How To Transfer Ultimate Rewards to an Authorized User’s Travel Account

I downgraded my Chase Sapphire Reserve card account to a Freedom Flex account a few months ago. Prior to doing so, I knew upgrading again to the Reserve was an option and a probable likelihood. I subsequently described why we decided to upgrade back to the Chase Sapphire Reserve from another Freedom account. Once Chase extended Pay Yourself Back, it was an easy decision to upgrade again. I’ve cashed out Ultimate Rewards for years, and Chase has paid me 50% more for doing so since Pay Yourself Back arrived. The wife and I ultimately decided to upgrade one of her Freedom accounts to the Reserve. One matter we didn’t overly focus on during the process is that I’m an authorized user on this account. The authorized user card carries an additional $75 fee, but we decided to keep it. Why? Many authorized user benefits exist, but primarily, I like the ability to transfer Chase Ultimate Rewards points to my travel partner accounts as an authorized user. Here’s how to do so!

How-To

Step #1 – Log In to Chase Ultimate Rewards

Log in to the Ultimate Rewards site and select the primary cardholder’s Chase Sapphire Reserve, Sapphire Preferred, or Ink Business Card. (The authorized user cannot transfer points from his or her Chase account.) Ensure the selected account holds at least 1,000 Ultimate Rewards points. Travel partner transfers start at 1,000 points and must be done in 1,000 point increments.

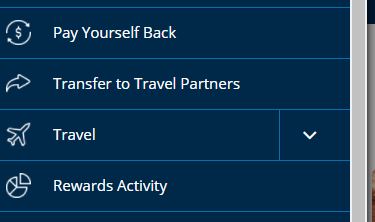

Step #2 – Select Transfer to Travel Partners

Once logged in, click on the menu (top left, three horizontal lines). Scroll down and select Transfer to Travel Partners (below). I noticed it’s right after my favorite Ultimate Rewards redemption method – Pay Yourself Back!

