Gift Card Zeroed Out – Terms & Conditions

We talk about gift cards A LOT on this site. Not only do I make money and earn a lot of travel rewards by purchasing and selling gift cards, but I also use them quite often to save money on both personal and business purchases. So yes gift cards have been good to me, but there is one huge down side. THEY AREN’T MONEY!

Gift Card Terms & Conditions

What do I mean by that? When you are given a $100 bill are you provided with pages of terms governing that money? No, for the most part $100 is worth $100, but that isn’t the case with gift cards. While there are some rules governing gift cards (and they vary by state), for the most part gift card balances can be taken away if you are perceived as violating the terms.

And that happens. Mark previously talked about how Kohl’s does this and recently Vinh at Miles Per Day posted about how Amazon initially tried to take his gift card balances for some unknown terms violation. He got his money back without much hassle, but that doesn’t always happen. For example I am out a couple of hundred dollars from The Children’s Place hack and then there is Build-A-Bear.

Build-A-Bear Gift Card Drained

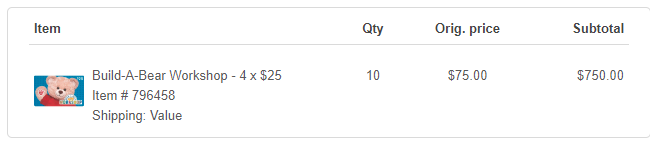

I used to buy/sell a few items from Build-A-Bear and used discounted gift cards to save even more. One day Sam’s Club had a nice sale offering these cards for 25% off. Knowing I would have some upcoming purchases at Build-A-Bear, I bought $1,000 worth of cards for $750.

One of the main reasons I went this route (even buying more than I needed immediately) was because I was buying these cards first hand from an authorized seller and thus should have more security with them. But what happens when the brand cancels your order, drains your card and then gives you a run around?

Well, when I placed an order for a few hundred dollars after receiving the cards, they flagged me in their system as a reseller and cancelled my order. Apparently they don’t like to sell to resellers which is fair enough. The only problem with this is that they emptied the gift cards when I submitted the order, but never credited back the amount when they cancelled the order.

We are in the process of escalation with them, but getting any help has been tedious. We have been told we violated gift card terms (which we haven’t), have been told to ask Sam’s Club and even more ridiculous stuff. Getting someone who knows what they are doing and is empowered is a joke. We ordered something. They took the money off of the gift cards. They cancelled the order. They never returned the money. Pretty simple right?

Not Just Build-A-Bear

This phenomenon isn’t just confined to Amazon and Build-A-Bear. Gift cards are not cash. They are pieces of plastic governed by a long list of terms you agree to when buying them. If you violate or even seemingly violate the terms then the brand can just take them or at least attempt to. I know for a fact that Walmart and Target have both taken similar approaches for online orders for example. I only use their gift cards in-store because of this.

There is a ton of fraud in the gift card space and for the most part brands are just trying to protect themselves. There are real bad guys who are violating terms and costing everyone a lot of money and sometimes we get caught in the middle. I am glad to see Amazon quickly fixed Vinh’s issue and just wish my pursuits with Build-A-Bear were more fruitful. In other words I understand their need for rules & caution, but don’t appreciate their bureaucracy and customer unfriendliness when it turns out we aren’t the bad guys!

Gift Card Best Practices

While the downsides of gift cards are something that everyone should be aware of, they also have very many good uses. Here are some things I do to ensure I have a good experience buying and using gift cards.

- Keep your receipts – You never know when something could go wrong and you will need to prove that you bought a card. Good record keeping always wins over bad record keeping.

- Secure your cards – If you aren’t going to use a card right away, secure it along with the receipt so you don’t need to search for documentation later if anything goes wrong.

- Be careful when using online – When you use a card in-store it is wiped and done when you complete the transaction. When shopping online orders can get cancelled for a variety of reasons. In many cases gift card balances aren’t proactively returned. Using gift cards in-store is much safer & having a tracking solution for online orders is essential.

- Make sure your savings are enough – If you aren’t saving money by using a gift card, then don’t! I only use gift cards when my savings is significant enough to measure. If I am going to save 1-5ish%, I would rather just use my credit card where I have far more protection.

