PNC Credit Card Highlights

There’s lots of points and travel filler out there. This just in – maybe you should consider the Chase Sapphire Preferred card. Shocker – Amex lounges are crowded. News flash – someone is proud of their Hyatt redemption. Admittedly, I probably add to this pile of cliche pieces from time to time. I won’t do so today, though. Rather, I’m focusing on a relatively unsexy part of our hobby – a mid tier bank. I’m specifically diving into the highlights of the PNC Bank credit card portfolio, where many can easily obtain solid, reliable rewards. Let’s go!

PNC Personal Cards

PNC Premier Traveler Visa

This card provides a very familiar rewards structure with different branding. The Premier Traveler earns unlimited 2x miles on all spending. Miles are worth one cent each when redeemed to erase travel purchases made on the card. Cardholders can also opt to use their miles to book travel through PNC, but I recommend the erase function to maximize travel redemption options. It’s basically the Barclays Arrival+ from a different bank. And since that card is no longer available to new applications, PNC’s version may be worth the effort for certain individuals. PNC is currently offering 30k miles with $3k spend within the first three billing cycles of account opening. The $85 annual fee is waived the first year.

PNC Cash Rewards Visa

Adding a bit of complexity and higher reward rates to the mix is the PNC Cash Rewards Visa. Rewards come in the form of cash back, and the card sports useful bonus categories: 4% cash back at gas stations, 3% on dining, and 2% at grocery stores. Bonus earning is capped at $8k annual spend combined across those categories. The card earns 1% everywhere else. Since most of us can do better with other cards for dining and grocery, this is essentially a 4% cash back card at gas stations. But many of us are very active at gas stations, and an extra $320 annually from a no annual fee card could be just enough for some. Plus, PNC is currently offering $200 cash back with $1k spend within the first three billing cycles of account opening.

PNC Points Visa

I’ll get the icky part out of the way first. Points from this card are only worth about 0.2 cents each when redeemed for cash back or gift cards, PNC’s easiest redemption methods. When redeemed for airfare, points could be worth a bit more – but perhaps only 0.3 cents per point.

The card does earn 4x points everywhere, and cardholders who bank with PNC can earn 25%, 50%, and 75% bonus points each period, depending on their specific accounts and activity. Still, at the highest level, that equates to only 1.4% cash back. Points expire 48 months after they’re added to the account. PNC is currently offering 50k points with $750 spend within the first three billing cycles of opening this no annual fee card.

Obviously, most should focus on the Premier Traveler and Cash Rewards cards over the Points card. But some individuals, particularly existing PNC customers, may rationalize adding this card to their portfolio.

PNC Business Cards

PNC Cash Rewards Visa Business

The business version of the PNC Cash Rewards offers uncapped 1.5% cash back everywhere. PNC offers $400 after a cardmember spends $3k within the first three billing cycles of opening this no annual fee card. New cardholders can also obtain 0% APR for nine months.

PNC Points Visa Business

This no annual fee Points card on the business side earns 5x everywhere, but point values appear to still be in the paltry range as the personal version. New cardholders can also obtain 0% APR for nine months. Unfortunately, PNC doesn’t advertise bonus points earning similar to the personal version.

PNC Travel Rewards Visa

The no annual fee Travel Rewards card earns 1 mile everywhere, including 2x miles on the first $2.5k in purchases. Cardholders redeem miles in the same fashion as the Premier Traveler Visa.

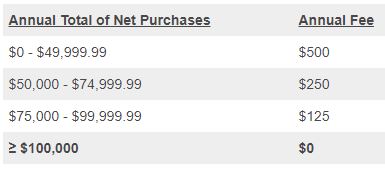

PNC Business Options Visa

Big spenders can earn a $750 welcome offer after $25k in purchases within the first three billing cycles. Cardholders can pick one of the three business card earning structures for their spending – 1.5% cash back, 5x points, or 1x mile. The first annual fee isn’t due until the 13th month of card membership. The annual fee depends on the amount of spend cardholders make on the card:

PNC Credit Card Highlights – Conclusion

PNC also offers other 0% APR and secured cards. While not jaw-dropping, PNC has a few credit cards that provide solid value to hobbyists, the Premier Traveler and Cash Rewards cards specifically. For those who have exhausted more lucrative card options with other banks, these PNC cards are especially worth considering. Indeed, I had the Premier Traveler a few years back but may opt for another go-round later this year. Whether it’s PNC or other mid tier banks, I’m always looking for less obvious options to earn lucrative rewards. And the hunt is part of the fun, in my view. What do you think of PNC’s cards?

No annual fee. Then $200 sign up bonus. Would do that Then scrap it.

Personal experience with PNC as a long term customer is that the rewards are frustrating to use (minus the “points” which are easy to use but not valuable) and expire after 2 years. The cash rewards card I hold just rolls your cash back away after 2 years. There is no notice in advance, and you only realize it expires at all when your balance starts to decline. This is primarily an issue since PNC only cashes you out at $100. It makes infrequent use – I leave it in my car for gas – frustrating. Just my two cents as a user.

Jay,

Thanks for sharing your experience – it’s a good warning for others with PNC cards!

PNC is larger than Capital One, for what it’s worth.

Interesting party fact!