Bank of America Travel Rewards Credit Card Application Experience & Strategy

Last year PDX Deals Guy covered the Bank of America Travel Rewards Credit Card in detail. At its base level, the card earns 1.5% cashback and works similar to the Arrival Plus in that you charge travel expenses to the card and then redeem your points towards a statement credit against those charges.

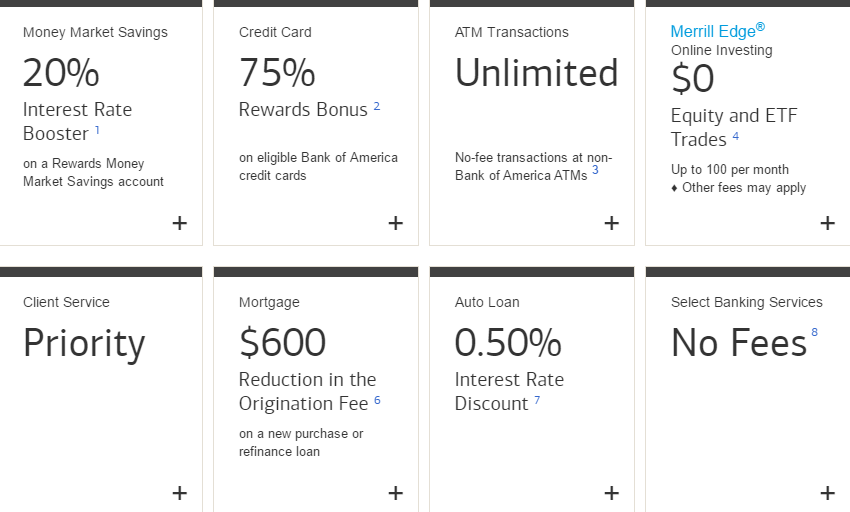

On the surface 1.5% cashback doesn’t look very good, but when you dig deeper, this card gets much better. That is because of Bank of America’s Preferred Rewards program. By being a good Bank of America customer you can get a bonus on the rebate. Here is how it works:

- Bank of America checking or savings customers: 10% bonus or 1.65% cashback.

- Bank of America Preferred Rewards Gold: 25% bonus or 1.875% cashback.

- Bank of America Preferred Rewards Platinum: 50% bonus or 2.25% cashback.

- Bank of America Preferred Rewards Platinum Honors: 75% bonus or 2.625% cashback.

As you can see, for Platinum and Platinum Honors members this card bests any currently available cashback card. Considering there is no annual fee and no cap, it is quite good.

Current Bonus Offer

The card actually has a very good sign-up bonus right now considering it is a no annual fee product.

Current Bonus: 20,000 online bonus points if you make at least $1,000 in purchases in the first 90 days – that can be a $200 statement credit toward travel purchases.

My Strategy For Applying

Since I have been doing quite a lot of reselling and since I like to travel a lot, this card has been on my radar for quite some time. Of course the main reason this makes sense is if and only if one has Platinum or Platinum Honors in the Preferred Rewards program. Platinum Honors requires a three month average of $100K between all Bank of America and Merrill Lynch accounts.

I carefully studied the terms and once you join the program, you have status for 12 months before you are re-evaluated. Then, if you don’t re-qualify for your tier, they give you an additional 3 months before knocking you down. In other words, I could get 15 months of Platinum Honors by moving money into BofA temporarily and that is what I did. Thankfully the sale of our house meant I didn’t need to move money from other places & although this money is only passing through it works.

Applying for the Card

Last week I decided to apply for both the Travel Rewards card and the Alaska Airlines 30K + $100 offer. I have applied for two cards before on the same day with Bank of America and the inquiries were merged. Additionally I haven’t opened a Bank of America card in awhile so two cards isn’t really pushing it. Since the Travel Rewards card was more important to my strategy, I submitted that application first and then submitted the Alaska app a few seconds later.

Bank of America Doesn’t Hate Me Anymore – Maybe

For those who haven’t been following along closely, Bank of America has hated me for awhile. For some reason they would approve me for cards, but always with a $1K limit. This forced me to stop applying for Alaska Airlines cards since I always was reduced to a 5K bonus. I was hoping that moving this money into BofA would help strengthen me as a customer.

Both apps took quite awhile to process and the Travel Rewards card came back first with an instant approval! I was also quite shocked when I saw the $17,000 credit limit. Success! Unfortunately the Alaska card processed forever, then asked me some personal information to verify identity and then said they needed to review my application. I am waiting it out and haven’t called them, but I am hoping for an approval.

Conclusion

Between my household’s many Chase Ink Plus cards, our two AT&T Access More cards and now the Bank of America Travel Rewards Credit Card we are setup pretty well for earning maximum rewards on our reselling and everyday purchases. Of course this fun will only last for approximately 15 months, but I’ll deal with that reality next year.