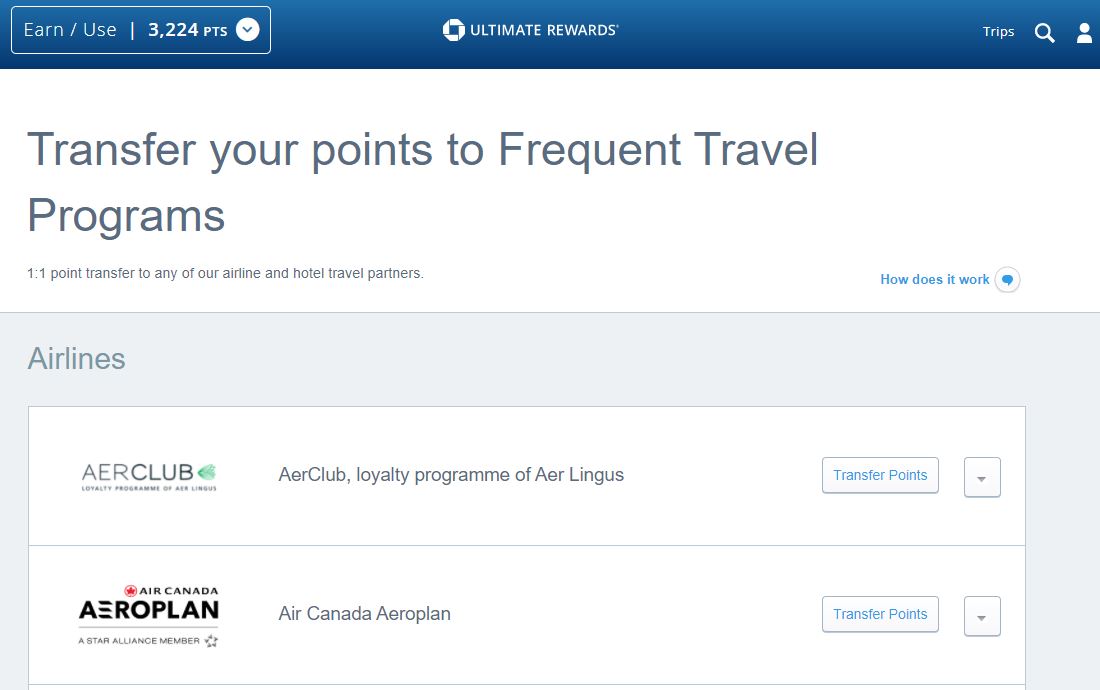

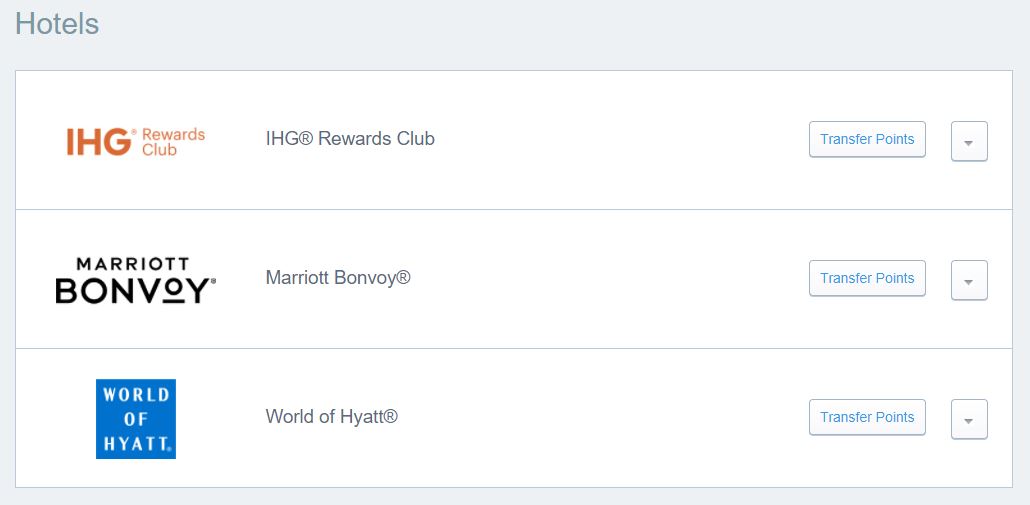

Step #3 – Select the Transfer Partner

The primary cardholder is next presented with all travel partner transfer options, airlines first followed by hotels. Partner programs are in alphabetical order.

I’m transferring to Hyatt today. It’s the very last travel partner listed.

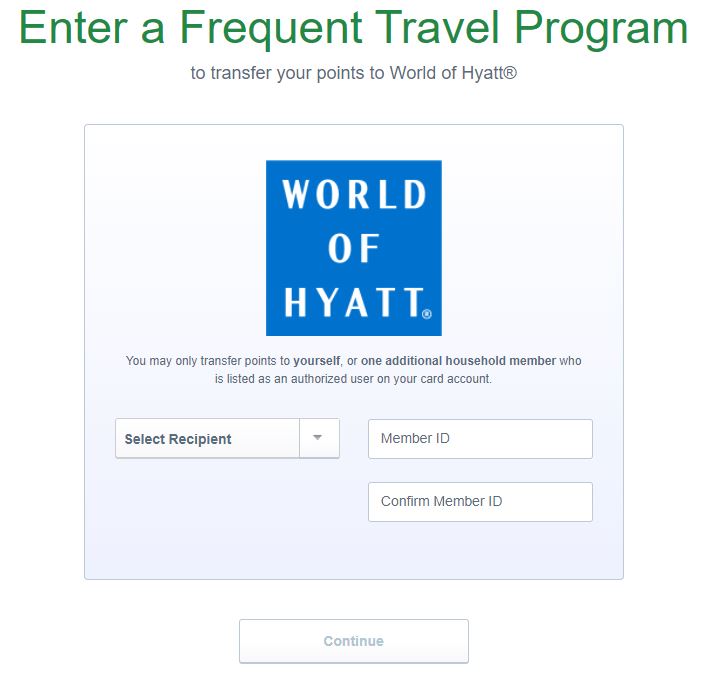

Step #4 – Select the Recipient and Enter Info

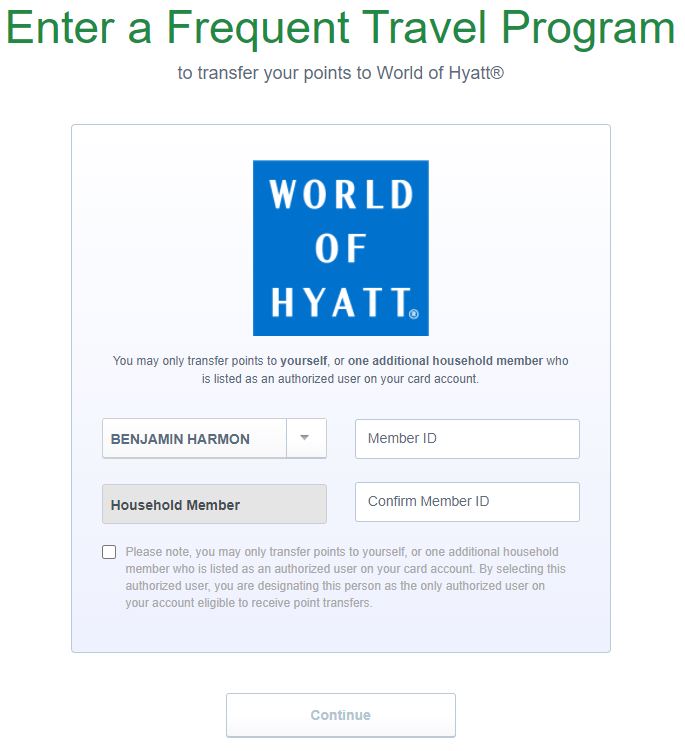

After selecting the travel partner, Chase describes who can receive points with the selected travel partner (below). Primary cardholders may only transfer to themselves or one additional household member who is also an authorized user on the card account.

