My Latest Bank of America Application Results & Some Good Data Points

Bank of America has not been a fan of mine lately. I have continued to strike out with them right and left since their rule changes a year or so ago. The one thing I have been able to get is a targeted offer for their Cash Advantage business card. For some reason they send this to me like once a year and I always get approved for it. Well this time around they sent it to me after 6 months and I decided to go for it even though I still have the last one open. My application results also led me to another application.

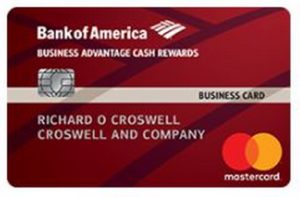

Business Card Application

As said above I received an email for the Business Cash Advantage card. It has a decent cash back earning structure (3% at office stores and gas stations) for a no fee card. But the welcome offer is $200 after spending $500. I like to throw in easy ones like that from time to time and since it is a business card it shouldn’t count towards Chase 5/24 which is a bonus.

I am 3 for 3 applying for this card through their targeted email offers. Even though I still had the card I decided to give it a try. I got a pending message and assumed they would deny me or send me the request for a whole bunch of documentation on my business. That is what they did on my previous Travel Rewards application and I didn’t think it was worth the effort.

Personal Card Application

Since I was assuming a denial was coming I decided to give a personal card a try. Even though my last 3-4 attempts over the previous 12 months have been denied. After my last couple applications I decided to close most of my Bank of America cards to free up available credit and de-clutter my life. Remember that you should reduce your overall credit limit before closing a BOA card.

I had been eyeing the Premium Rewards card and it’s $500 welcome offer since it first came out. And if I was ever able to get banking status with Bank of America it would become a great everyday card. In the past BOA had combined my personal and business applications so I thought why not see if that was still the case. Especially since I already burned a hard pull on the business card.

I crossed my fingers and hit submit and to my surprise I was instantly approved with an $18,000 limit. This was a stark change to just a few months earlier and I think focusing on business cards to clean up my personal record and removing unused cards from my account led to the approval.

Double Whammy

I was satisfied with my 50% hit rate and I was excited to get my new card. A few days later I got an email that my business application was also approved. Say what? I ended up getting a double whammy of value. I’ll take that any day!

Data Points

There were some data points that I think are worth highlighting:

- After a few denials I was able to get an approval from BOA and I think cleaning up the cards I had with them played a big part. Even though I was not at the 4 card maximum before I think reducing my number down further played a role. Reducing my overall credit limit helped as well. That plus lowering my overall applications the last 12 months led to an approval.

- It is still possible to get 2 of the same business cards with Bank of America. I applied for both as a sole proprietor but they are technically different businesses.

- The double application did lead to two hard pulls instead of them combining them.

Conclusion

I have a lot of irons in the fire with the Aspire retention offers, these two new cards, and the Delta no lifetime offer. No complaints here though, that is the way I like it. Getting maximum value from my everyday spend puts a smile on my face!

How have your recent applications with Bank of America gone?

I am also irritated with them. Have an AK Air Siggy with a 9.5k limit. Have had it for several years. They will not give me another card citing lack of existing business relationship as the main reason. No I will not open up a checking or Savings acct just to get one of their cards. Too many other fish in the sea.

Lol. I’m a bit annoyed at them right now. I applied for the same business card a couple weeks ago and they asked me for all kinds of crap: tax returns, business documents, etc. Gonna get it together and send to them in the next few days.

At least you are getting back in there! You are a better man than me – I wouldn’t send them all that junk for $200 🙂

Good going! Was denied a personal a few month back, but also decided to give a Biz a try – and got it approved after doing what you suggested: lowering credit on other card(s) and closing unused cards.

Another good benefit with them is Free Museum days.

Merrill points can be converted to cash if one has a checking account with them and can’t find a good use by purchasing air tickets (including $25 air credit to use).

Congrats Aleks!

Is the $500 reported as income?

Speaking of reducing cards, I need to get rid of my Merrill card, but haven’t used the points. Would be great to see an article on that.

No – on referral bonuses have been getting 1099’s.

Merrill Lynch is worth up to 2 cents per dollar up to 25,000 points per booking. Most people look for flights as close to $500 as they can and use the points to book them.

I cannot tell if the Amex lifetime rule applies to my Delta Gold gcard application/ Can you explain?

If you have had the exact type of Delta card you would not be eligible. So if you have had the gold you can’t get the gold but could get the platinum etc. They send out targeted offers from time to time that have no lifetime language in it though.

For me, business card application inquiries are either Equifax or Transunion, and personal is Experian. They also keep sending me an email to apply for the Biz card you mentioned and I applied twice, but never get approved. Then I get the offer email again a few weeks after denial. I am keeping one card with them for the card offers which if I’m targeted can be profitable.

That is weird that it is different for you. Every other business card gets a no but this one goes through every time. Strange!

Is their a total number of cards you can have with bank of america? Thanks!

I was down to 1 business and 1 personal before the applications so now 2 and 2

Congrats on the approvals! I applied for the Premium Rewards card last year but was denied. Your post says you lowered your applications over the last 12 months…can you share anything more specific about the number? I’m curious what BOA’s tolerance is for number of inquiries. I’d like to apply for the BOA Amtrak card if and when the sign-up bonus goes to 30k as it usually does over the summer.

6-7 personal cards over the last 12 months

Thanks for the good post and congrats on the approval. I was wondering if the reason led to two hard pulls is because you got one business and one personal cards??

Yeah not all banks combine business and personal apps (or two personal apps for that matter). In the past they had for me but not this time.