Maximizing Citi Rewards+ Spend – Worthy Effort Or Big Disappointment?

I enjoy Citi’s obscure, sometimes misunderstood card named the Citi Rewards+. Some don’t care or have the time to maximize the card’s two unique features, round up and 10% points back. But I do! So much so that I laid out by 2020 Rewards+ spend strategy for a high earning rate at low scale back in March. My last 2020 statement just closed, and I figured it’s a great time to look back at the year, crunch the numbers, and assess. Was maximizing Citi Rewards+ spend worth the time and effort or not? Let’s find out!

Reset: Rewards+ Feature Summary and My 2020 Spend Strategy

I’ll quickly recap the two unique features of the Citi Rewards+ card. The round up feature increases the earning on every purchase to the next 10 points. For example, a $9 purchase earns 10 ThankYou points. A $0.25 purchase also earns 10 points. Therefore, small purchases earn at a much higher rate.

The 10% points back feature provides cardholders with 10% of their redeemed points back into their accounts annually, up to a 100k ThankYou point redemption threshold. That’s an easy 10k points back annually for any cardholder who is a healthy point earner and pays a bit of attention to his or her redemption habits.

In order to take maximum advantage of these two features, I developed my 2020 Rewards+ spend strategy. Again, you can read more about that here. Long story short, I settled on this for 2020:

I use the Citi Rewards+ for any grocery or restaurant purchase $2 and under. For all other purchases, I use the Citi Rewards+ on transactions $3.50 and under.

Next, let’s aggregate the monthly data.

Rewards+ Spend Throughout 2020

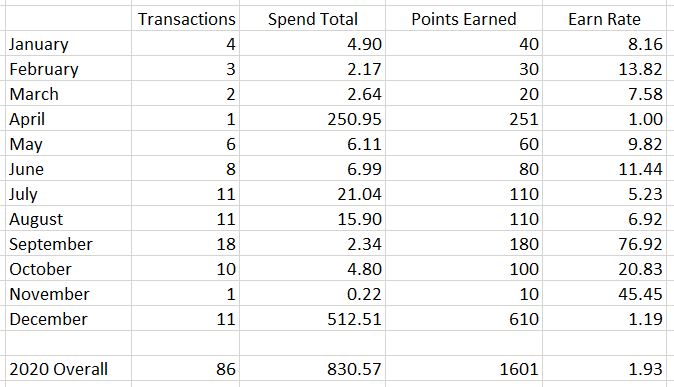

To get a better idea of my spending on the Rewards+ this year, I’ll go through each month. I’ll focus on the number of transactions, monthly spend total, points earned, and earn rate (ThankYou points per dollar).

Initial Observations

First, 2020 spend totals and points earned are low. This was expected, because the whole strategy revolves around only using the Citi Rewards+ on small transactions. But my overall earn rate (ThankYou points per dollar) is only 1.93x? Eww.

A Closer Look

But wait. Look at the numbers from April and December. The spend totals in those months are two huge outliers in the data. Why was spend so high on such few transactions? Because I used the Citi Rewards+ on each of those cards for specific opportunities. In April, I used the card on a $250.95 online purchase to trigger an airline online portal bonus. (It may not seem like the Rewards+ would be the best card to use here. It actually was, but it’s a long story…)

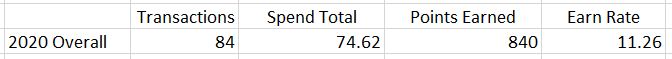

All of my Citi card accounts were targeted for the 5% back for online transactions (up to $500 spend per card) in late November. Therefore, I made a $505 purchase which appeared on my December statement. With that context, I ran the 2020 numbers again, leaving those two transactions out to better determine my earn rate on small purchases.

That’s more like it – I more accurately had an 11.26x ThankYou point earn rate on 2020 small purchases with the Rewards+. Overall, small transactions averaged well under a $1 per purchase, easily below my $2 and $3.50 purchase ceilings I determined earlier in the year.

Bigger Picture

Was this worth all the fuss and effort? Opinions can definitely differ here. Redeeming at 1.25 cents per point for Disney World, this ends up being a conversation about $10.50 in rewards. More accurately, if I was to put that spend on a Discover Miles 3% cash back card, I come out $8.26 ahead with my Rewards+ spending stunt. I admit that a conversation about $8.26 can be comical, but I enjoy the journey. Indeed, if the hobby isn’t fun, why bother?

