Club Carlson Bonus Award Night Devaluation

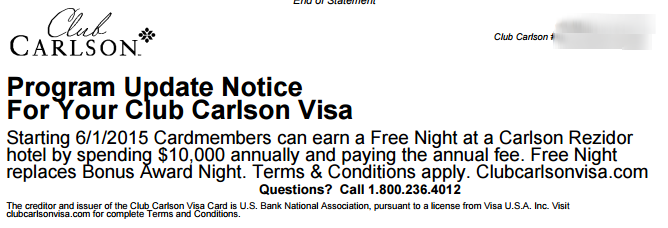

In case you were under a rock for most of the morning, Frequent Miler discovered that Club Carlson is devaluing by removing the Bonus Award Night benefit from their co-branded credit card. To replace that benefit, they are offering a free night annually with $10,000 in spend.

Before I go any further, take a look at my first sentence. The key part of this whole thing is that Frequent Miler (or one of his readers) discovered this change since it was printed on their statement. I have seen many people today refer to the “announcement”, but in reality there wasn’t one initially. Someone discovered this little blurb slipped into the bottom section of the last page of their statement. That is how the world got to find out.

You would think a company like Club Carlson (Carlson Rezidor) who has an overall good reputation in the community and who holds great promotions and Twitter contests would think far enough ahead to actually inform members of upcoming changes. In this case it doesn’t seem like they felt an announcement was important. If they did, then why not come out and say it?

Of course later in the day after many of their members shared outrage, the company sent out an email announcing the change. They also offered cardholders 30,000 bonus points after an upcoming stay which is nice, but it almost seems like too little too late. Where was this email before the news broke? Why was the only announcement in the form of a small blurb on the last page of a statement. A page that is otherwise blank and is easily overlooked I may add.

When Was the Announcement Added to Statements

After reading this morning’s news I logged into the two Club Carlson credit card accounts I have access to. One had a statement printed on March 19 and it didn’t have any word of this change. The other account’s statement printed yesterday and it had the infamous news printed on the final otherwise blank page.

So sometime between March 19 and yesterday they decided to start telling customers about this monumental change on their statements, but for some reason they didn’t feel it was important enough to announce publicly. How can they do such a good job of getting the news of their Twitter party out there, but fail to communicate such an important change?

I Don’t Hate Them

Unlike some I am a realist. Corporations are in business to make profit and I am sure this change is being implemented because the Bonus Award Night benefit costs too much money. Pretty much every blogger including myself has called the Bonus Award Night unsustainable since the card first came to market a couple of years ago.

My real issue isn’t with the company making this change (although it makes their program significantly less valuable in my opinion), but with how they dropped the news. Now to be fair U.S. Bank may have mistakenly started announcing this before Club Carlson was ready, but I find that unlikely given the benefit is going away in less than 2 months.

Their Biggest Mistake

Of course I don’t know, but I honestly think U.S. Bank and Club Carlson thought they could follow their legal requirement of disclosing this news on statements and that it would sort of go unnoticed. If that is indeed what happened, what a huge mistake. There is only one thing worse than heavily devaluing your program and that is being disingenuous about it.

Club Carlson and U.S. Bank may have had to make this change for business reasons, so I can’t fault them on that. The free market will ultimately determine if it is the right move for them. With that said, the way this news came out is disappointing and makes me doubt the company and the Club Carlson loyalty program going forward.

Conclusion

Hopefully Club Carlson will learn their lesson and be more transparent when the next devaluation comes around. It is a mistake to undervalue the importance of honesty and respect when dealing with your customers. Now lets pray that all of these 30,000 point bonuses don’t force the company to “announce” another devaluation soon!

[…] happened to the Club Carlson credit card over the past few months. First U.S. Bank and Club Carlson removed the Extra Bonus Night feature and then Club Carlson devalued pretty […]

[…] that number goes up to an astronomical 60 points per dollar. By combing this new promotion with the 30,000 offer for cardholders, you can get a nice chunk of points for not much money. Make sure to register […]

The Club Carlson credit card sign up page still shows the last night free offer. Since they are changing this they should stop misleading future card holders and take this down.

[…] with Grant, but it’s also been covered by Frequent Miler, One Mile at a Time, Mommy Points, Miles to Memories, View from the Wing and just about […]

THE LANGUAGE, the agreement we signed up for CLEARLY SAYS GET THAT 2nd free night AFTER PAYING THE $75 FEE. They have to live up to their terms & conditions here!

I can guarantee you if you file CFPB which is very easy to do on their website, and include this language , you will get the $75 refunded back and would also teach them a lesson on not to cheat us like this.

The only reason i have this card for 2 yrs is becos of the 2nd free night to use at their very rare radison blu properties.

all others like country inn and park inn are same or equal to cheap motels. low quality!

Their gold status is total worthless!

[…] Club Carlson is devaluing, too – but not in the good way. Miles to Memories explains […]

@Richard: Lesson learned… don’t hoard your points or miles. This stuff can happen anytime and you are stuck. While it sounds great to say you have 600,000, you have only 300,.000 next month. You better start booking.

CC made a mistake. This was similar to the Southwest Companion pass. That grows undying loyalty. CC is now just another hotel I will use when I fits me. I will not seek them anymore.

How many people did not receive the 30k bonus offer? It’s not in my email announcement at all.

