Bonvoyed Again! Marriott HQ Weighs In On Insane Hotel Credit Card Fees

This article about hotel credit card fees is NOT our standard article. We’re going beyond that to look at a Marriott hotel that is fleecing its customers. “Bonvoyed” has become a pejorative lately–a term to describe customers getting screwed by Marriott. I reached out to several parties on this to understand what’s happening with this Florida Marriott property and its anti-consumer hotel credit card fees. This is an investigation of sorts to see if this behavior will continue.

Update 5/26/21: Marriott has now instituted a policy for the US & Canada. From View From The Wing

Marriott recently instituted a brand standard for the US and Canada prohibiting properties from imposing surcharges when guests pay with a credit card. As a result, the Westin Ft Lauderdale is no longer engaging in this practice.

Florida Marriott Property Charging Excess Fees

A friend of mine walked into the Westin Fort Lauderdale Beach Resort at the end of March and saw this sign in the lobby. I can confirm this sign is new and appeared sometime after March 1, 2021.

Good on him that he left and didn’t stay there, since he found this ridiculous. I agree that it’s ridiculous for a Westin (high-end hotel property) to charge a fee like this. After thinking about it, I decided to investigate.

I Reached Out To Key Parties

This fee really rubbed me the wrong way, so I decided to see what Marriot has to say about it. I also was interested in what the banks who issue Marriott credit cards have to say. Since this fee discourages people from using their credit card, would this bother American Express or Chase (the banks that issue the various Marriott credit cards)?

Marriott Customer Service

I contacted Marriott customer service on Twitter. They told me they would have the hotel contact me within 5 days. 6 days later, I messaged them again asking what happened. A full 15 days after my original DM, the hotel contacted me by email.

The Hotel

I knew the hotel was going to say this fee isn’t illegal and give me some nonsense, which is why I hadn’t planned to contact them at all.

Yes, we do charge a credit card surcharge fee. I would reluctantly understand if you chose not to stay with us. However, should your travels bring you to our property please feel free to [contact the people CCed on the email] to be your personal ambassadors and showcase the experience so many rave about.

In other words: “Our hotel is so awesome, you’d be lucky to stay here, even if we charge a fee.” I’m not buying it.

NOTE: the fee technically is illegal by Florida law, but federal courts said that law is unconstitutional / not enforceable.

Back To Marriott Customer Service

In my reply to the hotel, I included Marriott’s customer service email. I said that this fee is not disclosed on the website, and I find it silly. I asked for a direct answer to this question: if I pay with my Marriott credit card, would they still charge this fee? The hotel replied nearly immediately saying yes.

Marriott customer service said this:

It is up to the hotels to set their taxes and we would stand by them in their processes. If we can be of any additional assistance in the future, please let us know.

I replied saying that we aren’t talking about taxes. I included a picture of the sign and pointed out this is an extra, optional fee. I asked for a yes / no on whether Marriott knows about this and whether this is acceptable to them.

As mentioned by my previous colleague, surcharges, taxes, and fees vary from hotel to hotel and each hotel has its own policy regarding these charges.

Chase Customer Service

At the same time as I originally reached out to Marriott, I contacted Chase customer service to see what they had to say. I figure a bank would want to know if its co-brand partner is actively discouraging use of the credit card they have together.

It appears that the institution in your photo may charge their own fees at their discretion. If you have questions about the benefits of your Chase credit card, kindly call the number on the back of your card anytime. Thank you.

I replied saying that wasn’t my question, and is Chase OK with the hotel discouraging me from using my Chase Marriott card?

American Express Customer Service

American Express took the unique approach of just never replying to me. I gave up on them after 3 attempts.

Those Went Nowhere, So I Went Higher On The Food Chain

Since I was getting a lot of TV lawyer ‘my client has no comment at this time’ type of response, I figured I was talking to the wrong people. Would someone with decision-making powers have an interest in this?

Chase Media Contacts

I emailed the ‘media contacts’ at Chase via their website. I included a picture of the sign and said that I’m interested in their thoughts.

- 1-did they know about this?

- 2-do they have any thoughts on a hotel discouraging me from using the co-brand card they issue together?

- 3-what could they say to convince me having that credit card is worth it, if I have to pay extra to use it at the hotel?

- 4-I mentioned that I do write for a blog, in order to be fully transparent. I didn’t name the blog, but I figured no one could claim I surprised them by taking an email reply and putting it in an article.

Chase never replied to me. I tried twice with the media contacts, and this was over 2 weeks ago.

