Marriott Credit Card Changes Are Surprisingly Good, Status Is Now Easier

Marriott credit card changes keep coming, and this is the first time it’s a good one. Marriott has made changes to the terms in their credit cards for personal and business cards. It’s now even easier to earn elite status with Marriott Bonvoy. Here’s a rundown on what’s happened.

Marriott Credit Card Changes In Terms

We first noticed this when people’s Marriott accounts showed more nights of stay credits than they should. I thought this was just an IT error. Maybe it was a glitch. Then, we noticed terms changed on credit cards. Look at the terms here for the Marriott Bonvoy Business American Express Card:

A maximum of 15 Elite Night Credits will be provided per Marriott Bonvoy Member Account, unless you have both a small business Marriott Bonvoy Card account and a consumer Marriott Bonvoy Card account; then, you may receive a combined maximum of 30 Elite Night Credits (15 per Card account). This benefit is not exclusive to Credit Cards offered by American Express.

The same terms are also listed in the terms of Marriott Bonvoy Brilliant American Express Card. It’s also important to note that the Chase Marriott Bonvoy Boundless credit card does not have these updated terms.

Previously, no matter how many Marriott credit cards you had, you could only earn 15 nights of credits. Now, you can earn 15 from a personal card AND 15 from a business card. That’s automatic Gold Elite status due to 30 nights credits from your credit cards. (Remember that you can also receive automatic Gold Elite status via other cards, like the Platinum Card and Business Platinum Card from American Express, though with much higher fees)

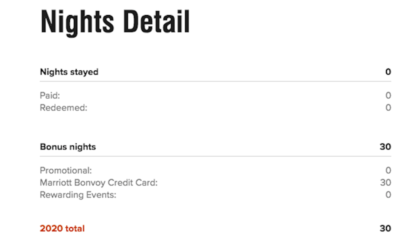

The new Marriott credit card changes to award 30 nights are showing in my account. They’re in my wife’s account, also. We both have the Chase Marriott Bonvoy Boundless credit card (personal) and Marriott Bonvoy Business American Express Card.

Earning Status With Marriott Now Easier

We’ve been on the Marriott rollercoaster for a while now. I mentioned planning to still chase Platinum Elite status for 2020. Then, Marriott announced it was cutting the 10 elite night credits from meetings & events, so status became more difficult to attain. I boldly predicted that Marriott’s negative changes would continue and that they’d reduce the credits you could earn from credit cards. Clearly, I was wrong. This change in terms from Marriott credit cards is very friendly to people in our hobby.

With 30 nights in your account already, Platinum Elite status is just 20 nights away. Given that award stays count, you could qualify without much spend (or spend at all). The other nice way to rack up nights is with the 5th night free after booking an award stay of 4 nights. Your award bookings from annual free night certificates via the credit card also count.

Final Thoughts

This is a very user-friendly change from Marriott. In fact, it surprises me. Love it or hate it, Marriott Bonvoy has a huge footprint but also has devalued its program a bunch of times. It took me 20 emails, 7 phone calls & 5 tweets to get them to fix my Platinum Elite status. Eric requested 40,000 Marriott points on the phone after straightening this out, and he got it. I asked for points and got an email offering me 5,000 points, which I told them was insulting. Their “final offer” was 20,000 points. Marriott seems to not understand customer service in the vast majority of my dealings with them. Surprisingly, they’ve made 1 positive change with the Marriott credit card terms.

Does this change anything for you? Will you pursue a status that you weren’t planning to pursue? Now that many of us have an additional 15 nights of credits with Marriott Bonvoy, I’ll have to re-discuss this with my wife. What are your new plans, if any?

[…] Take into account that you probably have a Marriott Bonvoy Credit score Card, these extra ENCs are on high of those awarded out of your Card. You may earn 15 from a personal card and 15 from a business card. […]

[…] Keep in mind that if you have a Marriott Bonvoy Credit Card, these additional ENCs are on top of the ones awarded from your Card. You can earn 15 from a personal card and 15 from a business card. […]

[…] Keep in mind that if you have a Marriott Bonvoy Credit Card, these additional ENCs are on top of the ones awarded from your Card. You can earn 15 from a personal card and 15 from a business card. […]

This is is great news!! Platinum is now within easy reach. I get 14 nights for my Westin Maui timeshare stay later this year. And a few free nights in London in the Summer (cross fingers). Plus, the free nights from the cards. That’s 51 with no extra effort.

Nice, sounds like you’re set!

Cancelled my Amex business Marriott card yesterday.

Have personal amex and chase marriott too.

Can I call back and say I want to keep the card reopen?♂️

Yes, most cards usually have a certain grace period. Amex should be 30 days.

I see it in my account and my wife’s account as well. I was thinking of cancelling the biz card since they raised the fee to $125, but this does get me to Gold so maybe I will hang on to it.

The most recent Marriott data breach exposed the data of 5.2 million guests. That’s a good reason to reconsider one’s loyalty to the chain.

To play devil’s advocate: even people who aren’t loyal to the brand were exposed if they’ve made bookings online previously.

Agreed! Even casual non-points gathering tourists should reconsider staying at a chain that puts their personal information at risk.

Fantastic…as long as they do not now increase nights needed for status.

That will be tomorrow. You now need 93 nights! 🙂

Got excited there for a moment then I read this comment and reality kicked in.

I have been bonvoyed too many times. I will stay there if it is clearly the best choice for me for THAT stay, but I will no longer chase status or Marriott. I have been a Marriott loyalist since 1997, but Hyatt is looking mighty nice right about now.

Fair. I definitely understand the feeling.