Chase IHG Premier

It’s about that time. Almost a year ago, I came to the realization that IHG One Rewards isn’t in our long term plans. At that point, we decided to position ourselves to finish up with the program over the next year or so. But the destiny of our two Chase IHG Premier cards remained uncertain. In the meantime, I held out hope something would change with the program or card to convince us to hold onto them. But now, it’s decision time – my card’s $89 annual fee recently hit, with my wife’s close behind. Here’s why we’ve decided to close our Premier cards.

Overvalued Free Night Certificates

Perhaps the easiest justification for paying the Premier’s annual fee is the anniversary free night certificate my wife and I each receive. This version of the cert allows uncapped point topoffs, a substantial upgrade from the legacy IHG card’s inability to add points for a stay at a nicer property.

That’s probably a great benefit for some, but as it turns out, not for us. For the past few years, we’ve ended up using our free night certs at the same Outer Banks property during low season. Nightly cash rates are similar to the card’s annual fee, anyway. On top of this, the dates for our certs only overlap for a few months, making them tougher to line up for a two-night stay. We’d be better off paying the cash rate, given the flexibility of booking any time we wanted, or maybe even not at all!

But you may be wondering why we’re not thinking bigger with the Premier’s supposedly attractive certs.

IHG’s a One-Trick Pony

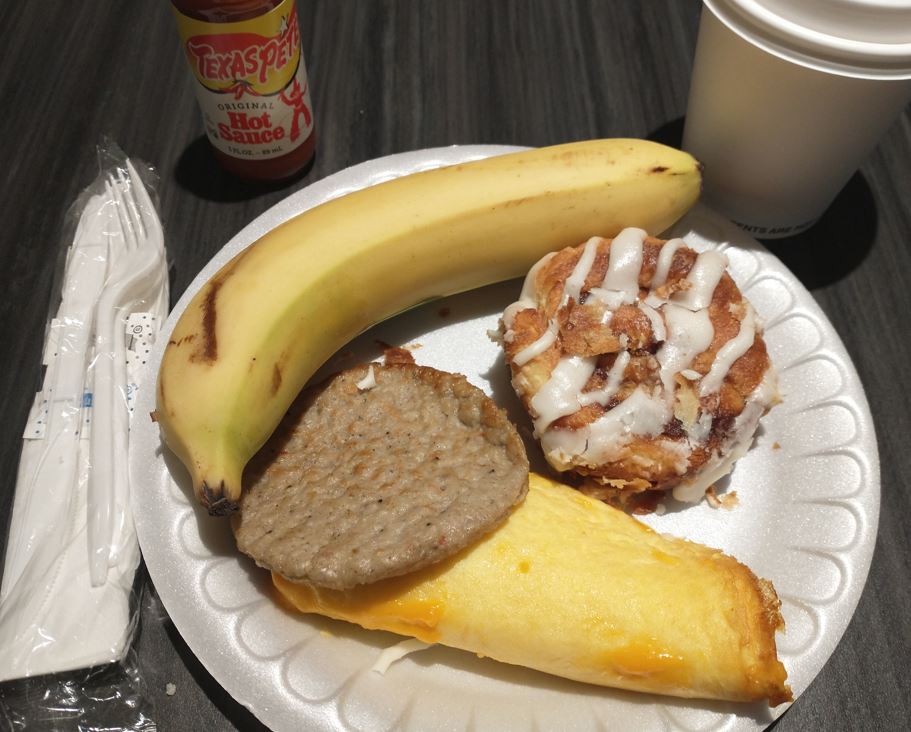

For our current life season, we find ourselves mostly staying in Holiday Inn Express properties on IHG Rewards stays. I’ve established a (probably) unhealthy relationship with their cinnamon rolls. I can only remember our family staying at a different IHG brand once in the past several years – a Holiday Inn, which pretty much felt like an Express property, anyway.

Again, many others probably stay across multiple IHG brands, and investing in the program is more understandable. That’s just not the case for us.

We Don’t Travel Enough

Between my solo short solo trips and several family vacations annually, our award lodging needs are met with other programs’ currencies. I can’t recall the last time we actually redeemed a sizable amount of IHG points. Burning Hilton, Marriott, and Choice currencies keeps us busy enough. Meanwhile, our IHG point balances grow mold.

Elite Status Means Almost Nothing

For how we use the program, the Platinum elite status which comes with the Chase IHG Premier card is pretty much meaningless. First off, since we primarily stay at a limited service brand like Holiday Inn Express, there’s minimal elite offering. And the little those properties can do, like providing a room upgrade, hardly ever happens for us. Since we exclusively book award stays, the accelerated earning on paid nights might as well not exist for us, either.

Illogical Chase IHG Premier Spend

On paper or screen, the IHG Premier’s earn rates looks attractive: 5x gas, dining, and travel, and 3x everywhere else. But IHG redemption rates are very unpredictable and continue to be devalued in our experience. Individuals can do better spending on other cards, even during temporary spend offers. I’m currently eligible for 5x and 7x IHG points on certain categories, and even that doesn’t make sense when I consider my other options.

My wife and I each spent a little in the 5x grocery category to get to a nice, round number for our IHG balances prior to upcoming redemptions. But now, we’re done and ready to move on.

Conclusion

In my view, the IHG program is probably the most unpredictable hotel program out there, and not in a good way. It’s not one we want to lean into, even with a simple Chase IHG Premier annual fee payment. The only way I can see us not cancelling is if either of us receive a retention offer, but I don’t foresee that happening. We’ve tried that for years with no luck. And we don’t take closing these cards lightly. We have no intentions on being eligible for new Chase accounts ever again, and we’re okay with that deal. But we can no longer squint and justify a credit card annual fee tied to such a wild card program.