[…] my life as has my wife. We actually do like them, but for our day to day spend have moved on to the BofA Travel Rewards card since we now earn 2.625% there. With that said, the Arrival Plus’s PIN feature is great, especially when traveling to Europe […]

[…] we both moved some money around in order to gain Platinum Honors status with Bank of America. I use that status to earn 2.625% cashback with my Travel Rewards card. While the everyday cashback with the Premium Rewards card will be the […]

[…] of late fees and interest charges on the annual fee and late fees. Thankfully my wife and I are Platinum Honors members with BofA which seems to get us a higher level of service. A quick call to an agent resulted in an […]

[…] card. This means that the bonus portion is only what you receive above that. For example, I can earn 2.625% cashback everywhere with my BofA Travel Rewards card, so the benefit is only marginal to […]

[…] I personally have obtained Preferred Rewards Platinum Honors status in order to gain the increased rewards earning. You can find out more about how I did it and why in this post. […]

I agree, it’s hard to beat Merrill’s Offerings combined with Platinum Honors unless you are doing margins, options, etc.

[…] Bank of America Preferred Rewards program and its generous benefits. You can find the details in this post, but I feel it is important to note that I now have the top tier status in that program and thus […]

[…] program. If you are interested in finding out how this works, I covered it in detail in this blog post. This card is the one I use for my everyday non-bonused […]

Out of curiosity have you done an opportunity cost analysis counting the dollars lost for 3 months in either interest on the full $100,000 or the transaction fees associated with moving stock/mutual funds? I ask because it seems like the breakeven amount you’d have to spend on the credit card to make the incremental 0.65% worth it over the standard 2% credit card is approx. 34k (math below)

Opportunity Cost:

X = $100,000 * 1% Ally Savings Acct Rate / 12 months in a year * 3 Months required to have balance over 100k

X = $250

Y = $100,000 * 0.06% BoA Savings Acct Rate / 12 months in a year * 3 Months required to have balance over 100k

Y = $15

Opportunity Cost = (X – Y) / 0.65%

Opportunity Cost = $33,800

This doesn’t take into account the signing bonuses but since you’ve already got it for this year the consideration is really for next year.

I have some plans for this card and personally will spend more than that and did complete the calculations. The other reason I did this was because I was having a hard time getting an approval of more than a $1K credit line for some reason with BofA. My theory was that this would loosen them up and it has worked.

Your logic is completely valid and everyone should calculate how it makes sense for their situation.

I stumbled onto discussion of this card and the cash back card and their Preferred Rewards multiplier. Was pleasantly surprised to find out that retirement accounts are qualifiers. Transfer one IRA with $100K+ and all is well. For those in that boat, no need to calculate opportunity cost for keeping $100K in a bank account with B of A. I was also pleased to find a bonus offer for transferring my IRA AND 100 free commissions per month at the $100K+ level. 2 months ago I would that it highly unlikely that I’d ever bank with B of A. Now they have quite a bit of my business. Let’s hope they don’t muck it up.

It’s more complicated, because for reselling the cashback amount needs to be subtracted from the purchasing price, hence increasing taxable profit.

What is the plan to redeem world travel points to maximize its value?

So here’s the big question mark with this card… Previously you could transfer points earned on this card to a cousin card, the FIA issued Fidelity AMEX in a manner that allowed you to cash out your earnings at 2.625% – IN CASH, not travel reimbursement. Unfortunately, the Fidelity AMEX card is dying this month. I’ve heard chatter about still being able to accomplish this with a different card, a Business Worldpoints card. But I’ve yet to find anyone who will absolutely confirm that it works. Would LOVE to hear someone confirm that this works and lay out the exact card involved and the process.

[…] week I talked about my recent application for the BofA Travel Rewards card. The main reason I decided to apply for that card is because I […]

You’ll need to wait 3 months before you get the status

It calculates your total qualifying balance on a 3-month rolling average, so it will take a minimum of 3 months before you can qualify for the top Platinum Honors tier (hopefully his money will be available to sit for three months while it is “passing through”, or else he will be sorely disappointed). According to the terms, the 12-month re-evaluation occurs on the 12 month anniversary of when you first qualifier for any tier of the preferred rewards program (while may not necessarily coincide with when your checking account or Merrill Lynch account was originally opened), and as the post stated, you will have 3 months to bring the balance back up to meet the requirements before you are demoted to a lower tier.

Yes it is a 3 month average meaning they take your last 3 statement balances and average them together so it doesn’t necessarily take 3 months. You actually need to opt-in to the Rewards program, meaning if you don’t opt-in until you reach the top tier, you should have 15 months at that tier.

True, clever idea, but be cautioned that they don’t seem to “poll” your account balance exactly at the end of each statement cycle. My statement cycle ends on the 11th of each month, but I’ve been checking every month and the qualifying balance has always been updated on either the 4th or 5th of each month. If you’re trying to time it perfectly, be careful!

I recently was given the top status by BOA, a fluke of sorts because I happen to be joint on a number of accts that together reach the needed threshold. (The primaries are currently abroad and wanted a local person also on the acct just in case; I actually have no accts with BOA for which I am a primary.) I was told that the CB each month will reflect whatever % fits the current sum of the balances, not that there would be an evaluation next year. Since I have no control over the balances I hope your explanation is the correct one,

They still hate me.And I don’t understand.

I hav been holding this choice for a while now, with my oldest cards being Bofa Cashback ones , should i move my wife’s card to the travel one? I know it doesn’t make much sense as I have to apply Chase Unlimited in course( & of course I do have SPG ) but 5/24 might make me wait for a while no harm in making use of something