| Miles to Memories does not have a direct relationship with the card issuing bank and this review does not include any affiliate links. If you wish to support the site, you can apply for cards by clicking through from this page. Before applying I highly suggest reading the following post about taking it slow. You can find all of our credit card reviews here. |

|---|

Synchrony BP Visa Card Review & Analysis

Recently Synchrony Bank took over the BP co-branded credit card from Chase. As you may know, Chase has a ton of great cards, so this one may have been overlooked before. Now that it is with the much smaller Synchrony, it may be worth a second look.

The BP Visa Card

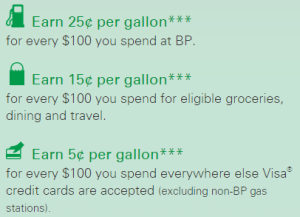

To see why you may want to consider this card, lets look at how it earns:

- Earn 25¢ per gallon (up to 20 gallons) for every $100 you spend at BP.

- Earn 15¢ per gallon (up to 20 gallons) for every $100 you spend for eligible groceries, dining and travel.

- Earn 5¢ per gallon (up to 20 gallons) for every $100 you spend everywhere else Visa® credit cards are accepted (excluding non-BP gas stations).

Sign-Up Bonus

So the everyday earnings aren’t particularly fantastic, but now lets look at the sign-up bonus:

Introductory offer: Earn 25¢ off per gallon for every $100 you spend everywhere Visa® credit cards are accepted for the first 90 days (excluding non-BP gas stations).

Now that looks promising. $.25 off per gallon for all spend for 90 days. I could see some of you racking up huge gas discounts, but is it really worth it?

Just off the top of my head, a $500 Visa gift card with a $3.95 fee generates roughly $1.25 off per gallon up to 20 gallons or a total of $25 off. If you are able to use the full amount and if your BP station is priced competitively, that is a pretty amazing sign-up bonus and as you can probably tell, it equates to 5% back.

More About the Rewards

Rewards earned on the card are good for 12 months, so you do have awhile to redeem them. While many people probably don’t have 20 gallon tanks, you can always share with your spouse or use a gas can to make sure you are maximizing. Or you have another option.

Buried deep in the fine print of this card is this:

You can choose to redeem your Rewards in the form of a statement credit on your Card Account. If you choose this option, the total amount of your earned Rewards will be multiplied by 15 and the product will be applied as a credit to your Card Account. For example, if you have earned $0.10 (ten cents) off per gallon in Rewards, you can choose to have $1.50 applied as a credit.

So basically you can redeem your gas discount for cold hard cash at 75% of the maximum discount value. A $.10 discount worth a maximum of $2 is worth $1.50 as a statement credit. Now this gets interesting. Even if you don’t have a BP station nearby, that 5% everywhere sign-up bonus turns into 3.75% everywhere for 3 months.

Where $40K in Spend Gets You

So what if you decided to go relatively big and spend $40k over the first 3 months. Lets assume you have a $3.95 fee per $500 in spending, although many people should be able to achieve this level of spending without a fee. With those assumptions here is what you would get:

$100 off per gallon of gas (obviously you could split this up over multiple visits) worth a total of $1,684 after factoring in fees.

OR

$1,184 in statement credits after fees.

Is It Worth It?

BP has a regular loyalty card that gives $.10 off per gallon on all spend at BP stations, so the everyday spending on this card only gives you an additional $.15 off or 3%. I would personally rather use the ThankYou Premier and earn 3x ThankYou points, so I don’t think the card is good in this manner.

The card does earn $.15 off at grocery, dining and travel which could be decent, but really only if you maximize the 20 gallon redemptions. I really don’t think I would want to lock my spending into BP’s rather complicated rewards program.

With all of that said, the ability to earn 5% back for gas purchases or 3.75% cash back during the first 3 months makes this sign-up bonus something to look seriously at. If I had a BP station nearby, I would probably get this card and rack up thousands in free gas. I don’t, so I have to think about whether the 3.75% cashback is worth it.

Synchrony Bank Limitations & More Information

Synchrony Bank isn’t always the easiest to work with and some people have reported being given small credit lines which could make this card tough for MS. Even so, it may be worth a try and is something I am strongly considering.

You can find the full terms of the program along with an application here. Doctor of Credit also has a full review of this card that is worth reading if you are seeking more information.

Conclusion

In the end I think the sign-up bonus on this card is quite interesting and makes it worth looking at. While I won’t be applying for the card tomorrow, as soon as my Wells Fargo 5% card runs dry later this month, it has to be in serious contention.

[…] BP’s New Credit Card & A Possible 5% Everywhere Sign-Up … – Synchrony BP Visa Card Review & Analysis. Recently Synchrony Bank took over the BP co-branded credit card from Chase. As you may know, Chase has a ton of great … […]

I want to check my BP balance and I can’t get in anywhere!!!!! This stinks!.

I might be incorrect but I think you can use the BP card at an ARCO gas station.

BP sold Arco a couple of years ago and they don’t list those locations on their website. I’m not sure either way, but they may still have an agreement.

you can do better with svmgiftcards at ebay or amex offer buying gas gift cards. that is 10% to 20% off plus CC points and any discounts that the gas loyalty program can provide.