Roundup of 5% Bonus Category Calendars for Chase Freedom, Citi Dividend & Discover it

Roundup of 5% Bonus Category Calendars for Chase Freedom, Citi Dividend & Discover it

The three major 5% cashback credit cards have released their 2016 quarterly bonus categories for the most part. Let’s look at the 2016 calendars for Chase Freedom, Citi Dividend and Discover it and see if we can spot some opportunities!

Chase Freedom 2016 Bonus Categories Calendar

As you can see, gas and transportation is going to start off the year. This wouldn’t be terrible except that Discover has the same categories in Quarter 1 as you will see a little later. I do love that Chase has kept the grocery store category in Quarter 2 since it is the easiest to maximize in my opinion.

While we don’t know the full details of Quarter 3 or Quarter 4, my guess is that entertainment will accompany restaurants and look for holiday shopping to probably include department stores and Amazon.com. Just a guess. You can find the calendar here.

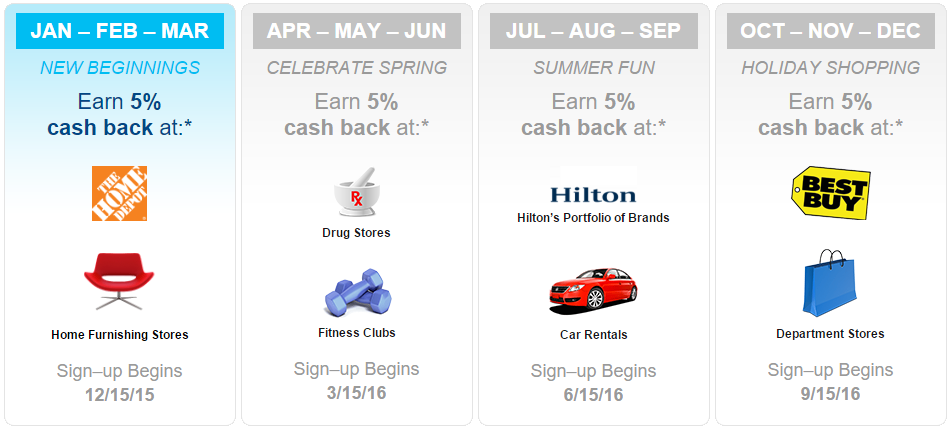

Citi Dividend 2016 Bonus Categories Calendar

Citi Dividend is unique to either the Discover it or Chase Freedom cards since you can earn all of your cashback ($300) total any time during the year. That means you aren’t stuck to any one quarter’s categories. With that said, look at Quarter #2. That should make it relatively easy for a lot of people to max this out.

If not, then you still have department stores, Home Depot and Best Buy to help you out. All of those stores not only carry ample goods for normal purchase, but they all generally carry Visa gift cards which can be loaded to Bluebird or Serve. The Dividend card isn’t available to the public anymore, but you may be able to product change over another card to it. You can find the calendar here.

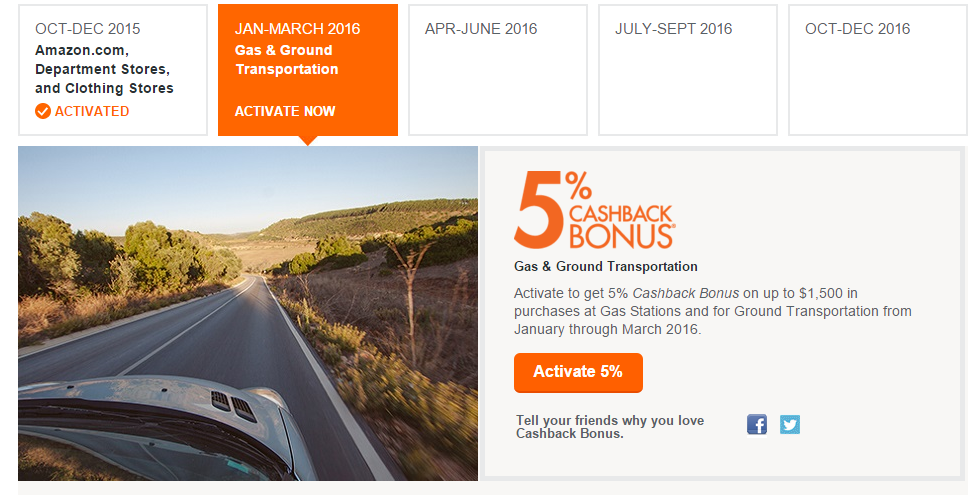

Discover it 2016 Bonus Categories

Discover hasn’t been as kind as the other two banks in releasing information. With all of their promotions, I have noticed a severe drawback in how generous Discover is. Their portal terms are constantly becoming more restrictive and hassles when using Apple Pay are more common. For that reason I don’t expect Quarters 2-4 to be especially good but who knows.

The Quarter 1 category is basically the same as what Chase is offering for the Freedom card. This sort of stinks, especially for people who don’t have the ability to MS at a gas station. Still, I know there are opportunities for many, especially those with the Double Cashback promotion. You can find the calendar here.

Conclusion

None of these categories are life changing, but there are a couple of things that I am happy about. The Citi Dividend should be very easy to maximize this year and Chase has quite generously kept the grocery store category when the other banks have removed it. Now if I could only find a generous gas station, then things would really be looking up!

Roundup of 5% Bonus Category Calendars for Chase Freedom, Citi Dividend & Discover it

Roundup of 5% Bonus Category Calendars for Chase Freedom, Citi Dividend & Discover it

Barclay bank has the Sally Mae card that gives 5% on the first 250 gas, grocery( even some Walmart supercenters), individually and the first 750 book stores. (like amazon.com for everything exempt gift cards and kindle, go figure) only thing is that they won’t send you a check, it has to be a statement credit, or student loan credit. But 5% w/out calendar categories.

[…] card. It earns 1% cash back on normal purchases which isn’t good at all, but it also has rotating 5% categories which represent a great value. Combine that with no annual fee and the ability to transfer points […]

[…] a month ago I did a roundup of the 2016 5%/5X bonus categories for the Chase Freedom, Citi Dividend and Discover It card…. While Chase and Citi released their calendars for the entire year, Discover seems to only be […]

Taxis count for Chase Freedom Q1 does that mean Uber and Lyft also count?

[…] All the 1st Quarter 2016 5x Bonus categories and 2016 Calendars. […]

I have both the DISC double promo and a Freedom card. Seems to me like DISCOVER would be the card I always use for gas purchases since I am getting 10% (5% back now and another 5% next summer). Am I missing something, or is that the way I should look at it? Only exception might be if you need to top off Ultimate Rewards for a specific redemption and therefore would use the CHASE Freedom, then switch to DISC.

If you can swing it, consider using either to load up on gift cards at your favorite gas station. Since these cards overlap their gas cashback quarter for next year, this allows you to extend your gas discount. It pays to check for sure, but many convenience stores also code as gas stations and sell various gift cards.

I’m glad Chase has the grocery store category in there somewhere! That makes me happy!