ll ask for proof. While Daddy’s claim might on the surface sound logical, it’s a claim to a certain reality, and that requires proof. Existential claims or claims of cause-effect require proof.

In fairness, Daddy and Rob are right.

There is only a limited number of award seats per year. If you book those seats through your ill gotten gains, you have hurt those that played the game fairly. To suggest otherwise or to ask for anecdotal evidence is merely ludicrous on your part.

To be fair, claiming something is happening requires evidence. Saying no evidence is needed for factual claims is merely ludicrous.

This is how logic works.

Award-space on some sectors (including partner-redemptions) has actually increased, but then even some who didn’t use mailers have had their accounts locked or shut down, so it’s not like everyone who was not on the grAAvy train is a winner.

While there is no factual way of knowing whether another individual attempted to book award travel and was unable because you beat them to it (which you seem to suggest is your winning argument) – there is no denying that the inventory of award seats is a limited number and you depleted that number (hence making it conceivably more difficult for another to book their desired award destination on certain dates).

Your arguments are starting to sound like bow tie guy before he got out of the business.

In order to claim something happened, there must be proof. You’d want proof a unicorn lives in my back yard if I claimed it. While seats are limited, you’ll need to prove I consistently took the last available award seat on flights. Until you have evidence, these conspiracy theories are a waste of your time, my time, and don’t serve any purposes. Facts prove things happened. Conspiracy theories don’t.

You know how many retiring boomer middle managers there are out there who are sitting on millions of miles, and very little time left to burn them? I have friends in the game whose uncles/grandpas wouldn’t think twice to pay 2x or 3x saver mileagle to book whatever award for the dream trip. They can’t take those miles to the grave with them. Churners aren’t insignificant, but probably very small percentage of total miles used.

AA has been cutting back on award flights (especially premium cabin) and devaluing AAdvantage for years. That’s why it’s hard to book seats. This will likely continue, perhaps with a small temporary change if they get bad publicity for the account terminations.

Any churner activity is insignificant in this context.

With the ease of data aggregation and analysis these days isn’t surprising they can very quickly identify accounts based on whatever criteria they want. Even with millions of accounts. The noose is only going to get tighter on this “hobby” and those that play on the fringes of the T&C’s will eventually get burned.

Perhaps. However, it looks like they were doing things manually from everything we’ve seen. Either they got more staff or changed tactics. Something is new in the past week, because the lack of freeze period is a new data point. Maybe they’re finally getting around to data they compiled before, but it still looks like they’re auditing the data manually to some degree. Yes, data aggregation is great these days. Doesn’t mean AA is doing it at optimal speed. It’s been slow. Look at how long all this has dragged out.

there is a distinct lack of anger in this post. this lack of anger is not representative of those amongst your readers who are also locked/shutdown. most people are seething and are filing DOT complaints and researching their local small claims court.

I can’t control how others feel. I am also looking at my options. However, to be clear, if my post displayed a bunch of anger, there would also be people upset about that and calling me a baby. You can’t win. I wrote focusing on the info, because I think that helps people the most.

Ryan

Thanks for your post. Appreciate you info. Try and ignore the trolls.

TD

Ryan,

Thanks for your post even I am not affected but you never know what next from AA. You have a guts to tell people your personal experience as well as provided the data points. I just wonder the people who criticized you are real or they ever wonder what AA can do next and may affect them.

To tell you the truth if I knew about it I would join in the game!!!

Anyone ever read a story about the guy who bought US coin by credit card and deposit back to the bank and earn 1 million points?

Why do you think this is news? It took forever to read the long post to get to the actual claim you are making. Can’t it just be that AA caught up and now there are less accounts to audit and therefore they get through the process faster?

Still sucks, but it is hardly groundbreaking news

the new data points are news.

Thanks for reading.

Nothing in this post is “news” to those who have been following closely. Exactly what you are relating has happened to many, many others. Your experience is 100% consistent with what has been reported for weeks and weeks. It sucks, but it’s certainly not “news.”

That’s not true. I’ve followed all of it closely, and the recent change to “shutdown without a freeze” is a new element. Yes, I’m not alone, but it’s new and started at the time I was shutdown. Prior to that, these were rare outliers. Now, it’s changing. This wasn’t common prior to this past week.

