Fraudulent Credit Card Application

It’s one of the calls that no one ever wants to receive. The call that sends your mind into a panic and makes your stomach sink into the floor. Yesterday I got that call. Someone placed a fraudulent credit card application in my name. Let’s take a look at what happened and then I’ll explain ways you can protect yourself if you are in the same position.

The Fraudulent Credit Card Application Phone Call

Yesterday afternoon I missed a call from 855-522-7663 which so happens to be Capital One. The voicemail went something like this, “This is an important message for Mr. Shawn Coomer from the Capital One Fraud Department. We are calling in reference to a recent application….”

I didn’t notice the voicemail until the evening and once I discovered it I searched the phone number on Google to verify it was legit. While I eventually discovered it is, I noticed a lot of people had reported 855-522-7663 as a scam number. Just to be sure I did a little more researching before calling in. Thankfully that is genuinely the Capital One Fraud Department.

Credit Monitoring Helped Me Confirm the Fraudulent Application

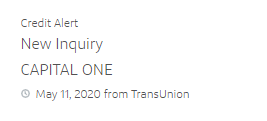

I have free credit monitoring through Capital One, Discover and various other places (see links below) and thus had received an alert when this application was placed. I want to step back and say I did place a legitimate application with another bank on the day before this happened, so the alerts initially weren’t concerning.

To verify the Capital One application was legit, I logged into my credit monitoring and did find the inquiry from Capital One on my credit. Ouch! Someone had definitely placed a fraudulent credit card application in my name and thankfully Capital One caught it!

Calling Capital One About the Fraudulent Credit Card Application

By the time I heard the voicemail and did a little research to make sure the call was legit, the Capital One fraud offices were closed so I called the next morning. Upon calling I was immediately connected to a representative who asked me very limited information. All I needed to provide was my name and application number and eventually the last four of my social security number.

The representative was friendly and explained that he had cancelled the application. He also went on to describe ways I could protect myself from identity theft and how I could place a fraud alert on my credit report. I’ll share that information below.

Which Credit Card Did the Scammer Apply For?

While I wasn’t able to get a ton of information about the scammer who placed the fraudulent credit card application, I did get a few tidbits of information. Said lowlife applied for a Capital One Quicksilver One card. He/she also asked for it to be shipped to Greenville, MS which is a small town on the Mississippi/Arkansas border.

How to Protect From Identity Theft with Fraud Alerts

At this point the scammer hasn’t applied for any other credit in my name as far as I can tell. I do have alerts setup with multiple redundancies so I expect to be notified of any application in almost real time. With that said, there are a couple of things that can be done to provide further protection.

Freezing Your Credit

If you aren’t applying for a lot of credit you can now freeze your report with each of the bureaus without a fee in most cases. Freezing your credit report prevents anyone from accessing your credit file which helps to keep you safe. Of course you’ll have to unfreeze it to apply for any credit so keep that in mind.

1 year Fraud Alert on Credit Report (Initial Fraud Alert)

Another option is to place a one year temporary fraud alert on your credit report. This is free and each of the bureaus allows it. I do believe if you place an alert with one bureau that they will inform the others, however I would probably just place an alert with all three major bureaus (Experian, Equifax and Transunion) just to be safe. There shouldn’t be a cost for this type of alert. I’ll link directly to each of the bureaus below so you can grab more info if you need it.

7 Year Fraud Alert on Credit Report (Extended Fraud Alert)

You can also file a police report and/or report this identity theft to the FTC in order to get a 7 year extended fraud alert for free. Capital One advised that local police departments can be difficult to deal with and recommended going the route of the FTC.

Important Identity Theft Fraud Alert Links & Phone Numbers

Here are some important links if someone applied for a credit card in your name and you need to place a fraud alert and/or report the theft to the FTC.

- FTC Report Identiy Theft – https://www.identitytheft.gov/

- FTC Fraud Alert Info – https://www.consumer.ftc.gov/articles/0275-place-fraud-alert

- Equifax Fraud Alert Info – Equifax.com/personal/credit-report-services or 800-685-1111

- Experian Fraud Alert Info – Experian.com/help or 888-397-3742

- Transunion Fraud Alert Info – TransUnion.com/credit-help or 888-909-8872

Free Credit Monitoring Tools

I highly recommend that everyone subscribes to free credit monitoring at the very least in order to protect against this type of fraud. There are many paid services like Lifelock that can provide additional levels of protections as well.

