MaxRewards Review – Gold Plan

Let’s start this review honestly: after hearing, “You should check out MaxRewards” coupled with “The best stuff comes in the Gold plan, which you have to pay for”, I had the same response most people will. I ignored it for a while. I’m typically not interested in apps that I have to pay for when it sounds like they aren’t offering anything novel. I consider myself pretty strong in the points & miles game. My points earning activity is pretty good.

After hearing about MaxRewards from a few more places, I decided to review it and see what the Gold plan might have to offer. In this article, we’ll look at MaxRewards, what it is, and how the free version compares to the Gold membership. We’ll end with the burning question: should you sign up?

Here is a referral link from our MtM Diamond member who suggested the service. You will get one month free to try it out if you sign up via referral.

What is MaxRewards?

MaxRewards is an app/website where you can collect information on all of the credit cards you currently have, then it will show you special offers on those cards. While it can do other things–such as recommend credit cards and keep track of your credit score–a host of other sites and apps can do those things. I’m going to completely ignore those features in this review.

For our purposes, we’re looking at MaxRewards for its ability to find offers that either boost your points earning or save you money via cash back. How does it do this? It automatically scans your available offers on the cards you’ve added to your account. Think of an app that basically finds all of your Amex Offers, all of your Chase Offers, and any other savings / points multiplier offers from other banks, then lets you add them quickly in one app.

Then, you can add and use these offers on your card. There’s even a way to find locations nearest to you. This can be handy if you’re at a store, waiting in line to pay, and want to see if any of your credit cards have an offer for that store.

Which Banks Does MaxRewards Work For?

Here is a list of the banks that MaxRewards will be able to integrate with and pluck out offers for:

- American Express

- Apple

- Bank of America

- Barclays

- Capital One

- Chase

- Citi

- Discover

- Fidelity

- Fifth Third

- First National Bank

- HSBC

- Huntington

- Key Bank

- Navy Federal Credit Union

- PenFed

- PNC

- SunTrust

- Synchrony

- TD Bank

- USAA

- US Bank

- Wells Fargo

- Multiple store-brand credit cards and local credit unions, as well

MaxRewards Review

Now that we understand the basic concept, let’s look at the good and bad parts of MaxRewards–including comparing the free plan with the paid Gold plan.

The Positives

For anyone with a lot of credit cards (that should be most people in this hobby), keeping track of all the offers you have available can be near impossible. From the start, the concept of MaxRewards is a good idea. Put all those offers in one place.

Additionally, the app is pretty easy to use once you set it up and add your credit cards. You can add them by linking your online banking profile at each bank you want to add. Add your Chase, American Express, Discover, etc. accounts. When MaxRewards logs in, it will ask you to select which cards you want to add to your account. You can select or de-select any cards you wish.

Update: MaxRewards reached out to me via email after reading my review and the comments. They specified that your login details with the banks are not saved. If someone hacks into MaxRewards, your bank login details are safe.

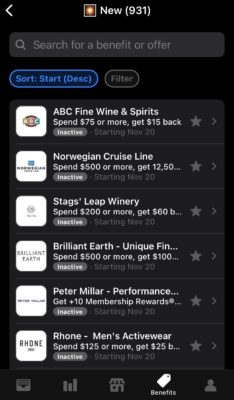

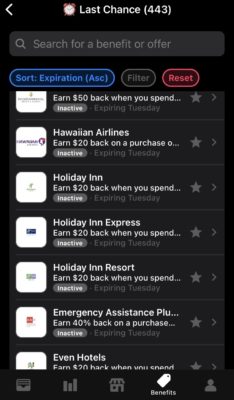

The fact I can see offers ending soonest (thus, I need to take action if I want to use them) is a handy feature.

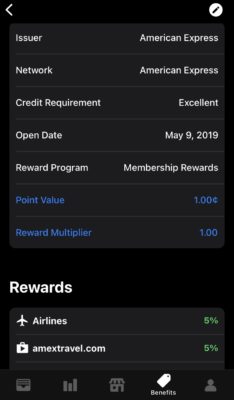

And when in doubt, you can click on a card to see what its bonus earning categories are.

That page will also tell you information about the card, such as when you opened it.

Lastly, the ability to enable “location services” for the app and then find nearby merchants with relevant offers is a nice touch. If there’s no offer for the store where you are, then this feature will recommend the “Best Card” to use, based on bonus earning categories.

The Negatives

There were some negative aspects of using the MaxRewards app that I want to cover in this part of the review; one of the most obvious is that you need the paid (Gold) plan for the best features. That’s to be assumed with most things these days, I suppose.

Additionally, I had a lot of difficulty adding my Chase cards to my account. It gave me an error, saying that this was a known issue at the time. I tried again a few days later…same error. It took over a week before I could add my Chase cards to the account.