If I could sum up my best advice it would be to keep good records, be careful about where you source gift cards, make sure they are saving you money and then to still be cautious about using them at some merchants.

Conclusion

Gift cards are a double edged sword. During my dealings with Build-A-Bear and other companies I have found that gift cards aren’t as safe and secure as once thought. Thankfully though they are still a tool I use to both generate money and points, albeit with much wider eyes than before.

Have you ever had issues with merchant gift cards? Share your stories in the comments!

Why even buy gift cards in the first place? Other then needing to make minimum spend on a credit card. I guess if you ever have to buy them. Make sure they get used while you can still dispute the charge with your credit card company.

Purchased a Target GC from Staples a few years ago. I never received my virtual gift cards and finally got them a month later after numerous calls to Blackhawk network as Staples refused to help.

Went to use them and they were showing as cancelled on Target’s webite. Took me six months of runaround and passing the buck fighting this. Blackhawk, no Target, no Staples is responsible. Blackhawk kept saying cards were good and target said Blackhawk had cancelled them and flagged as stolen. Blackhawk kept saying they don’t “do that”, Target kept saying sorry but they’ve been flagged as stolen. Even tried a chargeback with my CC which got me nowhere.

Don’t get me started about the “We don’t cash out gift cards”, “We cannot cash out gift cards” BS I get when I have less than $10 on a non-promotional merchant (not VISA/MC) gift card at merchants in California! With the exception of Starbucks (which I have not done, but I have witnessed was a painless transaction) there’s always some drama over the cashier not knowing how to do this, or knowing that it’s LAW in California.

Point is, unless you are buying direct and using it for your own purpose, this experience of money on hold is BS.

This is great. I want to resell gift cards later, & this is good to know. Thanks so much.

Stop trying to pick up nickels on the sidewalk in front of the steamroller.

Reselling is a sucker’s game. You make a couple percent after all the fees and trouble and expose yourself to problems like this.

I only buy gift cards that I plan to use (over $10k/yr), and average a 15% discount. That includes gas, groceries, Uber, etc. If your discounts are so good, why give them away to others for a couple of bucks?

@JASON SMITH

I really understand your situation and what happened.

I should tell you that what happened with UPS (refund to shipper) is the normal procedure, they are giving the refund to the party that ships and pays them. The policy makes business sense. When I purchase something the vendor is responsible and if there is a problem it is their job to resolve it.

I would think you could, once again, contact TI and report the shipment as never having arrived. By this time, if they bother tracking, they will have a note from UPS showing a problem with delivery and you should be home free. Then again, as a teen when the first calculator came out, TI refused to stand behind a defective calculator and implied that I was wasting their time.

I made the mistake of using a prepaid visa gift card to purchase extra charging cables for my kids graphing calculators ($36 worth). I ordered them directly from Texas Instruments. Well, UPS claimed they delivered the package but we never got it. I called TI and they told me I had to deal with UPS. After a couple of calls to UPS, they finally got the driver to admit that he delivered it to the wrong house and they tried to get the package back but couldn’t find it. So they filed an insurance claim and UPS refunded the money back to Texas Instruments. I called many times over the next 3 weeks, and every time I called TI they told me they had no record of UPS refunding them the money, even though UPS told me they had refunded TI. I filed a chargeback on the prepaid Visa, but unlike regular credit cards, they generally don’t side with the consumer and they sided against me. Lesson learned, never buy goods with a prepaid visa online, as you have no protection if you don’t get the item.

Send them a certified letter that you’re taking them to small claims court. Costs 80 bucks to file a lawsuit and you’ll definitely get that money back. Often times just the threat will make them change strategy. Worked for me with WOW Air.

You lost me here? Who’s keeping your money after canceling the Build-A-Bear cards? Sam’s is keeping your money? Would a chargeback help out?

No we are out of the chargeback period. Sam’s isn’t keeping our money, but Build a Bear is using Sam’s as a dodge. Basically we used the cards for an order and they drained them. They then cancelled the order, but never returned the money. And that is it. We still can’t get the money back on the gift cards.