American Express Media Contacts

I sent the same email to American Express. I got a reply within 15 minutes.

Thank you very much for reaching out. Allow me to look into this to better understand the details here and I will get back to you.

More to come shortly.

By “shortly”, I understand she will never reply to me again. I tried two more times and got no reply. I think 2 weeks was more than enough time for the people I contacted to get back to me.

I Add Marriott Corporate To The Email

When Marriott customer service was giving me nonsense replies, I decided to break the cycle of “we don’t set hotel policy on taxes” and me saying “this isn’t a tax” then getting the same answer again. For the 2nd time in my life, I emailed a company CEO. (I did this previously with my insane United experience)

Marriott HQ Responds

Someone from Marriott HQ (in the Ireland branch of their Office of Consumer Affairs) emailed me saying they got my email to the CEO. That was it.

I replied asking if they had any more to say, so he asked for my number and a convenient time to call me.

On a side note: this couldn’t be more “Bonvoy=mess”. This guy is from Portugal, working at an office in Ireland, calling me from a German phone number, to talk to me about a hotel in Florida.

Lack of telling the customer about the fee in advance

Him: My first concern was whether this was showing in advance. I confirmed with the hotel that it shows.

Me: The hotel told you the fee is on the website? It’s not. I’ve looked everywhere.

Him: I believe that it is, but that is something I will tell our IT team. Because I agree with you that this fee should be known to the customer.

Marriott’s view of the hotel credit card fees

This hotel is a franchise. There are some limitations with what Marriott oversees. I assure you […] we are looking into it. I cannot guarantee you whether the hotel will continue to be allowed to charge that fee or not, but it is being looked at. If there is something we can do, it will be done.

What’s the point of a Marriott credit card?

That’s a very valid point. I will bring this to the attention of our departments to look into it. I can’t give you a straight answer.

Do you think consumers will choose not to stay at your hotels if they have this fee? I know I won’t.

I understand what you’re saying. It makes sense. This is the first fee like this I’ve seen in the United States. We were caught a little bit by surprise and have to look into it. It goes above me, because there are other situations we have to look into, especially considering the partnership with the hotel. But 100% I understand what you are saying. This is not a common practice–not at all.

Every Marriott hotel has signs saying I should have / use a Marriott credit card, but now I have to pay extra to use the card. Does it make sense to have the card?

I understand that you want to earn the points and enjoy the benefits from the card, which is why you signed up for it. And we want you to continue to enjoy that and keep the card. We understand what you are saying.

How will customers know if the fee is continuing or going away? Will you give me an update?

I cannot commit to let you know when this will be resolved. Our team is looking into it. It will be discussed internally, but we will not be able to release a statement at this moment concerning this.

In the future, if you want to try to make a booking for this hotel, you can look online or talk to the reservation department or call the hotel to check with them. Then you will see if the fee is there and being charged.

My Takeaway On This

I understand that swipe fees are going up on credit cards. Personally, I can’t fault a mom & pop shop that asks for a minimum purchase amount if you want to use a credit card. I also won’t fault them for adding 50 cents or a small fee if I use a credit card. They’re struggling to make ends meet.

Marriott is NOT that. Not by a long shot. For a high-end property in a multi-national hotel chain to charge a credit card fee is beyond ridiculous. But that’s just the base of how insane this is.

Here’s why this extra fee on credit cards is totally ridiculous:

- This fee is not disclosed in advance. I scraped every detail of Marriott.com and the info page for the Westin Fort Lauderdale. Next, I made dummy bookings. I even clicked on every link. There’s no warning about this fee. That lack of disclosure in advance is unfair to consumers. It’s been over a week since Marriott HQ was supposed to get this fee onto the website, and it’s still not there. (Our prediction is that it never will be)

- I’d wager no one pays for hotels in cash these days, so you’re essentially telling your customers that they all need to pay an extra fee for the fact it’s 2021.

- PLUS, you cannot even reserve a Marriott hotel without a credit card. Then they want to charge you an extra fee for paying with this credit card they required you to put on the reservation.

- Marriott has its own credit cards via American Express and Chase. If you actively discourage people from using credit cards, that means you are discouraging people from using your own credit cards. What’s the point of a Marriott credit card if I have to pay extra to use it at the hotel whose name is printed on the front?

- Other hotels aren’t doing this, which means customers can go there to save money. This is a negative competitive edge.

- Due to the pandemic, Marriott actively encourages no-contact operations at its hotels. This includes checking in online and checking out online. You can’t do any of these no-contact options that corporate is encouraging if you don’t want to pay this fee. This fee punishes you for following pandemic protocols put in place at the hotel. They are telling you to do 2 opposite things at the same time.

