Arrival Changes Confirmed & Effective Date

A few weeks ago the news broke that Barclay’s was making significant changes to their Arrival Plus card. They held a call with some bloggers (not me) where they detailed the changes and tried to sell them as “enhancements”, but they are pretty much negative across the board.

Last week I wrote an editorial detailing exactly why these changes are a terrible business decision for Barclay’s. Only time will tell if I am right, but the new Arrival era begins today. Up until now the company has not publicly acknowledged the changes, but they have officially updated their website and opened the card up to new applications with the new terms.

Confirmation of Changes for Existing Cardholders & Effective Date

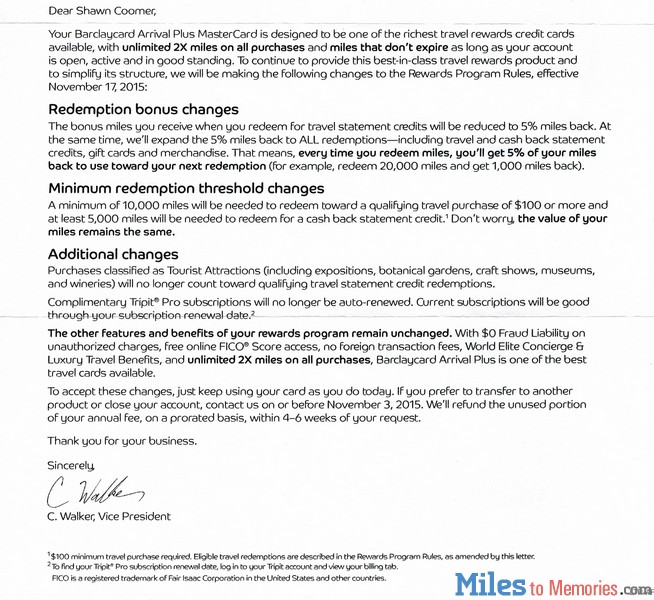

They have also started to send out a letter to existing cardholders detailing the changes. Up until now there had been a few dates thrown around as to when the changes will go into effect for existing cardholders. The letter (shown below) confirms all of the changes, the effective date and how they will handle annual fee refunds for people who don’t want to keep the card.

Key Takeaways

- As is stated at the end of the first paragraph, the changes will become effective on November 17, 2015 for existing cardholders.

- If you would like to reject the changes, you can cancel or change to another card before November 3, 2015 and Barclay’s will refund the unused portion of your annual fee on a prorated basis.

Conclusion

I said all that I had to in my editorial the other day. This is still a great card to churn if you can, since it still comes with a $400+ bonus which is quite valuable. As for its long term value, that has been all but erased!

For those who were awaiting the return of the application, here is a direct link.

It is 8/16/2016 actually!

Received a letter saying my change date is 8/26/2016.

“As for its long term value, that has been all but erased!”

I can understand that stance, but if you can put $80k in spend a year or close to it, is there a better 2% card out there?

Even if you spend more than 80k a year, the other 2% cards like Citi’s DBC does not have redemption thresholds of $!00. This makes a the card a lot less attractive. How many Uber/Lyft rides that will cost $100 or more. It would’ve been better if they changed to a aggregate system where you total charges below $100 to be able to be redeem if combined to be over that amount. I will wind this card down to 250 points by November and cancel it. I had this for more than 3 years now and I will just use Citi’s DBC card.

Let’s compare 100k spend between the Arrival and the DBC. With the DBC, assuming you pay your bill when due, you would have $2,000 cash redeemable in $25 increments. With the Arrival, you would have 2100 points redeemable for $2,100 in travel credits in $100 increments, or $1050 in cash. From this amount you would subtract the $89 annual fee, for a net profit of $2,011 in travel credit or $961 in cash. I think it is clear that even at 100k spend the DBC is superior to the Arrival.

I got the notice from Barclay yesterday. The letter mention that you can redeem to cashback statement. For 80K a year, you can redeem $100+ each month.

Yes but you only get $.01 per mile when redeeming against travel expenses of $100 or more. If you are redeeming for straight cashback, each mile is worth $.005.

Thanks for your clarification. I misunderstood the notice, I thought cash back is same as travel back. How naive I am.

@projectx You would lose a lot of value by spending 80k on this card. Your better off putting that kind of spend on a chase sapphire preferred card and/or citi Premier to move the points to valuable xfer partners. I’m cancelling the card.

I like this card. My wife and I have two Arrival+ and one 2.625% back BoA travel. I charged 80K+/year for each card. I also got my two Arrival+ annual fee waived at March & April have with 5 minutes phone talk. I have no complain.

Of course, I also have Chase freedom, Ink Bold, Old Blue Cash, …etc. I will managed to apply for another Old Blue Cash later this year.

How did you get the AF waived? I heard everyone is getting denied and they want to cancel it or prorated a refund

Each time I called, I asked to talk to the supervisor first since the representative cannot waive the AF. Probably I spent 80K+ , both supervisors waived my AF within 2 minutes.

Better off with a CSP? Not for my travel needs. Agree to disagree.

With these changes there is absolutely no reason to apply for this card except for churning.