Capital One Threatened to Decrease My Credit Limit? Easy Fix

I got an app notification, email, and letter in the mail from Capital One all saying the same thing: they might decrease my credit limit. That matters a lot to me, so of course I took action. However, the fix was laughably easier than I thought. Here’s what happened.

What Capital One Said

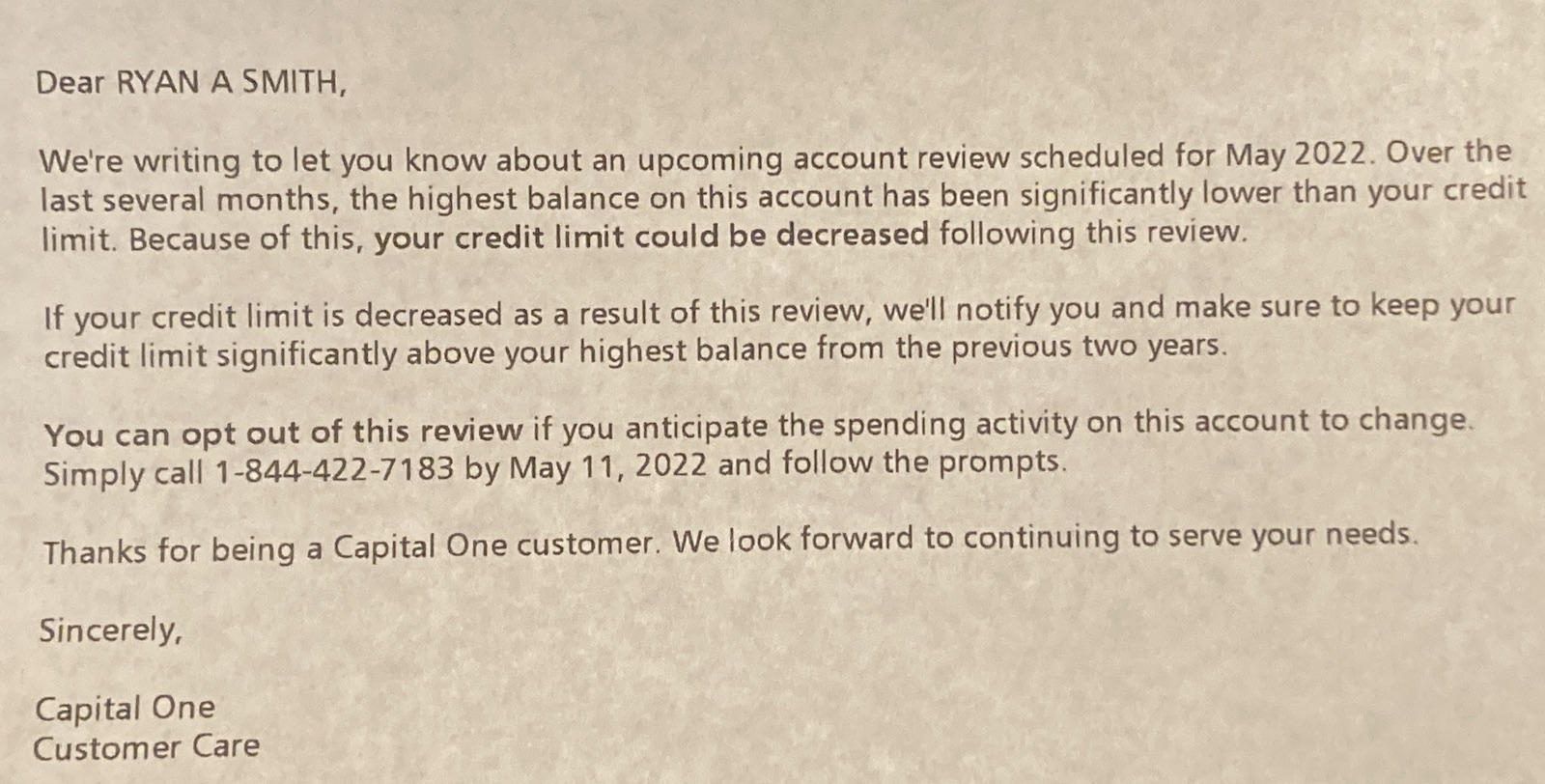

Capital One had no shortage of efforts to tell me about an impending review of my VentureOne card, stating that my spending has been far below the maximum credit limit on the card. Thus, I got an email, a notification in the Capital One app, and a letter in the mail saying that a review in May might lead to a decrease in my credit limit.

