Chase Credit Cards

I’ve asked myself the above question here and there over the years. I generally end up shrugging, knowing that I can still accomplish worthy goals with Chase credit cards regardless of how lame the bank is. But occasionally, I feel it’s worth reminding myself, and you, dear reader, about certain points and travel hobby pitfalls. Today is one such day, and once again, Chase deservedly draws my ire.

Obfuscation Continues

Chase routinely obscures the rewards picture for cardholders. Sometimes that’s obvious over time, such as with the Chase Sapphire Reserve (more on that in a bit). Elsewhere, Chase has made smaller-but-still-annoying changes.

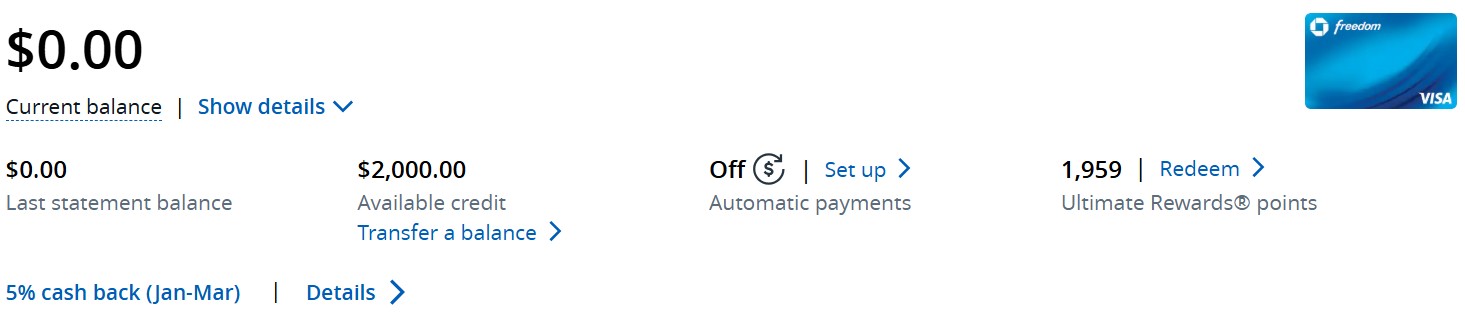

In my view, Chase’s website isn’t any better than it previously was. Rather, it’s become more unhelpful. For instance, I recall years of being able to fairly-quickly discern if I had activated my Freedom cards’ quarterly 5%/5x categories. After logging into the Chase site and clicking on a given Freedom card, I could quickly see the word “Activated” and know I was good to go for the existing quarter. Now, look how Chase unhelpfully updated the site:

Chase has removed “Activated” and replaced it “Details.” This requires two additional clicks – one on Details, the next on the particular card I want to review – and scrolling to see whether the Freedom activation occurred. Oddly, I don’t need to scroll to see the status on my Freedom Flex accounts. Apparently, things need to look considerably different on the “regular” Freedom and Freedom Flex pages. But hey, while that bothers me, it might not annoy you. Try this next one.

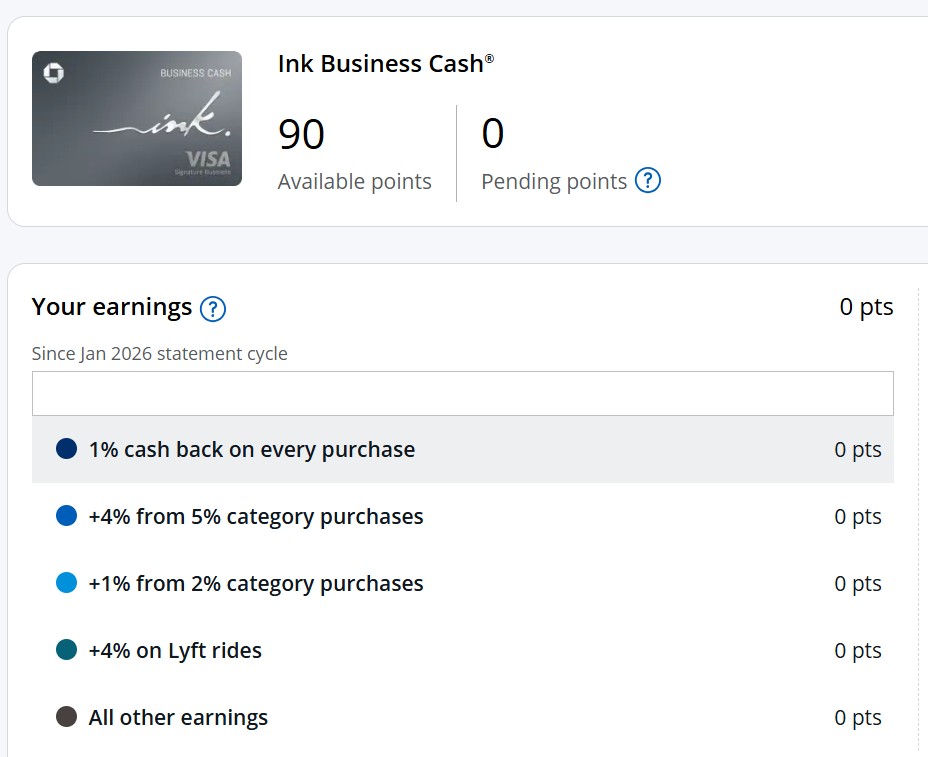

As you may or may not know by now, determining one’s Chase Ink Business Cash 5%/5x spending status is harder (or impossible) to identify online. Previously, the timeframe displayed would start at the beginning of the current cardmember year period. Now, it looks like this:

