Complete Guide To Capital One Miles, Transfers, Earning & Redeeming

This guide to Capital One miles and rewards will cover all aspects of the program. We will look at how to earn miles through Capital One rewards programs and credit cards, nuances of the program, and then how to redeem those miles in various ways.

A relative newcomer in transferrable points, Capital One has had options for cashing out your points at a fixed value for a long time. In late 2018, Capital One announced the ability to transfer miles to airline and hotel programs. Since then, the program has undergone numerous changes with uses of points, but the concept of the program and how to accumulate the miles has not changed.

With recent improvements to its program, Capital One miles are now on par with other transferable points currencies in many ways. The program deserves a fresh look, which we will cover in this guide.

Value of Capital One Miles / Rewards

The value of Capital One miles varies, based on how you redeem them. As there are numerous ways to redeem these rewards, the value can fluctuate. Logically, redeeming at the highest value possible should be the end goal for most people.

The purpose of this guide to explore the entirety of the Capital One miles and rewards program, highlighting how your points can be redeemed and the typical values involved.

The absolute minimum value you should get for Capital One rewards is 1 cent each, since you can redeem them at 1 cent for gift cards, statement credits on travel purchases, and travel purchases within the rewards portal. There is also the option to cash out your points, but this provides a value of only 0.5 cents per point, so avoid this option.

If you have a card that earns cash back and a card that earns miles, you can combine the cash back into your miles (but not the other way around). This gives you increased earning opportunities plus increased redemption options

Capital One Credit Cards

You can compare all Capital One credit cards and current welcome offers here.

Credit Cards That Earn Miles

- Capital One Venture X

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Spark Miles for Business

- Capital One Spark Miles Select for Business

Cards That Earn Cash Back (Which You Can Combine With Miles)

- Capital One Savor Rewards Credit Card

- Capital One SavorOne Rewards Credit Card

- Capital One Quicksilver Rewards Credit Card

- Capital One QuicksilverOne Rewards Credit Card

- Capital One Spark Cash Plus for Business

- Capital One Spark Cash Select for Business

Ways to Earn Capital One Miles

- Credit card welcome offers

- Credit card spending – including in bonus categories

- Promotional offers

- Referral bonuses

- Retention offers

Welcome Offers

The best way to earn a big chunk of points and miles is through card welcome offers. After understanding the application rules, you can apply for various credit cards with Capital One when eligible. Meeting the spending requirements to earn the new card bonus is the best way to earn a lump of points and miles from Capital One. You can do this across each different credit card that they offer.

You may see targeted offers that are better than what’s available to the public. These can come via the website, in the mail, or in your email. We alert our readers whenever we come across improved offers on credit cards.

Credit Card Spend

Another way to earn points is through credit card spend. Many Capital One cards cards earn 1.5x or 2x on nearly everything. However, there are categories where you earn at higher rates. Check our list here.

Promotional Offers

We cover these whenever we hear of them. There are promotions to earn points at increased rates, and you can see some of the past offers to get an idea of what to expect.

Referral Bonuses

If you have a Capital One credit card, you can refer others to get that card. Sign in to your account here to see available bonuses available to you for referring others who apply for & are approved for the card using your referral.