Was it worth the effort? For me, yes. I didn’t really spend a huge amount of extra time to get that extra $8.26. I would buy a single small item separately at the grocery store self-checkout when I was there anyway for other big transactions – maybe an extra 20 seconds or so each time. I’m also out the minimal time I used to pay the statement 12 times over the year. That’s about it.

2021 Plans

I plan to continue a derivation of my 2020 strategy into 2021, but I have some changes to consider first. In early 2021, I won’t have a Discover Miles card earning at an effective 3% cash back. How I value my ThankYou point redemptions is also changing (I’m tackling that in a different article). For right now, I’m planning to put all transactions $5 and under on my Rewards+ card in 2021. If this plan changes, I’ll definitely update you!

I’m interested to see how my 2021 changes will impact my earn rate. Raising the individual ceiling to $5 will of course pull this earn rate downward. But I’m improving at extremely small transaction amounts, and I’m gradually identifying new opportunities. I expect that to continue. Will the 2021 earn rate be higher or lower than 2020? I don’t know, but I’ll have fun in the meantime.

Maximizing Citi Rewards+ Conclusion

I bet some of you couldn’t get through this article without laughing at me. That’s understandable – I laughed at myself while writing it. I’ve spent substantial time describing points that amount to the value of a quick lunch out. But I love the hobby and the juice. If I love the easy, small stuff, I’ll continue to appreciate all of the bigger plays. And virtually all of them are bigger than this Citi Rewards+ silliness. Overall, kudos to Citi for figuring out a way to keep their Rewards+ card permanently in my money clip. What small play do you enjoy that’s even lower scale than mine?

Benjy, Carl, I agree with you both. The Rewards+ has been a winner for me for sure. I generate 100 points daily in less than 2 minutes and can do so while pooping if I wanted. LOL! I spend 12 hours a year to generate almost 40k TYPs (including the 10% rebate) and it doesn’t even cost me $350 to do it.

I’m averaging a little over 100 TYPs per dollar and I find that to be an incredible value for a card that has no AF.

Whoa! You’ve got me beat on PPD, but glad to see people are thinking outside the box on this card. IT’s crazy how much value you can get with little.

2808 Heavy,

Thanks for chiming in. That’s an impressive haul you got with the card!

The reason I’ve been able to do so well is I’ve found a few websites that will allow me to charge as little at a nickel which really helps. I spread it around as to not upset Citi and it has been working really well for the past year and a half.

That’s braver than me as I do not want to mess up what is working so well for me but I might get a little more so following your example. Not being able to travel all year has, I will admit, let me get a bit lazier on working on getting points! Have not been more than 40 miles from home since Jan 15!

I agree. I was a bit skeptical at first but Citi really hasn’t bothered me. And a good amount of the physical card swipes come from a vending machine and codes as such so I think that’s why it hasn’t tripped some sort of gaming algorithm. Also, there are a few big box merchants that allows for splitting of payments online and some that probably shop at often so there are quite a few plays if one is to get a little creative.

I know a lot of folks are a bit upset about the 25% going away via the Premier card next year (I was one of them) especially with the 25% bump from the Premier and the 10% back on redeemed for having Rewards+ but with the way I’m earning TYPs now it doesn’t bother me as much as the initial sting.

But I do have a complete Citi setup with the Prestige, Premier, Rewards+, and Double Cash so they get a good amount of legitimate spend across my accounts. Here’s to hoping that’s enough for them to leave me alone.

2808 Heavy,

You nailed it regarding payments online. I’ve identified several of my favorites there but know I have much more to discover in that space.

I forgot to mention that the vending machine at work really works great for this card as well. Nothing like .25 packs of chewing gum, sunflower seeds, and certs mints.

Man, there are many ways to increase the efficient use of this card by a LOT. Too easy and fragile to go into in detail, but that card has earned me thousands and thousands of points.

I will just say that shipping labels that are low cost are or can be an easy and FREQUENT purchase.

Carl,

Sounds like you got a good thing going. I know I can do even better with the card, and doing so will be fun in 2021.