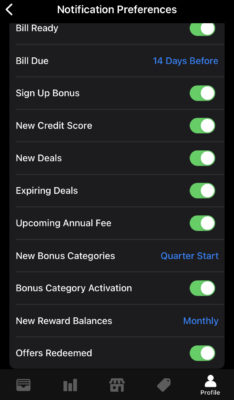

The last negative I will mention is that everything goes through the app. Everything. There’s no option in the app to get an email alert for anything at all. While you can get notifications from the app on a whole host of things, if there’s something really important, I’d like to get an email about it also. Heck…I work online. I’m at my computer nearly all day but often put my phone on silent.

MaxRewards Gold Plan Review – Paid Membership

Cost: The Gold plan costs $12 per month (maybe?)

As I mentioned, there is a paid plan available with MaxRewards. It’s called MaxRewards Gold and offers additional features not available in the free version.

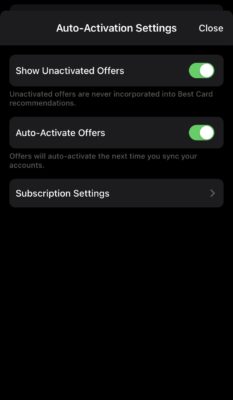

- Auto-activate quarterly bonus categories on relevant cards

- Auto-activate deals and add them to your card automatically

- Select “favorite” cards to list as a priority

- Best Card area has additional features for considering more categories

- Get notifications for new and expiring deals

- Tracking remaining spend on rewards with limits

- Customize your icon

- Priority customer support

Looking at this list purely from a “points earning” perspective, the features that are important here include automatically activating deals across your cards, better recommendations for “Best Card” when paying at a store, and tracking spending requirements. This can be useful for cards with annual spending goals, such as earning a free night at the end of the year if you “spend more than x dollars on the card”.

Lastly, I want to discuss this “auto-activate deals” aspect. As we know, you can only add Amex Offers to one card. Thus, if you want to use that offer on Card A but accidentally activate it on Card B…too bad. So how does this work with MaxRewards Gold, if it’s activating offers automatically? Is it putting the offers on the card I really want?

The answer is that their software activates these offers in the background somehow. I didn’t really understand the technical specifics of the answer they sent me, but offers with Amex are essentially pending in the background, and then they are attached to whichever card uses that offer first. Thus, if you have an offer at Walmart, for example, whichever American Express card you use first in a way that qualifies for the offer becomes the winner. The offer gets activated and used on that card. Could it work on multiple cards? “Maybe” seems like the answer, but it’s not a guarantee. And I wouldn’t want to try to force this to work on a regular basis anyway, given that it could draw the ire of RAT.

Update: MaxRewards reached out to me via email after reading my review and the comments. They said that Amex Offers are added to all card simultaneously, thus bypassing the “one card limit”. The email also stated that they have numerous data points of people using the offers on multiple cards without any reported incident of clawbacks or shutdowns for their users who used the offer on multiple cards this way.

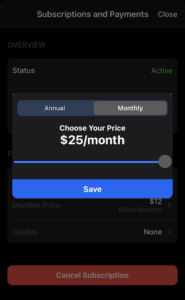

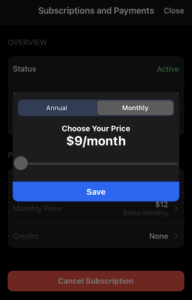

And what’s the real price?

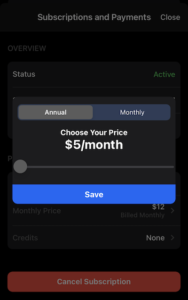

When I enrolled for the Gold plan, the app told me it’s $12 per month. Done. Later, I found this “set your own price” information. However, since I had enrolled for a plan, I couldn’t find any way to change the price or use this “pay what you want” feature. You need to cancel your subscription and then choose to reactivate it, then you can set a price.

It seems counterintuitive that you have to agree to re-enroll first before setting a price, but here are the options:

The maximum price is $25/mo, whether you pay annually or monthly.

If you choose to pay monthly, the lowest price you can choose is $9/mo.

If you choose to pay annually, the lowest price you can choose is $5/mo.

Update: MaxRewards reached out to me via email after reading my review and the comments. The fact that I couldn’t set my own price when I first signed up is apparently a bug. You should be able to choose your own price right away. And you should be able to adjust the price you want to pay at any time, and the new price will star the next billing cycle (monthly payment or annual payment). However, this was not my experience. It “should” work this way, but it wasn’t for me.

Is the Gold Plan Worth It?

Deciding whether the MaxRewards Gold plan is worth it will come down a personal review of how many extra points or how much extra cash back it provides to you. If you have the time and the patience to sort through your offers and use the best card for each purchase you make, then you likely don’t need this app. However, if you want something that can tell you which card to use, automatically activate offers that you are prone to forget, or help your “not so interested in this hobby” spouse increase their rewards earning by just a bit, then the paid version of the app could be great for you.

Without the paid version, the free version still allows you to see all of your offers but requires sorting and adding them to cards manually. The free version also doesn’t allow for tracking your spending or getting notifications for deals that are new or deals that will end soon. You’ll need to keep track of these yourself (which isn’t that difficult, honestly).

So, will I keep it?

