Capital One Venture X Rewards Credit Card Review

Capital One announced the new Capital One Venture X Rewards credit card on November 4, 2021, and our detailed review will cover this new card in detail. We will look at the welcome offer (including its overall value), application rules on who is eligible for this card, and then the features of the card. This will help us arrive at the end: is this card a long-term keeper or not?

Welcome Offer

The current welcome offer for the launch of the Capital One Venture X is as follows:

- Earn 75,000 Bonus Points after spending $4,000 within the first three months from account opening.

- Annual fee of $395 is NOT waived the first year.

- Learn More

Welcome Offer Restrictions & Application Rules

Before moving further into our review of the Capital One Venture X, we should understand the rules for applying for and opening the card.

As a credit card issuer, Capital One tends to be sensitive to the number of new accounts and credit inquiries on your credit report. Thus, if you have applied for or opened a lot of accounts recently, you may be declined for credit cards with them.

Additionally, you can only hold 2 personal credit cards from Capital One at any time. Another restriction is that you can only earn a welcome offer once every 6 months. If you don’t meet these restrictions, you should hold off on your application until you do.

Since this is a new card, typical restrictions from banks like “you cannot earn this welcome offer if you previously…” will not apply to anyone. For a full breakdown on application rules from Capital One, read our analysis here.

If you believe you meet all of these application rules, then you should be eligible to apply for this card.

Earning Structure

The Capital One Venture X has the following earning structure:

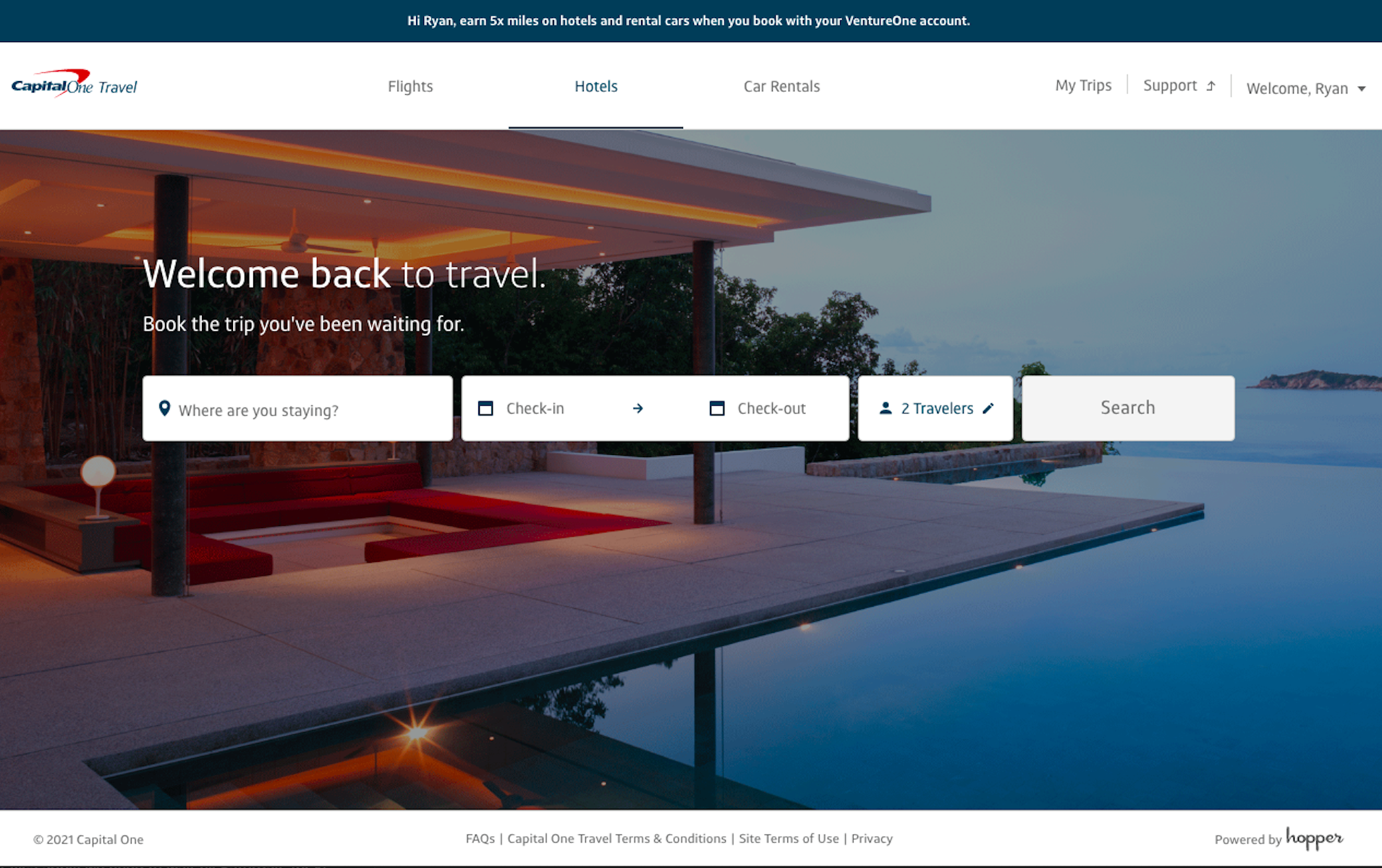

- 10X earning on hotels and rental cars booked with Capital One Travel

- 5X earning on flights booked with Capital One Travel

- 2X earning on all other purchases

- No limits on the total rewards you can earn, and your rewards never expire.

