IHG Premier United Travel Bank Credit

I’ve recently focused on making lemonade with IHG and our IHG Rewards Premier credit cards as we’ve started pushing back from their loyalty program. We’ve used all of our available IHG credit card free night certificates, and we’ve only focused on points stays otherwise. As part of the IHG Premier refresh and introduction of the business card earlier this year, cardholders receive a new benefit – $50 in United Travel Bank credit annually. Naturally, I wanted to use up what I could of this benefit, as well. But the credit doesn’t magically show up – it’s cardholders’ responsibility to actively obtain this credit. Here’s how to pick up the IHG Premier United Travel Bank credit.

Obtaining the IHG Premier United Travel Bank Credit

Step #1: Log In…

…to your IHG account here.

Step #2: Review Terms

After logging in, you’ll be immediately directed to the IHG Premier United Travel Bank terms. Note that cardholders actually receive the annual $50 in $25 increments biannually. New credits are available starting in January and July.

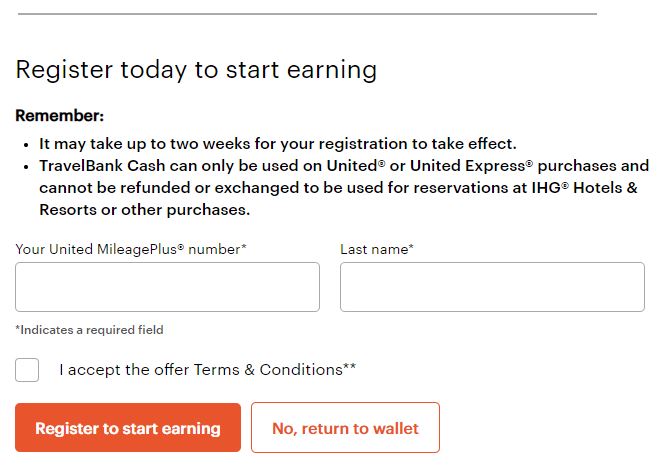

Step #3: Provide Your Info

Next, enter your United MileagePlus number and last name. Accept the terms and conditions, and click “Register to start earning.”

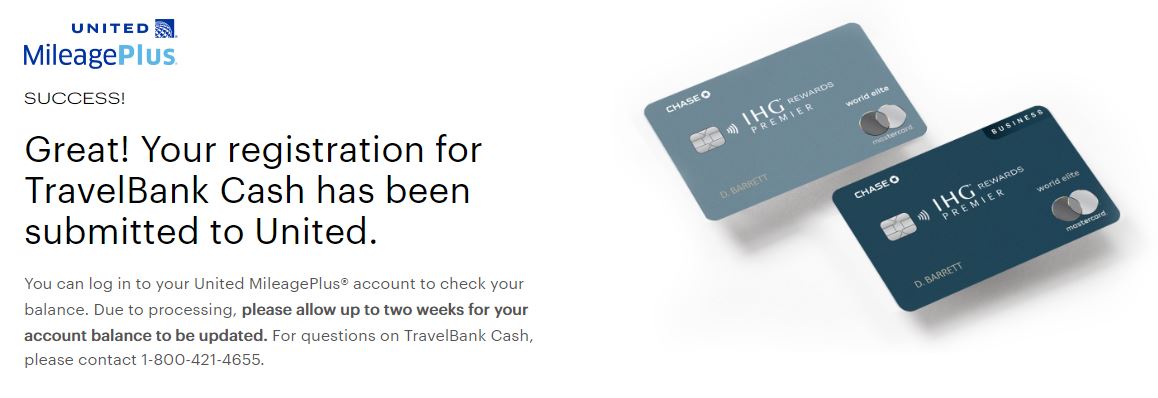

Step #4: Receive Confirmation

After clicking Register, you’ll next obtain confirmation of enrollment in the Travel Bank benefit. You’re all done for now!

Considerations

You’ll want to keep a few things in mind related to the IHG Premier United Travel Bank credit:

- Once you’ve registered, it can take up two weeks to receive your first $25 credit. In my experience, though, it appeared the next day. I recommend you play it safe and register for the credit well in advance of needing it.

- Once you’ve registered and received your first credit, you’ll receive another $25 credit every January and July.

- Each $25 credit expires approximately six months after deposit in your account. The January credit expires on July 15th, and the July credit expires on January 15th.

- United Travel Bank credit can only be used on United/United Express itineraries directly booked with United.

- If you hold both the personal and business Premier versions, you’ll only receive the United Travel Bank benefit for one card.

Conclusion

In my view, Chase and IHG made this benefit relatively difficult to use. The credit could’ve been given out in one lump sum annually and had a more generous expiration date. But of course, the companies can have their cake and eat it, too. They market the IHG Rewards Premier credit card’s United Travel Bank benefit as a useful perk. Meanwhile, they also benefit from breakage by making the terms tremendously user-unfriendly.

However, active United flyers can fully realize value from this small, periodic benefit. I don’t fly often, and when I do, it’s rarely on United. But if I’m able to use at least one $25 credit annually, I’ll consider it a win. Indeed, I was able to just do so on a sub-$100 flight in combination with additional Travel Bank balance. What’s your take on this credit?

I don’t know if anyone knows the answer to this but if you have the personal and business card, do you get $50 every 6 months ? Or is it capped at $25 ?

Got the first credit right after registering in March. Never got the second one so far (it’s November). Called Chase, UA, IHG. No one knew anything about this or how to get me the second credit. They all said to call the other parties. Has anyone actually received their second credit?

I received my second credit, posted to my account without notice. I just happened to notice it a few weeks after it had been credited. I’ll see if the next one posts next month (January).

Have you received your January 2023 credit yet? I don’t see it posted to my account yet.

Any clue if it would cause problems to point P2 to P1

UA travel credit account, in addition to P1’s IHG UA travel credit??

Did you try? Can we do that? two IHG accounts linked to the same UA?