Combining Product Changes & Retention Offers

Just over a year ago Citi blessed us with an amazing opportunity to rack up hundreds of thousands of AAdvantage miles in the form of their Executive card. For a $250 fee ($450 AF – $200 statement credit) upfront, you could earn a 100,000 AAdvantage mile bonus. Cha-ching!

In addition, Citi allowed most people to get the card over and over. While I know some people made the decision to cancel their cards once the bonus posted to avoid the $250 fee, others are coming up on the end of their first year. So what should you do?

Cancel, Keep or Change to a Different Product

Since the Citi AAdvantage Executive card carries a $450 annual fee, it really isn’t a great card to keep. While I have enjoyed having Admiral’s Club access the past year, it just isn’t worth that fee to me. If I was going to pay $450, it would be for an Amex Platinum, although I am not sure if that card is worth the money either.

So my decision is now whether to cancel the card or convert it to another Citi product. The main choices for conversion are:

- Double Cash – 2% cash back on all purchases

- Dividend – 1% cash back with 5% rotating categories each quarter

- ThankYou Preferred – 2 ThankYou points per dollar on dining & entertainment, 1 point on everything else

The Double Cash card is probably the best overall card out of these three since it earns 2% back on all purchases, however one of those cards is known to have amazing retention offers.

ThankYou Preferred Retention

Back in January I wrote about my wife’s amazing retention offer for her ThankYou Preferred card. For keeping the card, Citi offered her 2 extra points per dollar on all spend with the card for the next 6 months with no cap. (Many others received valuable offers as well. You can see some good examples in the comments of this Frequent Miler post.)

This offer equates to 3X ThankYou points earning on all purchases and 4X on dining and entertainment. Guess which card quickly made its way to the top of her wallet for everyday spend?

Converting Now for Retention Later

What if you converted your Citi Executive card to a ThankYou Preferred now and then waited a few months to see if you are eligible for one of those nice retention offers? (Some experiences suggest you wouldn’t need to wait that long.) Now there is no guarantee that you will get an offer as good as 3X with no cap, but it is worth a shot and you are likely to get something decent.

The Double Cash card is tempting, however I already have an Arrival Plus and there are other Citi cards I can convert in the future if needed. Additionally, the Dividend is a nice card, however the bonus categories are a little weak this year.

Benefits of Converting Over Closing

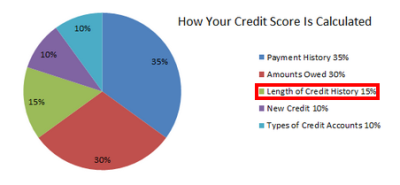

Remember by converting an existing account to another product, you are extending your average age of accounts which accounts for 15% of your FICO score. Since there isn’t an annual fee on any of the three cards I mentioned, you could keep this account open indefinitely. (Although Citi has been known to cancel accounts without activity, so make sure to charge something once in awhile.)

Also, by keeping your account open, the credit line is available to shift around if needed when you apply for new Citi cards. I have had to shift credit several times in the past and Citi makes it very easy. They want to approve you!

Conclusion

By thinking outside of the box and taking advantage of the knowledge that others are receiving lucrative retention offers for the ThankYou Preferred, you may be able to get yourself a great deal down the line.

Even if that doesn’t happen, by converting your Citi Executive card to another product, you are helping to extend your average age of accounts and keeping credit alive so it can be used to shift around later if needed. Convert me to a ThankYou Preferred!

I just got upgraded from a secured diamond Citi credit card to unsecure diamond preferred credit card with the same credit limit I had on my secured card (only $800), the new card is not interesting to me as I don’t have balances to forward and pay my balances in full every months. Will Citi allow me to do a product change for a car that fits my needs more, like miles or cash back? And what credit limit will they give me? Same as the card I’m trying to change? I don’t want a hard pull if possible.

Thank you

Citi does not allow product changes from the Simplicity to any other card.

