Flying Blue Elite Status

I described last week my first experience booking an Air France La Premiere award with only a brief reference to reaching Flying Blue Platinum, the level required to book it. Like many airline loyalty program setups, various methods exist to meeting it – including flights, credit card spend, or a combination of those and other methods. I focused on the second path. It was a bumpy, circuitous one with distractions, dead ends, and hazards along the way. Not every effort was successful, but I always kept in mind my intended destination. A hobbyist considering Flying Blue elite status through spend – whether exclusively or partially – should chart a path (as best one can) before getting behind the wheel. Today, I’m discussing topics which can inform that plan. So before the wheels fall off my metaphor, I’ll get on with it. But first, I’m resetting Bank of America’s Air France card refresh and sharing my initial take.

Bank of America Air France KLM Visa Signature Card

The Bank of America Air France KLM World Elite Mastercard is now a Visa Signature card for new applicants. Current cardholders are being transitioned, with new cards set to mail on 20 Mar. But the following primary changes were effective 16 January:

- Cardholders earn 3x on dining

- Cardmembers pick up 80 XP after spending $15k in a cardmember year

- Cardholders obtain an additional 60 XP for spending $25k in a cardmember year

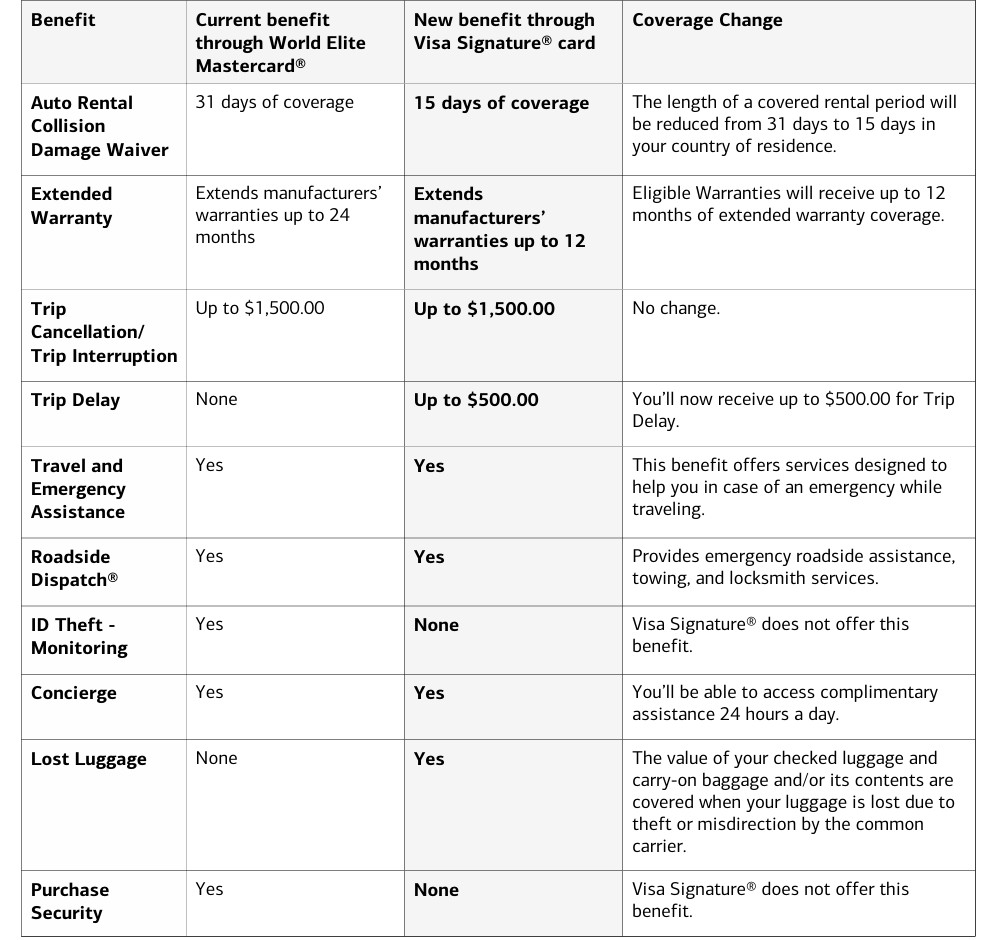

A few other benefit changes are effective 20 Mar. Here’s a summary:

My Initial Take

I’m pleasantly surprised at these card changes. This card was untouched for several years, and I inevitably expected a devaluation of certain benefits. But not only did the annual fee and many benefits remain the same, a few key ones improved. Cardmembers can now earn 3x on dining, an earning rate previously only for purchases on Air France, KLM, and other SkyTeam airlines. (Earning remains 1.5x everywhere else.)

More importantly, the card has substantially improved earning “XP,” experience points for meeting elite status. Cardmembers still automatically earn 20 XP at account anniversary. But perhaps the two biggest improvements are:

- XP earn after $15k cardmember year spend has doubled from 40 XP to 80 XP.

- In a completely new development, cardmembers can now hit a second big spend bonus at the $25k threshold to pick up another 60 XP.

