Amex Business Gold & Platinum 75K

Miles to Memories reader Pavel sent me some information that I think is worth passing along. He has been able to get targeted 75K offers for both the American Express Business Gold & Platinum cards by visiting the American Express website on his browser.

The Offers

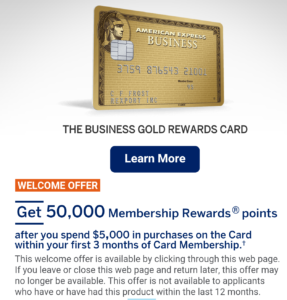

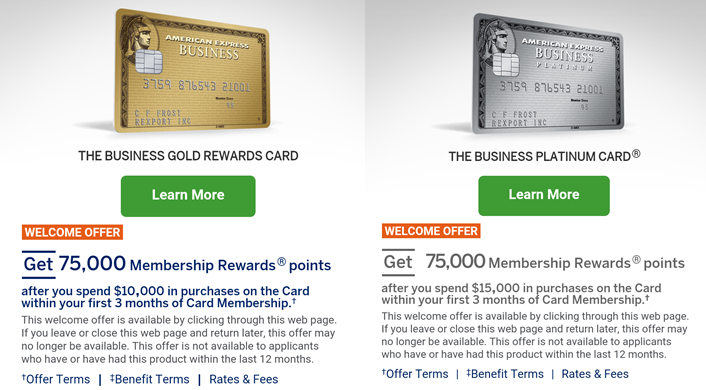

- Business Gold: Earn 75,000 Membership Rewards points after $10K in spend during the first 3 months. (The normal offer gives 25,000 points after $5K in spend.)

- Business Platinum: Earn 75,000 Membership Rewards points after $15K in spend during the first 3 months. (The normal offer gives 40,000 points after $5K in spend.)

How to Replicate

Pavel was able to get these offers to show up only on his Android mobile device. Here is how he did it:

1. Make sure you logged out from Amex in a mobile browser.

2. Open google.com and search for “american express business card”.

3. DO NOT open Ad link. (it contains 25K offer only)

4. Scroll down until you see “Small Business Cards – American…”

5. Go inside and hopefully you will see 75K offer for Gold (screen #3) and 75K for Platinum.

The “Small Business Cards – American…” is actually a link to their small business card site. I do believe you can visit the site directly to get the offers (here is a direct link), but if that isn’t working then try the Google steps above.

My Experience

I was not able to get either 75K offer to show up in my few minutes of playing with it, but was able to get a 50K Business Gold offer which is still double the publicly advertised bonus. While I didn’t have a ton of time to play with it, the 50K offer showed up both by going directly to the site and by going through the Google steps.

Are These Offers Good?

Remember that American Express business cards don’t have the once per lifetime limitation (you can get a bonus again if you haven’t had the product within the past 12 months) so it may be worth it for some people to jump when the bonus is good. 75K is the highest bonus on the Business Gold card that isn’t targeted directly to you. I personally applied for the Business Gold a year ago during a similar 75K bonus offer and think this is a great deal.

As for the Business Platinum card, I personally would wait for a better offer. We have seen a number of 100K offers surface and we even had that monster 150K offer earlier this year. For only 75K Membership Rewards (with a very high spend requirement) I would definitely go for the Business Gold card with its first year annual fee waiver and very nice 2X and 3X category bonuses.

Want More Increased Offers?

Last week I covered how some people were being targeted for increased bonus offers on personal American Express cards including a 100K offer on the personal Platinum card. You can find out how to see if you are targeted in this post.

Conclusion

While I wish that you could get these offers on a desktop like was possible last year, the fact that you can still sit around on a mobile phone and get a 75K bonus on the Business Gold is still newsworthy. If I hadn’t picked up the card exactly a year ago I would definitely jump on this opportunity.

Were you able to replicate these targeted offers? Let me know in the comments!

I got both to work yesterday using the link. The Google tricks however didn’t work for me.

Thanks for the update!

Tried the steps mentioned and never received the offer. Does it still work ?

I am out of the country right now and thus am not trying to replicate. Unfortunately it won’t show for 100% of people. The only things that can be tried are different browsers/devices and different IP addresses.

[…] Amex Business Gold & Platinum 75K Offers Surface: Full Analysis & How to Get Them! […]

meant to ask if loading amex business cards $1K/M to Serve would count towards minimum spend?

shawn or anyone, has serve loading counted towards minimum spend for amex business cards? TIA

Is it exactly 12 months from the cancellation date? I canceled on 1/3/15 and would like to know if I am eligible for the bonus.

Here is the exact language, “Welcome bonus offer not available to applicants who have or have had this product within the last 12 months.” If you are uncomfortable, you can always chat or call them to confirm.

How valuable are the points? Any link that discusses how to redeem it?

Got the offer thank you.

[…] Miles to Memories is reporting that people are able to get two offers on American Express business cards by doing the following in a mobile browser: […]

Can you get BOTH bonus? I currently have the Amex Platinum business that I applied last year. I’m going to cancel next month before the annual fee due. Can I then go ahead apply the Amex Gold business right away or I need to wait 12 months?

Not good , with the death of Bluebird and Serve lately…..it becomes harder and harder to MS to meet the minimum spending. Something to think before applying.

Definitely. Everyone’s ability to meet spend is different. For some $10K won’t be an issue, but for others it will be. It is important to know your limits.

I believe their rule is that you can receive a sign-up bonus on an AMEX business product as long as it’s been 12 months since you canceled (not opened!!) your previous card. This rule hasn’t changed, right? Thanks.

You are correct which is why I won’t be applying for it. I understand where my language may have been a bit confusing, so I have clarified it a bit better. I was basically saying I am not eligible.

[…] For more details and analysis, see this Miles to Memories post. […]