- Every Marriott property has signage encouraging you to pay with a Marriott credit card (or sign up if you don’t have one). Signs will tell you about the extra points you earn by paying with your Marriott credit card. Why is your signage telling me to do something that I’ll pay an extra fee for? Again, they are telling us to do 2 contradictory things at once.

For me personally

I’ve talked about the Marriott roller coaster and some of their anti-consumer/anti-loyalty moves before. I will drop my status with them in a heartbeat if this becomes a new norm. However, it sounds like Marriott doesn’t want this to happen and didn’t even know it was happening. That leaves me some hope this won’t continue / expand.

Granted, some of the discussion with Marriott HQ included non-answers or “no comment” because of their internal policies. And it sounds like the guy I talked to doesn’t set policy, so all he can do is listen to me, get my feedback, and tell me they’re looking into this. He can’t set policies or make any promises. It’s both good and bad.

Hotel Credit Card Fees – Final Thoughts

I loathe businesses that try to fleece their customers. I separate small businesses from mega-corporations in what I find tolerable. For Marriott, they rake in so much money every year that pretending they need an excess 2% credit card fee at a high-end Westin property is shameful. The fact corporate and regional management didn’t know about this speaks to a lack of oversight, which is another conversation entirely. I find this ridiculous and wouldn’t stay at a property that does this–especially if that fee still applies when I use a credit card with the hotel’s name on it. Too many hotels try to nickel & dime us already, and I’m not willing to pay additional hotel credit card fees. I’ll take my business elsewhere.

What would you do? Would you stay at a hotel if they charge an extra fee when paying by credit card? Stay there and eat the fee? Pay by cash or debit instead? Walk out? Let us know.

Whoa, I’d never even imagined that this was a thing in 2021. Sounds like they’re having the guests pay for some B&O tax claiming it as an additional fee. It’d be interesting to take this to the AG about improper business practices; especially, given that there wasn’t any disclosure before entering this contract with the hotel. Eesh, thanks for this write-up… my first article with this site and now am subscribing! (Titanium/Platinum lifetime – but starting in with Hyatt due to shenanigans like this with Marriot!)

Saralina – you may also want to check out this article (and especially the comments) -https://milestomemories.com/marriott-playing-games-hong-kong/

I’m also a Titanium member, but I can’t ignore / can’t not call out shenanigans. Good word for what’s happening.

I will say this about Marriott. I will NEVER stay in ANY of their properties EVER again ANYWHERE….PERIOD. Talk about non disclosure. I was one of many caught by total surprise by the Strike at 5 Marriott properties in Hawaii back in 2019. Specifically at the Royal Hawaiian. The story is WAY to long to tell, especially how they treated us once we checked in, and then checked out, what they “tried” to charge us and their lies about it all after the fact. American Express was a HUGE help in our actions against Marriot and the hotel specifically….so was out class action lawsuit that followed. “F” Marriott in others words.

The problem is in the lack of

Disclosure. Let’s face it. ALL of

us have been paying for rising credit card costs for years by business’ raising their pricing. Now business’ have a legal option to pass along the high fees that they get charged on to the people who are benefitting from the “points” and “cash back” and all those other things the credit card companies promise you… all at a ridiculously high interest rate. Owning a small business with slim margins is incredibly hard. So I don’t see anything wrong with this practice IF it’s disclosed properly.

I partially agree. For a small business, I totally get it. And I agree that disclosure is necessary. For companies that have multi-million operating budgets, this practice is absolutely unacceptable, at least in my eyes.

I agree with most of the blog points except some people do pay cash for hotel rooms. I’m not one of them, but I’ve seen it.

Art – this might happen on a significantly small portion of US hotel stays. Maybe it’s not “no one” but it’s statistically insignificant enough that the point remains that the large majority of people pay by card, which means this fee would become almost “everyone”.

Luckily, from me pushing them about this, Marriott has instituted a policy against it.

Two identical situations. Had to book two nights each in Hilton and in Marriott, both reservations using the free night certificates. Then had to cancel due Covid. When I went to rebook, neither property refunded the certificates back in my account. Had to call both. Hilton apologized, returned certificates, rebooked and without my even asking credited 10000 points. With Marriott, not that fast. They told me up to five business days, footballed me between three different department, bu finally returned certificates. No apologies, no extra points. I essentially switched all my business travel to Hilton after Marriott acquired Sheraton. See ya, Narriott.

