ATT Access More Which Merchants Earn 3X

The AT&T Access More card was launched by Citi in 2015 and has become a very popular product because of its generous sign-up bonus and earning structure. This guide is designed to help you maximize your use of the card by documenting which merchants earn the extra 2 points per dollar for online spend.

Note: This post is continually updated as new data points are sent in. Please help us to build this guide by providing your own data points. If you would like to receive a notification when this guide is updated, please leave a comment below. Thank you!

AT&T Access More Card Information

AT&T Access More Bonus

Receive a free phone (up to $650) after spending $2,000 on the card within the first 3 months of account opening.

AT&T Access More Earnings

- Earn 3X Points for every $1 you spend on purchases made online at retail and travel websites.

- Earn 3X Points for every $1 you spend on products and services purchased directly from AT&T.

- Earn 1X Points for every $1 you spend on other purchases.

More Card Info

- $95 Annual Fee

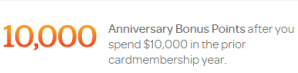

- Earn 10,000 Anniversary bonus points after you spend $10,000 in the prior cardmembership year.

For more information about the AT&T Access More card, see: Citi Launches AT&T Access More Card – With 3X for Online Purchases & Up to $650 Sign-Up Bonus, This Could Be A Gamechanger

How to Determine if You Received 3X on Your Statement

Unfortunately Citi doesn’t make it easy to see which purchases have earned bonus points and which ones have not. On your statement you will see a total amount of bonus points earned and will have to work backwards to figure out which purchases (based on their amounts) earned the points and which ones didn’t.

Online Merchants That Earn 3X ThankYou Points

This is a continually updated list documenting data points listed on other websites and in the comments here.

According to this Flyertalk thread, the following merchants earn 3X ThankYou points for online purchases:

- 6pm

- AliExpress

Amazon.comRecent data points suggest Amazon.com does not earn 3X.- American Airlines

- Costco.com

- Delivery.com

- Drugstore.com

- eBay

- GiftCardMall

- Groupon

- GrubHub

- Guess

- Kohl’s

- Lowe’s

- Mileage Plus X

- Newegg.com

- Staples.com

- Stubhub

- Target.com

- T-Mobile

- USPS.com

- Walmart.com

The following merchants earn 3X according to Doctor of Credit:

- Lastcall.com

- Neimanmarcus.com (through PayPal)

Raise.com(As of January, 2016 it seems Raise no longer earns 3X.)- Livingsocial.com

- Cardcash (through PayPal)

- Gyft (through PayPal)

- Swappable.com

The following merchants earn 3X according to readers:

- Mattel.com

Online Merchants That Don’t Earn 3X ThankYou Points

According to this Flyertalk thread, the following merchants DO NOT earn 3X ThankYou points for online purchases:

- Amex Gift Cards

- Giftcards.com

- Lumber Liquidators

- Netflix

- Norton/Symantec

- Sling TV

The following merchants DO NOT earn 3X according to Doctor of Credit:

- Cardpool.com

- Gyft direct payment (no PayPal)

The following merchants DO NOT earn 3X according to readers:

- Amazon.com

- Raise.com (As of January, 2016)

Online Merchants That May Earn 3X ThankYou Points

- eBay – eBay purchases seem to depend on how the seller is coded in PayPal. There doesn’t seem to be an easy way to determine if you will receive 3X or not.

Your Data Points

Do you have experience using the AT&T Access More card at merchants not listed above? Please share your data points in the comments so we can make this resource as complete as possible!

Has anyone gotten 3x for paying their federal estimates quarterly taxes online?

[…] of us build a valuable database of transactions that are eligible for this generous card, such as the one that Miles to Memories started, and this one from Doctor of […]

I was getting 3x at Plastiq for my mortgage. That changed as of my Jan 11th statement for a December 27th charge. I have seen some similar reports. Anyone else? The citi coding seemed to change from real estate to utilities or something.

Rock Auto, Amsoil, Google Store and Victoria’s Secret all trigger 3X points

Can you still product change to this card from another card?

The last positive data point I heard was a few weeks ago. I believe you can!

Do you know which cards will convert to the AT&T card?

I tried PC’ing from an AAdvantage Bronze and was told I could not; so I tried PC’ing that to a Double Cash, and have tried multiple times, but always told it wasn’t an option. I don’t know if it’s due to the length of time I’ve had those cards, or whether I’m just unlucky, or whether I’m trying to change from the wrong cards, or whether it’s just not available any more. Last positive data point I heard was October, and have been trying unsuccesfully since then.

A couple data points:

I seem to be earning 3x for Raise now.

My most recent SaveYa transaction (a couple months ago) did NOT code 3x.

Progressive car insurance via Paypal did not earn 3x.

Seashells round-up app did.

