Points and Travel Hobby Fears

With Halloween approaching, I’ve indulged in one of my annual routines – viewing several of my favorite horror movies. The Changeling, Hereditary, Dead Silence, The Fog, Midsommar, Rosemary’s Baby, Drag Me To Hell, The Thing, I could go on and on. But these days, it’s not just films that frighten me. And these other things are unwelcome scares. These items scare me most in our points and travel hobby.

The Basic Economy Boogeyman

I’m pleasantly surprised how I’ve adjusted to the vast majority of airlines moving from a standard award chart to variable pricing. Most of the time, I end up better off with the variable rates, paying much less than the 12.5k one-way miles which many airlines stuck to historically for domestic fares. But part of my deal with the airline devil is that I often must commit to basic economy fares.

Said carriers get their hooks into me with that enticing mileage rate, most always well under four figures of miles one-way. I’m particularly fond of those rates on non-stop itineraries where a ridiculously short transfer isn’t involved. Also, I’m a light packer and only book basic economy for solo travel. Nonetheless, I get antsy as I review all the warnings during bookings and click “Accept” after the multiple warnings. I know this is all by design, with the airline trying to scare me into paying more in miles for a non-basic economy fare. But regardless, it’s unsettling.

Jump to the airport when I prepare to fly on my basic economy ticket. I’m fully cognizant of the luggage limitations I’ve selected. I usually have a backpack or a small, underseat roll-on bag. But I still have a phobia of my bag being slightly too big. Of course, nothing has ever happened. Regardless, my bag being swiped for a big baggage fee due to my lowly fare is always in the back of my mind.

The Horrifying Wyndham Rewards Expiration Policy

I love hotel points, especially niche currencies, perhaps to my own detriment. Choice, Radisson, Sonesta, Wyndham, I’ll take ’em all. And I continue to accept a big risk with that last one. First, Wyndham Rewards points expire with 18 months of inactivity. No big deal there – I get 15k points annually with the renewal of my legacy Wyndham 2x everywhere card. Second, points expire four years from the date they post to a Wyndham Rewards account. Ewww.

Not only does Wyndham pressure members to actively redeem, they put all responsibility on us to track when the points posted in order have the full picture. Wyndham has a chintzy little notice in a member’s online account notifying when the next points expire, but nothing beyond that. (Yes, transferring to Caesars Rewards may help with expiration issues.)

But instead of holding off for that rare aspirational Wyndham stay that I’m unsure will happen, I sometimes redeem earlier at ho-hum properties to get the points used. A redemption tragedy!

Chase Pay Yourself Back Uncertainty

As a cashout fan, I’ve loved getting 50% more value out of Ultimate Rewards for doing something I was already enjoying at one cent per point. Indeed, Chase’s Pay Yourself Back feature started out with a bang, including grocery stores as one of the first redemption categories. Over time, Chase has whittled away at the categories, where the biggest current highlight for most Reserve cardholders is dining.

On top of this, Chase has continued a trend of only extending Pay Yourself Back three months at a time. Consequently, I’m reassessing my Chase earning and redemption strategy way more often than I’d like. I’m fine with the dining category, but I’d appreciate a bit more confidence in the feature by Chase extending the policy longer term. I have no reason to expect this happy ending, though.

