Two New Cards – 130K Points – More Amex Offers

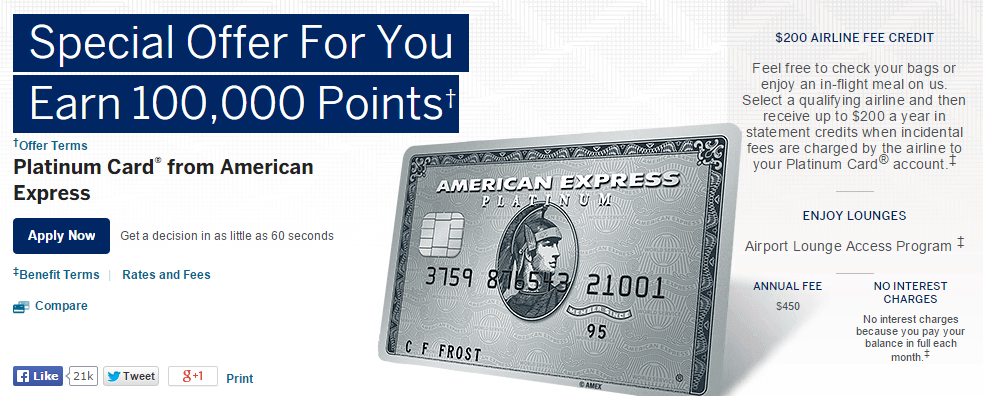

Last week several sites including Miles to Memories broke the news of a 75K offer on the Amex Business Rewards Gold and a 100K offer on the Amex Platinum card. Many of you were able to replicate the offer online until it was eventually pulled. I know even as recently as yesterday some people were able to get approved for the offer via the phone with the code: BUIU:0001.

I initially went back and forth before deciding to pull the trigger on the Amex Platinum card. My main hesitation was that I picked up the Business Platinum card about 3 months ago during a 150K offer. I will essentially only have a 3 month period after my Business Platinum comes due where I really would need the benefits of the personal Platinum card.

Still, 100K bonuses don’t come around everyday and while American Express currently limits the bonus on personal cards to once per lifetime, that honestly could change at some point. Also, after the $200 airfare credits (which I use) each calendar year, my actual cost is only $50.

During my last couple of application rounds and during my wife’s most recent, I have adopted the strategy of picking up two Amex cards at once. The main reason to do this is because Amex tends to merge inquiries, but in this case I had another reason. Right now the SPG card has a 30K bonus which was already on my radar. Since I was planning to apply for it in a couple of weeks, I decided to move my application up.

The Applications

In addition to the Platinum card, I decided on the SPG personal over the SPG business. I debated whether or not I should have gone for the SPG business instead since it comes with Sheraton lounge access, however I have opened up several business Amex cards and felt a personal card was a better idea.

To apply, I opened up both Chrome and Microsoft Edge (their new browser) in private/incognito Windows and filled out both applications completely. This strategy ensures no cookies get in the way and by using separate browsers the two applications don’t affect each other. Once I had both applications on the “Submit” screen I paused.

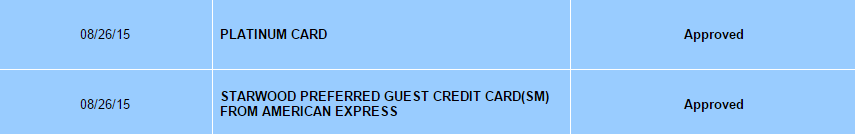

My goal was to get the 100K Platinum approved first, so I hit submit on that and waited. It took about a minute to process and then I received the approval message! Almost immediately I submitted the SPG application and received a message that it required further processing. This has happened to me in the past, so I wasn’t too worried.

Normally the processing happens pretty quickly, but when I went to bed the application was still showing as pending. I am not a huge fan of calling in, so I decided to let it play out. Thankfully I didn’t need to wait too long. The next morning I checked the application status and it showed as approved! After $6K in spend I will have 100K Membership Rewards points and 30K SPG points.

Strategy Shift

This type of small application round represents an overall shift in my strategy overall. While I did do one “app-o-rama” this year, most of the cards I have picked up have been during increased bonus offers. From Amex alone I have picked up the 75K Gold offer, 150K Biz Platinum Offer and 100K Platinum offer in the last year! Wow!

One of the main arguments against huge application rounds is that they make it much harder to jump on a limited time offer such as the American Express Platinum 100K that only sticks around for a short time. The “one-off” strategy also makes more sense as one matures in the hobby as well, since you tend to accumulate all of the best products over time anyway.

Conclusion

American Express really has been killing it with massive offers on their charge cards lately. Over the course of about 3 months I was able to get 250K worth of Membership Rewards points from two card apps. That is just insane! Hopefully many of you were able to get the 100K Platinum offer if you wanted it. Feel free to share your 100K Platinum application stories in the comments!

I was approved for the Amex Platinum 100K offer last week as well and my bonus posted last night. I figured that the Platinum 100K offer is much harder to come by than a good business card offer, so I took it. I’ve been waiting to apply for the personal Platinum until I could get a 100K offer.

I was also approved for the Business Platinum 150K offer this year as well as a BGR 75K offer, so it’s been a great year so far!

I’m going to close my Business Platinum in January after I take advantage of the $200 airline credit again so I can start the 12 month waiting period.

I’ve been falling into the same strategy… just when I think I don’t need any new cards for a while and set a goal of an app-o-rama for a month or two out, a great deal like the 100K Amex Platinum comes along. I went for it the first day it was out there and was approved instantly. (Yay!) My biz Platinum annual fee will come due in November. My heart was breaking at the thought of losing it. I’ve come to LOVE the Platinum card perks.

But, so much for the apps I was going to do in a couple of weeks for Hilton cards with offers that expire at the end of September. I might still try it.

How do you figure you only spend a net $50 on the plat? $450-$200 airline credit = $250. I’d love to know so I can replicate!

The credit is per calendar year and resets on January 1. Basically, you can get the credit twice in the first year of having the card.

Took 2 days to get a hold of Amex on the phone because I never could get the online Platinum offer. Applied Friday. Took until today, Monday, to show approved, but approved it was! Now I wish I had taken the chance to do the SPG the same day. I think I will hit that one on the next to last day to give a couple weeks between applications. Plus I need to check the Kate situation locally as well. But the cashiers at the Money center and the registers locally so far are all cool as well.

Man, I can go to Asia on just the points from the Platinum card and use the airplane credits besides. WOOT!

I was able to get the 100k AMX offer yesterday via the phone. There are still some reports on forums that the offer is still live if you call in.

I got the 100k signup for the platinum Amex last year, and cancelled the card yesterday. While I appreciate their monstrous sign-up bonuses, if Amex’s charge cards provided good earning on spend, people might actually hold onto them.

If I had it my way, The Platinum Card would have The Gold Card’s earning structure and The Gold Card would have the Amex Everyday’s earning structure, but what do I know?