Changing the Linked Credit Card with Softcard Serve

A few months ago American Express made a very sad change to their Serve prepaid card. They used to allow loads of up to $1,000 per month to Serve directly from a credit card. While they didn’t eliminate the $1,000 in loads per se, they limited them to Amex cards only, most of which don’t earn rewards on Serve loads.

There was/is of course a different version of Serve that was issued through the now defunct Softcard (ISIS) app. That version was unique because it upped the $1k limit on credit cards loads to $1.5k per month. As I reported back when this change happened, for some reason the Softcard Serve also still allows loads from non-Amex cards.

Can You Change a Linked Card?

The big question for many of us with a “Soft Serve” is what happens if we want to switch our linked credit card. If we remove the current non-Amex card, will the system restrict us from adding a new card? Well, I ran into a situation the other day where I had to switch my card.

I recently cancelled my Arrival Plus card. That card just happened to be the one that was linked to my Soft Serve account. Yesterday I finally got around to taking the old Arrival off of my Serve account. Thankfully I can report that I was successfully able to add a new Mastercard onto it.

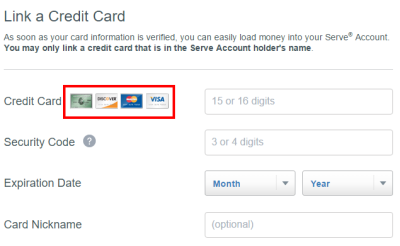

The process of removing the card was simple. I just clicked to delete it and then had the option to add a new card. As you can see from the screenshot above, the Visa, Mastercard and Discover logos still show as available to be added so the system. It looks like the normal Serve website looked before the rules changed.

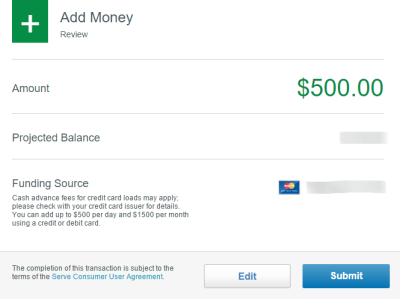

Adding the card was simple and before long I was able to successfully load $500 to my Serve card. It seems based on my experience that American Express has left the Softcard version of Serve on the old software platform and thus the system is setup to accept Visa/MC/Discover cards. Maybe this is an oversight or perhaps they know it is happening and don’t care or contractually can’t change it.

Conclusion

If you currently still have a Softcard version of Serve, I can confirm that it seems safe to switch out one card for another. At the very least I can confirm that I was able to add a new card and successfully complete a load with it. That is really good news and another reason that I am glad that I kept at least one of these magical blue cards around.

I have one of the legacy Softcard/Google Wallet Serve accounts that continued to permit funding (up to $1500 a month) from non-Amex credit cards, after they removed the non-Amex funding option from newer Serve accounts. For the past few months, I’ve been successfully funding my Serve account with a Chase card, with 3 $500 transfers a month. Today I got an email from Serve essentially terminating my account due to “unusual usage patterns”, with a reference to a section of the uuser agreement which references ‘manufacture activity”. It’s not technically a closing of the account. Serve has terminated the ability to fund the account from any source (not just a non-Amex credit card), but I continue to have access to the funds. When the balance gets to $0, the account will be closed.

This doesn’t come as a total surprise. In fact, I’ve been more surprised that I could continue to fund the account with a Chase card. And this may not be an across the board automated ‘sweep’ of accounts with non-Amex credit card funding transfers. I had a problem with a misdirected payment that required filing a dispute, so there have been actual humans looking at the account to resolve the issue. The timing, though, is curious, because the issue was finally successfully resolved yesterday, and the account termination came today.

Yes many people including myself received that sad sad email. https://milestomemories.boardingarea.com/breaking-american-express-shutting-down-bluebird-serve-accounts/

Tried to add a Barclay Priceline Visa to softcard serve last week and today. all failed.

in chrome, it only allows me to enter 15 digit number.

in IE and mobile app, i can add 16 digit number, but it returns a error.

So is the Visa/MC load got shut down?

My card that is already linked still works. Maybe they just shut down the ability to add a new card. That does stink.

I am repeating my above comment once again. Since you said Barclays card, I am guessing this may help you.

=====================================================

I was getting error because of some weird format Barclays uses for storing address in their Address Verification system. After doing some more reasearch over FlyerTalk, found the below solution. This worked for both mine and my wife’s cards.

“Barclaycard holders who have a unit / apartment / suite in their address should only input APT for the Address Line 1 and keep Address Line2 blank.”

So if your address is “1234 Main St, Apt 999”

then just Put “Apt” in address line 1 while entering in Serve account. Any other combination would fail the transaction and card doesnt get added.

hi noob question here I just started learning about manufactured spending and I have a softcard serve that I use, it only let’s me do online loads up to $1500 a month but can I use my new Barclay arrival + to load $3000 somewhere else to meet my spend requirements? like cvs or family dollar?