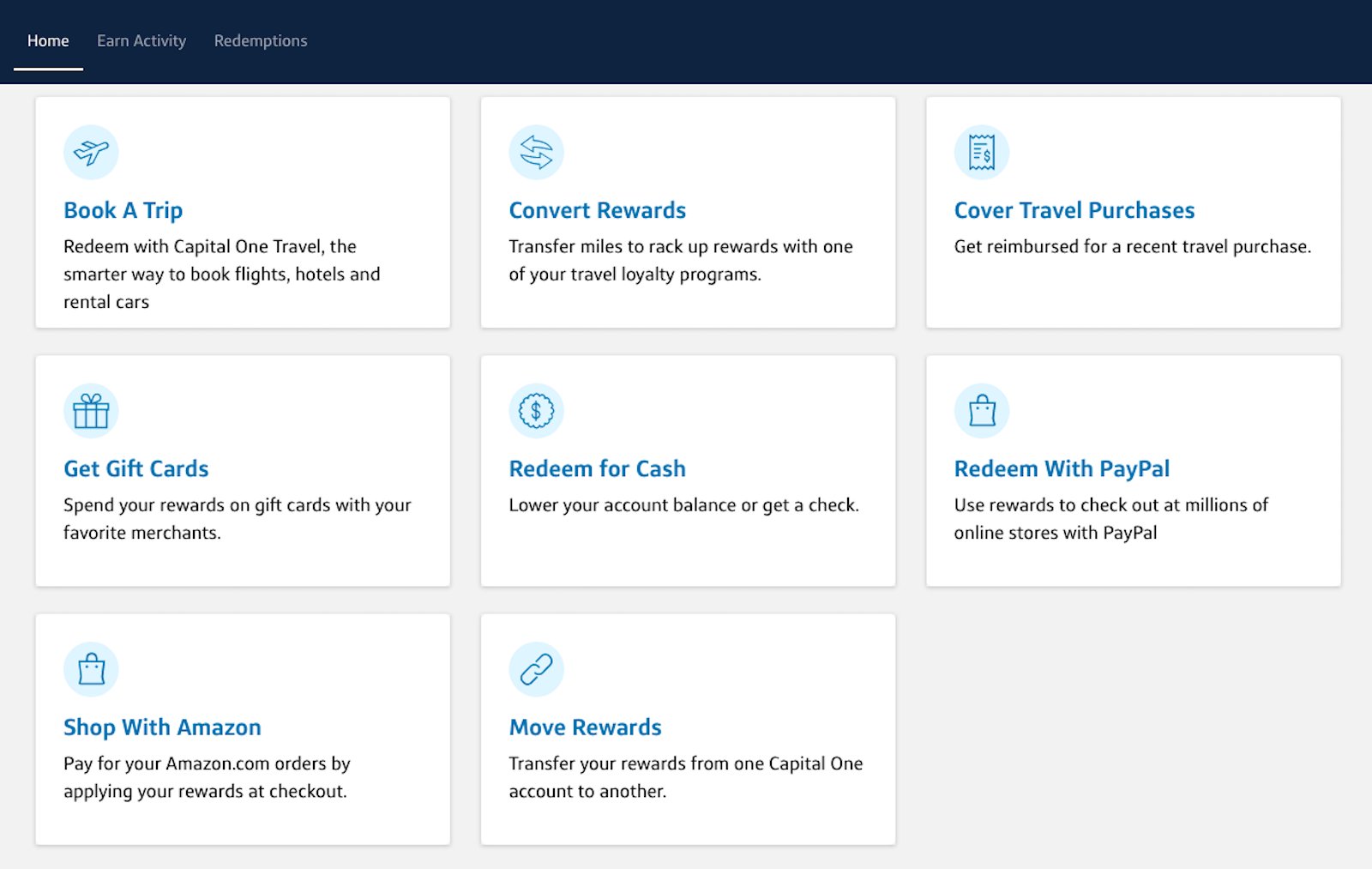

Redeeming Capital One Miles

- Transfer partners

- Book through travel portal

- Purchase eraser for past purchases

- Statement credit

- Redeem for gift cards

- Redeem on Amazon

Transfer Partners

Typically the most valuable Capital One miles redemption option, we’ll cover this first in our guide. From 2018 to present, Capital One has added, removed, and changed its transfer partner options several times. At present, you can transfer your miles to the following loyalty programs:

Airlines

- Aeromexico Club Premier

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- Avianca LifeMiles

- Cathay Pacific Asia Miles

- Emirates Skywards

- Etihad Guest

- EVA Infinity MileageLands

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

Hotels

- Accor Live Limitless

- Choice Privileges – starting in late 2021

- Wyndham Rewards

Programs in bold indicate that these are unique partners. You cannot transfer points & miles from any other points program to these hotel & airline programs.