- Learn More

This card earns Capital One miles, which can transfer to 11 airline and 3 hotel programs. Most of these transfers are at a 1:1 ratio. The only programs that aren’t are EVA Infinity MileageLands (2:1.5 ratio) and Accor Live Limitless (2:1 ratio). Our full analysis of the program—including strengths and weaknesses—is here.

You can compare the earning on the Capital One Venture X to earning opportunities from other cards in our list of credit card bonus categories.

Cardmember Perks

The Capital One Venture X has the following perks:

- $300 in statement credits for bookings made on Capital One Travel

- 10,000 bonus miles every account anniversary (equal to $100 towards travel)

- Priority Pass membership that allows two guests

- Add up to 4 authorized user cards at no extra cost

- Authorized users get free Capital One lounge and Priority Pass entry and can bring up to two guests as well.

- Complimentary Hertz President’s Circle status for primary cardholders and authorized users.

- Up to $100 in statement credits for either TSA PreCheck or Global Entry

- Cell phone insurance, limited to $800 per claim and a maximum of two claims per year. There is a $50 deductible.

- Learn More

Annual Fee

The Capital One Venture X has a $395 annual fee, which is NOT waived. There is no fee for adding your first four authorized users, and those users also get access to Priority Pass memberships and Capital One lounges, plus cell phone coverage.

Welcome Offer Value – Minimum $750 (Net $355)

Capital One Venture miles can be redeemed at a minimum value of 1 center per point. This is the value when using them to erase travel purchases from your credit card statement.

If we use the value of 1 cent per point, then the welcome offer is worth $7500 (75,000 points x 1 cent each). Subtracting the annual fee that you will pay on the card ($395) leaves us with a net value of $355 from the welcome offer.

However, 1 cent per point is the bare minimum value you should receive with Capital One miles. In our analysis of the program (read here) and research into redemption values (read here), you can expect to achieve higher value. Depending on your redemption strategies and uses of your points, you can often receive 2 cents per point or higher value from your Capital One points. By transferring your points to travel partners (see our full list here), you can seriously increase the value of the welcome offer, probably doubling our conservative number of $355.

The welcome offer is comparable in number of points to other credit card offers we have seen recently from Chase and American Express. Moreover, we’ve seen 100,000 point offers from the Capital One Venture Rewards Credit Card, earning the same type of points in higher quantity for the same spending requirement.

Analysis of Perks

Now that we understand the basics of the Capital One Venture X Rewards credit card, we will review the perks and benefits to understand how much value (if any) they can add.

Priority Pass

Even though many cards offer this perk these days this may be one of the best options available. You get access to all of the lounges and restaurants plus you can bring in two guests. The fact that authorized users, which have no cost for up to 4 cards, get the same access and guesting privileges is what sets this card apart.

Capital One Lounges

At present, there’s only one Capital One lounge, located in Dallas-Fort Worth (DFW) airport. More are coming in 2022, but there are only two more set to be added so far. Only time will tell if this becomes a valuable perk or not.

TSA Pre-Check or Global Entry

This is a nice perk if you don’t have other cards with this feature or need to pay for another family member. We will assign this a $25 value, since you can’t personally use this perk every year.

$300 Annual Credit

Valid only on bookings in the Capital One Travel portal, that limitation can be off-putting. However, their portal has access to most flights and hotels you could want. There is the down side of not earning elite status perks with your hotel booking, but you will earn miles on flights, since these are treated as cash bookings. Full $300 value.

Hertz President’s Circle Status

This could be a very useful, and valuable, perk for anyone that rents cars often from Hertz. There may be some status matching opportunities because of it too.

Anniversary Bonus Miles

This is an interesting perk. The miles are valid only on redemptions through the Capital One Travel portal, which is powered by Hopper. That limitation is a bit disappointing. However, you can redeem them at fixed value (1 cent), which is good for cheap flights or when you find a great deal on travel. We’ll give this an $80 value, because of the steps required to use it.

Cell Phone Insurance

If you don’t have any of the other cards with this perk, then this is handy. Pay for your monthly cell phone bill with this card and get coverage for loss–up to $800 per claim and 2 claims per year. There’s a $50 deductible per claim. Putting a value on this is tough, because it’s worthless until you really need it.

Visa Infinite Perks

The Venture X is a Visa Infinite card, so it will also include perks like concierge service, trip delay coverage, and trip cancellation insurance.

Long Term Keep or Cancel

To consider the long-term value of the Capital One Venture X Rewards credit card, consider what value it will provide to you year over year. Are you paying a fee to keep a card that offers you nothing in return? Here’s our review of the “real cost” of keeping the Capital One Venture X in your wallet each year.

- Annual fee – $395

- Subtract the following that add value:

- $300 of value for travel credits

- $80 of value for anniversary bonus miles

- $25 of value for the TSA Pre-Check / Global Entry perk

At this point, without assigning any value to lounge access, Hertz status or phone insurance, the card has paid for itself. You’re now moving into positive value. That makes this card a long-term keeper for anyone who can use the perks and meshes well with the transfer partners.

Capital One Venture X Credit Card Review – Bottom Line

Bottom line on our Capital One Venture X Rewards credit card review: the perks should offset the annual fee, as long as you use them. Between annual travel credits, annual bonus points, and the insurance protections, the $395 annual fee should pay for itself.

While the welcome offer jumps out at you with a huge number of points available, the spending required to earn it is double what comparable cards require with other banks. The silver lining here is that you get six months to complete the spending requirements.

Regarding the anniversary miles:

“The miles are valid only on redemptions through the Capital One Travel portal, which is powered by Hopper.”

Is this actually true? I think MtM is the only outlet that I’ve seen report this.