No but you have options. Read this and it should explain what you need to know. http://frequentmiler.boardingarea.com/the-complete-guide-to-bluebird-redcard-serve-and-softserve/

It’s been a while since I added a new account to softserve, but I remember getting some kind of error when I tried to put a new card on there. I think I had to call and verify. I also remember having to scan and send in a copy of my ID AND the CC I wanted to add. Has anyone else had this issue? I’m scared I won’t be able to change my card and be locked out of the current one if I try. Any help is greatly appreciated.

That happens every now and then. When I switched to new CCs or DCs on my SoftServe account, I uploaded the card(s) before I even linked it. I wait till the next day to use the card to load funds. So far, this tactic has worked for me and I have not gotten the error message to call CPS. I figured they must’ve checked the card to make sure my name is on it so they don’t block when I load. Lately, I don’t even upload my cards, I just switch to a new card, wait till the next day and I don’t get an error message. I must have “trained” them well…lol

my wife just signed up for a CSP so i deleted my CSP from her account and tried to load her softserve account but it triggered a “please call account protection services.” we called, got the block removed, and readded my CSP. it then proceeded to work with no problems. so i tried to re-add hers and it triggered the same error message.

I’ve been reluctant to try to change away from my Chase Sapphire and Marriott Rewards Visa cards. I’d like to flip to a Barclays card to help meet spending requirements for my AAddvantage EQM’s.

Anyone had good/bad luck w/ changing to Barclays cards?

Yes I did. Check my above comment.

Data point: It did trigger a fraud alert for both mine and my wife’s(AU) cards. I had to call twice to Barclays bank to release the alert but no impact in the serve account. Try loading <$100 for first time. Do let us know if it triggered ID requirement.

Yeah, I was so glad it was working fine until July. But unfortunately Barclays gave me a new card due to some fraud activity at one of the merchants. So I was forced to change my card as my old card was deactivated.

I am currently outside US for VISA renewal so I dont have any US address proof. My old Drivers License got expired in Feb itself. Through my friend at US, I got new card. When I try to add new card I am getting error now. 🙁

So I would need advice from you on below things

1. Is it okay to call Serve and ask them to update the my card manually?

2. Will it trigger any ID proof requirement?

According to their requirements, they would need me to send US ID proof which unfortunately I dont have. So any workarounds please?

You could call and see what they say. Anytime you add a card it could trigger the ID requirements. It is about 50/50 for me. So far for this recent change I haven’t been asked for ID, although it has happened to me several times in the past.

Thanks Shawn. Let me give a try. I will report back here.

I was getting error because of some weird format Barclays uses for storing address in their Address Verification system. After doing some more reasearch over FlyerTalk, found the below solution. This worked for both mine and my wife’s cards.

“Barclaycard holders who have a unit / apartment / suite in their address should only input APT for the Address Line 1 and keep Address Line2 blank.”

So if your address is “1234 Main St, Apt 999”

then just Put “Apt” in address line 1 while entering in Serve account. Any other combination would fail the transaction and card doesnt get added.

I hope it would be useful for somebody else.

This makes me very sad that I got rid if both my softserve cards for redbirds, although I’m still probably mathematically ahead..

I had to take the opportunity to get the redbirds when I was around them.

Good for those who kept them, though.

Thanks for your posts, you do great work. Since you do a lot of retention calls, maybe you could do a post on best cards to downgrade to? I don’t remember seeing the information before, and I know I’d find the information valuable.

shawn,

I have a brand new softcard sim from T-Mobile, never used, is it still possible to get an existing serve account to work with softcard? I know I’m a little late to the party.

I don’t believe so because the company is defunct so I don’t think the app is available and even if you are able to install it, my guess is it won’t work.

I am in the process of doing a test with Citi and will let you know.

I’m sure it won’t work to register for a Softcard account because it has been dissolved as of March 31, 2015 when Google bought it.

I’m glad I held on to my 6 Softcards when all others were switching to RBs and mocking all those who continue to serve. I had an inkling that RB free loads with CCs were not sustainable and wouldn’t last. I was right.

Nice!

I did the same thing.. held on to 5 softcards resisting the temptation to switch over to RB and quietly waited for the news 🙂

I revisited some old posts and it seems Citi and BofA is probably still not safe to load Serve.

I have been loading 2 of my Serve accounts with Citi DC and get 2% CB.

I know this has been covered before… which cards are safe and won’t trigger cash advanced fee. I’ve been using nothing but barclays and chase cards. Anyone using Citi (AAdvantage) or BofA (Alaska AIr) for the load?

I know of some who loaded Serve with BoA Alaska signature Visa and were not charged CA. While everything can change in a blink, you can test with small loads initially just to make sure they’re still posting as purchase.

Thanks for reporting back on this, I’ve been worried about losing this feature. What if I wanted to get points for an amex card on a softcard serve account? That won’t work huh?

American Express issued cards do not earn points or rewards. Third party issued Amex cards (Amex cards issued by other banks) may earn rewards.

Thanks for posting about this, I’ve been worried for months to switch my card. Now, what about this? I have a bunch of spending I need to do on some AMEX cards I just got to meet requirements. Can I not add an amex card to my softcard serve account to do this?

You can add an Amex card too.