Points will transfer from Capital One to these programs at a 1 to 1 ratio (1,000 Capital One miles becomes 1,000 miles in your Etihad Guest account, for example). There are 2 exceptions to this: transfers to EVA Infinity MileageLands are at a 2:1.5 ratio, and transfers to Accor Live Limitless are 2:1.

How to Transfer

Transferring miles is pretty simple. When you log in, click on your miles balance. The options for redemptions will appear on the next page. Choose the program you want to use, enter your loyalty number with that program, and then you can complete the transfer.

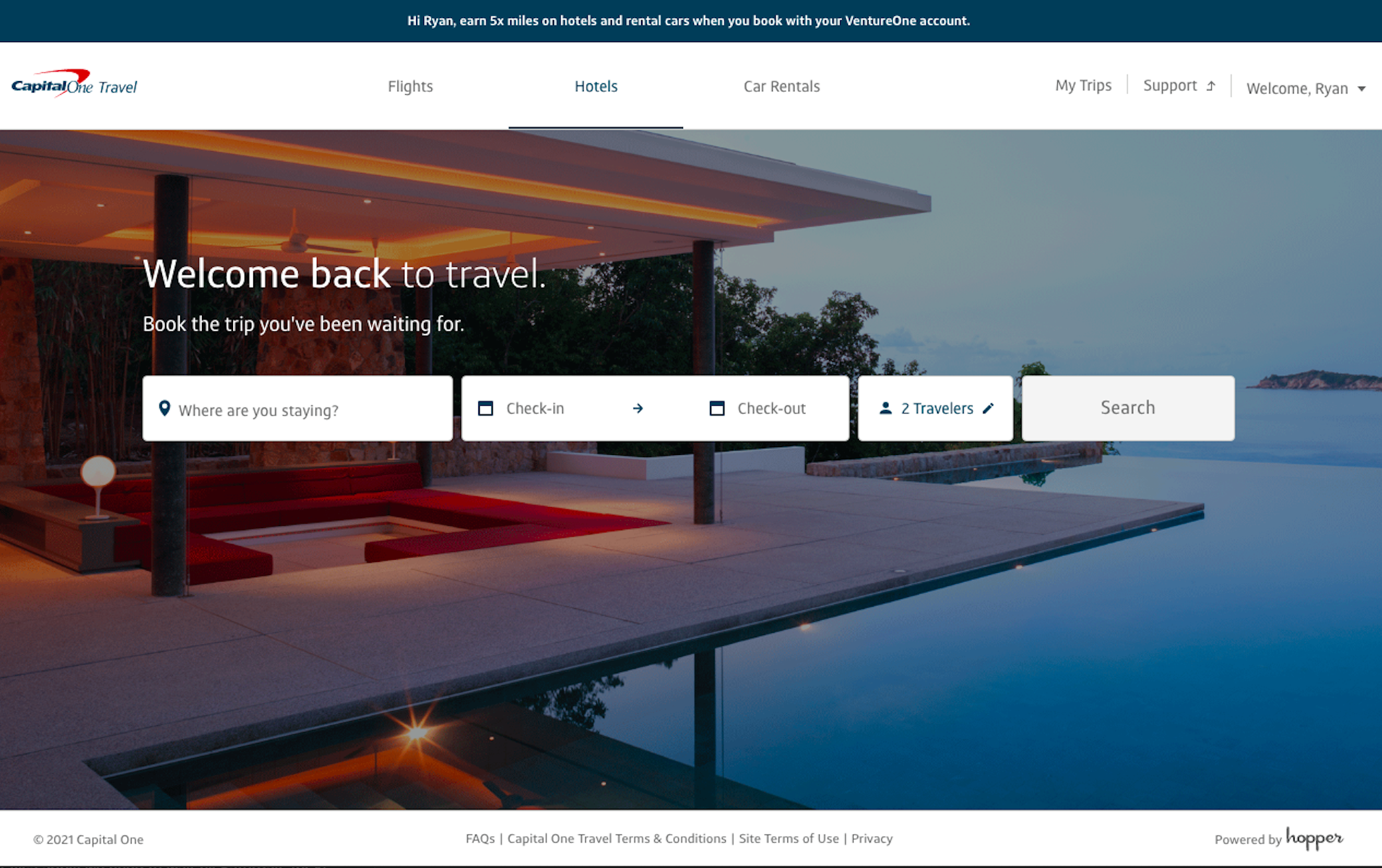

Book Travel

You can redeem your Capital One miles for new travel through their travel portal here. There are a few things to consider before doing this.

If you find a great price on a hotel or flight, redeeming your miles at a fixed value (1 cent per point) can be a smart move. However, paying cash in this portal can earn 5x, so balance the pros and cons here.

Additionally, if you book through a different travel website, you can typically earn extra rewards not only from your credit card but also from using shopping portals. You may come out ahead, so make sure to do the math before finalizing purchases. Read more about how to use shopping portals for extra earnings with online purchases.

Purchase Eraser For Past Purchases

Probably the redemption option that Capital One is most famous for, you can apply your miles and rewards against travel purchases you’ve already made. Thus, you can “erase” them from your bill. These are fixed-value redemptions, where your miles are always worth 1 cent each.

There’s no minimum redemption amount to use your miles this way. You can only apply your miles to purchases within the last 90 days. You can redeem for purchases made with airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents and timeshares.

Statement Credit

Unlike other redemption options, simply cashing out your miles is worth only 0.5 cents per point. This is not a good use of points.

Redeem For Gift Cards

You can redeem your Capital One miles for gift cards, so it’s worth mentioning in this guide. Points are worth 1 cent each when redeemed this way, except for Amazon gift cards (0.8 cents per point on these redemptions).

