Changes Coming to Softcard Serve in 2016

Don’t you just hate when someone talks about a good product that has gone away? I have a friend who has a Citi Forward for example. It pains me every time he pulls it out to pay at a restaurant because he is earning 5X. That card also earns 5X at book stores including Amazon. Crazy and of course that is why it isn’t available any longer.

ISIS or Softcard Serve

While not nearly as good as the Citi Forward, the Softcard version of Serve was definitely the best flavor of that prepaid card and it has gotten better over time. While American Express has moved other versions of Serve off non-Amex online credit card loads, the Softcard version still allows Visa & Mastercards. Additionally, it allows up to $1,500 per month to be loaded online instead of $1,000 with the regular versions. So so nice.

Usually when companies have a product that is too generous, they will make changes or discourage its use. Apparently that is happening now. About a week ago I received notice of a new monthly fee coming to “SoftServe”. I had forgotten about it until today when Ryan sent me the same notice. I figure it is newsworthy enough to share.

Here are the changes as described by Amex:

New Monthly Fee & Fee Waiver

Starting on January 6, 2016, there will be a $4.95 Monthly Fee for your American Express Serve Softcard Account. This fee will be waived if you Direct Deposit money onto your Account during a monthly statement period.

So they are implementing a new monthly fee. This doesn’t surprise me given the split of Serve into many different versions with varying fees. Thankfully they do give us a way to avoid the fee. We need to have a direct deposit into the account at least once a month!

ACH Transfers

In the past, ACH transfers to Serve have counted as a direct deposit. The easiest way to get this fee waived is to setup recurring transfers so you don’t forget. A lot of banks have this ability. I personally am going to use my Discover Savings account for now to accomplish this. If for some reason it doesn’t work then I’ll make sure to update everyone.

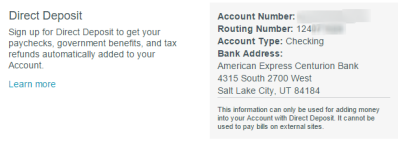

To setup transfers to your Serve account, simply login and go to settings. There you should see the account and routing numbers that you’ll need to tell your bank.

Conclusion

For those of you with the defunct ISIS (no not that ISIS) and then Softcard branded Serve card, there is still hope of waiving that monthly fee rather easily. I personally am still glad I have the card and its ability to load $1,500 per month from a non-Amex card. That alone is worth the $4.95 per month, but why pay when you don’t have to?

Here it is almost 10 months after and after waiting on my phone for 30 minutes because of disconnects, I get through to get password reset cause I’ve been locked out.. then I see since January American Express Serve has been taking $4.95/ $60 a year – for WHAT?

I’ve gotten notice that my $50 a month that was no longer being deposited cause I cancelled the card bcoz of fraudulent charges (not Serve).

Ok so I’ll transfer (recurring) from my savings account and hopefully not get charged a fee. Do I have any recourse for the $49.50 they’ve taken already?

[…] monthly fee on the One VIP card is only $1. Not bad. Unfortunately as of January, 2016 the Softcard Serve has a $4.95 monthly fee and I am now paying it. The question now becomes when it […]

I’ve tried to set up recurring ach transfers to Serve from 3 different bank account.s. All 3 reject posting an ach push to Serve. If someone else figures out how to get direct deposit working, please let us know!

Do you know the minimum direct deposit required to avoid fees?

It didn’t say. I suppose they will publish the full terms in January, but for now based on that language I am assuming any direct deposit will work.

Shawn

I’ve been notified this month tgat because I direct LOADED my AmEx Serve card more than $500 then my monthly fee is waived.

Won’t the same be true after this proposed change?

This only pertains to the Softcard Serve. If you have that, then it seems based on the language that after January 6, they will charge the fee without a direct deposit.

For the old soft serve card, can you unlink the current credit card and relink a non-Amex card?

As far as I know you can. The last time I did it was two months ago, which was still well after the change. It is possible something has changed since then, so I can’t guarantee it will work, but I suspect it will.

Yes, you can still link a non-Amex card but you may have to use an app to do it. I didn’t have the option to load a non-Amex card on the Serve website but had no problems using my iPhone app 30 minutes ago. I didn’t even have to do the security verification upload.