Chase Credit Cards After Bankruptcy

I write often about the negative effects of debt and how I believe people should take it slow. Debt creeps up pretty easy and sometimes life gets in the way as well. For some people, bankruptcy is inevitable.

Fortunately, for people who have worked to rebuild their credit after bankruptcy, there is still a possibility of getting premium rewards cards to earn free or discounted travel. Today I am going to talk about applying and getting credit cards from Chase with a bankruptcy on your credit.

How Long Does A Bankruptcy Stay On Your Credit Report

There are two main types of bankruptcies that consumers can file in the United States. Chapter 7 wipes away debt completely, while Chapter 13 requires the repayment of a portion of debts. They stay on your credit report as follows:

- Chapter 7 bankruptcies remain on your credit report for 10 years after filing.

- Chapter 13 bankruptcies remain on your credit report for 7 years after filing.

As you can see, bankruptcies stick around a lot longer than financial problems in many cases. Some people have 8 or 9 years of fantastic credit, but still get denied because of an almost decade old bankruptcy.

Fortunately there is some hope, but don’t expect to get premium rewards cards one or two years after emerging from bankruptcy. It takes time to reestablish yourself, but not quite as much time as the bankruptcy lingers.

The Chase Credit Card Application

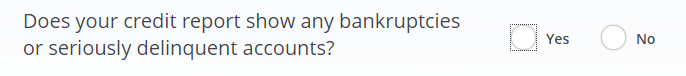

Chase is the only bank that I am aware of who asks you point blank on the application whether you have a bankruptcy on your credit report. If you answer “yes” to this question, then you will receive an automatic denial without them even running your credit.

While it may seem counterintuitive, the correct answer to this question is “NO”. By answering no, you are ensuring that they will run your credit. Unfortunately, as soon as the system sees the bankruptcy, you will automatically be denied. (The application may go in process, but I know several people who have been in this situation and the application is always automatically denied because of the bankruptcy.)

Which Cards to Apply For?

Some Chase cards are more difficult to get than others. For example, business credit cards are generally much tougher to get, so I wouldn’t recommend applying for one if you have no other relationship with Chase.

The two big personal cards are the Sapphire Preferred and Freedom. Both require decent credit, although the Freedom’s requirements are much lower. Which card you apply for is going to be a personal decision based on your situation.

I highly recommend doing research before applying. One good resource for finding out requirements is the myFICO forum. While I can’t assess your chances of success since everyone’s situation is different, I can say it is possible to get any Chase card with a bankruptcy on your credit. Other factors combined with the bankruptcy may stop it, but not the bankruptcy alone.

Chase Reconsideration

Fortunately Chase has a pretty good reconsideration department who is empowered to assess your application based on its merits. If you have established many years of good credit history after a bankruptcy, they may want you as a customer. Don’t be discouraged.

Chase reconsideration numbers can often be hard to find, but this Flyertalk thread usually has up to date information. While you certainly can wait before calling, it doesn’t hurt to call immediately after submitting the application.

Reconsideration Strategies

I have found that Chase reconsideration representatives are among the friendliest around. They always seem helpful and genuinenly willing to help. I suggest starting the call by informing them that you are checking on your application status.

Normally they will look up the application and inform you that it has been denied because of a previous bankruptcy. At that point ask if the application can be reconsidered. They should say “yes” and then begin asking you a few questions.

During the reconsideration process be prepared to share the reason for your bankruptcy. While I always feel it is important to tell the truth, make sure you emphasize the positives of your situation and try to downplay the negatives.

One of the best things you can do is remind them over and over of all the good credit you have established since the bankruptcy. They have your credit report in front of them, so mention specifics. Showing you are knowledgable about your own credit can go a long way.

Finally, emphasize how you want to begin a relationship with their bank. It may not hurt to mention that you aren’t looking for a large credit line either, but rather a chance to prove yourself. In the end, if you have decent credit, are polite on the phone and properly make your case, you should be approved.

