Greenlight Debit Card Overview

I heard about the Greenlight debit card a while ago, and I subsequently noticed their commercials more and more. I was mildly curious about this product for managing childhood spending, but other priorities precluded me from trying it out. Mark asked me to give Greenlight, a new Miles to Memories partner, a try and share my thoughts. I figured the card may be useful for many, but how exactly? Is this a niche product or one that has wide application to many? Today, I’ll step through how the Greenlight debit card works and its related features. Let’s see how practical this card is for the masses.

How Greenlight Works

Getting Started

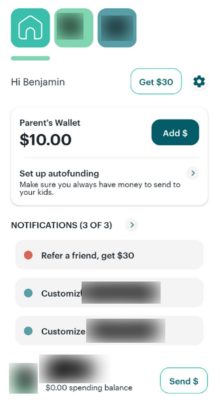

Signing up for the Greenlight debit card began with entering a cell phone number, receiving and responding with a confirmation code, and providing basic info on myself and children (names, address, DOB’s, etc). As part of the process, I was asked to load an initial amount (I chose $10) to the “Parent’s Wallet.” Setting up this load involves connecting and verifying an outside checking account, similar to how I’ve done so with other bank accounts previously. Loading can also be done via debit card. The Parent’s Wallet is the account from where I can fund my children’s debit cards.

Once I confirmed the trial deposits in my external checking account, the $10 was automatically moved to the Parent’s Wallet. I received the debit cards for our two children approximately ten days after signing up. Activating debit cards is a snap – I did so by entering the expiration date and creating PIN’s for each card. I chose not to customize each card with a photo, an additional $9.99 fee per card.

The basic Greenlight debit card plan costs $4.99 monthly. Greenlight offers a 30 day free trial to start; a substantial chunk of the trial time is waiting the ten or so days for the card(s). Customers can also choose to upgrade to Greenlight Max for an additional $4.99 monthly, or $9.98 a month (more on Max later).

Referral Program

As you can see from the above app image, Greenlight debit card members can refer others and receive a $30 bonus. With their current tiered referral program, members can earn a $50 second referral bonus, and a $70 third referral bonus.