No. I know credit card bonus categories pretty well and use my cards advantageously to get the most points possible on each transaction. It’s not 100% perfect, but I consider myself pretty good in this area. My wife doesn’t know which cards earn points in which categories. And I don’t really think she would remember to use this app at a store. We get around this by just keeping very few cards in her wallet. She knows which one is for “anything” and which one is for restaurants, etc.

The goal of the paid version–MaxRewards Gold–seems geared towards helping in a way where a review of my own life makes it look unnecessary. For you, it could be different.

Final Thoughts

The concept of MaxRewards is an interesting one, so we looked at the positives and negatives in our review and also considered the extras of the Gold plan. Essentially, this is an app that can help you find and use all of the bonus offers on your credit cards to earn more points and more cash back. The paid plan adds these offers to your cards automatically and will even notify you about offers ending soon.

For me and my wife, paying for the app doesn’t really make sense. For you, it could. Evaluate how much of this you do intuitively and how much you’d like an app to take care of these things for you (or remind you about them). Would that be worth a few bucks a month for you? If so, and you get more in cash back and points each month because of it, then paying for MaxRewards Gold could be worth it.

What do you think? Do you use (or will you use) MaxRewards?

Here is a referral link from our MtM Diamond member who suggested the service. You will get one month free to try it out if you sign up via referral.

Thanks for following up, but encrypting data even 20 times doesn’t do any good as it leaves a huge attack vector through their servers. That’s where they decrypt your credentials and send your bank login and password to the bank servers to simulate logging in as you. Compromise that server, and an attacker has full access to your bank accounts (in the case of Chase; less scary with Amex if it’s just credit card data, for instance).

There’s a right way to do this but it requires the banks to work with you to establish a secure, read-only connection that’s tokenized so that your account can’t be fully compromised as it can be right now with them. Even with that solution in place, in terms of privacy, you expose all of your purchase data to a third party; that’s a tradeoff some people will make, but it’s worth thinking about.

Their reviews are littered with 1 star ratings due to connection problems as it seems that Chase became aware of them and are blocking them to help protect their customers’ accounts (after all, it’s the banks who will foot the bill if their customers’ accounts are compromised).

If you haven’t “tested out” the “set a fair price” feature, can I ask where you got the $12/mo from? The only place where I’ve seen the price is where you can move a slider back and forth and literally set your own price – subject to a minimum and a maximum.

Interestingly, I’ve seen different reviews mention different prices, leading me to wonder if it differs per person, perhaps based on the number of cards/accounts perhaps?

Also, there are actually 2 prices, one monthly and one annually. My minimum prices are $9 for monthly and $5 for annually. (IIRC they both max out at $25.)

It is really a set your own price set up so I am guessing the suggested price may vary by person.

OPR – interestingly, now that you said this, I went back and tried to suggest my own price. Now, it allows me. When I first signed up to check it out and do a review, it told me I had to pay $12/mo. There was no option on the price. Then, I found the “set your price” info later on, after I had canceled. If I want to re-enroll for the paid plan, it now gives me an option. I do wonder if it scales pricing according to how many cards you’ve added (AKA how much it thinks you’re going to get out of the app). I’m seeing the same prices as you mention now.

I have the paid version. My issue is it keeps losing connectivity to Chase. And sometimes Amex. For weeks.

Not their fault I don’t think, because apparently Chase has been changing their login process / API intentionally.

But I’m not sure it’s worth paying for.

They are saying the system can “add” an offer on a Amex card after you’ve already done the swipe? I’m wondering if that would really work. Also, can you add multiple logins for each provider? Can I add all my AU Amex login accounts or is restricted to one?

I know people who use this feature with Amex regularly. It does work that way.

As for adding log in info, I hadn’t thought about that. I just tested it, and it allowed me to link my wife’s Amex account and add her cards to my app.

I cannot see getting $144 worth of value from this in a year. This seems to me like a product that people would be interested in if it was $10-20 a year. Just my thoughts

John – Just adding this in case you wanted to know: the lowest you can offer to pay is $60 annually, so $5/mo.

You sure lost me at “provide them your bank login info”.

Same. There is ZERO chance I’m providing an app with my bank login info. None. This is a huge glaring security concern and I’m baffled that in this day and age people still think this is reasonable.

Bad wording. You link the accounts. They don’t save your user name and password. I’m updating this to dispel the idea that they save a copy of it somewhere.

So you don’t have to give them your username and password in their app to link the profile? What else do they have access to once the “profile” is linked?

They do, actually, store your raw bank credentials on their servers, which is a disaster waiting to happen if they ever get big and are targeted by hackers. Nothing they do with banks is tokenized via OAuth to any of the banks, they’re literally logging in as you from their servers which means that they have your full credentials stored. Scary stuff. (Full disclosure: I make an app in the same space but chose to work around requiring bank logins as there’s no safe, privacy-focused way to do that, and doing what the banks don’t want you to do is not a great long-term plan IMHO)

Emmanuel – Thanks for the technical knowledge you’ve shared here. Much appreciated.

Emmanuel – MaxRewards saw my review and sent me an email stating that they use 2 keys to encrypt and don’t store this login data, so it’s safe from hackers.