Citi 0% APR Targeted Spending Offers

Citi is sending out some intriguing spending offers for various cardmembers. Let’s take a look.

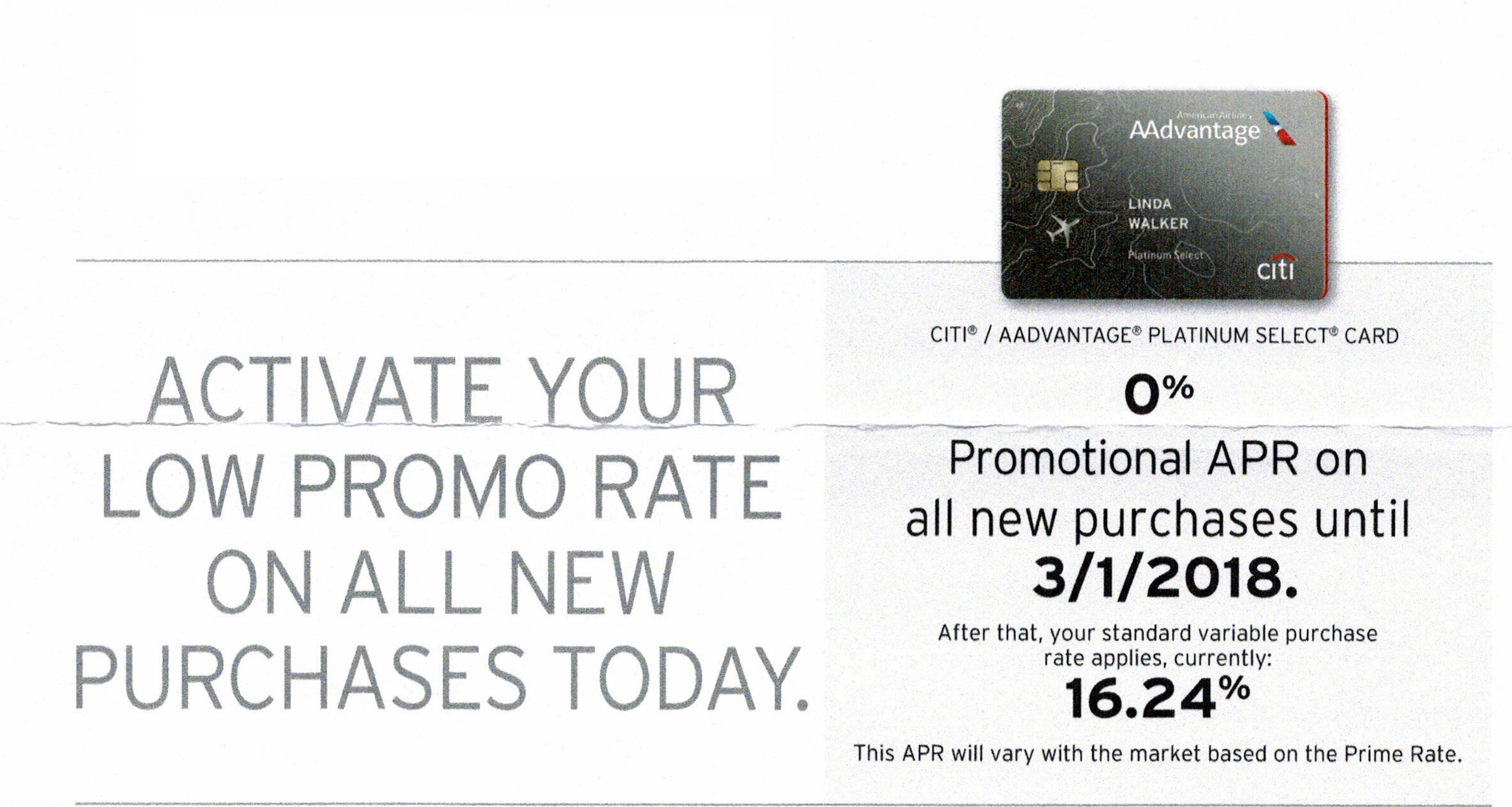

The Offer

0% promotional APR on all new purchases until 3/1/2018. Register for the offer by 8/31/2017.

Offer Terms

- Your account must be open and current for you to qualify for this offer. If your account is closed for any reason, you may no longer be eligible.

- Eligible purchases exclude balance transfers, cash advances, convenience checks, account fees, and interest charges.

- Once you activate this offer it will be effective immediately on your account. Only purchases that post to your account between when you activate and the offer end date will receive this promotional rate.

- All purchases must post during the promotional period.

How to Register

To register for this promotion or to see if you have been targeted, go to citi.com/specialpurchaserate and login to your Citi online account.

Once logged in you will see the offer on each card which is eligible. I should note that my wife seemingly only received the offer in the mail on two cards, however when she logged in the offer was on 3 cards (ThankYou Preferred, ThankYou Premier & AAdvantage Visa). I did not receive the offer on any of my cards. 🙁

Analysis

Going into the holiday season this could be a good way to give yourself a bit more liquidity. With that said, you will have to pay interest on this “debt” if you don’t pay it off by March, so only keep a balance if you know you will pay it off. I can think of a few ways that the money could be put to good use, but this type of offer isn’t for everyone.

Did you receive similar offers from Citi? Share your thoughts/experiences in the comments.

Got one on my AT&T AM card! Woot woot! That actually does help a lot – especially if I get a new BNB and thrown all the expenses on there. Hmmm… *ideas*

Oh I wish I had one on my AT&T card. I spend waaaay too much money on it though.

Just make sur you have a zero balance before you start or they will keep charging you interest on that.

Good tip!

I find they always target me a month or two before the Annual Fee hits. Is that annual fee also at 0%?

I’m not sure. In this case the cards were $0 annual fee so I don’t have access to the terms. I would assume it isn’t because generally the 0% only applies to purchases.

Aw, I’m targeted for past offers (1/1/18). The extra 2 months would be wonderful.

many CC will come out during the holidays for 0% APR on purchases. just wait for those. otherwise you can always get the Chase Slate if under 5/24 then PC to UR cards.

FYI. these promos are always ongoing and always sent out periodically to targeted people based on soft pull credit report info. citi branded cc gets the most offers vs the cobrands probably because due to profitability.