Chase Freedom 5% Category Tracking, A New Improvement?

I don’t know if this is new or not but it is new to me so I thought I would share it. I checked with some other people and they had never seen it either. Most of us love our Chase Freedom and Chase Freedom Flex cards for their rotating 5% categories. It is one of the best ways to rack up Ultimate Rewards (UR) points at a pretty good clip. If you max out every quarter that is 30,000 Ultimate Rewards points each year. That is if you have premium UR earning card to pair it with, or $300 in cash back if you do not. One of the frustrating things about Chase Freedom 5% category tracking was that Chase only gave you an estimated progress bar.

It never gave a breakdown of the actual spend though. You would be able to tell you were about halfway done etc. but you were never sure of the exact dollar amounts, until now. I was poking around my Ultimate Rewards account and found a tracker that shows the actual amount earned so far.

Steps For Chase Freedom 5% Category Tracking

Here is an easy step by step guide of how to find it. It is possible that not every account is set up with this option yet. If you are not having any luck I will show you another trick you can try below.

![]()

Step 1

After logging into your Chase account you want to go to your Chase Freedom Flex, or Freedom card, and select the Ultimate Rewards site.

![]()

Step 2

Once there you will want to click on your current progress at the top of the screen. It is highlighted in red on the screenshot above.

![]()

Step 3

Once you select your current progress you will be taken to a screen with recent purchases and earning amounts etc. You will want to select see activity details underneath the pie chart. You will see a 5% counter to the right in this image. That one doesn’t give you the full details we are looking for, just an approximate amount of spend for the quarter and not the full breakdown.

![]()

Step 4

After you click see activity details you will want click on the 5% cash back option. You can also just scroll down to the 5% back categories. There you will find a tracker that shows an actual dollar amount of how much you have earned. It will also show which of the available 5% categories you have spent it in. As you can see from mine I did all of my spending on PayPal and nothing on Walmart’s website.

![]()

What If You Can’t Get This To Show Up?

There is a chance that this is only for certain accounts. My wife’s Chase landing screen changed a few months ago and it doesn’t look like anyone else’s that I have seen. I asked Ryan to check his account for the tracker and he was unable to locate it on his account. So maybe it is only there for accounts that have been update? Here is what her Chase screen looks like after logging in, completely different than mine.

![]()

Well if you fall in that bucket Ryan shared a good tip for you in a recent question of the week post. Here are the details or you can check out his post for more info.

Ryan’s Tip

The final spending we want to track is quarterly spending bonus categories for Freedom cards. Each quarter, Chase offers 5x earning on Freedom / Freedom Flex / Freedom Unlimited cards in certain categories. This is capped at $1,500 spend. Want to see how much you’ve spent?

![]()