Conclusion

Chase does seem to have a policy at the application level of automatically denying applicants who have a bankruptcy on their credit report. Fortunately, they also have an empowered reconsideration team who is friendly and helpful.

If you are someone who has spent years with some of the less attractive credit cards out there and want to step up to some of the premium rewards cards, it may be possible. It is definitely a long road back from bankruptcy, but it doesn’t have to be quite as long as you think.

I have repeatedly been told no by Chase, years after the bankruptcy came off my credit report. I have an excellent credit rating, over 800, several credit cards at other major banks, one was even included in my bankruptcy, paid off two car loans, paying on one now, a business checking and savings, and a personal checking and saving account, and an investment account with Merrill Edge. I am not going to beg Chase for a credit card. If they can’t see what other lenders see, they are the ones missing out. It frankly baffles me.

Same situation here! Chase expects applicants to beg for their credit card after they, themselves were bailed out. With Credit scores in the 700 and 800s, I’m unsure who they think they are. I have an open credit line of 60K with Citi, AX, Synchrony, and others. Chase wants to be stand-alone and hold us to a higher grade. Who really needs them? Many cards can match what they offer and you usually can’t find a branch in the northeast if your life depended on it.

I filed a chapter 7 bankruptcy in October of 2012. This week, August of 2022, it was removed from the credit monitoring bureaus. On my Chase credit monitoring my score went up 63 points to 815. Since it has been removed will I now have any chance for a credit card approval by Chase?

Has anyone been able to get approved with chase after including them in the actual bankruptcy ?

Your question was answered in a comment down below placed on December 12, 2016.

In other words, I’m f*cked to say the least.

I was just approved for a United card after being denied, 2 BKs 6yr6mo old and 6yr3mo old, no other negatives and 750s, took about 2 minutes of actual dialogue and about 15 minutes on hold for which the phone rep profusely apologized for.

If you use the new Everett, WA airport which at this point is only served by United and Alaska, with United having the best flights to SFO this card is virtually a requirement.

I was just denied a reconsideration with Chase with a 773 credit score and 5 years, 5 months out to Chapter 7 with a high household income. No derogatory marks on my credit, only public record showing the BK filing in 2012. Chase told me they only consider UNSECURED tradelines and that you need to have around 5 years of good established unsecured debt since the date of the BK. They do not look at the student loans and told me they do not when I asked, even though I had 7 years of perfect payments and zero balance. They do not look at car payments, even though my 2014 loan is almost paid off without any defaults. They only care about credit cards other than Chase (I only have 2.5 years of my two high limit Capital One cards in this category) and if you had them discharged in your Bankruptcy (which I did), it is a red light. I asked them if I could be considered for a small credit line to prove myself again, she said she couldn’t do it now. I asked would they consider a new application in 2022 when my BK falls off of my report even though I had them included in my BK; she said she honestly did not know. The representative was very polite and I enjoyed a nice conversation with the lady who seemed genuinely sorry for not being able to approve it. Do not waste the inquiry on your credit report like I did if you fall outside their guidelines. I had zero inquires the past few years and now I have one that I wince at because I did not know they only look at unsecured and that 2.5 years wasn’t enough, alone. This is the only time I have been denied any credit since my bankruptcy.

Your situation most resembles mine, being 4 yrs out of my BK today. Any updates today? Have you gotten back into any premium cards?

Hello, so my bankruptcy has been nearly 20 years ago. I did have a very small amount less than $500 I believe with Chase. Anyway I did apply for a credit card with Chase approximately four years ago maybe five years ago.

At that time my bankruptcy was 15 years past. They denied me I asked why they said because of my bankruptcy.

So I asked when will you give me one and they replied never. I thought that was really a horrible thing to say I have not reapplied at this time my Fico score is close to 800 at this time.

I have no negative credit and have not had such cents in the last 20 years. I paid off over $30,000 in credit cards approximately one year ago.

So I’m wondering if they do that again is there someone that I can report them to I mean I guess they have the right to do that, but I really don’t think that is fair especially since I’ve been banking with them for more than 20 years as well.