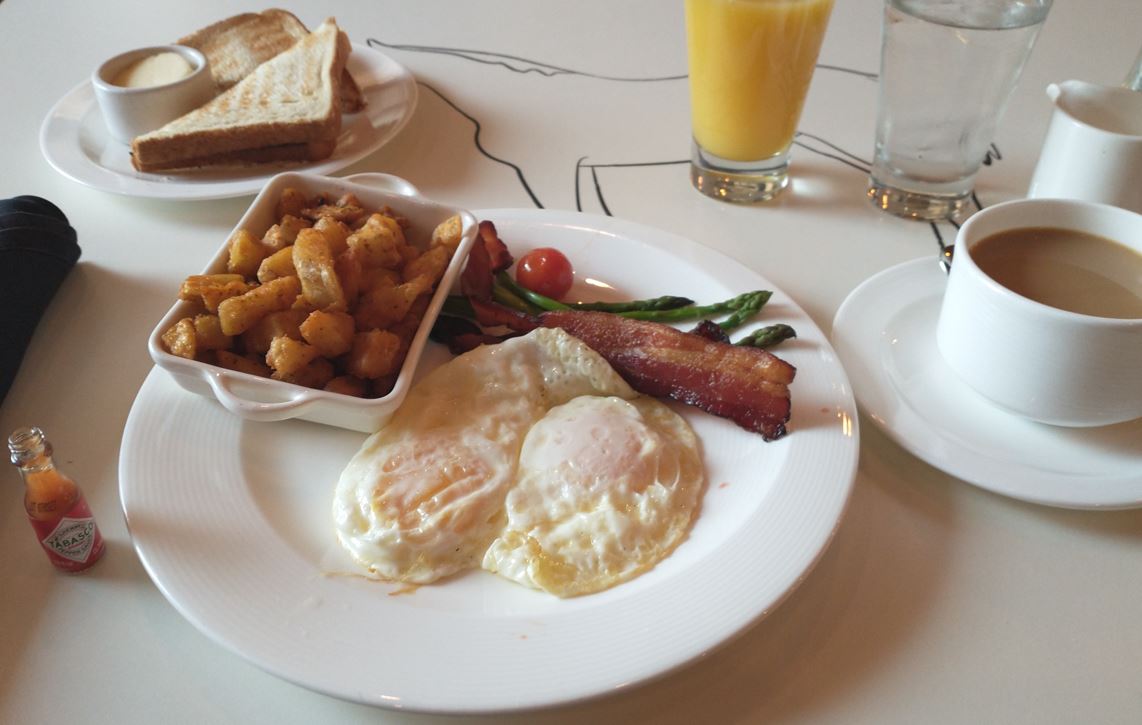

Hilton Elite Food & Beverage Credit Suspense

I’ve learned to accept the Hilton program’s daily elite food and beverage credit for what it is. But part of “what it is” is tremendously inconsistent and unpredictable from property to property. I’ve learned to treat this benefit on a purely case by case basis, since so many properties interpret and enforce it differently. To manage my own expectations, I’ve taken on more work to confirm the exact benefits in advance and at check-in. Regardless, a smooth, sensible experience with the food and beverage credit is not guaranteed. And in my experience, going line by line through a folio with an inexperienced front desk agent at checkout can be a horror show.

The Most Dreaded Amex Pop Up

My wife is currently in Amex pop up purgatory. Long story short, she hasn’t been eligible for several new card welcome offers in months based on her prior behavior with Amex. Ironically, one could say that status is more calming than not being in the pop up inferno. At least someone in pop up jail knows they’re there and will eventually get out, most likely. Me? I’m not there and inevitably wonder how each of my Amex actions contribute to my inevitable pop up destination. This paralysis by analysis can be horrifying. But ongoing Amex juice makes it a net win. That’s what I’m telling myself, at least.

Conclusion

Taking a step back, the points and travel hobby items aren’t a horror show. They add up to something more like Vanilla Sky (maybe I’ll get into that in a future article). But the more I think about it, these “fears” are worth embracing. They make our game more interesting, and fun, to play. And if we’re not having fun with all this silliness, why bother doing it? And so, dear reader, as Halloween approaches, what’s in your points and travel nightmares this year?

Chase Sapphire Preferred® Card

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Why not just avoid what we don’t like (e.g. hotels with resort fees)? Might these fees go away when hotels, for example, with fees don’t get our business?

DaninMCI, the 57.5k AA redemption to Europe still exists and I see it regularly. It’s just that it’s on BA metal and has BA’s fuel charge. The 110k redemption is on AA metal and has no fuel charge. That’s the difference.

That being said, I agree with you and others that the airlines practices are turning people into free agents. As what’s happened in the hotel world. It is liberating to let go of tier status.

As for the economy, inflation was baked into the equation when the federal government gave support payments during COVID. This was not on Biden’s watch. But, I don’t blame his predecessor either. The inflation we’re experiencing now is a necessary evil to have avoided a depression caused by COVID. But, memories are short.

The real scary part (besides anyone that ever thinks Wyndham is ever going to be a great place to build up points) is the double-edged devaluation. This was caused by dynamic pricing and is being impacted by the Biden administration’s poor handling of the economy which has resulted in record inflation. Most airlines and hotels have gone dynamic for awards which are mostly pegged to demand and the actual cash cost of the awards (in most programs now). That $ 100-a-night hotel that is now $175 or $200 is no longer 10k in points it’s 36,343 points or whatever amount over your free night certs. That $6000 premium cabin award flight to Europe that was 57,500 each way is now some random amount like 130,000 or more but well over double the old charts. It’s really too bad that these travel loyalty programs are failing to understand that they are making most people into free agents. This is especially true with less business travel where road warriors used to just build up miles or points because they had favorite problems and got taken care of. We now have leisure travelers or miles and point gamers that just try to obtain loyalty status even if they hardly ever fly or stay at a single chain. There are still some bright spots out there like Aeroplan or Hyatt but with time those will also fall due to overuse and abuse. We are already seeing cracks at Aeroplan with their recent churner warning email. The travel companies are at risk of breaking the golden goose and we are going to help them hunt it down and shoot it. I won’t even get into how credit card companies will contribute to all this. It’s scary out there folks so earn and burn asap.

Most of your points I agree with. Hotels and airlines, in the end, are free agents/ actors in the economy except for they are allowed to engage in monopolistic practices. Not sure how you make this political, but you do you. The points / program erosion has been going on for decades. Dynamic pricing for points is no different that dynamic flight pricing or room pricing (convention in town? Guess what? That room will not cost double, even if the size of the room did not increase, and on and on. Fly during Spring Break or Thanksgiving/ Xmas? Pay deep. Add on junk fees? Yes, let some chain or airline go first and the rest will follow. Cut breakfast to zero or give “points instead,” yes, why not. And on it goes. Your last sentence nails it perfectly, “It’s scary out there folks so earn and burn asap.” I used to smile when I say 1M points in X loyalty program…now I realize I’m being an idiot! Travel safe everyone!

I think the real “horror” is the ongoing, slowly boiling the frog situation that we are seeing with all so-called loyalty programs. The long-term result is that eventually these will be worth about zero. With so many ways to achieve “top status,” lack of enforcement by the brands to the individual properties, continued erosion of what your points are actually worth, etc, you have to ask yourself, when was the last time these reward programs have actually improved for its members?

Completely agree…we all accept less and pay more and then wonder why the programs so arrogantly label devaluations “enhancements.”

Marc,

Thanks for the perspective worth extra reflection. As far as improvements go, Hilton making their free night certs more flexible is my recent favorite. But that’s a droplet in the largest of buckets.