Granted, the credit limit on my card is $15,000, and I think the highest month of spending in the last 6 months is about $25. So, yes, I am not spending a lot on the card.

However, keeping a low utilization rate helps my credit score. Thus, I wanted to keep this limit where it was to keep my overall available credit as high as possible.

RELATED: How Your Credit Score is Calculated

Taking Action

The letter from Capital One stated that I could opt out of this review if I anticipated my spending habits changing. And if I wanted to opt out, I could call the phone number in the letter.

Of course I called. It asked me to input the last 4 numbers of the card I was calling about and the last 4 of my SSN. I expected to talk to someone after this. Nope! The call was over. That’s it.

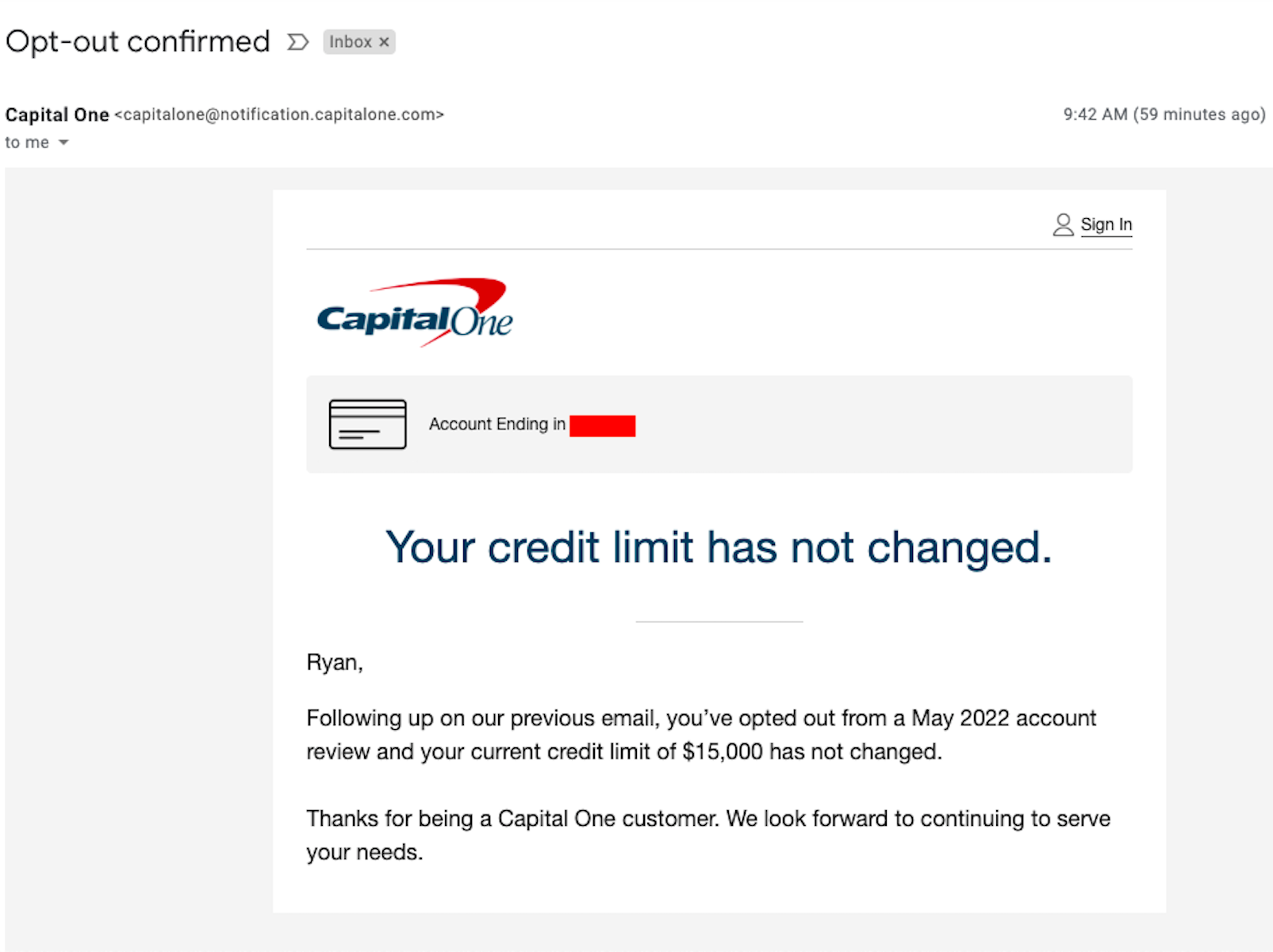

Confirmation saying that I opted out of the review came via email within a few minutes.

Of course, I will put some spend on the card. It’s not going to be up to the maximum, though. But I’m out of the review in May, didn’t have to talk to anyone, and now it looks like they won’t decrease the limit on my Capital One VentureOne card.

Final Thoughts

We’ve seen banks reducing credit limits on cards during the pandemic. And it’s true that banks will often close credit cards with no activity. I was surprised that Capital One told me about an impending review that might reduce my credit limit, that I could opt out of it, and that it took next-to-zero effort.

If you get one of these notifications, now you know what to expect with Capital One.

I received similar communication from Capital One. Unable to confirm the telephone number provided belongs to Capital One. Confirmed with Capital One they did not initiate any communication of this nature. This is a scam. Providing the last 4 digits of a social security number is dangerous. The area number (1st 3 digits) and Group number (4th & 5th digits) can be ascertained based on where you lived and when you applied for your social security card.

Cap one is one of the few lenders to ever decrease my CL. Of course that was back in the day when you could combine CL and I got my Venture up to 50k. Lol. Funny my wife has a 50 k CL on her NFCU Flagship card and has never gotten a CLR despite minimal spend on the card.