[…] Hacking Citi Product Conversions – Turn An Unwanted Card Into A Potential Points Machine […]

I have a Thank You Preferred Card, which I got in Jul 2013 with 21 months 0% APR, but with Zero TY points during Sign up. I was planning to sign up for another preferred card now which gives 30K TY points for signing up, because I never received any bonus from the “Thank You Preferred product”.

But this new language in the application set me back, “Bonus ThankYou Points not available if you have had a Citi ThankYou Preferred Card opened or closed in the past 18 months”

So should I close my “Thank You Preferred product” now and wait 18 months to get the bonus.

This brings in another question, what about AA Cards. I have AA Amex and AA Executive MC. I planned to convert the Exec MC to “Double Cash” once the $450 fee posts.

But do I also have to close all my AA card and wait 18 months if I need to get the bonus once again…

Citi used to be very easy 🙂

The Exec can actually be churned based on many reports. The regular AA card requires 18 months. As for the TY Preferred, the language is so poorly written.

It says you can’t have opened or closed an account in the past 18 months, but in your case you have done neither. I would call and ask, but the way I read it you should be able to get the bonus.

Thank you, Shawn

[…] few days ago I wrote about an interesting idea I had to convert an existing Citi card to the ThankYou Preferred in order to get one of the very lucrative retention offers that they have been handing out. This […]

I just tried to close my AA Exec and shift my $11k to my AA Plat and yes, they required a hard pull for the “increase”. When I asked about converting the card to ThankYou, they said I could do that but that I would NOT get any of the sign up bonuses and I’d have to pay the $125 annual fee that is going down to $95 in a month. So I’m going to close it outright once they approve the shift, and then apply at some point for the TY. Sucks because that’s two hard pulls.

Was the agent wrong? Has anyone gotten sign up bonuses when converting?

Strange things are going on at CITI, and here’s a new one: yesterday I called to cancel an old card ( wasn’t looking for a retention offer) and move the credit line over to one of my other CITI cards. I was speaking to a manager, not just a customer service rep. And do you know what he said? He started asking me questions like annual salary, employer, etc as if I were submitting an application! Just to move my own credit! With that kind of attitude and the AMEX “once in a lifetime” signup bonus policy I will soon be 100% CHASE.

Yes I can confirm Citi is treating credit line shifts almost like new applications. They are performing a hard inquiry and asking for income information,etc.

I don’t want to miss the opportunity to apply for the TY Preferred and receive a sign on bonus, so I think I’ll convert to a Double Cash since it doesn’t have one. Heard wildly good things about that card anyway.

[…] Hacking Citi Product Conversions – Turn An Unwanted Card Into A Potential Points Machine – A look at how to convert Citi products to take advantage of generous retention offers. […]

I’m taking a combined tack – I chose the Prestige card for the bonus and to retain the club (I’m an AA flier), and will then do the above and downgrade the Exec to TY to rack those points collectively, retaining the older, “regular” Citi AA card in a drawer for AAOA…

Not a bad strategy. Thanks Tim!

Tim, Did Citi do a xfer to Citi prestige card or did you submit a new application. I was told by Citi that they are having technical issues on conversion, not sure if this is a short term glitch or it cannot be done.

I’m taking a different tack – I chose the Prestige card for the bonus and to retain the club (I’m an AA flier), and will downgrade the Exec to TY to rack those points collectively, retaining a “regular” Citi AA card in a drawer

Hi Shawn,

Thanks for all the good information you share.

I have the Citi Aadvantage Exec Mastercard. I notice you recommend conversion to Citi Thank You when the fee comes due. My question is: As I have only one product from Citi, shouldn’t I just apply for the Citi Thank You and get the 50,000 bonus points? Then when the fee is due on the Aadvantage Exec card, drop down to another no-fee card? It looks like the annual fee is dropping to $95 in April, and is waived the first year. Thanks!

Dottie

That is the ThankYou Premier which is a good product and gives you the ability to transfer your ThankYou points. You could still apply for that and convert your Executive card to the ThankYou Preferred to earn more points. Of course the right thing to do depends on your situation.

As always, great info. I look forward to getting my first TY Pref card when my AA Exec AF comes due this summer.