Gene – I wish I could say that was the first time I heard (or experienced personally) that story with Marriott dragging feet on a refund of points/certs.

Thanks for going to bat for all of us. Now, for me, it’s on to resort fees. I will continue to avoid these properties. Same amenities as before without them.

[…] Exhibit #345,765 why Marriott sucks. You won’t hear that from bloggers when they sell Marriott Bonvoy cards. Bonvoyed Again! Marriott HQ Weighs In On Insane Hotel Credit Card Fees. […]

While there are some states that disallow credit card surchages (FL not one of them) and some rules from Mastercard/Visa in their contracts, it is likely allowable for them to charge the fee. As you say, there are some questionable business practices there. But as you highlight, the most egregious thing is that this is not disclosed until you arrive at the property, and hotels are not often something we book by walking into and comparison shopping the day of. In fact, not disclosing this online at time of booking is most likely a clear violation of Visa and Mastercard’s policies. You reached out to the hotel and to the Banks, but the one who really enforces these things contractually and are incentivized not to degrade the trust in using your credit card are Visa and Mastercard. You should reach out to them and see what they have to say.

I’ thinking a good argument could be made that this practice, not disclosing the charge until check-in, could legally be considered a “bait-and-switch”….ie: I booked my room on the understanding that the charge will be X dollars when, in reality the charge will be X dollars + 2%.

Ryan — superb post and write-up. Appreciate your detail, candor, and persistence. Sure, the faux-heads will say, leave the corporations alone, celebrate their freedom to exploit we the sheeple…. But so very nice to see miles-to-memories has the independence, the courage to speak up. (with reason, calm, and all-around awe-someness) You and M2M could become the Andy Rooney (bless his memory) of travel bloggers.

PS: I had a surprisingly bad experience at a Marriott Spring Hill Suites this past week in Richmond, VA…. beyond annoying, while my son and his young family encountered a hellish first nights at a Days Inn Outer Banks, NC (Mariner)….. (and I’m a Wyndham Diamond — in response to my own intense complaints, their corporate offices are initiating an investigation — which likely will lead to fines of that scandalously horrid place, if not outright kicking them out of the franchise….) I could write-up both tales of serious woe….. Am really encouraged to see miles-to-memories be the antithesis of “loyalty-lobby” type blogs — where their first loyalty so often seems to be to the lobby owner, not the customer….

Escot – glad you got something out of this. We aren’t afraid to call it as we see it!

Escot – can you tell us more about what happened in Richmond, VA and what happened in Outer Banks, NC?

Unfortunately, another really great reason to miss SPG!

Seems simple, stop staying at all Marriott hotels till they get their act together. Period, no exceptions. If you keep giving them any business at all,, it just encourages this crap.

So many people will arrive for cruise bookings (I know now, but hopefully soon), and will have no option other than to pay as everything else will be booked. I thought that you could not legally charge more for using a credit card?

CLA – federal courts ruled that laws on this are unconstitutional because they violate ‘corporate free speech’.

As you may know, another related gray-zone is when you do reservations via Chase Ultimate Rewards (Expedia)….. and then discover that the bottom-line points you’ll pay get ratcheted up exponentially over the headline reservation prices (and if you’re not asking questions, you won’t realize it’s often for far more than taxes, parking, resort fees, — but often includes special tack on fees which CUR/expedia doesn’t disclose…….. that subject too ripe for a Ryan Rooney special write up)

Easy, just do debit and pay them with Visa gift cards :).

According to an earlier commenter who called the hotel, if your debit card has Visa/MC branding, they count it as credit and charge the fee!

Excellent investigation, Ryan. I check on fees beforehand, never pay a resort fee, and am seldom willing to pay a small parking fee. But I have never before heard of a fee to use a credit card. With hotels on every corner, there are many options to go elsewhere (after I use my million plus points). I hope they don’t start charging extra fees to use these up. But I wouldn’t be surprised . . .

Don’t give them any ideas!

You may recall that Diners Club charged a fee to transfer to a partner. That’s when I threw them out of my wallet.

Seems like it’d be easier to just raise room rates 2%. This way, you still capture the extra revenue from customers who choose pay in cash. Not to mention it would eliminate the need to have a cheap and tacky looking sign out front explaining a 2% CC fee.

Unfortunately the hotel could just add it as part of the “resort fee” since those (regrettably) remain legal.

Any old way they can find to screw their guests. It’s really pathetic that travelers can’t get a net quote up front from hotels, airlines or car rentals. Why hasn’t the gov’t looked into this yet?