Chase bans you from their cards if you have a chase card discharged in bankruptcy.

Can someone provide the number to be reconsidered please.

Thanks

Here is a link with numbers. Good luck!

http://www.flyertalk.com/forum/credit-card-programs/1390839-multi-bank-guide-reconsideration-phone-numbers.html?utm_source=Frequent+Miler+Free+Trips+and+Tricks&utm_campaign=01289cf1b5-Week_2_planning_your_first_churn4_18_2012&utm_medium=email&utm_term=0_952ab88f70-01289cf1b5-66502581

I had a BK in 2012 have had perfect credit prior and after and today got approved for a $5,000 limit with the Chase Southwest card after calling the reconsideration line. The person was extremely nice and pleasant to talk with. I remained absolutely polite and ended the call in success

Unfortunately, the first time i called – I recieved the standard bankruptcy line and that I would be getting a letter. Very short and abrupt conversation. I got off the phone feeling really silly and defeated.

I was going to let that be the end of it, but then resolved to try again.

I just got off the phone with Chase after calling a second time – I told the representative I had already called, but didn’t do the best job making a case for myself.

It took a while, but at the end I was approved for a Freedom Unlimited card with a 5k limit.

The second person I spoke to was fantastic – I honestly hope I get a survey or I may call back to give her kudos.

I have some banking “in my blood”, and listening to her questions made me think back to being a personal banker… you need to think like an underwriter.

Generally speaking – to approve an application outside of policy, you have to address all the items “failed” to support your override decision.

Be prepared to talk about (in brief) the reasons for bankruptcy, a few credit accomplishments since then. Mention how long you have been on your job (or same field), time at your residence, education you have completed since and your desire to strengthen your credit and begin or add to your existing banking relationship.

At the end she remarked that she was glad I called back to give them another chance to review the application in further detail. Until today, i didn’t think exception approvals were part of the big bank mentality anymore. I’m glad to find out I was wrong.

Great article!

Shawn,

Thank you for the excellent advice. I’m a very regular Amazon shopper with Prime Membership because we live in a somewhat rural area of NY, and it’s easier to order online than it is to drive to a store. I’ve been wanting to apply for the Amazon Visa by Chase but have been hesitant because of the Ch. 7 BK on my report since 2009 and Chase’s notorious record of BK denials. After reading your article and the various replies, I decided to bite the bullet and apply. Per your advice, I selected “NO” when asked if there was a BK on my report, and as expected, I got the screen that said my application will be reviewed further and they will contact me with their decision. I immediately jumped on the phone with a reconsideration agent who was very friendly. He explained that I was declined because of the BK and because the BK included a Chase product (oh no!), but he said that since my BK was almost 8 years ago and my credit score was 712, he would reconsider my application. He asked me a few questions about income, current credit usage, employment and reason for BK. When he asked how much credit I was applying for, I took your advice and told him I’d be happy with any credit limit, as I was more interested in building a good relationship with Chase. After waiting on hold for five minutes while he reconsidered my application, he came back and told me I was approved for $3,000!! On top of that, Amazon instantly applied a $70 gift card to my Amazon account as a welcome gift for signing up for their Visa card. Before I got off the phone, the Chase rep reminded me that should I ever run into this initial denial again, I should always call the Reconsideration Department, as it’s my right and they strongly encourage people to exercise this right so Chase can evaluate each denial on a individual basis and identify extenuating circumstances that might allow for approvals. Because of your article and this message board, I’m very excited to begin earning 3% cash back on all of our Amazon purchases moving forward. Thank you and I hope my comments encourage others to follow your advice.

Matt

Congratulations Matt! I’m really glad this post helped.

Congratulations!

Shawn,

Thank you so much for your advice. You are a genius. I am going to Disney World in a few weeks. I wanted to use the Chase Disney for the $200.00 Cash Back as well as discounts up to 30%.

