DISCLAIMER: Miles to Memories & the author are not credit providers and do not provide personal financial or professional advice or credit assistance. The information published on this site/page is of a general nature only and does not consider your personal objectives, financial situation or particular needs. All information published here is my own personal opinion and comes from personal experience. The information published on this site/page should not be relied upon as a substitute for personal financial or professional advice. Miles To Memories and the author strongly recommend that you seek independent advice before you apply for any product or service, which is described on the site/page.

Your Questions Answered

A few days ago I opened up a discussion for readers to ask questions that they haven’t been able to find answers to. Two days ago I answered one reader’s question about acronyms and coded language and yesterday I talked about money orders, Amex AUs and upgrading/downgrading cards. Today I am going to answer a few more questions.

If you want to ask a question yourself, head over to this post and leave a comment!

Question 1

Our first question comes from Beechy:

I have both Chase Ink Bold and Plus coming up for renewal. I am only planning on keeping one. Would you suggest that I keep the Bold since it is not offered anymore, that way in time I can try for another Plus card after 24 months ? Cancel outright or a different strategy ? I appreciate all the help and really enjoy your posts !

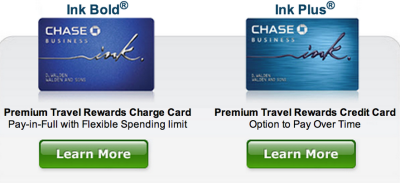

The answer to this question is largely personal based on your needs. If I was in your situation (and actually I will be soon since I have both a Bold and a Plus) I would definitely close the Plus. Since I pay off my bills in full every month, the Bold charge card and the Plus credit card work the same for me and both are identical in every other way.

Here is the language Chase uses for how they pay out bonuses on the Ink Plus: “This new cardmember bonus offer is not available to either (i) current cardmembers of this business credit card, or (ii) previous cardmembers of this business credit card who received a new cardmember bonus for this business credit card within the last 24 months.”

Since it will never be possible to get another bonus on the Bold, it definitely seems like the card to keep if you only want one. That way after it has been more than 24 months since you received the bonus on the Plus, you will be eligible. I think your strategy is exactly what I would do.

Question 2

Our second question comes from Pam:

Hi. When going through a shopping portal, does the portal know if you return something after you’ve bought online. (Other than a credit card portal where you have to use that card for payment.). Thanks!

This is a great question Pam. Lets just say the portal should know when you return something which is why they often wait weeks or months to pay you. Some merchants do a great job of reporting returns while others don’t. I remember a couple of years ago when a popular retailer was allowing 30% off codes to be used on their gift cards. I went through a portal paying 10x. The retailer realized the error and cancelled the order themselves. Somehow though the 10x still posted! I received 12,000 free points.

Through that experience I realized I could buy and return anything from that retailer and still earn portal rewards. But there is a difference between “could” and “would”. Some people do buy and return just to keep the points, but that crosses a line for me. Some people also buy online and return to store since there are merchants who don’t claw back portal rewards for in-store refunds. There are always ways to work the system, so you will have to sort of keep to your own moral compass.

Question 3

Our third question comes from Mel:

Can I use my Citi Executive card to pay for my husband’s Global Entry application and get reimbursed? I’m not sure if this can only be done for the card members own application.Thanks in advance!

Mel is referring to the fact that the Citi AAdvantage Executive card just added a Global Entry fee credit to its list of benefits. A couple of other popular cards that have this benefit are the American Express Platinum card and the Citi Prestige.

Thankfully I have good news for you. Citi doesn’t know or care whose Global Entry fee you are paying. They simply will provide you with one credit for the fee. Here are the terms for the fee credit on the Citi AAdvantage Executive card:

Citi® / AAdvantage® Executive World Elite MasterCard® account cardmembers are eligible to receive one (1) statement credit per account, every five (5) years up to $100, for either the Global Entry or the TSA Pre-Check application fee. Cardmembers must charge the application fee of at least $85 to their Citi® / AAdvantage® Executive World Elite MasterCard® to be eligible for the statement credit. Cardmembers will receive a statement credit for the first program (either Global Entry or TSA Pre-Check) to which they apply and pay for with their eligible card, regardless of whether they are approved for Global Entry or TSA Pre-Check.

The one (1) statement credit every five (5) years for the application fee charged to the Citi® / AAdvantage® Executive World Elite MasterCard® account is applied by Citi directly to the card account. Please allow 1-2 billing cycles after the qualifying Global Entry or TSA Pre-Check is charged to the eligible account for the statement credit to be posted to the account.

As you can see nowhere does it mention that you need to pay for the cardholders application, but only that you can get a total of 1 credit up to $100 every 5 years. The Citi Prestige says something similar. “As a benefit of the Citi Prestige Card, Citi will provide one statement credit for this $100 application fee, once the fee is charged to the account.”

I can also confirm that this works the same on the American Express Platinum card. If you already have Global Entry and so does your spouse, the next time you get a card that has the benefit, offer to pay for family members or friends! Spread the Global Entry love!

Conclusion

There are many more questions left to answer and I’ll be trying to get to a few each day. If you want your question answered then please leave a comment here. Also, feel free to chime in with your experiences and opinions about any of these questions in the comments! Have a great weekend!

| Miles to Memories operates under the Value for Value model. If you receive value from this site, find out how you can provide value back. |

|---|

[…] Ink Bold or Plus, Paying for Someone Else’s Global Entry & Shopping Portal Clawbacks after Ret… […]

[…] Ink Bold or Plus, Paying for Someone Else’s Global Entry & Shopping Portal Clawbacks after Ret… […]

I usually ask stores to put it on a gift card or store credit, because I have had Skymiles shopping claw back points for a return. A department store-which-will-remain-nameless, ignored my instructions (verbal and written) and credited the return back to my card. This was a couple weeks after the purchase but they caught it and deducted the points.

On question #1, a follow-up question and an observation. The question is: I’m assuming Beechy could also downgrade the Ink Plus (or Bold?) to a Ink Cash? Or is the downgrade option not available for Chase business cards? (And, if available, they might want to apply for the Cash first before the downgrade, to get the Cash sign-up bonus, since it won’t be available for 24 months after the downgrade.) The observation is that Beechy might also want to call for a retention bonus instead of cancelling (or downgrading). I have done this in the past on the Plus. It wasn’t huge (I think 5000 bonus UR for not too much spend), but it was enough to neutralize the annual fee … and still leave that $50k of potential office 5x spend on that card available to me.

Great points and definitely an angle I should have covered. Thanks!

Happy to add something to the discussion. Love the Q&A. So am I correct that the Ink Plus is downgrade-able to the Cash?