Citi AAdvantage Card Multiple Bonuses

About a week ago, my wife and I did something that we hadn’t done in awhile. We embarked on an adventure known as an App-O-Rama or AOR. For those who don’t know, an AOR is when you apply for multiple credit cards in the same day.

In the old days it was believed that applying for multiple cards within a few hours of each other was beneficial since the banks didn’t see the inquiries from other banks. Unfortunately it doesn’t work that way and inquiries show up immediately, so banks are able to see all of your applications.

It was for that reason that I moved away from AORs about a year ago and have stuck to a strategy of applying for deals and offers when it made sense. It just so happens that an AOR made sense given our recent lack of applications.

The Citi DeniAAl

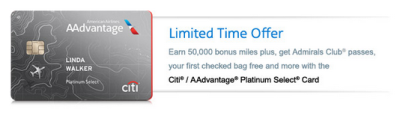

While I will have a full write up on what we applied for and the results coming in a few days, I wanted to highlight the lone denial. It came from Citibank on an application for the increased 50,000 mile sign-up offer on the Citi AAdvantage World Elite Mastercard.

Both my wife and I have several Citi AAdvantage cards, however as you may know, they have been pretty generous in giving out more. What we know about Citi’s rules for AAdvantage cards comes from the experiences reported by others. The rule used to be that you could get a new Citi AAdvantage personal card every 18 months.

The Phone Call

During the AOR, we applied for the Citi AAdvantage Mastercard. It had been over two years since the last application, excluding the Executive card(s) we got earlier this year. After submitting the application, Citi said they needed more time to process the application. We weren’t able to call until the next day.

During the call, we were immediately told that the application was denied because we already had an AAdvantage credit card. Specifically the agent said that a lot of people just get the bonuses and that the offer was for first time cardmembers only. I am paraphrasing, but that is the language the agent used.

Naturally with that information I headed over to Flyertalk where other members have recently reported being told something similar. Apparently Citi is now blocking existing cardmembers with any personal AA card including the Executive card from getting another AA card.

Change In the Rules

While the rule used to be that you were no longer considered an existing cardmember if your last approval was more than 18 months ago, it seems that time frame has now stretched to up to 24 months.

Before you shout at me that this is all old news, some of these developments are new. With all of the changes we have seen from Citi in the past six months regarding AAdvantage credit cards, it is clear that they are trying to prevent people from getting bonuses multiple times.

Agents don’t use that type of language with customers if they haven’t been told to. Of course I cannot blame Citi for cracking down, considering they allowed some people to get upwards of 6-8 Executive cards earlier this year.

Conclusion

If you have ever had a Citi AAdvantage credit card, I highly suggest keeping up with the latest developments over on Flyertalk before applying for another card. While the rule used to be 18 months, it may be longer now and if you got an Executive card this year, the clock may have reset.

So is it 18/24 months after approval? or 18/24 months since closing it as well. I’ve had it for like 4 years now because they keep waiving the fee but I’m thinking about closing it so I can get the offer again, but wondering how long I’d need to wait?

I have had multiple citi cards over the last 3 years, every 3-6months i would churn my cards. nothing too serious. As of Nov ’14 i was denied a card because the last one was closed 4 months previous. Jan ’15 i was approved for the card, offer 50k miles for $3k spending in 3 months. Easily spent dbl the requirement, but was not credited 50k miles. Called and supervisor said that I was not eligible since i was a customer in the last 18 months. After 15 mins of going back and forth, I was saying that I was never made aware of this when I was approved. She said that there was no way that I would be able to get a credit for the bonus miles. Approval for the card and mile bonus were separate things she told me. I ended up closing the acct out of frustration.

Seems to me that Citi has cracked down heavy on churning.

Thanks Peter. They have definitely started enforcing the 18 month rule. At least they aren’t as strict as other banks, but it certainly isn’t as easy as before.

I thought Citi changed the churn rules again. I thought that you now were able to get bonus again provided you had neither opened OR closed the same card type in the last 18 months. S Kris would have been able to get a gold, as the platinum is considered a separate product under the new rules. Gold, platinum and Exec are all now considered separate products under the new rules. This is what the WIKI is stating on Flyertalk. I no longer see the reference 18 to 24 months between applications, so appears that part has changed since your application — correct?

Not entirely true, just got approved for a gold with platinum open.

[…] the past couple of weeks I have written a couple of posts (Sapphire churning & Citi AAdvantage card churning) eluding to my last churn, but nothing that talks about it in detail. Today I wanted to break […]

[…] other day I wrote about the possibility of Citi tightening churning rules. Thankfully Chase has moved in the opposite direction and reopened the door for credit card […]

I was under the impression since the beginning of this year (when I was in on the multiple Exec cards) that if you were approved for the AA Exec then the clock for the AA Platinum reset. So if you had an Exec card (or 2 or 3 haha) earlier this year it is not surprising that you were not approved.