American Express Centurion Application for Consideration

The American Express Centurion card is perhaps the ultimate status symbol when it comes to credit cards. For many years the card and its benefits had remained stagnant, however American Express announced last year they were refreshing the card on April 1 with new credits and airport perks while eliminating the airline fee credit and some other benefits.

Prior to these changes, the annual fee for the Amex Centurion card was $2,500 not including a $7,500 initiation fee just to get the card. That increased on April 1 to a $5K annual fee and $10K initiation. And don’t forget each authorized user card will also have to pay $5K!

At this point you probably realize this card isn’t for you, but if you still think it is, then you are in luck! Previously you had to hope to find a rep who could help or wait for an invitation. Now, you can simply apply online to be considered.

American Express Centurion Application for Consideration

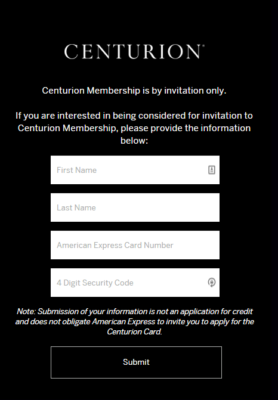

Here is how you can fill out the American Express Centurion Application for membership consideration.

To start, visit the American Express Centurion website and click “Interested in Centurion® Membership? Click here.”

You will then be asked to fill out the simple form above. All you will need is an American Express card number with the security code plus your name. It doesn’t say you need a specific Amex card to apply, however I suspect most people will use their Platinum card.

Who Is Eligible for the American Express Centurion Card

American Express doesn’t publish eligibility requirements for Centurion membership. They do have a business and a personal version of the card, however they use a mix of income, spending and other data to determine if they want you to join their exclusive and expensive club. A “secret formula” if you will.

Over the years I have heard various numbers for spend required to be considered. For businesses many think around $500K in spending is required and for personal cards $250K-$350K, but again these are estimates. Even with substantial spend they may look at other factors (income, etc.) in determining if you are eligible or not.

American Express: The Most Entertaining, Unpredictable Card Issuer Today

Amex Centurion App – Bottom Line

You can now fill out an American Express Centurion application to be considered for membership online. The process takes a few seconds to complete and I suspect the vast majority won’t be eligible. While this card was not really worth it before, the higher annual fee makes it even less so now for most people. But of course there is the cachet of pulling out that black card. Many will do it just for that.

Do you have an American Express Centurion card? Did you fill out the American Express Centurion application to be considered? Share your experiences in the comments!

Chase Sapphire Preferred® Card

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.