However, this is not the best use of your Capital One rewards. Why? You can typically buy discounted gift cards in other places (Gift Card Mall, Raise, etc.). Additionally, you can buy gift cards with cards that will earn significantly more rewards, depending on which card you use and where you buy. Think long and hard before redeeming your rewards for gift cards.

Redeem On Amazon

You can redeem your points for 1 cent each on Amazon.com after linking your card. The best way to maximize this redemption, though, is watching for promotions. Sometimes, you can get $10 or $20 off or similar discounts by using even just one point at check out. See some examples here.

Final Thoughts

When it first launched, Capital One’s transfer partner options were not great and not truly worth a guide the likes of which we have for Chase Ultimate Rewards, American Express Membership Rewards, and Citi ThankYou Points. However, now that nearly all of Capital One’s transfer partners are at 1:1 ratios and their list of partners has improved, the program deserves a fresh look.

Capital One miles are approaching equal footing with the more traditional transferrable currencies. You can earn miles in a variety of ways, such as credit card welcome offers, referral bonuses, and spending bonuses. Additionally, the fact that you can combine cash back from cards that earn this into your miles balance from cards that earn miles provides further opportunities for maximizing earnings and redemption options.

We now have numerous ways to earn and redeem Capital One miles, which we have outlined in this guide. Redemption partners are improving, as are the transfer ratios. As the earning and redemption options in this guide show, Capital One miles are much more valuable now than when they first launched three years ago.

Aeromexico Club Premier is not unique to Capital One. Amex MR also transfers to Club Premier, and at a 1000:1600 ratio vs. Capital One’s 1000:100 ratio. Granted, that’s to “correct for” Aeromexico’s earn/burn being done in kilometers, not miles. Even with the Amex MR transfer ratio, you’ll seldom find good use cases for Aeromexico vs. just using Delta/AirFrance miles.

Eeeesh, thanks for catching that. Not sure why it was in bold, since I know Amex transfers to AM. Thanks for letting me know!