Greenlight Debit Card Features

Spending

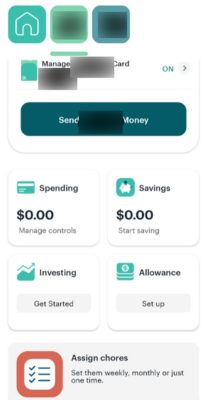

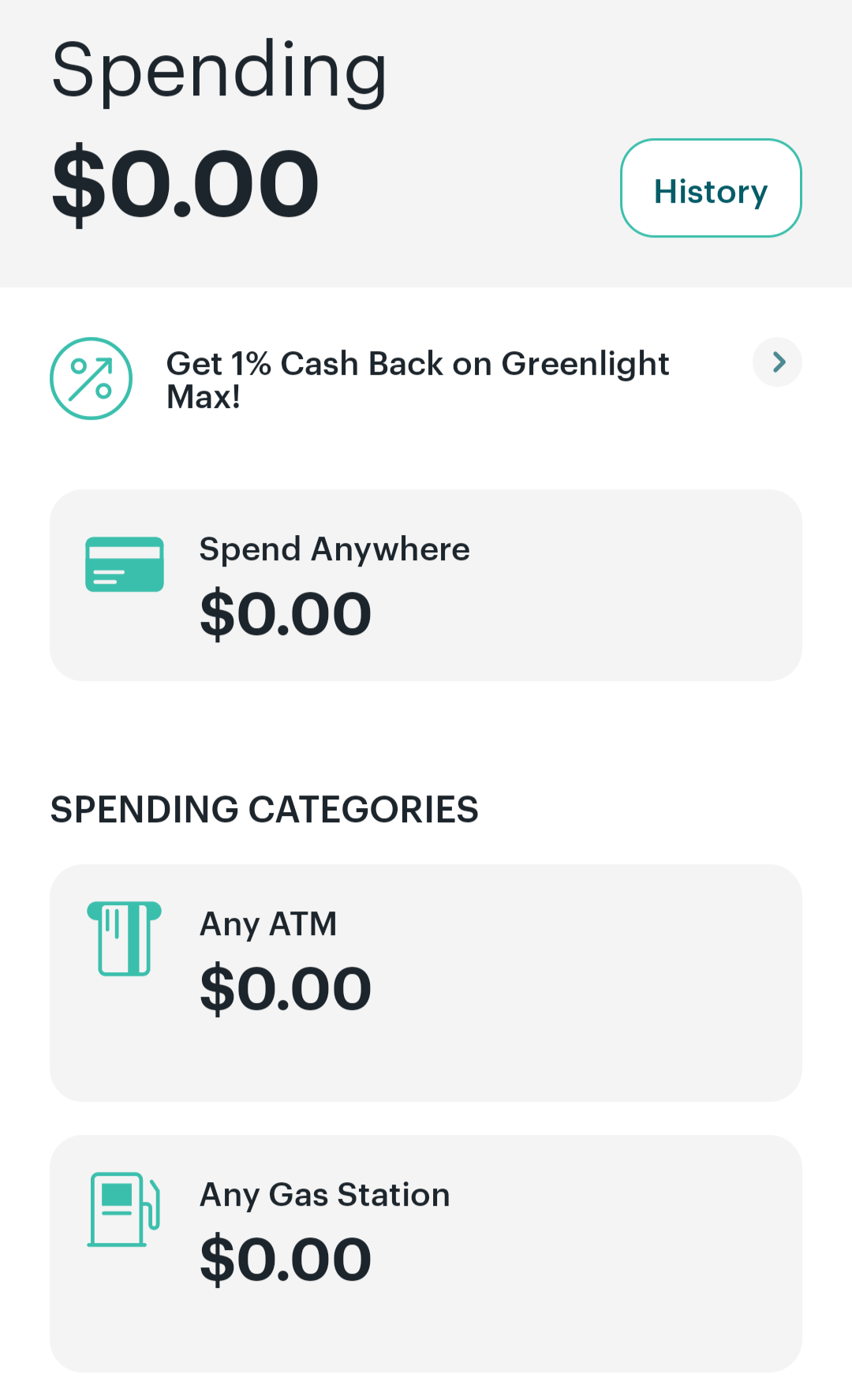

As the parent, I have a dedicated space to manage each child’s settings. I can add money to a child’s account by simply tapping the Send Money button, then entering the amount and the account to draw from (e.g. Parent’s Wallet). I can also create spending settings. Within spending, I can specify where the card can be used and the spending limits.

In addition to “Spend Anywhere”, the other default categories are:

- ATM

- Gas station

- Grocery store

- Restaurant

- Online gaming.

- Also, I can customize additional spend controls for specific stores or websites.