How are you feeling about IHG One Rewards and related credit cards these days?

Would you consider downgrading to the no-annual fee IHG Traveler Card? Since you plan “to never be eligible for Chase cards again” – that’s more of a just in case something good ever happens to the IHG program and/or cards.

It’s so individual as the above comments show. I’m a fan of IHG, and always get huge value of the free night certs. I too have both cards, and almost always use them for IC properties, especially the Mark Hopkins in San Fran. Easy to get nights there for 40K during the week or off season. Also loved the IC in Berlin and in…Davos!!!!

Nice work, David!

Another problem is IHG’s “half price” sale of points. The room price usually is less than I paid for the points.

BTW: Hilton is even more of a ripoff for how many points they want for a room compared to the room rate. The cost of the points has been 2.5 times as much as the room rate. I have learned never to buy points on sale.

For the second year in a row I struggle to find great uses for the certificate. I like to keep them in my account for unexpected trips that would require an expensive night and I end up scrambling to book anything a month before they expire so they don’t go to waste. Last year I actually couldn’t use one and it just expired. So I’m with you here and I will cancel the card too when the (increased) annual fee hits. I too don’t find the benefits compelling.

Which Choice hotels you loved to use? Had the best redemptions?

I’m a fan of Cambria, certain Ascend properties, Preferred Hotels, and (gasp) some Comfort Suites. Plus, the new Radisson additions bring even more options.

For me the card is a keeper. I don’t get amazing value from the annual free night, but definitely far more than the annual fee. I’ve used the 4th-night free feature at least twice which makes the points per night a terrific value. And I’ve gotten some value from having platinum status – welcome drinks, and much better rooms than standard. (high floor, river view, etc). IHG is not my first choice when traveling, but the program and credit card have been pretty useful to us over the years.

Lynn,

Thanks for chiming in. The fourth night free feature is outstanding – it just turns out my family and I haven’t needed it as much as we originally thought.

“But we can no longer squint and justify a credit card annual fee tied to such a wild card program.”

I don’t get what makes it so “wild”. I’ve been an IHG member for almost 15 years and have gotten tremendous value from it. I’m puzzled why you would use your certs at a HIE? I would never use the certs for a HIE. I’ve used them almost exclusively for great Intercontinental hotels in Asia and also in the US. Even in the US I have gotten upgrades to a suite at an IC when I booked an award night (yes it’s rare and unexpected).

Jacob,

Our travel destinations aligned with our goals simply don’t offer other intriguing IHG options, and that’s fine. It seems like your travel patterns align with IHG – great! We can each be correct for our own situations.

Actually IHG has become my favorite hotel program, we live in a part of the country where Hyatt and even Marriott don’t work for us, the only Hyatt hotels are in the city where I live. Same with Marriott with a few exceptions. As retired people who currently do driving trips (with dog!) IHG fits the bill for us. And the value of four ‘free’ credit card nights (that would cost 2 to 4 times in cash) work out great. Could not care less about suites, upgrades, etc. Nice large basic Holiday Inn Express rooms, sofa for lounging, decent free breakfast. Occasionally more upscale Kimptons with free happy hour and great pet policy.

It sounds like IHG works great for you, Toots.

My wife and have both the Select and Premier IHG cards. We use our FNC’s at Kimptons and Indigo properties and some IC hotels. We get great value from IHG between the 4 FNC’s per year and average over 1cent per point. We have a NY stay coming up later in August at the Kimpton Eventi and used our 2 Premier certs which cover 40K plus 12K points additional for a room that runs $400 plus per night. Having the Select card we get 10% of our redeemed points back.

Bravo, Michael!

Out of all the various hotel(s) breakfast options, the cinnamon roll is the lowest quality out on the market. I mean gee, they’re not even worth the calories. Disclaimer. I recently had a bite at the HIE on Cone St in Atlanta (nice downtown property).

Several years ago, I closed my Chase IHG $49 annual fee card which included Platinum status. We had years of great stays using the free annual cert, easy points usage, receiving room upgrades at The Venetian in Las Vegas, The Willard in D.C., and a great IHG hotel in Century City, Los Angeles, that no longer exists as IHG, among others. But once IHG devalued their program, I could no longer see even paying the $49. I found prior to cancelling that I was scrambling to use the annual free night just so it would not be wasted. Today with room rates so high and low availabitity to use points, it was a good decision for our situation.

I hear you, Vee!

Cinnnnnnnamon Rolls

Any reason not to product change to the no annual fee card?

Jake,

I’d like to transfer the Premier’s credit limit to other Chase cards I use more. But downgrading to the no-fee version before doing so is probably a better move! Thanks for reading and the comment.

Ever since the Guaranteed Room Upgrade for Intercontinental Ambassadors was replaced with Guaranteed or we’ll give you $50 or 10,000 IHG points, guess we get when trying to upgrade. Hint- it’s not the upgraded room because the upgrades are suddenly “not available”.

Who do you think you’re kidding here? It’s us, remember?

We all know the REAL reason: so you can reset the clock and eventually get the 160000 point bonus, or whatever it is, a few years from now. Why all that blather above? You’re fooling no one.

Agreed. Yep, Benjy, start the timer.

Billy Bob and Enjoy Fine Food,

It appears you missed the concluding paragraph and the linked article within.