Pay all in coins!

Love that idea.

If they want to nickel and dime us, we should pay in nickels and dimes.

Nice try, but with the national coin shortage, you’re doing them a favor!

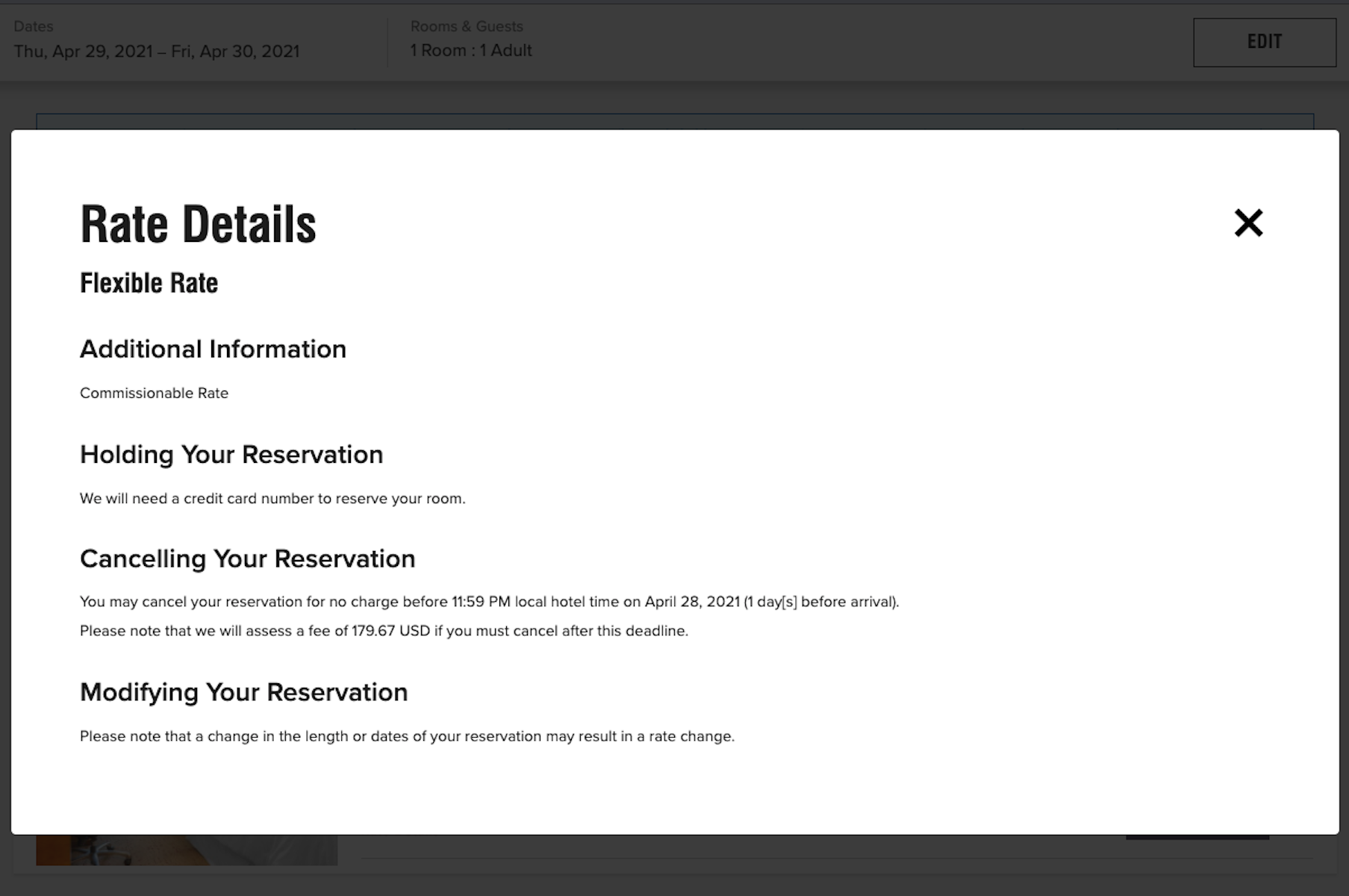

When booking a prepaid reservation, under credit cards, in the payment options section, it asks:

Why we ask for this?

(click above link) and a window opens with the following (note the last line)…

A credit/debit card is needed to hold your reservation; you will not be charged at the time of booking unless stated

If you have booked a rate that requires a deposit or prepayment, the deposit or prepayment will be charged to this credit/debit card

For rates that allow cancellation, you may be charged if you do not cancel in time (see specific rate rules)

You will be asked for your credit/debit card when you check in

No fee will be charged for using a credit card

Wow, that’s new. Glad to see that, but they make it hard to find. Thanks for sharing!

