Chase Ink Preferred 100K & Ink Cash 50K Offers

Chase has been fairly aggressive with their bonus opportunities for new cardholders the past couple of years or so. Of course we all know about the blockbuster Sapphire Reserve bonus, but we have seen very nice bonuses from time to time on other cards as well including their newly launched Ink Business Preferred.

Thankfully it seems they are taking bonuses to yet another level on two of their popular business cards! Let’s take a look.

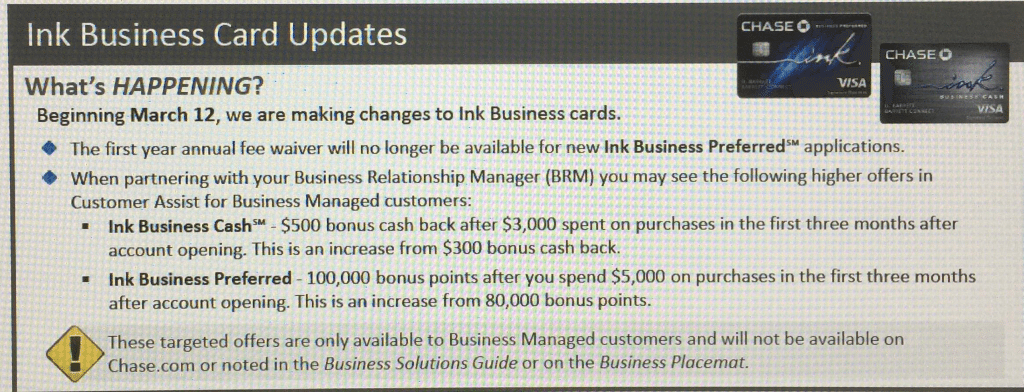

Note: Thanks to Doctor of Credit for the screenshot below and for making me aware of these offers.

Ink Business Preferred 100K

The Offer

100,000 Bonus points after you spend $5,000 on purchases in the first 3 months.

Need to Know

- Earn 3 points per $1 on the first $150,000 spent in combined purchases in the following categories each account anniversary year:

- Travel, including airfare, hotels, rental cars, train tickets, and taxis

- Shipping purchases

- Internet, cable and phone services

- Advertising purchases made with social media sites and search engines

- $95 annual fee is not waived the first year.

- Can transfer points to travel partners.

- No foreign transaction fees.

- Ink Business Preferred IS seemingly subject to Chase’s 5/24 rule.

- This is the highest bonus I have ever seen for this card.

Analysis

100,000 Ultimate Rewards points is A LOT. This bonus is definitely worth looking at considering the generous 3X bonus categories and the value of the sign-up bonus. It isn’t the easiest card to get due to 5/24 but it is quite a prize. Of course you can also transfer these points to partners or use them to book travel directly at 1.25 cents each. If you have a Sapphire Reserve, then they can be redeemed for travel at 1.5 cents each!

How to Apply

It appears that this offer will only be available via a business banker in-branch beginning on March 12, 2017. It may not be available to all customers.

Ink Business Cash 50K

The Offer

$500 bonus cashback (50K points) after $3,000 spent on purchases in the first three months after account opening.

Need to Know

- Earn 5% cash back on the first $25,000 spent in combined purchases each account anniversary year:

- At office supply stores

- On cellular phone, landline, internet, and cable TV services

- Earn 2% cash back on the first $25,000 spent in combined purchases each account anniversary year

- At gas stations

- At restaurants

- No annual fee

- Points can be redeemed for cash or gift cards. You need a premium card such as the Sapphire Preferred, Ink Business Preferred, Ink Plus or Sapphire Reserve to transfer to travel partners.

- Ink Business Cash IS seemingly subject to Chase’s 5/24 rule.

- This is the highest bonus I have ever seen for this card.

Analysis

A $500 bonus on a no annual fee card is pretty amazing. When you also factor in the transfer ability of those points to travel partners via a premium card or the ability to redeem them at 1.5 cents each if you have a Sapphire Reserve, you can see this is an amazing deal.