What’s ur plan with AA now? Small claim court?

Unsure. I need to really talk it through with my wife. Living in Brazil, not sure it would be worth it for us to fly to the US just for this. It would have to coincide with another trip if possible.

Why can’t you sue them in Brazil? They have flights to Brazil and generally you can sue a business anywhere it operates.

I doubt any court here would allow it, since my AAdvantage account was originally opened in the US, my credit cards are registered to a US address, AA is a US airline, etc. I don’t think anyone here would want to handle it (1) and I think consumer protections on this sort of thing are much stronger in the US (2) as crazy as that sounds.

Quick googling (brazil small claims court) suggests you could sue in small claims court (up to about USD 8,000) and other courts and that there seem to be consumer protection laws. Courts in many countries will handle cases against foreign businesses that operate in their country.

You might want to look into it, as it would be much easier for you to sue in Brazil than the US. Also, many courts tend to favor locals over foreigners. I have no familiarity with Brazil, so none of this might help, but it’s worth looking into.

Hey Ryan. Sorry about your shutdown. Did you and your wife use mailers addressed to you personally, or did you use someone else’s mailer codes?

A mix. We never paid for them, if that’s the follow-up question.

For the credit card accounts you have listed, how long did you keep each open?

I’ve had 2 aviator cards and 1 Citi platinum, and 2 Citi executive cards over a period of probably 8 years. Canceled all but one card now. But I put a bunch on all and have maintained executive platinum for the last 8 years.

They’re all currently open.

So the main issue is using mailers that doesn’t have your name on it?

I think AA probably did a calculation, how much is on liability on those miles accounts vs how much those people spend and then decided to shut down accounts which net below a certain threshold. It goes hand in hand with making miles based on spend only.

Possibly. We’ll never know for sure, but the one thing we know is that 3+ Citi AA bonuses is the recurring element.

Could you clarify why the assumption is that AA is more sensitive to Citi bonuses then Barclays?

Because that’s what the data from polling people affected suggests at this point. Also, it was easier to obtain multiple Citi bonuses than Barclays.

Yes, but with a caveat – people with low number of miles haven’t been shut down yet, although they’d probably be shut down later

That becomes part of the “how far will this go?” metric that we have no answer to. Will the ceiling drop below current metrics? Will more people be affected? Does it have an end date? Hard to guess.

Play stupid games, win stupid prizes. This is one of the very few things AA is getting right in recent times.

Why do you think this is beneficial to our hobby?

Why was fraud in the amount of billions of AAdvantage miles good for our hobby? People found a loophole due to crAApy IT and exploited it, violating terms of AAdvantage. People who actually earned AAdvantage miles without fraudulent mailer codes or loopholes are locked out of booking any award space because of this fiasco. So it will be beneficial when AA actually opens award space up to the rest of us who didn’t defraud the airline.

But that’s the thing. I believe the “loophole” was not because of crappy IT. One can reasonably deduce that Citi wanted people to be approve for cards repeatedly. I believe that there was a quota for new accounts that some executive wanted met, and they did what they had to do to meet their goals, turning a blind-eye to churning.

This included allowing a bunch of mailers to go out with 9 digit codes, which Citi knew were transferable. Also included the lack of non-transferable language on the mailers. Finally, the fact that this “loophole” existed for so long caused many reasonable people to believe that Citi actually wanted new accounts to be opened, by any means.

There comes a point when people who watched others’ talk about churning Citi AA cards that goes on for a DECADE so they reasonably believe that Citi was aware of and had no problem with churning.

I think the same. I think Citi doesn’t care. I think they will start to care that AA are seizing miles that they had to pay for to hand out to customers as bonuses. If AA isn’t crediting Citi for that somehow, Citi will start to care. Only for the $ sake, not the churning aspect.

Great point Jamie – I think any lawsuits etc. brought forward about this will be based on the fact that there were no terms broken by using mailers addressed to others. Will be interesting to see if courts take that into consideration or stick with the old saying loyalty programs are owned by the company and they can kind of do what they want.