This info is essentially no help for 5%/5x purposes since it only covers the period since the beginning of the calendar year. Those not paying close attention may think they have fresh capacity for those categories, while in reality they spent in them during the previous calendar year/within the same cardmember year. At best, this isn’t a thoughtful update by Chase. At worst, it looks like the bank’s encouraging cardholder mistakes. Of course, other methods can be used to determine your 5%/5x status, such as reviewing statements or calling in to confirm your cardmember year. Regardless, it’s not as easy as it used to be.

Less of a Good Thing

Chase Freedom

The Chase Freedom and Freedom Flex have provided a relatively simple option for obtaining 5%/5x in categories rotating every quarter, up to $1,500 in spend. Such options have generally included staple categories and others which are still fairly broad and reasonable. But it seems like Chase is increasingly hemming us in.

- 2025 Q1: Grocery stores (excluding Walmart/Target), fitness clubs/gym memberships, hair/nails/spa services, and Norwegian Cruise Line, Tax Preparation/Insurance (Mar only)

- 2025 Q2: Amazon, select streaming services, and internet/cable/phone services (Jun only)

- 2025 Q3: Gas/EV, Live Entertainment, and Instacart

- 2025 Q4: Chase Travel, Department Stores, Old Navy, and PayPal (Dec only)

- 2026 Q1: Dining, Norwegian Cruise Line, American Heart Association

In my view, these categories are tougher to responsibly earn in. Significantly spending in these categories increasingly involves expenses incompatible with the way many of us normally live. Now, I’ll move to the redemption side.

Chase Sapphire Reserve Pay Yourself Back

Chase Pay Yourself Back debuted in spring 2020, and I was a big fan for many years until recently. I could effectively cash out Ultimate Rewards points at 1.5 cents or 1.25 cents per point when I was previously doing so at 1 cpp. Chase has limited 1.5 cpp max value to mostly 1.25 these days. The categories have tightened up over time, also. In the current quarter, cardholders can redeem in the following three categories at 1.25 cpp, the fourth at 1.5 cpp:

- Gas stations

- Fitness Clubs/Gym Memberships

- Annual Fee

- Select Charities

Theoretically, someone can more significantly redeem at gas stations by purchasing gift cards and applying points via Pay Yourself Back. But of course, many cardholders aren’t necessarily comfortable with such purchases. And historically, I’m accustomed to seeing broader categories here, as well. Other Chase credit cards participate in Pay Yourself Back, but the Sapphire Reserve has generally had the best categories. Sadly, I expect they will keep getting worse for the Reserve.

Chase Band-Aids a Compound Fracture

Early on in the latest round of premium card refreshes, I felt Chase had already won in the court of public opinion. But Amex came back in a big way, essentially how I’d hoped. Meanwhile, Chase Sapphire Reserve negatives became more prominent. It seems that Chase designed the card to discourage people dumping it, but it apparently had the opposite effect for some. That was definitely the case for me. I also pondered if Chase was sweating the Sapphire Reserve. Elevated card welcome offers appeared and lasted longer than I expected. The bank added a temporary travel credit that I perceived as a Band-Aid to the card’s bigger problems.

We’ll see where things go from here, but I’m even less inclined to return to the Reserve now than I was before.

The Obvious One

What hangs over everything is that Chase still employs what I consider the most draconian of all credit card application rules – 5/24. This rule is why my wife and I gave up on ever obtaining more Chase credit cards via new application. Beyond our existing Chase portfolio, we assessed that we could obviously do better taking our business elsewhere. So many other individuals have come to the same conclusion, but this rule is continuing to work on others. I occasionally speak with individuals who are avoiding cards with other banks because they are waiting to hopefully pick up another Chase product. If they haven’t done so already, I encourage them to consider if waiting around for more Chase cards is the best personal decision.

Chase has essentially outsourced some of their marketing to cardholders, and even non-customers just hoping to get one someday. While that may be diabolically genius, I also find it uncool.

Chase Credit Cards – Conclusion

Again, I’ll keep finding the wins where I can with Chase, but they seem fewer and farther between these days. Regardless, it’s taking customers more work to do so, which I expect Chase wants. Those wins will take a relatively-limited amount of my time, though. I’ll continue to focus my efforts more on Amex and elsewhere, as I’ve done for years. All those other banks not named Chase have won the war for my attention span long ago. Maybe they should for yours, too.

What annoys you most about Chase these days?