If this is the case, it would be interesting to see a class action suit against Marriott and the franchisee.

IANAL, but that language seems to create a contract, which would make the actions of that hotel a contract violation.

All this makes me that much happier that we nearly always use small independent hotels, and pay with the Barclay’s Arrival card and then take a credit with our points.

A friend asked me to stay at this hotel about 5 years ago. Very high cost with few benefits. Nothing felt special about the place to me. We had the window open during the day and returned around dinner to find the room cool so I turned up the thermostat. No heat came out so I called maintenance who told me that the hotel does not have heat. I know it is south Florida but for the cost of this hotel I could not believe that they didn’t have any heat. The room was 66F. We ended up turning on the shower and heating the room with steam. My opinion is you can stay for much less a few blocks away from the beach in a place with some real character.

So…how does the thermostat work if there’s no way to heat up the room? It’s for “cool down only”?

This is why God invented Hyatt.

. Great comment!

Been thinking about that as I wonder why I don’t have a Hyatt card in my wallet….. (and then wondering what this amex platinum status is really for?)

God didnt invent Hyatt. Ted Hyatt invented Hyatt

Uh, Hyatt was started by Hyatt Robert von Dehn and grown by Jay Pritzker. But nice try.

the disclosure issue the heart of the problem. The points are valid in the sense of “do I want to do business with them again” but to have you reserve and not know – and I assume by the time you arrive and have the first opportunity to see the info you are past the cancellation point, in which case they would – charge your credit card!! It’s slimy and it’s wrong but I’d key on the one indefensible point – disclosure.

Years ago I had a Budget rental of a pickup with a tonneau cover and I wanted more height on the opening so I disconnected the hydrualic bars that held the cover – bad idea – they whiplashed and scratched the vehicle. I reported this on return explaining my bad – they said no worries. Six months later I got a bill for the damage. I started up the chain each time being told I am responsible. I never denied that by contract any damage was on me (or my insurance if I so chose). I got nowhere until I got to the C suite and a staffer there and I agreed 1. You were responsible. 2. We waited to long to bring you the claim. 3. Case closed.

Doug – exactly. If you show up and see it in the lobby, you will have to pay a fee to cancel. They’ll charge the CC they required you to use for the reservation, then they might tack on the fee in addition to this 1 night penalty they’re charging. As someone commented below, he called the hotel today to ask about disclosure, and they said they will even charge this if you use a debit card that has Visa/MC branding on it, and there is no advance warning — just the sign in the lobby, according to the hotel. That’s unscrupulous, to say the least.

I agree “For a high-end property in a multi-national hotel chain to charge a credit card fee is beyond ridiculous.” But historically hasn’t it always been these type properties that charge every fee they can think of? It is precisely this type property I would expect this from.

You rarely see middle and lower tier properties try to nickel and dime you nearly as much.

A valid point.

Franchisers need a tighter grip on their franchisees. A 2% credit card fee is absolutely ridiculous. It’s as if Marriott is afraid of their franchisees.

Yes, that last part sums up my thoughts on the “we have to see what we can do” response. This company is operating under your name, and they’re creating negative publicity for your brand. Who’s the boss here?

Can you report to BBB? Seems deceptive business practice – forcing you to reserve with credit card then charging an extra fee to use credit card without advance and upfront notice. Agree with (some) of the commenters – thanks for highlighting this issue and trying to bring Marriott’s attention to it. Personally will not be staying at this hotel until they eliminate the fees.

Reports to BBB only do if any good if people actually check BBB comments before doing business with companies. Few ever do.

BBB does little to go after the companies (and really have no power) – especially if they are dues paying members.

Right. BBB isn’t an enforcement agency, really. It just keeps a log of complaints, which you and I can check before deciding to use a company’s services. So contacting BBB could potentially hurt a company’s reputation, enough complaints could hurt their credit, but not really. These days, a ton of bad reviews becomes more meaningful to a company.

Thanks for doing the deep dive on this. While the hotel comes out of this pretty much looking like scum, this shows me that Arne may be gone but his spirit of screwing over the customer lives on at Marriott.

… wait, people pay actual money for hotel stays? Maybe I’ve been doing it wrong

“people pay actual money for hotel stays”

I don’t recommend it!