I would think a lawsuit would be based on the fact that Citi bought the points from AA, then gave them to people who met a spending bonus set by Citi. If Citi had pulled the points or not awarded them for abuse, they might have a point but how can AA take points that Citi gave out and did not clawback? Citi has not closed the cards for fraud, accused anyone of fraud, etc. I can’t think of any circumstance in which this would be ok. If you told me you would give me $100 gift card to (just say) IHG to listen to a presentation and I could only do it once but then you went ahead and paid me to listen 3 times, even though you knew full well I had been there more than once – could IHG void the gift card? You presumably paid them for it, even if you got it discounted. Not really any different.

Amazing amount of rationalization here for fraud.

Did you lawyer tell you to try to push this in public domain.

This comment is not based on any facts. It offers nothing constructive to the discussion.

First off, condolences on your accounts being shut down. You certainly don’t seem to have engaged in any pattern of abuse, which is why everyone else should be afraid. Is there any definitive proof or even strong evidence that the mailers are involved? I think AA is making a terrible mistake here by letting rumor and fear take the place of fact. All they have to do is send an email to every member explaining who they’re freezing and why. By not doing that, the uncertainty will actually deter business. American has shot itself in the foot so many times since Parker arrived that I suppose you could just chalk this up to another instance of Parker stupidity but this time it could all have been avoided with a single email blast.

There were multiple polls (anonymized) on Reddit for those affected and wanting to participate. The data points to people with multiple citi bonuses. There are outliers who didn’t use mailer codes, but that’s a small subset of people who had multiple bonuses.

At this point do you have a sense of what the cut-off is for getting your account axed? I’ve seen some people say 4 or more bonuses in 2 years…any thoughts?

Other thoughts: some people say even Barclays bonuses are being included in the count?

Do you know if it’s a rolling 2 year period or are we talking two calendar years?

Some of that is really hard to nail down. Here’s my best understanding of the pile of data: 3 Citi bonuses seems to be the cut-off. I haven’t seen any data about people with 2 Citi bonuses being affected. If it’s out there, I haven’t seen it. It’s hard to know how involved/uninvolved Barclays bonuses are for 1 simple reason: most people in this hobby trying to amass AA miles are going to also chase Barclays bonuses. It’s hard for us to separate that since it’s not common in this hobby to only go for 1 without the other. However, the bulk of data revolves around Citi, and the final result is “our best guess”. Best guess is also that it’s focusing on 2018-2019 as calendar years with 3 being the minimum bonus threshold.

Hmm. Any thoughts on whether the three bonus threshold you mentioned would include a person who just applied and was approved for three cards in 2018/19 without any mailers?

Yes, there are people frozen who just happened to get 3 cards from Citi and never used mailers and also people who only used mailers that specifically arrived in the mail targeted to them without trying or doing anything to garner them. It’s very possible to get 3 citi AA bonuses without using mailers. There are some (not a majority) of affected people who are in this boat.

Thanks for the detailed response. What is the best source for info at this point? I applied for entry into the reddit thread a while ago but never got an answer from the admins.

They’re not adding anyone, since they have no way to verify who might be an AA employee, etc.

Isn’t the abuse, using mail that’s not addressed to you?

Nowadays Amex mailers are linked to SSN, but that’s another story. I think if mail is addressed to x and y uses it, then that’s not really right.

I think calling that abuse is a massive stretch of the word. This entire hobby is built on loopholes. Anyone who says it’s not seems confused.

Subway/Burger King also mails me coupons, is it fraud or abuse when my wife uses that coupon? If it was non transferrable, it would be locked to a FF or SSN number the way Amex offers are.

Are you really comparing buying a burger with applying for credit?

Yes, I believe the comparison can be made, assuming both offers did not restrict transferring. The potential financial gain may be higher in the case of a credit card application, but that doesn’t make one act perfectly legal and the other criminal, as you suggest.

Make sure you file the DOT complaint form: https://www.transportation.gov/airconsumer/file-consumer-complaint

It’s on my growing “to do” list.

Any guidelines on filling this out? I just received the shutdown email. Haven’t really been following the shutdown saga and just started researching. TIA

Poof!! Goes your miles. Haha. Man, that’s like losing several thousand dollars.

Yeah, at least I didn’t spend much of my own money getting the bonuses, so I still got more out of my miles than I lost, all things considered.