You say: “… waited a few months to see if you are eligible for one of those nice retention offers? (Some experiences suggest you wouldn’t need to wait that long.)”

How long would you wait? Is there any harm to calling in too soon to ask (i.e. – having a record in their system of you calling in too often looking for offers)? Any data points out there on how often you can get these offers (how long after the 6 months before you call again)? Seems like a great deal for a no-fee card!

[FYI – I didn’t get an email about this post yesterday (usually get emails for all of your posts). The only reason I found this post, was the link from your AA Exec post from today. I checked my spam box, and nothing there. Not a big deal – just thought I’d let you know.]

There is no harm in calling sooner. In fact, some people have called shortly after getting the card. Unfortunately it is a guessing game to figure out how each card is qualified for each offer. Of course if you call in right away and don’t get a good offer, there isn’t anything stopping you from waiting and calling back a couple of months down the line.

As for the email, there was a glitch when I published that post, so I apologize. Thanks for letting me know it didn’t go out. Gotta love technology!

[…] Yesterday I wrote about a strategy that I personally used to convert my Citi Executive AAdvantage card to a ThankYou Preferred. (See: Hacking Citi Product Conversions – Turn An Unwanted Card Into A Potential Points Machine) […]

Hi Shawn,

Thanks for this great post. I want to share my experience in reference to this:

“Also, by keeping your account open, the credit line is available to shift around if needed when you apply for new Citi cards. I have had to shift credit several times in the past and Citi makes it very easy. They want to approve you!”

My experience: Have 2 Citi AA Exec MC and one of the card’s annual fee is due this month. Before I called retention department, I talked with 5 different customer service agents by doing HUCA to ask them to move my credit limits to other cards that I use more often, so in this case I have $10k CL on my Citi AA Exec and want to move $4k CL from it to my Citi AA Platinum Select. All the reps told me that moving the CL means decreasing the CL on one card and increase it on the other card, and it will be a hardpull and they need to verify the financial/income information again to request the CL move or decrease/increase the CL on one card. After I tried HUCA 5 times with 5 different agents on different days (they are pretty nice and professional and I know they want to help out, so I believe that it does really require a hard pull to move/decrease/increase the CL), then I decided to call the retention department to ask about retention offers, and the offer not really interest me (they offer me something like 1000 extra miles per $1000 spend /month for 13 months I think). I asked if the annual fee can be waived, the agent said unfortunately they can’t waive the fee. Finally I asked it to be converted to Double Cash and the agent did so without a problem and I would keep the same $10k CL.

My concern is, since you said that in the future “the credit line is available to shift around if needed when you apply for new Citi cards”, is this even possible without incurring a hardpull or providing financial/income info again as those agents told me? Maybe this only my experience and you or other people have different experience regarding moving/decreasing/increasing a CL of Citi card, please share.

If you try to shift credit lines from one existing card to another existing card they do a hard credit pull and ask for income info as you described.

When you apply for a new card and are trying to shift credit from an existing card, a new hard pull is not done for the shift. They have already done a hard pull for your new card application.

So their process really isn’t different, but you have supplied the income on your new card application and they pulled your credit as well so they don’t have to do it again.

Hope this helps!

….so there will be a hard pull when converting Citi Executive card to ThankYou Preferred?

No. There is only a hard pull when you want to close a card and shift the credit line to another card. There is no hard pull when converting a card to another product.

I see, it make sense now on what constitutes a hard pull from Citi. Thanks for clarifying, it really helps a lot!

Personally I think that this is kind of weird since there is no hardpull required when I did decrease/increase/moving my CL with Chase and Barclay. Not sure about Amex, anybody has experience with Amex on this?

Citi’s process is different depending on which bank you’re familiar with. I’ve always been a Chase customer and for Chase, no hard pull is needed whenever shifting credit lines from one Chase credit card to another Chase credit card.

I was told by a Citi customer service person on the phone that I needed to have my Citi Exec AA for at least a year before they allowed a conversion. Is this true? Or was she lying to me?

Yes that is their rule, although I know of people who have been able to get a conversion before then. (YMMV) In scenario though, just wait until the annual fee posts after a year then convert.