IRS Stimulus Website Fixed for More People

The IRS launched their stimulus payment website for filers known as “Get My Payment” a couple of weeks ago, although many I know were left out in the cold. I know a ton of people who should have been eligible for payments, but for whatever reason received an error when trying to check their stimulus payment status.

Why You Should Try the Get My Payment Stimulus Site Again

Thankfully the IRS seems to have improved things a bit. MtM moderator Kevin posted in our miles/points Facebook group yesterday that he was having success with the site after previously receiving an error. The site seems to be very particular when it comes to the formatting of your information. I know others who previously had issues, but were able to get in and provide their bank account information to the IRS in recent days.

Here is what Kevin wrote:

For those that got not available – I managed to get in today and provide my direct deposit. They added some language on how to enter your address. I successfully entered mine in the format as: “999 W Main St #9999.”

Note that when I filed my taxes, I entered Apt 9999 – that did not work on the site for me however, but #9999 did.

Another potential issue is in how you type in your social security number. Some say hyphens work while others say they don’t. It’s probably best to try both ways.

What is the IRS Stimulus Website Error

While I think the majority of people were able to access the IRS stimulus website, a lot of people got an error saying “Payment Status Not Available”. With no other information it was frustrating, especially since people need the money. Despite the site seemingly working better now, people are still getting the error.

If you get the “Payment Status Not Available” error, here is what the IRS says as to why you might have received the dreaded message:

- You are required to file a tax return, but:

- We haven’t finished processing your 2019 return

- The application doesn’t yet have your data; we’re working on adding more data to allow more people to use it.

- You don’t usually file a return, and:

- You used Non-Filers: Enter Payment Info Here but we haven’t processed your entry yet

- You receive an SSA or RRB Form 1099 or SSI or VA benefits; information has not been loaded onto our systems yet for people who don’t normally file a tax return.

- You’re not eligible for a payment (see Eligibility).

We update Get My Payment data once per day, overnight so there is no need to check more often. If you are eligible for a payment and have provided your information either through a recent tax return or the Non-Filers: Enter Payment Info Here application, please check back for updates..