I just got off the phone with the hotel and they are telling me it’s 1%. That being said, they DON’T take checks. Debit cards are still counted as a credit card. And the rep said the fee is even mentioned until you check out. Sheesh!! Now THAT’s what I call a scam.

So be prepared to bring a wad of cash if you want to avoid the fee.

hahaha this is laughable

Charge back , not enough time to discuss that with at all with customer no service. Cost them time and 25 usd minimum….

Exactly… chargeback!

Maybe show up with cases of rolled pennies? That would be a fun experiment.

Rolled? that seems silly. I’m sure you could simply fill few pillow cases with what $800 in pennies (depending on length of stay). Sure the bank gave them to you rolled, but what’s the harm in dumping all those rolls out, cash is cash right? $800 in pennies would weight between 440 and 505 Lbs depending on the mix of pennies as the weight varies by year. I’m sure they will learn that there is a cost to cash.

you are my new favorite commenter hahaha

i hear soaking them in transmission fluid prior to payment is a nice touch

I agree with you about full disclosure, but not your other complaints. Rising credit/debit card fees are hurting everyone – buyers and sellers – with the only exception being employees and shareholders of the banks and credit card networks. If this became a widespread practice it would put pressure on the credit card cartels to limit fee increases.

Consumers need to know what they are paying for and given an option to pay by other means if that will save them money.

Scott – if you are actively telling me I should get your credit card and use it at your hotel, then you tell me I will pay an extra fee for doing that, this doesn’t make sense.

Okay, you’re right about that part also. However, that’s just a marketing problem on Marriot’s part. The bigger issue, IMO, is the disclosure of credit card fees and I have no problem with businesses adding them to prices as long as they are disclosed. I actually think that’s a good thing.

Look at the end of the day Marriott ( its really Host International as the real Marriott’s are gone) is afraid to offend it’s franchise owners/operators for fear of losing them, it’s all about door count for equity capital pure and simple. There are so many properties flying the Marriott flag today that wouldn’t have a chance of a snow ball in hell if Bill or Willard were still running the show. This is just not Marriott ( Host International ) it’s all the other flags as well, get use to it. Bottom line don’t stay there as I do with some properties then as you did post on social media that will get to them more. I hate fee by the by. If we are booking a company function or multiple rooms for a project we condition our stay based on no “fees”

I think you efforts would be better served at finding a way to outlaw activity/destination fees at hotels. To me that is the biggest rip off. Charging for infrastructure that they have had always.

We’ve talked about that at length in numerous articles and podcast episodes. There are even whole groups and sites dedicated to it already.

Looks like they are getting a few 1 star reviews for this fee, I suspect it will be gone soon, properties need to protect their online rep. Out of curiosity I posted on Bonvoy’s Twitter page to see if they would answer my question about swipe fee’s, I linked your article, I doubt they respond, but who knows. I already prefer other hotels to Marriott anyway, but usually give them a few stays a year, One undisclosed at booking fee will be the last one though.

Jeff – their customer service team was unhelpful when I first asked them. The fact it’s gotten attention and traction might get a different reply.

It’s a HUGE problem. You go expecting to pay with a c.c. and find out when you get there that in order to avoid paying the fee I have to pay with cash? Where am I going to get $1,000 plus cash at the last minute/(I’m assuming a visa debit car still counts as a credit card)

The debt issue also needs clarifying. If my debit card says Visa or MC on it, they won’t clarify. I’m not willing to stay there and test it out.

I also pointed out the “where do I get a ton of cash at the last minute?” issue on the phone with the Marriott guy, and he didn’t have an answer.

The cynic in me says the hotel will put an ATM in the lobby, of course with a fee that they get to keep.

I will never stay there again because of this fee, and mainly because of their weird design of putting a window with wooden shutters in the bathroom that opens to the rest of the room. If you aren’t traveling solo, why would you want this, and if you are solo, why would you want this?

We stayed at a place that had a full-length window with blinds in the shower. I found it super strange. https://milestomemories.com/staycation-as-a-couple-just-what-we-needed/

I stayed here back when it was the Dana hotel. Corner room of all floor to celling windows and the trend continued with the shower. They had a shower curtain on the room side to block off the floor to ceiling glass wall in the shower.

https://exp.cdn-hotels.com/hotels/2000000/1890000/1880400/1880320/7b07f81e_z.jpg?impolicy=fcrop&w=1000&h=666&q=medium

https://www.yelp.com/biz_photos/dana-hotel-and-spa-chicago?select=4JJSYfwN6TXd44LL9QuX2Q

I would think it’s not an illegal fee, just a poor business decisison. The best thing we can do is speak with our feet and never stay at this hotel again, and have everyone post their feelings regarding their stay on Tripadvisor and Yelp

Correct, it’s not illegal.