Saving

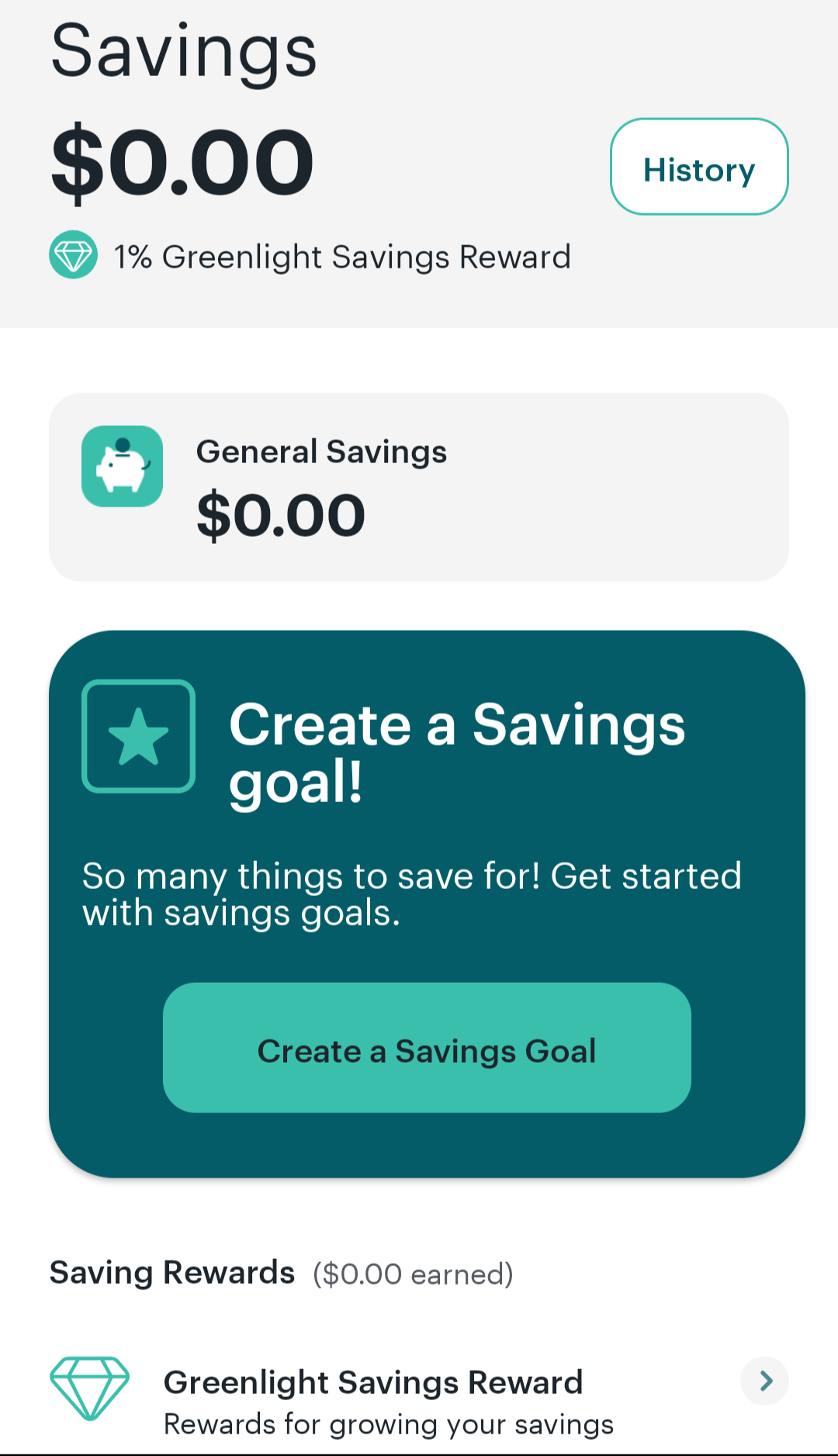

With the Greenlight debit card Savings area, I can move money into the child’s General Savings and create a savings goal. Money is moved into and out of savings by the parent, similarly to the spending area. With savings goals, we specify what the child is saving for and the goal amount. Once money is moved to the goal, the child will need my approval to move any money out. Basic plan members’ funds in the savings area earn an annualized 1% reward. Parents have the option to pay interest to their child’s account based on how much they save. As with other features, parents configure this percentage. The interest is paid directly from the Parent’s Wallet on the first of the month.