@Dom — Thanks, wasn’t aware Capital One were also approved with $10K and $20K limits. I figured it should be possible to lower the CL by calling Capital One but haven’t had a need to do so (yet).

@Ryan — What I mean is a credit card company that gives you a huge credit limit may “block out” room for another CC issuer to approve a new card (and extend more credit). For example, say someone has a decent income and credit rating/history that allows them to support total credit limits of $100K. Imagine that person already has 6 credit cards, each with a $10K credit limit … so a total credit line of $60K. Now, let’s say s/he applies and gets approved for a Capital One card and receives a credit line of (a whopping) $40K, for a new total credit line of $100K (now putting them at their maximum limit). Capital One’s super-generous credit limit could actually make it hard/er to apply for other/new credit cards as a result.

Can you show me any data points where a bank has denied a credit card application saying “you have too much credit with other banks”?

I am aware of banks doing this internally (“we don’t want to give you more credit”), but I think you are saying having a high credit limit at Cap One affects other banks. Can you provide any data points/evidence showing this happens?

best advice? i just started using capital one.

@Quo Vadis, Venture X cards were approved with a $10K, $20K or $30K credit limit.

If you wish to lower your credit limit, call C1 and tell them what you want your CL to be.

As best I can tell, everyone who is approved for Capital One’s Venture X card gets a $30,000 credit limit. I would be fine with (and even wish that) Capital One would cut that limit in half, as there is basically no scenario where I would ever charge more than $10K in a month.

A $30K limit is essentially that of two credit cards and makes it potentially more difficult to get approved for new credit cards (from Chase, Amex, or other card issuers).

I was confused by the part about having a $30k limit on a card with Capital One making it more difficult to get approved for a card with Chase, Amex, etc. What do you mean by this?

As a bank, I’m sure they have underwriting guidelines as to how much credit a person can afford total. Imagine if one card had 100K limit. Would the person’s income be able to cover that card plus additional cards?