I had a BK back in 2009. I was a victim of the Housing Crash where I owned investment properties that went bust. My credit score is now 720. I make 125K, and have not missed any payments since my BK.

I applied online . For some reason on the Disney site they didn’t ask me if I had a BK. A few days later I was declined. ( I was expecting it as I read your blog the day I applied).

I called the reconsideration line. I spoke with a very nice women. Told her how awesome the card was and that I was taking my kids to Disney and wanted to buy them presents with the card. ( All True) . She looked at my present situation and asked about the BK. I explained it , ( All True) .

It also helped that I have a Sapphire Card ( under my wife ) that I used to purchase the airfare and use it for all my spending . I pay it off every month.

Three minutes later she told me I was approved for 5K. Not bad. …… I only want to use it for this trip.

Great advice and Thanks

Congratulations and enjoy Disney!

[…] only has this reader defied the logic that it is impossible to get a Chase card with a bankruptcy (something I have written about), but he has three of their Ultimate Rewards earning cards and more importantly he found a way to […]

Just got approved for a Chase Sapphire Preferred after calling the reconsideration number listed on the Flyer Talk thread. I applied for the card and as expected got the notice where it says they will have to look it over and get back to me (Instant denial because of BK 8 years ago). I called the number and told them I just got declined but I think it is because of the BK 8 years ago. They were very nice on the phone and looked over everything and saw the BK but also saw that I’ve drastically improved my credit situation. I was put on hold after a verification and then they said I was approved. A welcome kit will come in the mail in a couple weeks too. Not sure what that’s about though but I’m stoked! Thanks for suggestion in call them back.

Congratulations! Yes Chase is a bit tough on bankruptcies, but once you get a human to actually look at your credit, there is definitely hope. Thanks for sharing!

This has been a very informative thread. I received a letter this week stating I was denied due to my bk but tried calling anyway to speak to someone about the decision. That rep basically told me the same information that I was denied due to me having a bankruptcy on my credit report. She was very forward. I then asked her if there were any other cards I would qualify for, and she basically said she wouldn’t know. I’d have to apply first. That was frustrating considering they had already pulled my credit and had access to my report. I didn’t understand why they would run someone’s credit again. Most companies will use the report for at least 30 days. But needless to say I stumbled upon this article and became inspired to try again. I just called this morning to speak with someone in the cc department in regards to my status. In their system it had me still under review even though I’d received the letter. The rep had a hard time verifying my information and immediately transferred me to the loan processing department. From reading your comments, I felt like oh maybe this would be my chance. The new rep verified my info and then begin to ask me why I filled for bk back in 2010. After that he put me on hold and I could tell he was reviewing something. He got back on line and said he was looking to approve it and then asked me how much I spend monthly and what limit I would be requesting. I told him the limit of another card I have, but that because I was trying to establish a relationship with them I would take whatever they were willing to approve me for. (I hope that was a good answer). He said he’d figure out how much he could give me and forward my application to the management department for the final decision. It would take up to 2weeks because of their workload and I’d received notification in the mail. I’m hopeful now. And I wouldn’t have even tried if it wasn’t for the information and story’s you all provided. Thank you!! I hope this helps to encourage someone else. I hope be able to update you with great news.

Hello everyone! Just wanted to update you all. I received my card yesterday! Yay! I applied for the Chase Military CC with really great perks. I was originally denied due to my bankruptcy in 2010. But I was able to speak to someone for reconsideration and they said I would receive notification of the final decision. They did approved me with a lower credit limit, but I’m excited that they approved me nonetheless. Now it’s time to build the relationship. Don’t be discouraged with the immediate denial, calling to speak with the loan department does work.

Chase by far is trying to be one of the strictest banks on consumers applying for credit cards. But if they they were so fantastic in the first place they would not need US taxpayers to bail them out. I am a Chase customer that fell on hard times due to the real estate meltdown , got approved after BK by other issuers except for Chase. Talk about hypocrisy.

They definitely are strict when it comes to people with BKs which as you say is somewhat ironic.

