Disclosure: Miles to Memories has a direct affiliate relationship with Discover, but I am not including direct affiliate links in this post. If you would like to support the site, you can click the Discover it Miles card on the right sidebar or find a link on our Value for Value page. Thank you for the support and feel free to contact us any time with questions.

Discover it Miles – 3% Back Everywhere (For 1 Year)

I had been hearing rumblings of a new card from Discover focused more on travel as opposed to cash back. Today Discover finally made the Discover it Miles card official. (Thanks to Frequent Miler for tipping me off and providing amazing insight.)

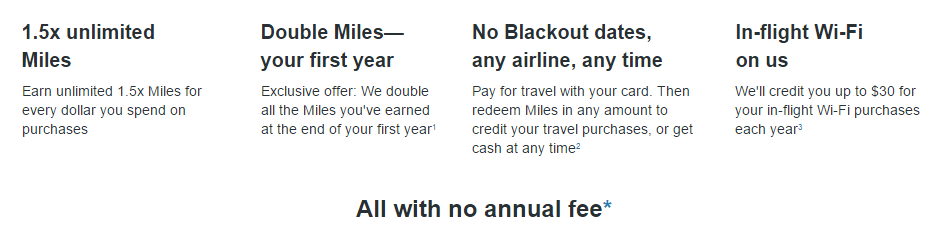

Just like the normal Discover it, the new Miles card carries no annual fee and provides a free FICO score, but there are many differences as well. Lets take a look at the card in depth.

Earning

First off, “Miles” are earned at 1.5X on all purchases. All miles are worth $.01 and there are no bonus categories. Essentially this is a 1.5% cash back card. Not great when compared to the Arrival Plus (my review) or Citi’s Double Cash, but that isn’t the end of the story.

While you won’t get anything other than a 0% promotional offer for signing up, Discover will double the miles you earn at the end of your first year. So basically, this card pays 3X on all purchases the first year. Good stuff!

Unique Features

The Discover it Miles card has a few unique travel features:

- Free overnight card replacement at home or away, to any U.S. street address at your request.

- $30 back each year for in-flight Wi-Fi purchases.

- Redeem your miles for any amount to credit your travel purchases from your statement or get the cash at any time.

I guess the free overnight replacement would be good if you lose your card while traveling in the U.S., however I don’t see that as much of a benefit. The $30 in free Wi-Fi is nice though and I am glad that brought in the same “any amount” redemption model the regular Discover it card has.

My Take

With its first year 3X earning, the Discover it Miles is perhaps the best card for everyday non-bonused spend. Unfortunately that truth doesn’t hold up until after the first 12 months, but this is a new product and things can always change.

If you can only get either the regular Discover it (my review) or the Miles version of the card, I would have to say the new Miles version wins out. 3X everywhere is just too good to pass up even if it is only the first year.

Conclusion

I have made it clear on several occasions that I am a huge fan of Discover. This card has a unique take on the Discover model, but it still has the great benefits I have grown to love from the bank. With the addition of 3X everywhere the first year, I think they have a winner and a contender for a top spot in your wallet.

[…] couple of weeks ago Discover launched their new travel branded product called Discover it Miles. The card is similar to the normal […]

[…] New Discover it Miles Card Launches – Earn 3X Everywhere the First Year! […]

What do you mean by “if you can only get the regular Discover It or the Miles version”? I’m relatively new to the game, and the regular Discover is my second-oldest card; don’t want to shorten average age of accounts by getting this one if I have to drop the It version. Yet I used your link and was informed the old version is what I’m offered. How many Discover cards can you have?

I have been planning on staying at a Universal Studios, FL hotel this summer and just found out Discover cash back can be applied at a 1:2 ration at Universal Resorts! That sounds pretty good to be, especially when staying at the resort gets you to the front of the line on rides.

Candace, I assume mean 1 Discover point for $.02 credit?

This offer comes as no surprise. Happy it finally rolled out.

Reading the terms for miles redemption, it states you can redeem for cash back or use for miles. If I get this card I’d want to use for the 3 % cb. It doesn’t state however what the value is and if there’s any loss in taking the cb route. I’d have to call them (which is weird) to find out apparently.

I smell some nice MS opportunities for a year if they don’t devalue as cb.

Hard to tell but I think the cash back is if you have already paid your statement. I think you will need qualifying travel purchases to redeem, but it isn’t 100% clear.

Here are the terms:

Starting at 1 Mile, you can redeem for cash as a electronic deposit to your bank account or for a credit for Travel Purchases on your statement made within in last 180 days. Travel Purchases include airline tickets, hotel rooms, car rentals, travel agents, online travel sites and commuter transportation. Redemption may be delayed up to 48 hours if your card is lost or stolen. See Miles Terms and Conditions for details.

Just found it on their second page:

“Any way you redeem, 1 Mile is the cash equivalent of 1 penny.”

So it seems it’s effectively a 3% cash back card for the first year. With these terms, I don’t see what the point of keeping them as miles is when there is no loss in value in the conversion to a cash redemption.