Here are a few free credit monitoring tools that I personally use:

- Credit Karma – I’ve been using this service for 5 or 6 years

- Capital One CreditWise – Free for everyone. You don’t have to be a Capital One Customer.

- Experian Free Credit Monitoring

If you are a Discover cardholder their alerts work as well. More info here.

Fraudulent Credit Card Application – Bottom Line

Someone placed a fraudulent credit card application in my name and it sucks! I’m glad that Capital One stopped the application, but now I have to be even more diligent in protecting my credit and finances. While having a fraud alert on my credit will be a pain, it will ensure I am contacted whenever someone applies for credit in my name which will give me some peace of mind.

Have you ever had someone fill out a fraudulent credit card application in your name? What did you do when you found out they applied for a credit card without you knowing? Share your experiences in the comments!

Interesting how you can’t link to a single instance of this being a legitimate phone number.

ZERO

Got the same call, same number and since this seemed suspicious, called Capital One main number. No account was opened or attempted to open on their end. Do not call back!

[…] 2. Fraudulent Credit Card Application: Did Someone Apply In … […]

This 1855 number given by shawn is highly suspicious. I cannot find it anywhere on capital one website. infact I called capital one’s direct nubmer found on their website, no one ever heard of this 1855 number. For all we know, this Shawn Coomer could be working for or with the fraudsters.

Do not call this 1-855 number. instead go to capitalone.com and call themd irectxly

That number turned out to be legitimate based on my communications with them at the time (although I have no current knowledge of if it is used), but the best idea if you are weary is just to call the number on the back of your card and ask to be transferred over to the fraud department.

I agree with most people who said to just freeze your 3 credit reports. I had this happen to me last year. The issue didn’t stop there. My info was obviously out there, so the fraudulent credit card applications continued for about 2 months. Of course, after the first attempt, I froze my credit with the 3 bureaus. But even with a frozen credit report, someone can still apply. Naturally, they will always be DENIED with a frozen credit report. So you should re-thing your strategy. It’s the same hassle to freeze/unfreeze as it is to place calls to Fraud Departments. Six of one, half dozen of another.

[…] Rewards Visa card (it is really not, especially in these pandemic times!), here comes Shawn with: Someone Applied For a Credit Card In My Name & What To Do If It Happens to You. This sucks and takes time to take care of it. So, when other bloggers who specialize in selling […]

Something to think about: Once your information (name, address, SSN, etc.) is out there, it’s out there forever.

When someone did this to me, they were at an Apple store and had a handful of iPads, phones & accessories. They were trying to do “instant credit” and would have walked out the door with thousands of dollars in brand new merchandise.

They had all of my data: SSN, mother’s maiden name, etc. The only thing they did wrong was using an old address. That tripped the fraud alert and they tried “Plan B” — running out of the store with the loot. (They got caught.)

From that day forward, I’ve had my credit frozen. It’s fast & easy to open back up as needed. (I’ve learned to just ask up front: “which agency do you use?” to get ahead of the curve.)

Would you rather find out that the fraud has already occurred with a merchant that didn’t have a robust fraud team, or prevent it in the first place?

And — no doubt — whoever has your data and lost out on “sharing” your good credit has certainly cut their losses by selling your info to the next person that will make a run at you.

Aren’t there a couple of smaller credit reporting agencies that become the default when the big 3 are frozen? I recall something about people using a credit freeze as a way to circumvent having too many inquiries with the big 3.

No, don’t do a fraud alert! It’s a pain when you apply for a CC.

Instead, just freeze and un-freeze your credit reports as needed.

It’s just not smart to leave your credit reports open. Freeze all three and this won’t ever happen. Takes 5 minutes to unfreeze when you need to apply for a card and you can set the temporary thaw to expire next day so you don’t even have to manually reapply the freeze. Credit 101 stuff.

Freezing your bureaus is overkill for most poeple. Especially people who utilize their credit often. It’s definitely not credit 101, but if it makes you feel safer than go for it. It requires a lot of time and effort for little gain when you can setup credit monitoring to protect yourself and not have to deal with all of the hassles of freezing and unfreezing. Now, if you are compromised then freezing is definitely a good idea as is a fraud alert for an additional level of protection.

Hi Shawn,

I think you may be missing a key issue. With your details it is unlikely the fraudster will stop. This means there will be numerous hard pulls against your SSN which will probably tank your FICO and thus damage your own ability to apply for credit. The freeze and unfreeze when needed is the smarter play. This can be done online, so low hassle.

Q: Did Cap One do a hard inquiry on all 3 credit bureaus?

Yes.