George, I took my money out of Chase after we bailed them out and put every cent of it in NFCU!! Besides, I get the best card benefits between Amex & Discovver!! — And neither service supports the DAPL, unlike Chase(J.P. Morgan), Goldman Sachs etc.!! Help in making them change their policies, by not doing business with them at all — They’re not the only players in town!

I followed the advice to a T before I read any of this on the website and was kinda disappointed they declined me but, I did put I had a BK on application. I have 712 FICO. I filed BK in 2009 and no late payments since. I called today to check the status and was told I was declined, because of the BK. I asked if I could appeal that and they put me into contact with a rep who was very nice and did ask me about why I filed my BK. I explained my case. She said I should receive an answer within 2 weeks if not before.

I followed your advice and applied today for a Chase Sapphire Preferred card. I have a 6 year old bankruptcy, no issues since, I have 2 houses with Chase, no debt, I just paid off a $30,000 car loan with Chase, and make over 300K/yr. Credit is 740. I called the Reconsideration department and was flatly denied the card based on the bankruptcy. Period. No reconsideration, no nice people, nothing! She said not to bother to re-apply until 2019 and not to believe everything I read online about reconsideration with bankruptcy in the credit report.

I did not even had the chance to plead my case.

They have certainly tightened up over the past year, however if it was me, then I would call back and try to see if another agent is more receptive. This article was also written quite some time ago, so keep that in mind. With that said, people have been able to get Chase cards with bankruptcies in the past.

Hello i just got off the phone with reconsideration department. She told me she sees my bankruptcy was discharged in 2013 , she had my credit report in front of her. She told me i am doing good it is just to soon.

Same exact scenario happened with me!

Dan, did you have a credit acct. with chase that you defaulted on that you included in your bankruptcy? — If they(or any of their close affiliates) lost money on you in the past that they couldn’t recover, that would be a very good reason to deny you credit with them — even after your bankruptcy clears.

i’m on chapter 13 for almost 4 years with credit score of 707 and applied for chase CC, I check the window of bankruptcy and they told me that need more time to review my application and if i get approved they’ll send the card in 1-3 bussines days if not they will send the reason why in 30 days.

Today it’s my 2nd day and still waitting for the answer but i feel they’ll approve my application…

Miky,

Can you check back and let us know what happened? I too am 4 years post chapter 13 and have a 695 score and was thinking about applying for a Chase cc. Curious to know your results.

Did you end up getting approved?

Wouldn’t this be considered falsifying your application, and (arguably) fraud since you’re lying about the lack of a bankruptcy on your initial app?

I don’t know about anyone else but I would be Leary on checking off no when I actually did. However, I believe they are saying to do it because it would open the door for an explanation as to why you declared bk in the past. It does seem to be tetering on the line of fraud. Either you did or didn’t.

I declared ch 13 back in January,2016. Having no late pymts or collections since that time. I decided to turn my life around. Last year I got an amex blue cash preferred card 2000.00 cl, DISCOVER card with 5,000 cl and U.S. bank with 5,000 cl. My ch 13 bk will fall off in January of 2o 2023. So I have about 13 months more to wait before my report is clear of all negative info. I’ve been up and up about all my info with the banks. I have prese presently fico of 702 so when the bk falls off it’ll go up another 50 points or more. I believe that if you treat your credit well it will treat you well in return.

Hoping for future successes in your life.

Kindly,

GIL LOERA

L.A.CA

[…] in January I wrote a post called Getting Chase Rewards Cards with a Bankruptcy on your Credit Report. In that post I walked through how to handle the application and the eventual reconsideration call […]

Chase is very good at reconsideration and there have been many folks that have been approved with a BK on their reports after calling for a recon. To your point, should have a perfect payment history from three to five years from the date of BK and maintain a low utilization.

[…] other day I wrote about how to get a Chase credit card with a bankruptcy on your credit. Today I am going to talk about a problem that many people with past bad debts (bankruptcy or […]