| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

|---|

Bank of America Cashback Deals

I write a lot about Amex Offers, because there simply isn’t anything like them. American Express has shocked me time and time again with the generosity of their offers. With that said, did you know that Bank of America has a similar program for their cardholders? It is called BankAmeriDeals.

Before I go any further, I don’t want to oversell BankAmeriDeals. Generally they aren’t very good, however I know from time to time people get very lucrative offers. Up until today, all that has been available for me is 10% off at restaurants like Applebees, Panera and Pei Wei. Today I finally found a better deal.

My Best BankAmeriDeals & Stacking for More Savings

The targeted promotion I was offered gives $10 back when I redeem any of my other available BankAmeriDeals. Sort of a deal within a deal. Well I checked my other Amerideals and none really stood out to me (see merchants mentioned above), except for one. I can get 10% back for using one of my BofA cards at Starbucks.

While that savings isn’t too crazy, remember that purchasing a simple Starbucks drink would result in $10 cashback, so it definitely could be worthwhile. Also, I ran across this deal. Right now Starbucks is offering a $10 bonus when you use a Visa card to load $25 in their app. So potentially, for $22.50 out of pocket (after my 10% back) I could get $10 in cashback plus $35 in Starbucks credit or roughly 50% off.

Now I don’t know if a purchase within the app would trigger the Amerideal for 10% off, but the $10 bonus deal is pretty good in and of itself. Either way, this is a good reminder to check the Amerideals section of your online account every once in awhile.

How BankAmeriDeals Work

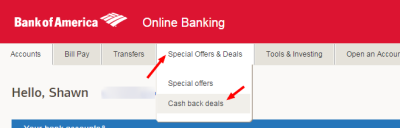

To check your available BankAmeriDeals, simply login to your account and hover over the “Special Offers & Deals” menu. Then click on “Cash Back Deals”. Unlike Amex Offers which are linked to a specific card, these deals work for any card. So in my example above, I can pay at Starbucks with any of my Bank of America credit or debit cards to trigger the 10% off and the $10 bonus.

Conclusion

I know this isn’t the greatest example of a deal, but free money is free money. No matter whether you have a good deal in there now or not, its probably worth it to take a second to click that link once in awhile when checking your account. Definitely not as good as Amex Offers, but still something nonetheless.

[…] Check Your BofA Accounts for Great Cash Back Offers […]

@Shannon – It works, being there had it 🙂

@Shawn – If you use your BofA card a little more often you would get some great deals. There are some great offers like $100 cashback for paying Comcast bill, $75 for T-mobile, ATT etc. So keep an eye on them and check out slickdeals or Fatwallet to maximize them.

Hey Shawn awesome posts as always. I checked my B of Ameri deals and saw 10% off at office depot/max online or in store. This could be great for Visa Debit cards as negative mf spend if it works right? Details on B of A site didn’t say there were any exclusions. I’ll try it and repost if it works. Maximum cash back of $15 though.

Can you let me know if buying a gift card/inapp reloading triggers the 10% offer please? Thanks.

PS:This starbucks offer has a $3 maximum.

For the starbucks offers yes. I’ve done it before. As long as you charge it on your bank of america card and the transaction is coded with ‘Starbucks’ then it will work.

I see certain restaurants on mine, which works really well when I can choose the restaurant for a work reimbursed expense.

Just $3 on my offer.

I have better luck with Sears. As part of their “Shop Your Way” they weekly send me Surprise Points worth $10 off (anything over $10). I just set it up for pickup. Somehow I ended up with two accounts (and two offers), so I grab about $25 worth of stuff for $5 (on average) each week. Building up a good tool supply.

It’s the only time I go there and the pickup is about six steps inside the store. Rather than going in they’ll also bring it out to the car.

The points are also good at Kmart.

I have been lucky in getting 15% off at both sears and kmart. So I just go there and just buy a $100 or $200 visa gift card (depending on what’s available). After fees and everything, still comes out at to at least 10% off which is better than any credit card rewards can give.

My wife and I have each had 10% back at Kmart (up to $20 back). And she had the same deal at Sears too. Bought a $200 VGC with each eligible card and filed the CCs back away. Free money is always good.