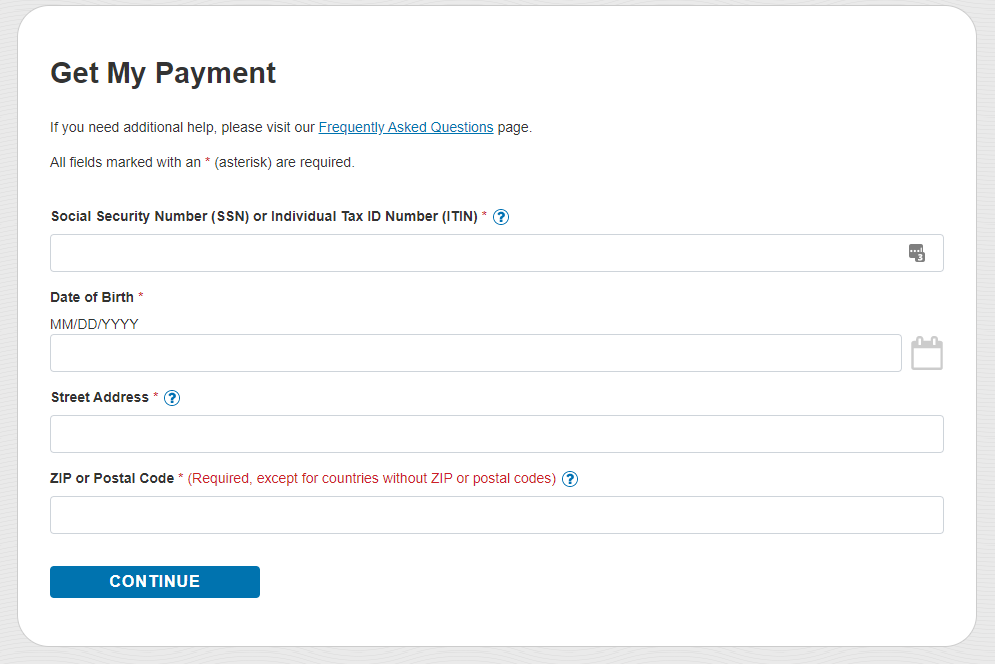

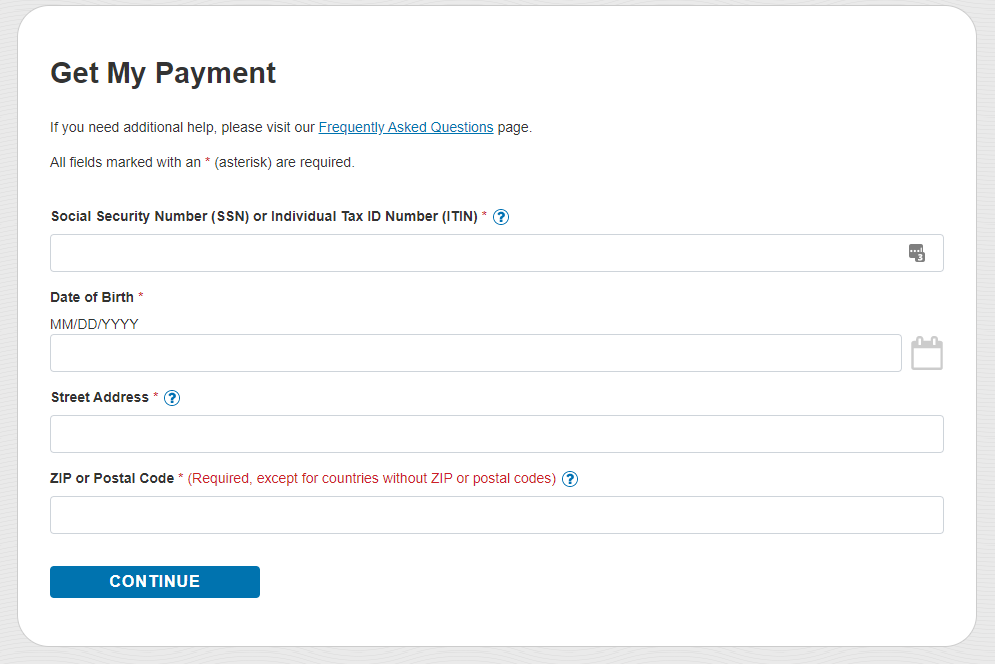

What Information Do You Need for the Get My Payment Website

If you are able to get past any errors on the IRS stimulus website, then you will need a few pieces of information to ensure you are able to gain entry and provide your bank account information for payment.

Here is the information you need to provide to the IRS Stimulus website:

- Your social security number

- Your date of birth

- Your address and zip code

- Your adjusted gross income as shown on your 2019 tax return (or 2018 if you haven’t filed 2019)

