Chase Pay Yourself Back Categories

Chase launched Pay Yourself Back a year or so ago to much fanfare. It offers cardholders a way to cash out their Ultimate Rewards points at a higher rate than they can for just standard cash back (25%-50% more). The catch is that it is only for certain categories, and those categories are different depending on which card you have. The Chase Pay Yourself back categories change a few times per year too. The current slate of categories were set to end at the end of March. Chase has extended some of those categories, add a new one and it looks like others will be dropping off. Let’s take a look at the categories for each card that is eligible (active categories and extensions are in bold).

Update 9/29/22: The categories have been extended until the end of the year.

Be sure to bookmark this page, we will update it often as categories change.

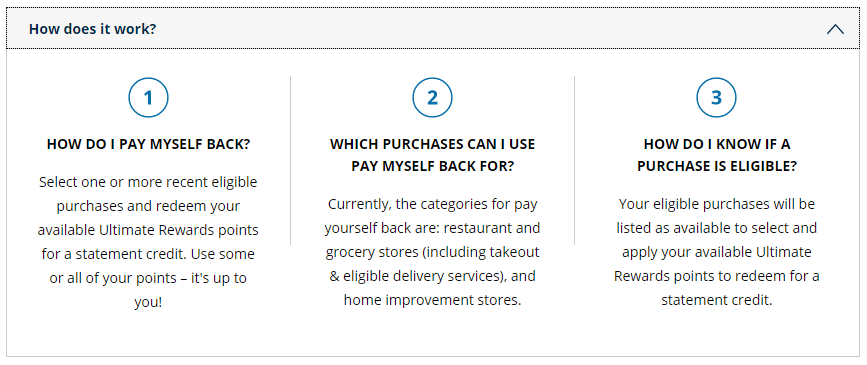

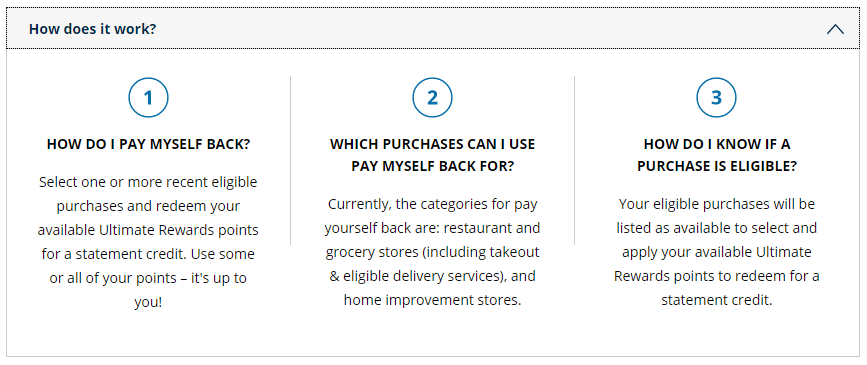

How ‘Pay Yourself Back’ Works

Before we dive into the categories we should talk about how this all works.

After making a purchase in an eligible category or making a donation to an eligible charity, cardmembers can select from recent transactions made up to 90 days prior, choose to redeem points for all or a portion of the purchase, and get paid back with a statement credit. Categories and redemption values will evolve over time to continue to provide the most relevant and practical value for cardmembers.

To access the Pay Yourself Back feature, cardmembers can simply log into Ultimate Rewards on their desktop at www.chase.com/ultimaterewards or through the Chase mobile app. Also check out Shawn’s guide here for more information.

Chase Sapphire Reserve Pay Yourself Back Categories

Here are the current Pay Yourself Back categories, and their end dates, for the Chase Sapphire Reserve where you get 50% more for your points:

- Airbnb – 12/31/22

- Dining – 12/31/22

- Annual Membership Fee – 12/31/22

- Select Charities – 12/31/22

Chase Sapphire Preferred Pay Yourself Back Categories

Here are the current Pay Yourself Back categories, and their end dates, for the Chase Sapphire Preferred where you get 25% more for your points:

- Airbnb – 12/31/22

- Select Charities – 12/31/22

Chase Ink Business Preferred / Plus Pay Yourself Back Categories

Here are the current Pay Yourself Back categories, and their end dates, for the Chase Ink Business Preferred and Ink Plus where you get 25% more for your points:

- Internet, Cable & Phone Services – 12/31/22

- Select Charities – 12/31/22

Chase Freedom Flex / Unlimited Pay Yourself Back Categories

Here are the current categories, and their end dates, for the Chase Freedom Flex and Chase Freedom Unlimited where you get 25% more for your points:

- Select Charities – 12/31/22

Eligible Charities with Pay Yourself Back

Current eligible charities with Pay Yourself Back include:

- American Red Cross

- Equal Justice Initiative

- Feeding America

- Habitat for Humanity

- International Medical Corporation

- Leadership Education Fund

- NAACP Legal Defense and Education Fund

- National Urban League

- Thurgood Marshall College Fund

- United Negro College Fund

- United Way

- World Central Kitchen

Chase Pay Yourself Back Categories – Final Thoughts

It appears Chase Pay Yourself back is here to stay, at least till the end of 2022 for sure. I like the extensions we have seen listed above, including the annual fees for the Sapphire Reserve. Although, as Benjy pointed out, you don’t earn points on that spend like you do for the other categories so max it out elsewhere first. It is sad to see office stores not extended on the Ink cards since that was an easy category to rack up the spend in with the card’s 5X earning and office store promotions.

Chase Sapphire Preferred® Card

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I see that now my Chase Ink Business Plus PYB for internet, cable, and phone, as well as shipping is extended to 3/31/23. Charities PYB still expires on 12/31/22.

For the Freedom Flex it also lists International Rescue Committee. That is my preferred charity (never more needed than now, with so many refugees in all parts of the world). Just donated to them the same amount as all my Chase points.

That is great to hear Jeff. I would probably just cash out the points at 1 cent and then donate to the charity separately to ensure you get the proper tax info back from them.