After selecting my name, an auto-populated field confirms my eligibility as a household member. Enter and confirm your travel partner member number. To avoid a mistake, I prefer to copy and paste the number directly from my account on the partner’s site. Check the box and click continue.

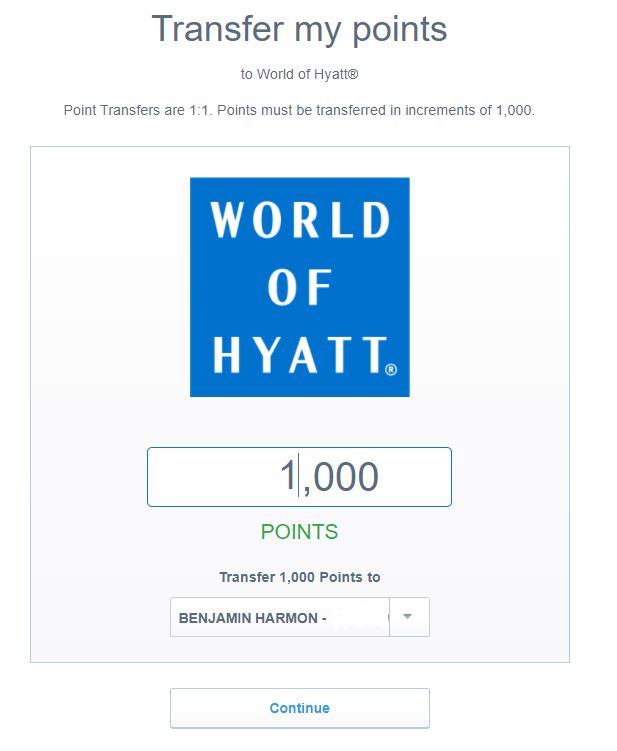

Step #5 – Enter the Transfer Amount

At the next screen (below), enter the amount of points the primary cardholder wants to transfer to the authorized user. Remember, transfers start at 1,000 points and are in thousand point increments. This is my first time doing so from this Chase account, so I’m starting small with 1,000 points. Click continue.

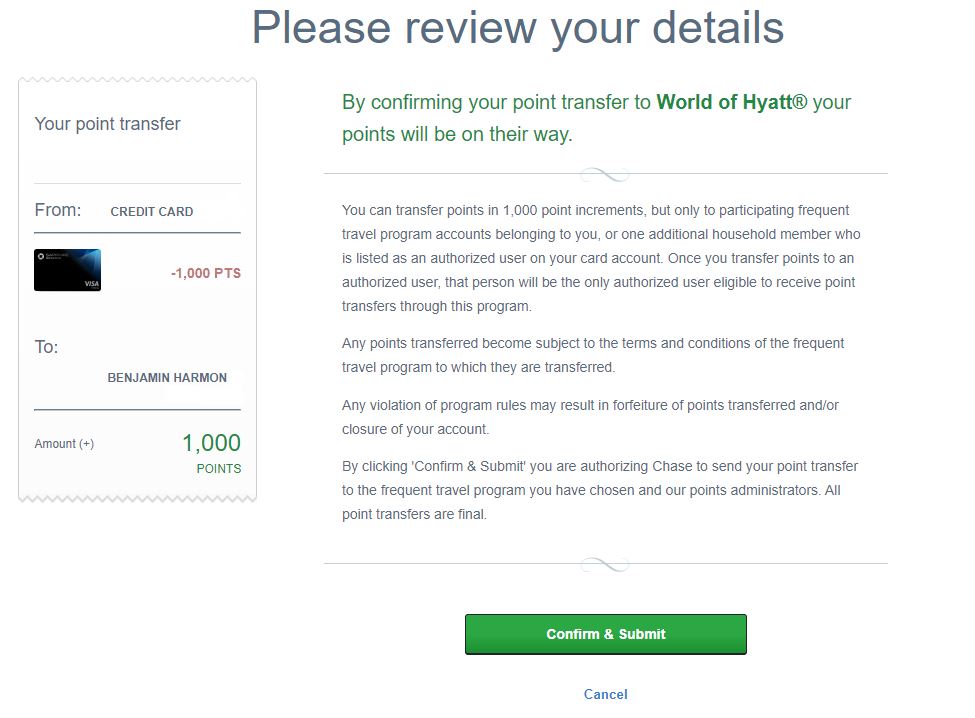

Step #6 – Review

To the left on the next screen, the primary cardholder sees the amount to be removed from the Ultimate Rewards balance and to be added to the travel partner account. Review the fine print and click Confirm & Submit.