Regarding legality…

http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&URL=0500-0599/0501/Sections/0501.0117.html

“A seller or lessor in a sales or lease transaction may not impose a surcharge on the buyer or lessee for electing to use a credit card in lieu of payment by cash, check, or similar means, if the seller or lessor accepts payment by credit card. A surcharge is any additional amount imposed at the time of a sale or lease transaction by the seller or lessor that increases the charge to the buyer or lessee for the privilege of using a credit card to make payment.”

Oh boy

Patrick – http://myfloridalegal.com/pages.nsf/Main/7D1661D57F5A4066852586020067FE78#:~:text=Florida%20has%20a%20law%20prohibiting,surcharge%20to%20credit%20card%20purchases it’s not enforceable due to federal court rulings

Thanks for the “update”

Yeah, a bummer. To be honest, it would be really on-brand for them to be violating a law and not know it.

But if the information on the website at as yes there will be no fee for using the REQUIRED CC, that’s an implied contract. And charging the fee a violation of that contract.

Yes, if the info says no fee and later they say yes fee, I wonder what they’d do when you show proof from the time of booking that you were told there would be no fee.

And its not that great of a hotel to begin with.

The hotel reduced the fee to 1% several weeks ago

https://viewfromthewing.com/this-resort-defied-marriott-continues-to-charge-guests-an-extra-fee-to-pay-by-credit-card/

Interesting!

Pennies. Lots and lots of pennies.

Here’s the thing….Marriott sucks as a hotel chain and Bonvoy is s trash loyalty program. Do yourself a favor and stay elsewhere.

Great article! I was looking into getting the Bonvyoy cc but that’s going to be on hold for now until they clear things up. I’ll apply for Hilton instead.

@Stephanie – others have posted there is nothing in FL law that prohibits this fee. Also there are numerous site specific surcharges, resort fees, add-ons for what would be considered basic service, etc at hotels. While it annoys people this isn’t that unique.

The agencies you mention likely would care or if they did it would simply be a report that doesn’t impact the hotel’s operations.

Pick your battles – this one just isn’t worth it. I won’t be staying there and you likely won’t either so end of discussion

Ryan – I know it annoys you but get over it – you won’t change anything. Also while I agree Marriott should be stricter on their franchisees in this case it is the franchisee, who may be a local small business, adding the fee. So the “profit” from this doesn’t go to Marriott. For you to act like they are the ones implementing the fee and profiting from it is wrong. I seriously doubt this addition fee causes the franchise fees paid to Marriott to go up.

I guess w limited travel bloggers have to obsess about something but it is time to move along!

With that type of attitude nothing will ever change with anything AC. But being pro corporation is your go to play so not unexpected.

At what point did I say Marriott implemented the fee?

I get that you always try as hard as possible to miss the point, but don’t claim I said something I didn’t say.

I see the post is dated May 26, 2021. Since then we’ve all read ThePointsGuy’s interview with the Marriott head. Does his dismissive and disdainful opinion of Marriott Bonvoy members and general guests surprise you at all? Does this affect your outlook on this credit card fee issue at all? Yes, I know this fee issue was “resolved favorably” this time, but, the corporate head’s input was, frankly, disgusting. I’ve been loyal to Marriott for years, then spent the last 5-6 with Hilton. I was just drifting back to Marriott this year and getting Platinum. But both of these issues leaves me feeling “what’s-the-use”….

Carlos – I actually haven’t read that interview yet. I’ve been intentionally avoiding reading other people’s opinions on it as much as possible, until I can read it. After that, I plan to write up some thoughts on it.

This is about the weakest post I’ve seen in quite some time. Plenty of things change with awareness.

How does that work anyway? A travel blogger posts about something travel related costing travelers more money UNFAIRLY and you tell the travel bloggers to essentially shut up?

What a joke.

Retired Gambler? That’s a euphemism for ImSoStupidIWentBroke lmao

its pretty easy for corp to fix this by amending their franchise agreement if its not already in there. They could even have it only apply to US based hotels. I would expect corp to want to maintain consistency across the brands and properties.

I would not stay and I would report it to the State Attorney General, local newspapers and a local news TV station that has a consumer report segment. I bet the fee doesn’t show up on Hotels.com,Booking.com, etc., in which case the hotel may be engaged in false advertising.

Thank you for doing such a detailed write up!

Well done Ryan