I have yet to receive any notice of this, but do see it on my 4/1 billing statement on the last page. I think they’re frantically sending out these emails manually to appease the wave of complaining customers, but not getting to everyone.

CFBP definitely needs to be notified. They’re selling one service with their annual fee, then taking away the main benefit.

I received the email this morning, but no 30K bonus. This is definitely targeted

Club Carlson has confirmed via Twitter that all cardholders are eligible even if it wasn’t mentioned in the email.

Well written story and I completely agree with you. When a company (or person) has their integrity questioned its time to evaluate your relationship with them.

I’m more interested in the extent of their acknowledgment of their poor handling of the issue. In many ways this is more indicative of their integrity than making a mistake, which obviously happens to every business and person alike.

There really hasn’t been an acknowledgement. Sure they sent out an announcement later in the day, but that was only in response to the story already breaking. I agree that we can’t write them off. Lets see how things develop going forward.

Does that mean you can no longer use your 600k points on your trip?

Do you think they will still honor any prior reservations made for summer travel. I have 4 nights in London (2 seperate stays) and two nights in Paris already booked. Will they still honor the free night? Lastly, I just purchased 50,000 CC points at the dailygiveaway last week and was going to use them in Switzerland for the same trip in August. I would have never purchased those points if I knew the free night was going away.

All reservations will be honored and you can still book new reservations with the Bonus Award Night until June 1, 2015 according to their email.

But the key question really is:

As a current cardholder, if you book a stay before June 1 with the bonus night for a stay late in the year, and then later you cancel the card to avoid paying the annual fee, and therefore are not a cardholder at the time of your stay, will they honor the bonus night?

I have been saving my points & have encouraged my wife to get this card. She did & now we have 600,000 points between us .I was planning a long trip to France next year. This is totally devasting! I hope you bloggers don’t try to rationalize this & keep pimping this card!

No rationalization here, although I don’t have any direct links. I plan to do a write up when the dust settles about the value of the card going forward.

Devastating? You have two full months to book your trip at the current rates. Get working on it.

I wonder what happened to all those people who were begging for CC points few weeks ago not raising any voice against CC today in Twitter. At times human behavior puzzles me.

@Michael File a complaint with the Consumer Finance Protection Bureau consumerfinance.org I filed a complaint based on the purpose for paying the annual fee includes a certain set of benefits that have since been removed, in part before they can even be used by new cardmembers. USBank has already told me they will not be waiving/refunding the annual fee so I filed complaints with them at the DC Office of the Attorney General. I want my annual fees back.

I am expecting $75 fee credit very soon after CFPB complaint.

THEY don’t live up to your terms! I am supposed to get 2nd night free with the card per agreement after paying the $75 fee. when you file the complaint which is super easy,You just include their own agreement and your own 2 sentences.

Nice analysis of the whole situation as a blogger but as a reader i don’t have anymore loyalty to club carlson for the way it has decided to treat its loyalty as stupidity. Same story with all hotels, airlines and banks. CC is worst. Promoting all those useless points in Twitter all these days and keeping quiet about this massacre they had planned. I think other hotels like Wyndham and Hilton knew this is going to come and have changed the program or increased cdt card bonuses. Next due is southwest in couple of weeks. Then soon the big one from American followed by some other airline/hotel. This goes on and on. I think these loyalty programs are like drug addiction. Luring customers by showing them the carrot, ensuring that many are in and screwing them ultimately. Enough of this nasty game. I think cash is king for all – rich or poor and it is better all credit card users and MSers focus on cash for ongoing MS and use these companies only for the signup bonuses and show that consumers can screw these companies as well.

I wish you all the good luck my friend trying to buy biz tkts for a family and ‘Vendoming’ by MSing for cashback.

To each his own.

I don’t have the urge to travel by biz or to vendome. Even if that is the case, churning and signup bonuses are sufficient for most. Agreed, to each his own but at the same time, no one can deny the fact that cash is king for all.

Having just signed up for this card 2 months ago, it almost feels like bait-and-switch (although I realize technically it isn’t)… To make it even more annoying their website is still pushing the award night bonus today as a reason to sign up for the card… This is one card I won’t be renewing.

I agree it is in really poor taste to still have that language up on the website, especially considering people may be applying based on that benefit.

Note that the annual free night after $10k spend can only be used for Carlson properties in the US. This was only mentioned in the email notice they sent out today, not in notice on the account statements.

Free night only in US is devastating. I’m fairly sure I’m gone now.

Well, I guess this is one card I don’t have to worry about applying for now!

I am with you. With all the people having problems with US Bank’s fraud alert denials and closing of accounts and just being a difficult bank to deal with in the first place, I had thought of signing up for this card for the 85k bonus and free nights on redemption.. Now that that’s gone.. there is no reason to pursue Carlson as a hotel chain of my choice.

We’ve all just got to take this in stride and re-evaluate our loyalty/credit cards. I was disappointed for sure but have already moved on to evaluating how to squeeze all I can out of the new T&C.

Today on MommyPoints she posted that the terms of the 1 free night after 10k annual spend would be good at only US properties.

I’d love some verification on this.

And if Club Carlson is reading this, I was totally on board with maintaining my credit card/loyalty with you, but if you make me only redeem my free night in the US I’m out!