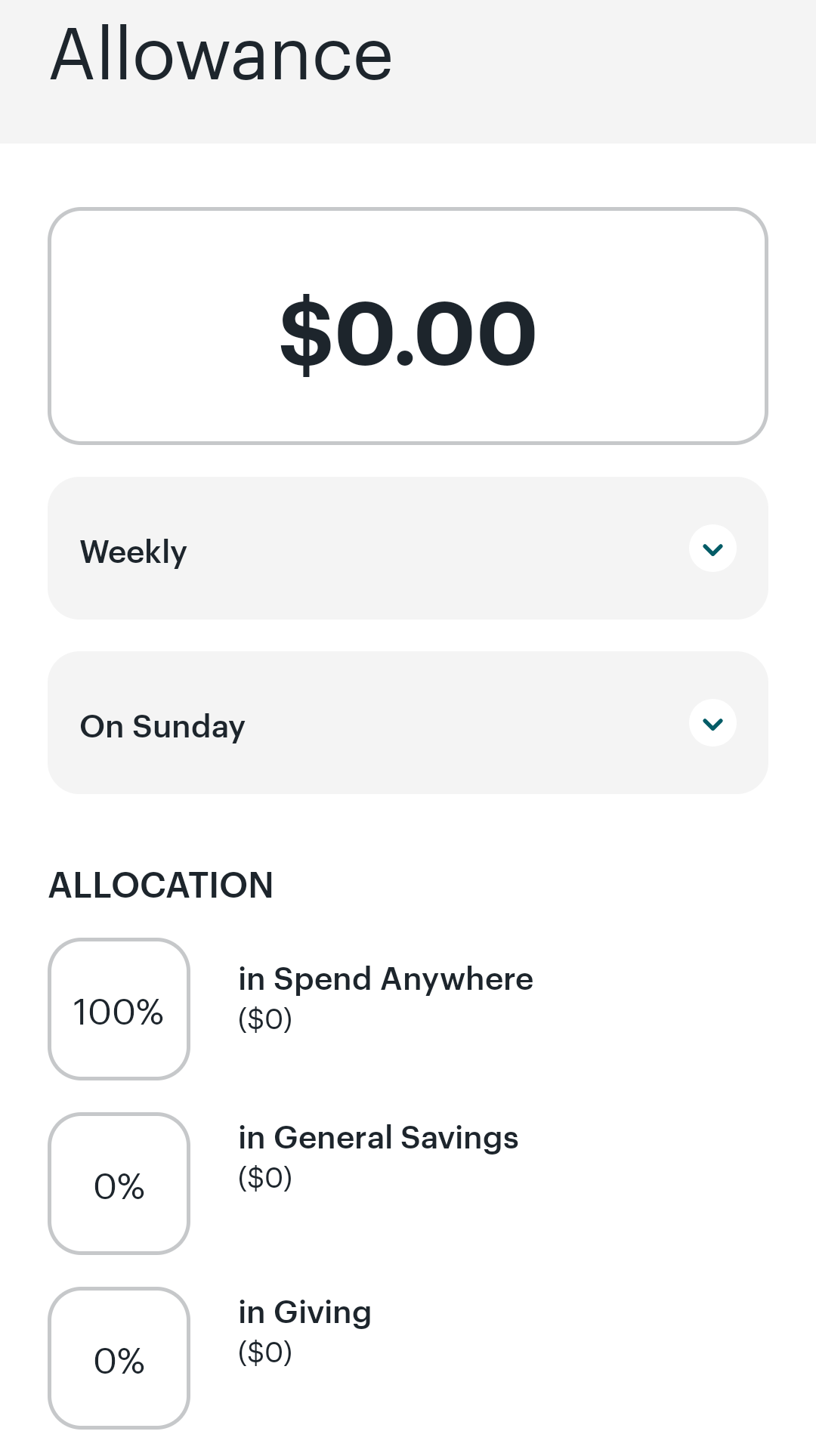

Allowance

The allowance area enables parents to automate the process. In addition to the allowance amount, I can set the allowance frequency, arrival date, and allocation to the Spend Anywhere, General Savings, and Giving categories.

Assign Chores

This area allows parents to aggregate and track all chores (one-time and weekly) for each child.

Examples are:

- Clean the bathroom/bedroom

- Do the laundry

- Mow the lawn

- Read

- Set/clear the table

- Take care of the pet

- Take out the trash

- Vacuum.

Parents can also customize chores. In conjunction with the allowance setting, parents can get a notification to pause the allowance if all chores aren’t marked complete.

Greenlight Max

For an additional $4.99 monthly ($9.98 total), parents and children can enjoy additional features of Greenlight Max. In addition to all of the basic Greenlight features, Max users obtain the following:

- Investing Platform for Kids

- 1% Cash Back

- 2% on Savings

- Identity theft, cell phone, and purchase protection

Investing Platform

You may have seen on the child’s home screen above the Investing area. This is only active once a Greenlight debit card user upgrades to Max. The investing platform allows children to first research by exploring stocks and ETF’s with expert analysis provided by Morningstar. Next, children invest by buying real stocks, as low as $1. Parents must approve every trade. Finally, children learn more by tracking investment performance with their parent(s).