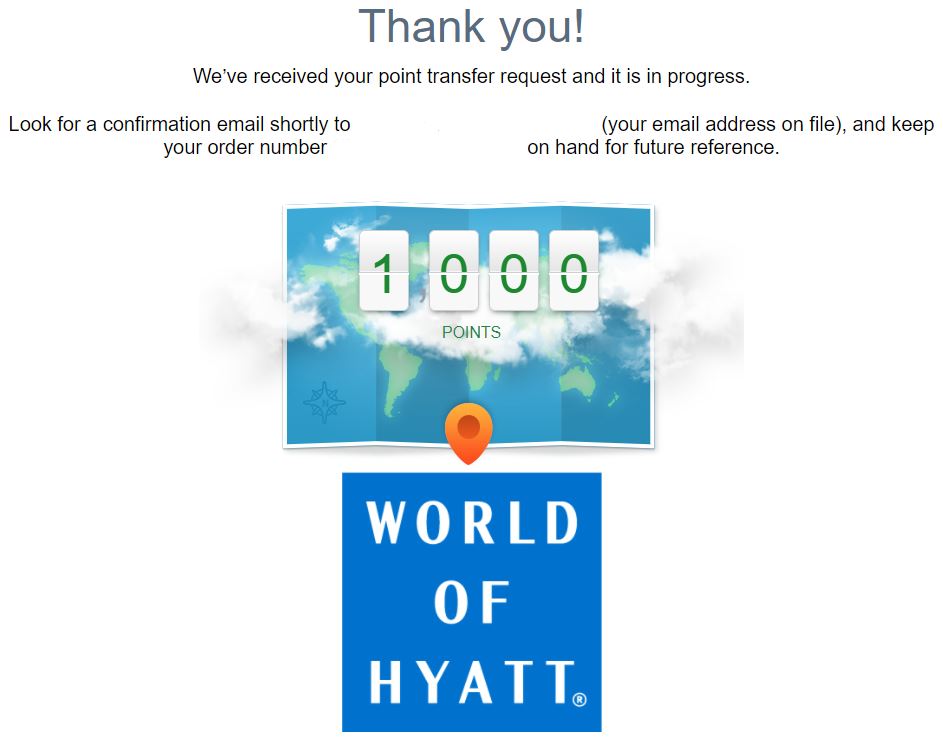

Step #7 – Confirmation

Next, the primary cardholder receives the following confirmation (below). The primary cardholder (not the authorized user) is sent an email confirmation, as well. The redemption also contains an order number. During this process, the points arrived in my World of Hyatt account instantly.

Conclusion

In all our years as Chase customers, my wife and I had never transferred Ultimate Rewards points to an authorized user’s travel partner account. I enjoy how easy the process is! It’s remarkably similar to a primary cardholder transferring to his or her own account. Cashing out will continue to be our redemption preference for Ultimate Rewards. However, I’ve heavily burnt my Hyatt stash over the years, and it’s time to replenish that currency a bit. We’ll push more Ultimate Rewards into my Hyatt account over the next year, but I probably won’t bother with transfers to Chase’s other travel partners. Nonetheless, I’m glad to have another valuable Ultimate Rewards redemption option beyond cashout, when needed. Do you transfer Ultimate Rewards to an authorized user’s travel account(s)? Why or why not?

I have a Sapphire Preferred with no AU. Does that mean I can’t transfer UR points to my spouse Frequent flier account without being a AU on my SP card?

Thanks!

Don’t want to pay the $75 AU fee. Does this same concept work for Ink Preferred AUs? If yes why not add AU that way for $0 fee. You can transfer points between Sapphire and Ink cards n then do it to the Ink’s AU (aka employee).

Albert,

A natural question. What you brought up can work fine for many. I product changed my Ink Preferred to another Ink Cash account years ago. I’d rather hold multiple Ink Cash accounts for more 5x office supply spend capacity ($25k per account).

“the wife snd I?” perhaps “my?”

Title is misleading. You’re not transferring Ultimate Rewards to Ultimate Rewards.

I was hoping they reversed their relatively recent (and very annoying) restriction on being able to do that without calling.