- Whether you received a refund or had to pay on your last tax return

- The amount of the refund or payment to the IRS

- Your bank account routing number and account number

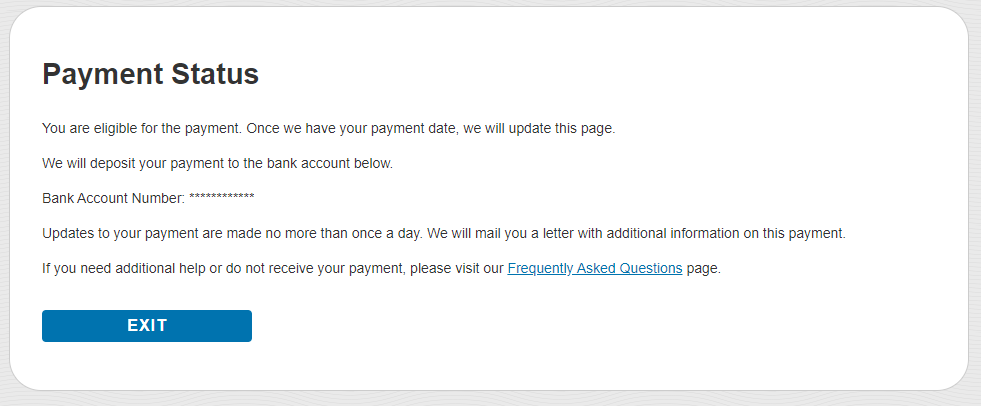

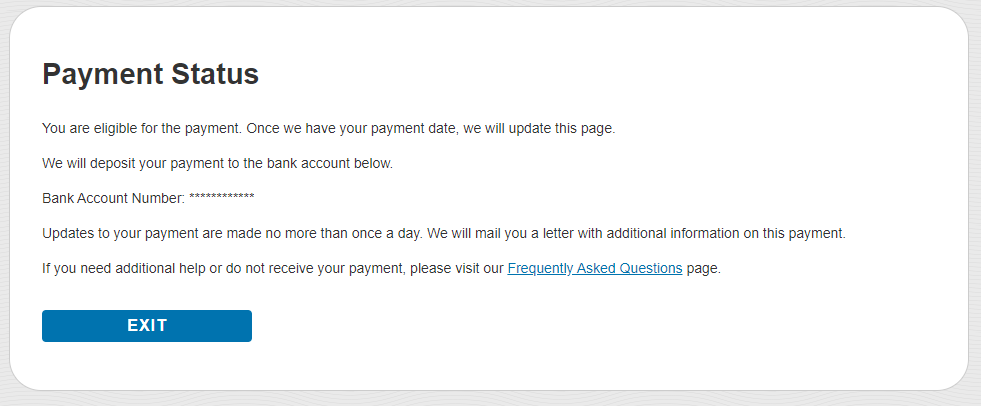

Thankfully other than the errors, the site is fairly quick and simple to use. The information shouldn’t take more than a minute or two to fill out. Once you have submitted everything, you should be able to see that the IRS will be sending a payment to your bank account as shown below.

IRS Stimulus Website Fixed – Bottom Line

While the IRS Stimulus website worked for some from the beginning, other eligible taxpayers were temporarily left out in the cold due to website errors. It seems the IRS has fixed their website to allow many more taxpayers to get past the errors. If you previously received an error, then I recommend you try again.

Were you able to gain access to the IRS Get My Payment website in the past couple of days after initially receiving an error? Let us know in the comments!

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I GOT A DATE FOR DIRECT DEPOSIT ON APRIL 29 BUT NEVER GOT IT GOT A LETTER TODAY SAYING I WOULD BE GETTING MY $1200 DEPOSIT IN MY ACCOUNT HAVE NOT GOT NOTHING YET WHATS THE DEAL ANY ONE KNOWS

If you type your address in the IRS form in with ALL CAPS then it will work when it gave you an error before.

I got .y stimulus check but they put wrong name on it, what to do

“For any other issues, once you get your payment, the IRS will send a confirmation letter via mail (not by email, text or phone call) within 15 days. This letter will explain the amount of your stimulus check and how to report any issues with the payment. You can use that information when the letter comes to report any discrepancies. ”

https://www.cnbc.com/2020/04/24/what-to-do-if-your-coronavirus-stimulus-check-amount-is-wrong.html

It let me enter all my info but it’s still saying I’ll be mailed a chech why?

Maybe give it time to update? Do you see your bank account information in there?

I updated my info weeks ago still nothing and no date

That seems to be happening to quite a few others. There apparently is no rhyme or reason as to how they send out payments, but they are going in waves all the way through May.

I put in my direct deposit information on April 15th. I just got a date when I check last night.

@BenM @Retiredat39

I got all the errors for over a week, trying both my husband’s and my SS#. Our 2019 return was filed electronically but our refund was applied to our estimated taxes. I tried again last night when I saw this post, and got the technical difficulties error again.

Just for the heck of it, I just tried again using my SS# this time instead of my husband’s which I had used last night. BINGO!!! I just selected Got a Refund and put in 0 for the amount. Almost fainted from the shock! Good luck.

Great info! Thanks Marilyn!

This app and IRS are so funny For the first week i was locked out finally was able to put my DD in and yet 2 weeks later still see we have your information and will update when date is available.. Lmao people are getting paper checks and yet i am still waiting for a deposit date…

Hello, Shawn, I had filed my taxes for both 2018 and 2019 and my direct deposit information didn’t stick with the IRS (reason unknown). So, on the morning of 4/15, when the Get My Payment tool came live, I went in and was able to enter my DD information. Immediately afterward, I received the following message,

Payment Status

You are eligible for the payment. Once we have your payment date, we will update this page.

We will deposit your payment to the bank account below.

Bank Account Number:

However, as of the morning 4/25, this message has yet to change. I have checked each day since the 15th and the message has never changed. Any ideas as to why this is the case would be much appreciated.

Thank you!

There are quite a few others who have been waiting for 2+ weeks. The IRS says they are sending out the payments in waves all the way through May.

Does any of our problems get to the irs so this stuff can be fixed? It wouldn’t let me put my bank info in it kept saying it didn’t match what they had on file iv had the same account for 15 years .filed my 2019 taxes wirh a refund so they have the correct banking account .

I even tried to register on https://www.irs.gov/payments/view-your-tax-account. I wanted to confirm they processed my 2019 1040 (they definitely cashed the check I had attached). Unfortunately they couldn’t verify my cell number. Owed both years.

I’ll get the full $1,200 if they go by 2019 – just $950 if they go by 2018. I retired in August 2018. My understanding is that I would get the rest when filing in 2020 if they go by 2018.