I would’ve been fine with things just staying the same. Indeed, we live in a world where I often consider no devaluation a positive by itself. Now, I earn 80 XP on something I was already doing for 40 XP. And for only $10k more, I can obtain another 60 XP per account anniversary. I’m still astonished at these improvements while the card maintains its modest $89 annual fee.

Of course, a few other changes are occurring (some negative, others positive) for certain benefits which I consider secondary (if at all) for my situation. See the table above.

Spending for Flying Blue Elite Status – What to Consider

For most of you, I’m pretty much done with the good news. In my view, only a small portion of hobbyists come out ahead pursuing Flying Blue elite status through spend. An even more miniscule portion will enjoy that journey, whether it’s to Silver, Gold, or Platinum. Let’s get into certain parts of that challenge.

The Flying Blue Program’s Structure

In my view, earning elite status with the majority of airlines’ programs is like playing checkers. With Flying Blue, it’s chess. From the bottom, a member must earn 100 XP to reach Silver, the first elite level. Most other programs continue tracking a member’s total elite earn in a previously-set timeframe, but not so here. Once a Flying Blue member reaches Silver, both earning and the clock is reset. A member has a fresh 12 months to earn another 180 XP to become Gold. Likewise, once to Gold, a member has a new 12 months to earn 300 more XP for Platinum.

I may have lost some of you by now. Fair enough! For those still interested, let’s move on.

Bank of America Application Rules

While not the worst of all bank application rules, Bank of America’s are just enough of a speed bump to slow down or completely stop certain aggressive hobbyists. Let’s take a quick look:

- 3/12 and 7/12: Individuals generally won’t be approved for a new Bank of America card if they’ve obtained three or more cards from any bank in the past 12 months. For Bank of America deposit account holders, change that number to seven or more.

- 2/3/4: Individuals can obtain two new Bank of America consumer cards per rolling two months, three new cards per rolling 12 months, and four new cards per rolling 24 months.

- 5 Cards: Bank of America generally limits individuals to five personal cards.

And one must also consider this language from the Air France card’s welcome offer. The offer terms state, “limit one opening of account XP bonus offer per Flying Blue member for each Air France KLM credit card account opened within a 24 month period.”

I’m confident I’ve lost even more of you now. Between Bank of America’s rules and many hobbyists’ other BoA card priorities, Air France card(s) may not fit. But for those still in, let’s consider perhaps the biggest challenge.

Timing

Those still interested must overlay the two above requirements to ensure they obtain the right amount of XP to get to the next level in the program, and most will want to repeat it again. Indeed, very few – if any – of you would be happy just picking up Flying Blue Silver, whether it’s via an elevated welcome offer or big spend within a cardmember year. (Of course, look for other opportunities to jump-start your Flying Blue status if they align with your goals.)

Unfortunately, much of the Flying Blue elite status climb involves personal trial and error. When I started out this process, I made mistakes. But even when I understood everything on paper, I had to put faith into how and when certain activity tracked and posted to my Flying Blue account (for better or worse). Again, things don’t always go as planned, and one must build in some room for error on timing everything, especially XP posting. There’s how things are supposed to happen, and then how they actually do. Again, in our hobby, this can work out for or against us, depending on the situation. Alas, even with planning, those of you looking to spend to Gold or Platinum should be ready to take on a substantial amount of uncertainty along the way. You may find yourself not knowing how something will truly work out until you’re already pot committed.

Spending and Program Assumptions

Achieving any level of Flying Blue elite status, especially beyond Silver, generally involves not-insignificant spending over multiple years. While techniques change over the years, I’ve been lucky and curious enough there. But not everything is within our control. Options are dynamic, and of course, there’s risk that individuals lose the ability to reach spending thresholds along the way. Even more unknown is the state of the Flying Blue program. Air France/KLM could suddenly, substantially tweak Flying Blue, changing elite qualification, devaluing benefits, or both. One must calculate all of this into their plans before initiating such an endeavor.

The Upside

But back to being pot committed. When things worked out for me – along the way and upon reaching Flying Blue Platinum – the senses of satisfaction and accomplishment were real. I also know how silly this may sound to many within and beyond our hobby. There were surprises and mistakes during the process, but I look back and appreciate them. They made the accomplishment taste even sweeter. The Flying Blue program doesn’t make it easy, but I was also looking for a new challenge all those years ago, anyway. Some of you may feel the same now.

In terms of requalification, I’m also being rewarded. In a sense, the climb to Flying Blue elite status can be tougher than staying there. I “just” need to earn 300 XP every twelve months in order to maintain Platinum. The next goal is to reach lifetime Platinum after ten years at that level. Interestingly, this refreshed card can help expedite that goal (a bit). But first, the card’s benefits (among other things) need to hold up for several more years. We shall see.

Conclusion

I intentionally wrote this article as NOT a step-by-step-how-to-do-everything guide for obtaining Flying Blue elite status. Like many hobby pursuits, it’s a personal one which can vary by the individual, and any curious person must take ownership of it. This angle is for a small portion of Flying Blue enthusiasts with a particular tolerance for the long play.

Allow me to end where I began. The recent changes to the Air France credit card make elite qualification a bit easier, but intrigued spenders should still be ready for a multi-year investment. Flying Blue elite status and obtaining it via spend certainly aren’t for everyone. But for the curious few out there, Godspeed!