Hacking Hotel Redemptions & Thinking Outside of the Box

My family and I are headed to Washington D.C. next weekend thanks to Frontier and their $30 roundtrip sale earlier this year! Since I can never commit to anything, I am still researching exactly where we should stay during our trip.

I am a Hyatt Diamond member and prefer to stay at their properties whenever possible. Thankfully there are quite a few Hyatts in the D.C. area. No problem there.

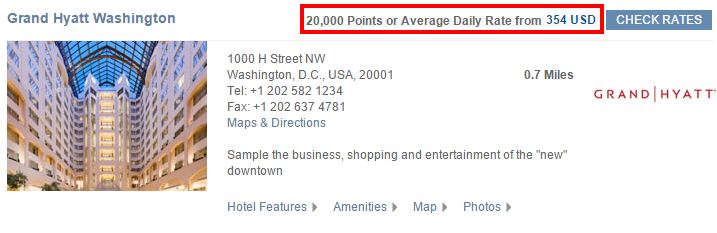

Given that we want to stay in the city, I have narrowed our choices down to two properties. The Hyatt Regency on Capitol Hill is a Category 4 property and runs 15,000 points per night while the Grand Hyatt is a Category 5 and is 20,000 points per night. Lets talk about the Grand Hyatt.

You Pay the Same in Points No Matter the Rate

Last night while searching for a room at the Grand Hyatt, I noticed that rates drop significantly on the weekends. In fact, the rates are so low that I could never justify spending 20,000 points to book it. In hotel loyalty programs, the number of points required to book a room is not dependent on the rate.

For example the Grand Hyatt Washington D.C. costs $354 per night during the week of my arrival, however it is only $120 per night on the weekend. (When we will be there.) The rate doesn’t matter in this situation though. As you can see the hotel still costs 20,000 points either way.

How to Solve This Situation

My main source of Hyatt points is Chase Ultimate Rewards. If I transfer Ultimate Rewards over to Hyatt for this redemption then I am only getting a value of $.006. That is simply not acceptable. So what can I do? I could actually pay money to stay at the Grand Hyatt. With tax it comes to around $280 for two nights. Not bad for a hotel of that quality, but I hate to pay for hotels when I don’t need to.

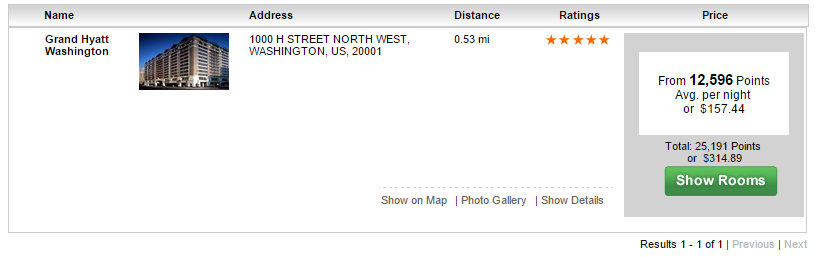

While I haven’t made a decision on what I am going to do, there is another option if I want to use points to stay at this hotel. I can actually book it directly through the Ultimate Rewards website for a lot less points. As you can see below, the Ultimate Rewards site has a higher rate, however I would only pay about 25,000 points for two nights instead of 40,000. So transfer 40,000 points to Hyatt or just spend 25,000 points through Chase.

Now I could also look into using ThankYou points or other bank currencies as well. My Barclay’s Arrival Plus (review) card could be used to pay and then I could redeem their miles to reimburse myself later. I also have some credit with Hotel Tonight & Travelpony which I may use to pay. The aim of this post though is to show you the same room can cost 40,000 points directly through Hyatt or 25,000 of those same points another way.

Should I Redeem the Points for 1.2 Cents Each

While I always try to get around a 2 cents per point redemption value for my Ultimate Rewards points, I often get higher. This allows me to offset the poor redemptions. If I book through Chase and redeem at 1.2 cents each is it a bad thing? No, not necessarily. Here is why.

First off, I have a lot of Ultimate Rewards points. Secondly, as a Hyatt Diamond member I get a lot of perks such as lounge access and free breakfast. If I decide to stay elsewhere on points then I need to factor that in.

Keep the Cash (That is Why We Play This Game)

Since I am a huge believer in keeping cash in my pocket, I have actually used this strategy recently. Next week I am going to Colorado and needed a flight back. I managed to find a cheap flight on Frontier for about $45. Instead of paying for it, I booked through Ultimate Rewards for 3,700 points. Cheaper than an Avios redemption and I still have my $45.

Some people would rather spend their money to buy a ticket then redeem Ultimate Rewards points at 1.2 cents. That is a personal decision. If I didn’t have so many points, I probably would consider another strategy. While it is not something I would do often, I have had enough 10 cent per point redemptions that it doesn’t make me lose sleep.

Conclusion

In the end I highly suggest looking before you book. Just because a loyalty program prices a hotel at 20,000, 30,000 or in Hilton’s case 90,000 points, there may be a cheaper way points wise to book it without having to spend money out of pocket. In the end, no matter how I end up booking this hotel or another one, my priority is spending as close to $0 as possible.

I started this game in April and I’ve got about 175,000 points, weighted two-thirds to airlines and about 60K in Sapphire UR. I have no hotel cards. I want to start building up hotel points so I can stay where I fly, which will mainly be South America and Spain. My CRAs are 720-755. What cards have the most bang for the buck south of the equator, between sign-up bonuses and low minimum night point charges?

If you are looking for hotel cards, I recommend the US Bank Club Carlson and any of the 4 Hilton credit cards out there. Those should provide many free nights/stays for you.

Going to DC next September – thinking about staying at the JW Marriot, but only because I have points from the Marriott card sign up. Let us know what you decide on, and if u do get Hyatt points for the stay booked through UR.

Will do! There are a lot of great properties to choose from in D.C.!

I did the same thing when I booked my rental car to go to #FT4RL. I used 2500 Ultimate Rewards points rather than pay the $37 or so. In that case, in hindsight, I might have paid cash so I could use a card that gives benefits / insurance when renting cars, but my thinking was pretty much the same as yours.

If you book Hyatt through the UR portal, do you earn points on the stay?

Dan, if you redeem UR Points for the stay, you are essentially selling the points back to Chase at 1.2 cpp and in return, they are booking the hotel stay for you. After you make the reservation, you can call Hyatt and have them add your Hyatt account number to the reservation so you will earn points. Since you are a Hyatt Diamond, you will earn 30% bonus points on the stay. Base earning is 5x at Hyatt, so you will earn 5×1.3 = 6.5 Hyatt Points per dollar.

If you use your Chase Hyatt Credit Card, you will earn an additional 3x. Hopefully you check all the math and see what works best for you.

Since the entire thing is paid for with UR points the Chase Hyatt card 3x wouldn’t matter. Also, are you sure it will earn points/stay credit with Hyatt? Chase uses an OTA to book the room. Does that count as eligible? I know I will receive my elite benefits, but I am not sure about getting points. I am not questioning you, just asking if you have ever done it before. Thanks for chiming in Grant.