I am now on Social Security, but that just started in February 2020 (so NO 2019 SSA1099). SSA does have bank info, but I’ve read in at least one spot that the Treasury was now going to mail checks rather than go to SSA.

Who knows? Mine is a bit of an unusual case. I can wait, but I am curious.

You got it right as far as I understand it. The stimulus is essentially a tax credit. Whatever you don’t receive but which you are eligible for should be corrected on your taxes.

I’m going to wait for a check and would like to know when it will be mailed but I have to give my bank information. Nope, still useless.

Unfortunately the system only allows you to see if you are eligible and to provide bank info. It would be nice if they gave you a date, but that doesn’t seem to be happening. Hopefully they’ll get these things out as quickly as possible.

It worked but I had to use my 2018 return. My question is since we filed jointly, does my wife have to go in to the IRS website and enter basically the same information, or will we see the combined stimulus check based on what I put in?

Your wife’s should now be fine since you had a joint return. If you go into the website and check for her you should see that they now have the bank account info showing carried over from when you did for yourself.

I teied all the ways possible and still receive TECHNICAL DIFFICULTIES error at the end. Have been receiving the same message since the tool launched.

Worked for me finally today. put street address in ALL CAPS as someone told me that could be another problem. was able to put in my 2018 tax info, and bank info.

ALL CAPS? Wow. Could they made this thing any more sensitive? I guess they only had like a week to build it though so we can give them a break. 🙂

All caps made no difference for me. Did you try it regular, and fail, and then immediately caps right afterwards (and succeeded)? Otherwise it could have been coincidence if time had passed.

I tried it again it let me put all the info in but said that it didn’t match what they had on their records iv jad the same banking account for 15 years so I dont know what info they have .

After entering all information I get a “Technical Difficulties…Please try again later.”

I suspect a IRS programming error as we were eligible for a refund on our 2019 tax return but elected to receive $0 and apply the entire refund to 2020 estimated taxes.

I am in a similar situation as you. Today was the first day I could get to the bank information screen. I filed a return for 2019 but had zero refund and zero taxes due. But your only option on their site is to indicate if you had a refund or owed! I tried both on two separate occasions, and got the Technical difficulties error. I can only hope they continue to review error logs and fix this one too. There should be an option for those of us that neither paid nor received a refund.

I just got mine to work using the refund button and stating my refund was zero. they now have my information!

So people have to file 2019 taxes to get this? I had previously read that if 2019 had not been filed that they would use 2018’s information.

You need to have filed 2018 or 2019. If you didn’t file 2019 then your 2018 info should work. I have confirmed with several people who only filed 2018 that it is working for them when it didn’t before.

I got through, but “The tax return information you entered does not match our records. Try again in 24 hours.” Oh well.

Are you entering the whole amounts exactly as shown on your return? I know one person was getting a return but had the IRS withhold some for future taxes. The refund amount in the form ended up being the amount they got back not the total amount due to them. Example, they got a $10K refund, but asked the IRS to hold $3K for future taxes. Then $7K would be the refund amount.

Of course there are probably still going to be errors for some people.

It’s letting me go ahead this time and get pass the screen but when I enter in my bank information it just gives me an error so I don’t think it’s working for some but at least it’s confirming I’m eligible but won’t let me finish entering my bank info.

See my other comment about refund amount. Could that be the issue?

Hi Shawn. No, at least for me it’s not the refund amount because I didn’t owe anything. Almost all of my income is from rental properties. It causes me to have no tax liability as my adjusted gross income with 4 kids causes me to have no tax liability. It only gives me the option to put either I owe money or I have money owed to me. It’s asking me for the amounts and I enter $0 so maybe that is causing the problem as I neither owe nor is money owed to me.

My adjusted gross income I’m taking directly from the IRS tax transcript website.

People can go to https://www.irs.gov/individuals/get-transcript. to see past transcripts which will give you the exact adjusted gross income details if you don’t have a copy of your return around.

But it’s still giving me an error and not allowing me to enter my Direct Deposit details. So a + that I can now get through but a negative that it’s useless as I can’t enter my direct deposit details.

Good advice on the IRS transcript! I love that site to make sure I have all of my documents, etc. before I send them off to my accountant.

My guess is you just fall in a category that very few people do and they didn’t account for that. Maybe the next update will fix it or worst case you’ll probably just have to wait for the checks to be mailed, which hopefully won’t be too long.

Hi Shawn,

I tried again today and voila! It FINALLY would accept it. I entered that I had a tax due and put $0. This time it would accept it and says that they have my direct deposit information but still doesn’t show when they will deposit it but just happy I don’t have to wait for a paper check now.