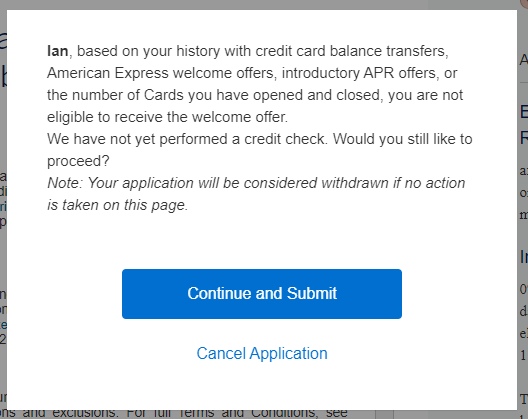

Amex Pop Up Box

Amex is my favorite card issuer by far, for many reasons. They’ve been consistently generous with welcome offers, and it was recently time for my wife to go after another. The Hilton Aspire is probably the final card that is a) useful for us, and b) one she hasn’t received a welcome offer yet. We’d been waiting on an elevated welcome offer here for a long time, but it’s held steady at 150k Hilton Honors points. We decided it was worth picking up now, and she applied. Unfortunately, she received the Amex pop up box advising she was ineligible for the welcome offer based on her previous history. It had been several years since my wife received it. So what caused it this time? Here are some possible reasons.

Lots of New Amex Cards

In the last 14 months, my wife has opened six Amex credit cards. She also opened four Pay Over Time cards. She received solid welcome offers on all of these cards, so we don’t regret her applying for any of these. But it’s certainly possible that all of these new cards contributed to the Amex pop up box appearing now.

Closing Cards

Over approximately the same period, my wife closed three Amex card accounts. That doesn’t seem like much to many of us. But compared to casual consumers, closing three cards with an issuer during that period may stand out. I don’t feel like this played a major part, but it probably had a role in how she got the pop up.

Plenty of Retention Offers

This is one I don’t normally consider a contributor to receiving the Amex pop up. But the sheer volume of retention offers my wife has accepted may have partially caused the pop up. Amex has richly rewarded her for keeping cards open. Stacking all those retention offers on top of each other, Amex may have grown tired of doling out all those rewards. Or maybe I’m totally off on this one.

Is It Our Spend?

We’ve spent plenty on my wife’s Amex cards, particularly her Gold and Hilton cards. Similar to the retention offers, maybe the volume of what she’s earned has turned off Amex. Maybe we did it too quickly. Again, this is just a guess, but another factor I’m considering.

Maybe It’s Me

I’ve received plenty of data points of hobbyists in two player mode getting a pop up in one situation but not the other. For instance, player one applies for a card using player two’s referral, but receives the pop up. Then, player one directly applies with Amex (not using a referral) and doesn’t get the pop up.

We could experiment here, but my wife doesn’t need the Aspire badly enough where we want to give up a juicy referral bonus to obtain the card. This is especially true because of the Aspire’s hefty $450 annual fee.

Something Else

Regarding the pop up, let’s not forget that Amex probably considers factors unknown to all of us. I could guess about possible causes until the cows come home and never hit on what exactly caused it. I feel at a certain point I’ve thought about it enough, and it’s time to move on.

Conclusion

I may be close above, or I may be totally off regarding what’s caused my wife’s Amex pop up. It could’ve been a combination of the above guesses. Regardless, we do have a plan moving forward. We’ll keep spending on her Amex cards, especially her Hilton card. Hopefully, that and time will eventually grant departure from pop up jail. Indeed, we’ve spent our way out of the Amex pop up before.

While we successfully avoided Amex pop up jail for quite some time, it’s come for my wife again. But we probably wouldn’t change anything in our past. She obtained plenty of huge bonuses by playing the Amex game aggressively, and she only has one Aspire welcome offer merely delayed. Have you received the Amex pop up lately? What do you think caused it?

If you really want the card you can try applying without the referral or through the Hilton website. Some data points that different application paths can get around pop-ups

Parts Unknown,

I understand what you’re saying. But as I stated in the “Maybe It’s Me” section above, we don’t need the card badly enough to give up on a referral bonus.

Yes my daughter got the pop up for the platinum card, surprised me, she’s only had two Amex and spends regularly on one of them.

Kate,

Ouch! Hang in there.