I got x3 on 6pm and US outdoor store

Bought an Exxon Gas GC sold by SVM and did not receive 3X. Went through Topcashback portal if that matters.

Didn’t earn this month: Zappos.

Did earn: Snow.com, Bed Bath and Beyond, REI, Kohls, VitaminShoppe and Plastiq for 3 different mortgages.

Any data points regarding Plastiq getting 3x points?

Yes some people have reported that it does, although I have not personally tried it.

Hi,

There is a easy way to see what transactions earn 3x online!

In your Citi At&t account, press “Points summary”

Select your At&t Card and press “Continue”.

You will see the amount of points you earned over the months you choose. Changing from “view by account” to “View as a List” will give you a list of transaction dates and a icon showing “3x” or “1x”.

You cannot see the merchant, but you can see the date and amount of points earned, so its pretty easy to put 2 and 2 together.

Gallery of screenshots: https://sli.mg/a/B4hQzr

I’m sincerely sorry that you have to go through all this trouble to figure out solver.

Thanks!

This only shows you how many points you earn monthly for 3X and 1X. It doesn’t show individual transactions.

Agreed, Shawn. I missed your latest reply so went in and checked for myself and found the same. Darn, I was hoping they had added transaction-level detail.

Use this brilliant method to easily see which purchases earned 3X: http://www.demflyers.com/2016/06/04/using-excels-solver-function-to-determine-which-citi-transactions-earned-bonus-points/

He describes using it with Excel, but I followed the same instructions for Google Docs and it worked easily.

Here are few to add to the database:

Did earn 3x:

TickPick

Vitacost

Amazon

Starbucks reload

eBay

Did not earn 3X:

ScoreBig

eSaving

Thanks for the data points Anita! That is a great article. I’m about to crunch my numbers now.

Did you find that the excel tip worked? Any confirmation on Amazon showing up as 3x aside from Anita’s datapoints?

It was hit or miss for me. I can’t say it works 100% since it showed some merchants inconsistently earning 3X.

[…] Related: Which Merchants Earn 3X ThankYou Points with the AT&T Access More Card: Complete Guide & Res… […]

[…] on all online purchases? Surely there is a catch? Actually, although a few things here and there don’t code as 3X, for the most part what you see is what you get. Of course that is if you can actually get one. The […]

[…] Which Merchants Earn 3X ThankYou Points with the AT&T Access More Card: Complete Guide & Res… (Miles to Memories) […]

[…] The Citi AT&T Access More card is perhaps one of the best deals on the market. In addition to giving a free phone (up to $650) as its sign up bonus, it gives 10,000 bonus points per year for $10,000 or more in spending and also pays 3X ThankYou points for purchases made online at retail and travel websites. (Find out which merchants earn 3X here.) […]

[…] An interesting perspective although he did initially leave out the AT&T Access More card, but added it in via an update. Having the right arsenal of cards for reselling is a must since the points really start to add up very quickly if you utilize bonus categories properly. As a reminder, we have a resource detailing which stores earn 3X with the AT&T card. […]

Just got my statement. Looks to me like Amazon does NOT work for 3x (disappointing and strange). I can also confirm that it appears Raise stopped working for 3x sometime between January 10th and 14th (got 3x on the 10th, but only 1x on the 14th – and future charges).

I can confirm (or re-confirm) that the following worked for 3x: Groupon, Mattel.com, eBay/PayPal (at least for the 3 charges I had), and NewEgg.com

Thanks! Data points added.

That’s interesting. I just got my statement and all my purchases on Amazon for 2/9, 2/10, and 2/12 all posted as 3x. It was about $260 worth of purchases. My Amazon Prime renewal interesting enough looks like it was only at 1x.

Thanks for the data point!

Raise.com did not give me 3x in the most recent statement. It was giving the 3x in the previous statement. So something changed there. This card is too unpredictable. Why should card not present be treated differently from Online?

I also have noticed a change in Raise.com; now 1%

Bad news.

Any way to get the $650 if you are not with ATT?

nick

it clearly states in tos that the phone purchase does count towards spend requirement. also att and purchases come with 12 mos of no interest. so buy the phone and take your time paying it off. that’s how I got my iphone6s plus.

any data points on whether the $650 spent towards the phone counts toward the anniversary bonus (realizing that it is credited back when the spend req. are met). I know the credit doesn’t result in negative points (i.e. you get 3x for the phone purchase). Tx

Has it been confirmed that these points transfer if you have the prestige?

I have the no annual fee AT&T version (downgrade fr AA Exec) and Sears.com earns 2x. So Im assuming it would be 3x with the premium version.

Great resource!

You can add BestBuy.com to the list of confirmed 3x.

too bad giftcardmall going pinless.. otherwise it ought be great MS card!

How can they get away with this? I thought all prepaids are required by law to have PINs under Dodd-Frank.