1% Cash Back

Max enables children’s debit card spending to earn 1% cash back. Based on how Greenlight calculates the cash back, it may not turn out to be as much as one thinks. For example, a child spends $40 in a month using their Max card. One percent of that figure is $0.40, subsequently divided by 12 is $0.03. This cash back is deposited into Savings by the 5th day of the subsequent month the charges were made. You can read more specifics, including calculation, in Greenlight’s terms of service.

2% on Savings

Basic Greenlight users earn 1%, but Greenlight Max users earn 2% interest on funds in Savings. Greenlight refers to this feature as the Greenlight Savings Reward (GSR). This interest applies to a savings balance up to $5k. For instance, a child has $500 in savings. Two percent of that figure is $10, divided by 12 is $0.83. Using the same example, a basic Greenlight user earns $0.42. The Greenlight Savings Reward will be provided to customers by the 5th of each month.

Again, refer to the terms of service for more information on identity theft, cell phone, and purchase protection.

My Take on the Greenlight Debit Card

There’s much to like about the Greenlight debit card. First off, I’m a fan of the product’s all-in-one nature for $4.99 monthly. Greenlight centralizes spending, saving, chores, and allowance matters for parents and children. For an additional $4.99, children can earn and learn about debit card rewards and investing while taking advantage of an increased interest rate on savings. I particularly like the interest on savings feature. Kids can learn more about the substantial benefit of saving over spending with this feature. And as a points and miles fan, I enjoy the palatable entry for kids to learn about a rewards program structure (even if it’s just bank account-based). One may be able to do better with these single aspects from other banks’ products, but that individual would be give up the streamlined convenience of Greenlight.

Speaking of being streamlined, the Greenlight app is a smooth ride. The app’s polished design prevented the various tasks from overwhelming a user like me. Somehow, Greenlight has managed to pack all these features into the app while maintaining some semblance of simplicity.

Unfortunately, the Greenlight debit card does not provide this functionality to users who prefer a desktop experience. The website does not have a traditional login and online account area where users can configure everything like on the app. But I realize that Greenlight isn’t unique here. Times are changing, and many products and services are primarily (or solely) app-based. Also, it’s difficult to familiarize oneself with the specifics of Greenlight without signing up for an account. But hopefully this article and Greenlight’s terms of service are substantial enough for one to make an educated signup decision.

Who Will Benefit from Greenlight?

From my perspective, Greenlight is useful for the vast majority of parents with busy lives who are also competent with phone apps. This is obviously a huge demographic. One can easily justify a $4.99 monthly fee for the Greenlight debit card based simply on the time savings aspect. Couple this with all of the positive financial habits children can learn along the way, and that $4.99 comes off as money well spent. Springing another $4.99 monthly for the Max product is probably only useful if the investing, extra interest, and rewards are substantial enough to outweigh the fee. Crunch the numbers to decide if going the Max route is worth it for your family’s situation.

Will I Keep Greenlight?

Long story short, no, but I’m an outlier. Here’s why I won’t keep it:

- Primarily because I don’t work a 9 to 5 gig anymore, I have the time to dedicate to these individual matters in a less automated fashion for each of my children.

- It’s still a bit early for my kids to optimally leverage Greenlight. They’re still too young to use debit cards.

- For now, I want my children to focus on paper and coin money, fully appreciating and discerning the impact of various financial decisions. Perhaps this is related to #2, but it’s a huge aspect for our family.

Greenlight Debit Card – Conclusion

As a parent with growing children, I’m routinely looking for new bank products useful for their age group. Quite often, I’m confounded at how few options are out there. The Greenlight debit card offers an excellent structure and app which simplifies multiple financial tasks and encourages positive money habits for kids. I was pleasantly surprised how much of Greenlight was about financial activities not involving spending. While I’m not ready to continue with Greenlight right now, I won’t be surprised if I sign up again in the future. Have you used Greenlight? What do you think of the service?