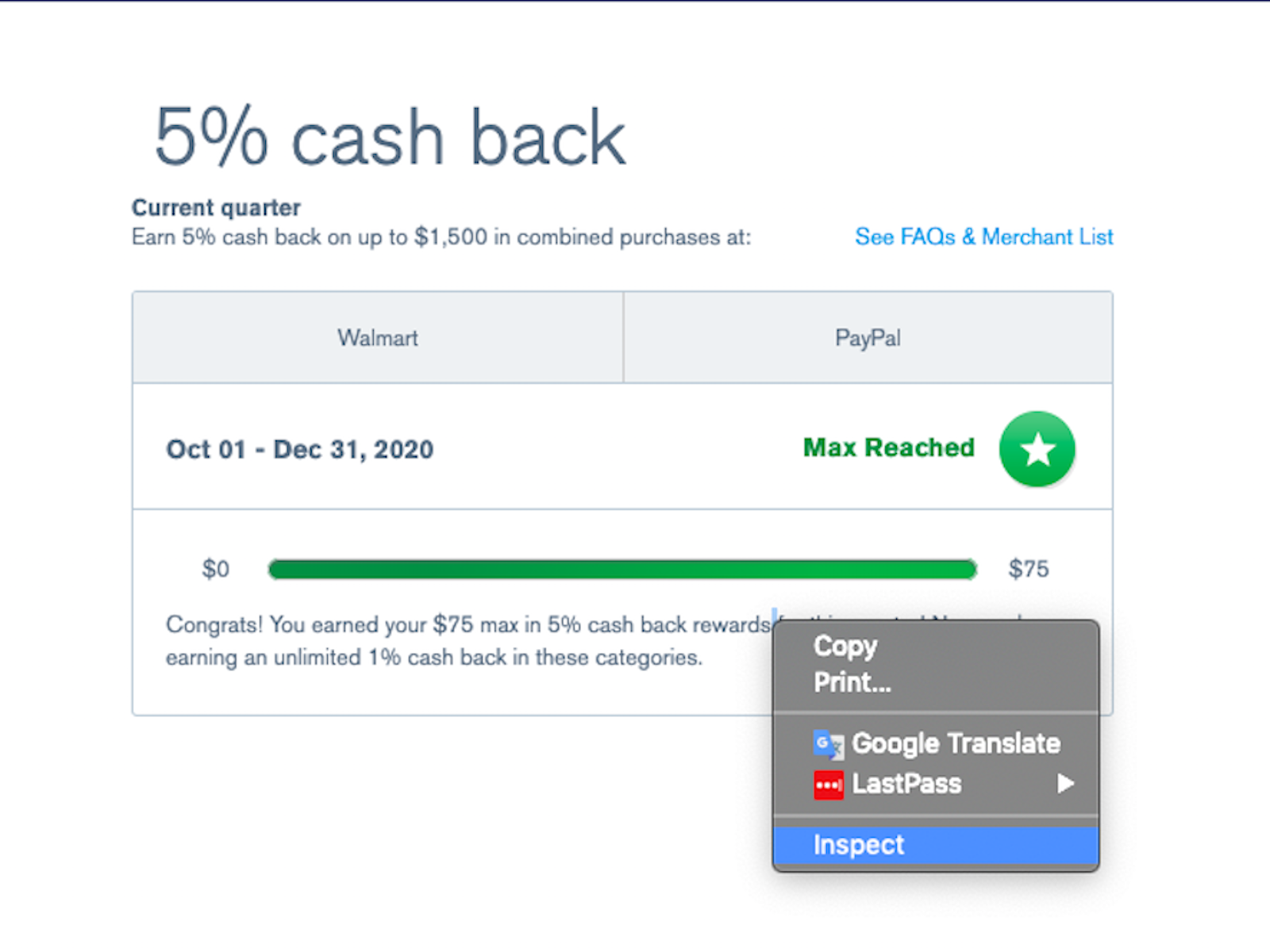

Click on the ‘details’ next to the 5% cash back area. You will be taken to the next screen.

Mine tells me that I’ve reached the maximum. If yours doesn’t say that, it’s annoying that there’s no “how much” given. It won’t say 40% or $832 spent…nothing. Right-click on the status bar and choose “inspect”.

![]()

All of the coding for this web page will come up. You can “find” or just scroll down until you see the part I’ve highlighted. Here’s an example from someone who has not yet maxed out the quarterly category. “You’ve earned 60 dollars out of 75 dollars”. This person is 80% finished with the quarterly maximum. 80% x $1,500 means this person has spent $1,200 in the category, so $300 remaining to max it out. It’s a bit of work, but you can find it.

NOTE: This only updates when your statement closes. Spending today won’t adjust the bar in this card option. If you need “through today”, use the other options.

Final Thoughts

If you are tired of doing your Chase Freedom 5% quarterly tracking manually each month then this should be a fix for you. Hopefully I have everyone covered with one of these two tips. This should save you some time in the future. No more digging through previous statements with your calculator out!

Maybe I missed it but are you saying there is a way to see how far along you are on a daily basis instead of just a per statement basis?

I am not sure if this is updated when the charges or not. I have already maxed it out so can’t test that but will next quarter. This was more about it showing you the actual breakdown versus just the approximate amount.

nice