I also earn a lot of points on my Ink Cash cards by shopping at office supply stores and earning 5X. That means this card isn’t only one to get for the bonus, but it also pays to keep it for the long term. This is especially true now that the Ink Plus has been discontinued.

How to Apply

It appears that this offer will only be available via a business banker in-branch beginning on March 12, 2017. It may not be available to all customers.

Conclusion

Both of these offers are truly fantastic and in my opinion warrant a visit to a local branch come March 12. While both cards are subject to 5/24, if you don’t have a lot of new cards and/or are pre-approved in their system, you might just be able to get a nice chunk of points!

[…] saw this posted on Frequent Miler, but apparently Miles to Memories broke the story…either way it’s a FANTASTIC deal and I applied within 15 minutes of […]

[…] Chase Ink Record High 100K & 50K Offers Coming: Full Details & How to Apply! […]

I was approved for CSR (27K) in September and added the Freedom Unlimited (18K) this month. Should I wait a few months to apply for an Ink card? Do you know, does the Ink Cash card have a minimum CL?

It is hard to tell with Chase, but getting three cards in 6 months isn’t outside the realm of possibility Generally it depends on your history with the bank. I am assuming you are under 5/24 or else there isn’t much chance of an approval. I have never heard of a minimum CL on the Ink Cash so I can’t answer that one.

Shawn,

I don’t know how to take your link? Do you not want to be called a blogger but yet a travel writer? Ok…I’ll call you a travel writer. BTW, I’m not trolling you…but just using this post as a rant against Chase, as I don’t see any real pushback from any of the travel writers against banks like Chase and their 5/24 rule compared to the amount of written stories pushing the latest Chase card.

Overall, I imagine that the 5/24 rule does hurt travel writers as well; as there is less affliate link payments made by Chase because less of us (your readers) are even able to apply.

I just hope that collectively we can get Chase to get rid of the 5/24 rules…Similar to how Verizon brought back unlimited data recently due to them having to meet the competition.

I’ve written similar complaints about Chase’s 5/24 rule on other travel writters boards…most of them don’t publish them though; so thank-you letting me (an actual travel reader/follower) rant & for publishing my note.

I’m WAY over Chase’s arbitrary 5/24 rule. I will not be applying for this card nor any other Chase cards.

When are the bloggers going to push back on Chase and stop promoting their cards as a means to punish them until they remove the 5/24 rule. Ah, I get it…you bloggers earn too much money & points/miles from them that you cannot bite the hand that feeds you!

I cover good offers that I feel are worth pursuing for my readers. If you search this site you will see me often being critical of the banks including Chase. To conclude, I’ll leave you with this:

https://milestomemories.boardingarea.com/trolls-you-bloggers/

I’m really curious, do you think if I’m way over 5/24 but have a legit business LLC, could I theoretically use my mom’s name and SSN along with the FEIN of my LLC to apply for the Ink Preferred under her name and still have her still be approved even though when I got the Ink Plus as the Owner in that LLC’s name when they run that LLC name in their database during application they will be able to see that I’m way over 5/24?

Like I could maybe have her apply as a co-founder or something and she might get approved, and then I would add myself as an employee card to that? and we would both use that account?

I applied in branch while over 5/24 without a legitimate business (used my SS#) and although I didn’t get approved on the spot (I got application pending) they sent me the card a week later.

It is never a good idea to put misinformation on a credit application. I’m not sure if it will work or not.

Is March 12th still the end date for 100k branch offer on CSR?

As far as I know that offer ends March 11.

Not sure what the hype is.

This is only for ‘business managed customers’ which likely means people who already have a biz checking account with activity history.

i was thinking the same thing. Not open to anyone who has a business (legit or not) walking off the street (traveling to a state with a Chase branch)

I do not have a business to my name.

How do I get such a card ?

Thanks

Nat

If your business isn’t registered, you can use your SSN.